Gold: Surging prices make Mali Lithium see the light; it’s now drilling for gold

President Trump and first lady Melania view a solar eclipse at the White House in 2017. Pic: Getty

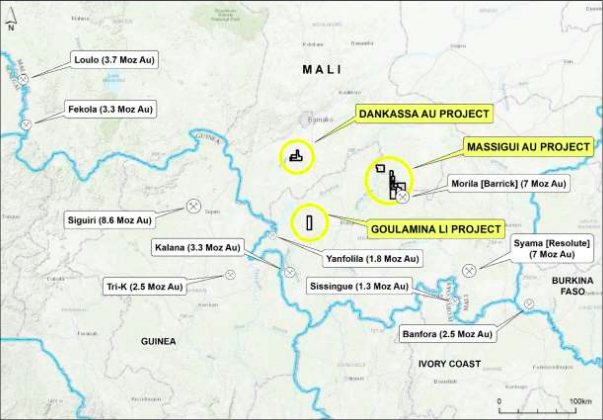

Mali Lithium (ASX: MLL) is now drilling for gold in Mali, right on the doorstep of its lithium projects.

On one hand gold is looking promising in the short-term with surging prices and exploration success on its tenements. On the other hand lithium markets are over supplied and prices are falling.

A definitive feasibility study for its lithium project is being undertaken and previous studies estimated production of 362,000 tonnes per annum of 6 per cent lithium spodumene. But this won’t be done until next year and the company isn’t keen to wait to make money.

“The current gold price has created an opportunity to consider options to further unlock the potential in our gold portfolio,” managing director Chris Evans said.

“Now that we have identified highly prospective drill targets in the review of our gold portfolio, it is an ideal time to capitalise on these high prices.

The company is now testing high priority drill targets at its gold tenements. One of these is a joint venture with Barrick and has previously produced gold. Evans said this gave the company confidence more was present.

Mali Lithium has made nearly $4.5m in royalty revenues in the joint venture in the last 12 months. Its other project, Dankassa, has returned drilling hits in the past of 8m at 1.29 grams per tonne (g/t) gold from 16m.

Shares jumped 10 per cent upon this morning’s announcement.

In other ASX small cap gold news today:

Classic Minerals (ASX:CLZ) has hit high-grade gold at its Kat Gap project. The best results include 9m grading 20.94g/t of gold. “These deeper gold intersections clearly show that Kat Gap has legs with the potential to grow significantly at depth,” CEO Dean Goodwin said. “The further down we drill the wider the gold zones seem to be getting.” The company is working to extend the known gold mineralised zone from its current drilling area.

Magnetic Resources (ASX:MAU) has uncovered a new 200m-wide gold anomaly at its HN9 project at Laverton. The new zone was discovered in an extensive drilling program nearby other large deposits including one deposit owned by Dacian Gold (ASX:DCN). Managing director George Sakalidis said that with the Australian gold price still going up and at record levels, the HN9 project was shaping up and had potential to be a large-scale shallow deposit.

Gold from a waste rock dump? That’s what Red River Resources (ASX:RVR) thinks it has stumbled across in New South Wales. It has reviewed historic sampling at Hillgrove, which it recently acquired. Tests undertaken by its then owners found a sample grade of 3.49g/t of gold. In fact, gold was first discovered in 1887 but production ceased due to limited technology at the time. Twenty four samples were taken and some of the best results came from deeper depths.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.