Gold price pulled back by surging Bitcoin, US dollar

Picture: Getty Images

- Gold price tumbles to $US1,844 per ounce ($2,390/oz) as US dollar recovers

- ‘We are seeing the dollar rebound, and some gold bets are unwinding in the process’

- ASX Gold Stocks Guide: Everything you need to know

After starting the new year with a bang, the gold price has retreated to $US1,844 per ounce ($2,390/oz) – and Bitcoin may be partly responsible.

The price fall in gold was sparked by a jump-up in the US dollar and higher yields on US government bonds with the 10-year bond climbing above 1 per cent.

“Gold is seeing intense technical selling,” OANDA senior market analyst, Edward Moya, told Kitco news.

“We are seeing the dollar rebound, and some gold bets are unwinding in the process,” he stated.

Expectations that a Joe Biden victory in the US presidential election will lead to more government stimulus to the US economy is likely to weigh on the US dollar, analysts said.

“The US dollar may rally modestly further in the near term, but we expect the rally to be brief and contained,” said Commonwealth Bank of Australia analysts.

Bitcoin’s price surge holds back gold

Another relatively new factor in gold’s sell-off late last week is the rise of cryptocurrencies which are presenting an alternative safe haven for worried investors.

“Gold’s safe-haven trade has taken a back seat to the cryptos, especially Bitcoin. When you look at gold’s positioning, you see a diversification away from gold into cryptos,” said Moya.

Bitcoin hit a new high of $US41,000 over the weekend, but edged slightly lower in Monday trading to $US38,400 ($49,444).

Some analysts expect Bitcoin’s rally to be short-lived, and for gold to stage a comeback in the months to come.

“The Bitcoin bubble will pop at some point over the next few months, if not sooner, but until then gold is losing the backbone of big-money interest,” OANDA analyst, Craig Erlam, told Investing.com.

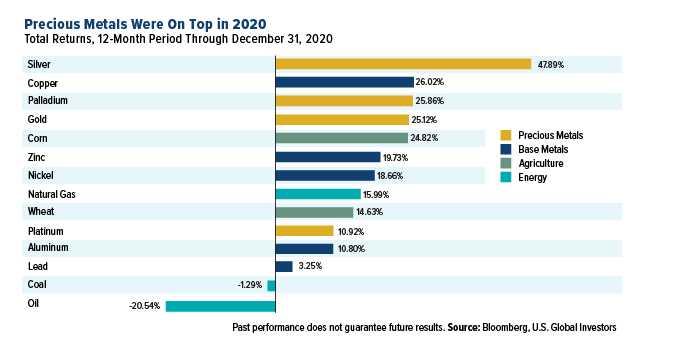

The price of silver has dipped to $US25.20 per ounce ($32.60/oz). Despite this setback, silver was the top performing commodity in 2020, up nearly 50 per cent.

The white metal has benefitted from save haven buying, and industrial demand including its application in solar panels as a component of photovoltaic cells.

Metal Hawk restarts drilling at Goldfields project

Gold and nickel explorer Metal Hawk (ASX:MHK) has restarted drilling at its Kanowna East project, one of three joint ventures with Western Areas (ASX:WSA).

A further 120 drill holes remain to be drilled at the project located near Kalgoorlie, after 9,000m were drilled late last year.

“We are expecting to receive the majority of gold assays from 2020 drilling within the next few weeks,” managing director, Will Belbin, said.

Western Areas can earn a 75 per cent interest by spending $7m on three Metal Hawk projects — Kanowa East, Emu Lake and Fraser South — over five years.

Chalice Gold Mines (ASX:CHN) can earn a 70 per cent interest on Metal Hawk’s Viking gold project south of Norseman in WA by spending $2.75m on exploration.

Queensland explorer Sunshine Gold hits paydirt

First drilling results have filtered through for Sunshine Gold’s (ASX:SHN) Bald Hill West and Bonneville prospects at its Triumph project near Gladstone.

The Queensland-focused gold explorer drilled 13 holes for 1,364m in December at Triumph, as part of a drilling program for 7,500m.

“The first drilling results are encouraging as we move east toward the core of the Bald Hill West lode,” managing director, Damien Keys, said.

Results for Bald Hill West include 3m at 1.91 grams per tonne gold from 55m, and the latest drilling builds on earlier programs to assess the potential for a shallow open pit deposit.

PolarX picks up gold project in Nevada

The share price of PolarX (ASX:PXX) made some gains with the acquisition of a high-grade gold and silver project in the US state of Nevada.

The Humboldt Range project in north-western Nevada sits between two precious metal mines, Florida Canyon and Rochester, and numerous historical mines.

Humboldt Range has two lode claims: Black Canyon and Fourth of July, neither of which has been extensively explored using modern techniques.

High-grade gold and silver assays from previous rock-chip sampling of outcropping veins and grab sampling from old mine workings have peak values of 3,384 grams per tonne gold, and 2,837 grams per tonne silver.

PolarX has paid $US35,000 for an option to secure the project, and is required to pay a further $US175,000 and 5 million of its shares, and some royalty payments.

“Humboldt Range will enable us to generate strong news flow virtually all year round, and leverages our US team, most of whom know the region,” managing director, Frazer Tabeart, said.

PolarX has other projects including Caribou Dome copper project and Uncle Sam gold project both in the US state of Alaska.

ASX share prices for Metal Hawk (ASX:MHK), Sunshine Gold (ASX:SHN), PolarX (ASX:PXX)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.