Gold rally slows as Marvel expands Mali footprint, Mayur rejigs PNG assets

Pic: John W Banagan / Stone via Getty Images

A recovery in the US dollar is slowing gold’s price progress as the yellow metal struggled to find support around $US1,924/oz ($2,669/oz), Wednesday.

The US dollar index (DXY), a measure of the currency’s strength, rose off recent lows to trade around 93.50 Wednesday despite China saying it was selling US Treasury bonds.

China holds $US1 trillion ($1.4 trillion) of US government debt, and Chinese economist Xi Junyang from Shanghai university reportedly said this week the country wanted to reduce this to $US800bn.

On the other hand, Swiss bank UBS said it was advising clients that holding up to 10 per cent of their investment portfolio in gold as a hedge to the US dollar was “not a bad move”.

“It could be a good hedge with interest rates where they are, with the dollar where it is, and with markets where they are,” UBS Wealth Management advisor and portfolio manager Charles Day told Business Insider.

Marvel expands Mali gold tenements

Three ASX gold companies said they were making adjustments to their tenement holdings.

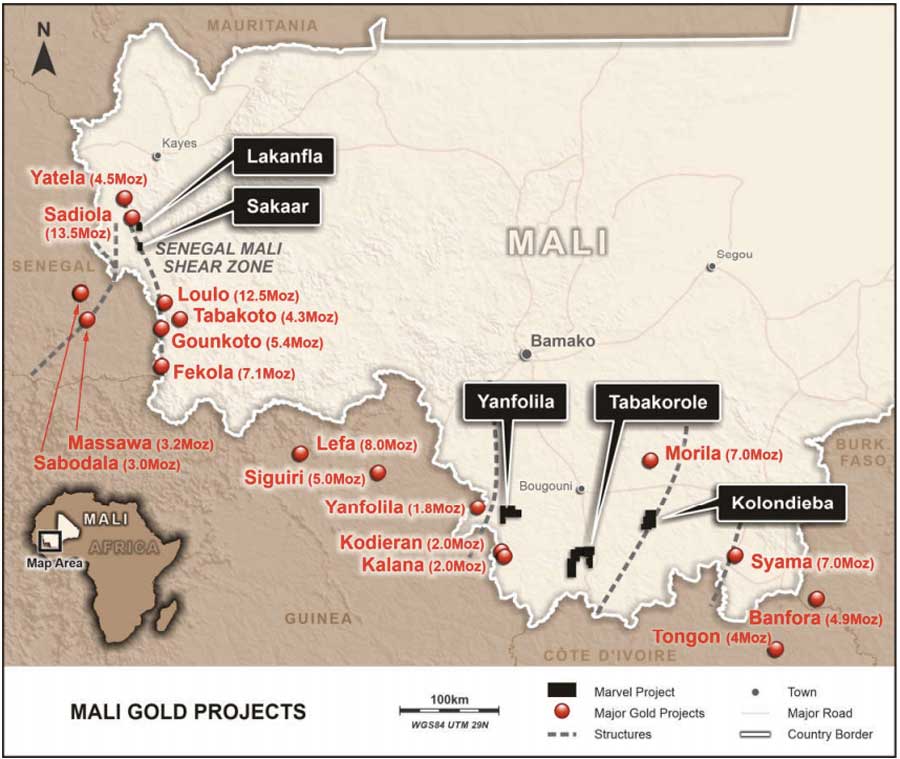

West Africa-focused Marvel Gold (ASX:MVL) has increased the size of its Mali gold tenements by acquiring the Sakaar exploration permit, 15km south of its Lakanfla project.

“Sakaar has exploration synergies with our Lakanfla project and both projects are strategically important due to their proximity to the Sadiola gold mine, which we understand will require additional oxide feed in the relative near term,” managing director Phil Hoskins said.

Marvel will earn an 80 per cent interest in Sakaar under a three-stage deal over three years by sole funding exploration through to the completion of a pre-feasibility study.

The Sakaar project is located on the northern edge of the Senegal-Mali Shear Zone, and the Lakanfla gold project is located 6km from the AngloGold Ashanti (ASX:AGG)-operated Sadiola gold mine in western Mali.

Mayur rejigs PNG gold assets

Mayur Resources (ASX:MRL) will list its copper-gold assets in Papua New Guinea on the TSX Venture Exchange via a reverse takeover to raise $C5m ($5.2m).

Managing director Paul Mulder said the spin-off would unlock value for shareholders and allow the company to focus on its industrial minerals and energy businesses in PNG.

“Upon completion of the transaction and capital raise, the first two years of activity will focus on progressing the Fergusson Islands assets towards cash flow and testing drill targets on Feni Island to replicate and enhance previous attractive copper and gold intercepts,” he said.

The company will own a 50 per cent stake in the new TSX-listed company, which will be headed by Mayur non-executive director Frank Terranova, a former managing director of Allied Gold. The transaction with TSX-listed XIB Capital Corp will happen before year end.

Mayur will use the deal proceeds to acquire Papua New Guinea gold companies, Ballygowan and Pacific Arc Aurum, that hold highly prospective gold assets including the Gameta and Wapolu projects on the Fergusson Islands.

Cyprium gains mining licences for WA projects

Back in Australia, Cyprium Metals (ASX:CYM) has been granted mining leases for its Cue copper project and for its recently acquired Nanadie Well copper-gold project in WA.

Cyprium has applied for exploration permits to the east and west of Nanadie Well, which also hosts the Stark copper-nickel-platinum group elements prospect that is open in all directions, to increase its resource base.

“The Nanadie Well deposit and Stark mineralisation are both very prospective and is located only 75km to the east-northeast of our Hollandaire copper deposits,” executive director Barry Cahill said.

CYM, MRL and MVL share price charts

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.