Gold moves to test $US1,800 per ounce support level despite inflation concerns

Pic: John W Banagan / Stone via Getty Images

- Gold touches 14-month low on higher US bond yields, silver price at eight-year high

- ‘The economy is a long way from our employment and inflation goals’ – US Fed chairman Powell

- ASX Gold Stocks Guide: Everything you need to know

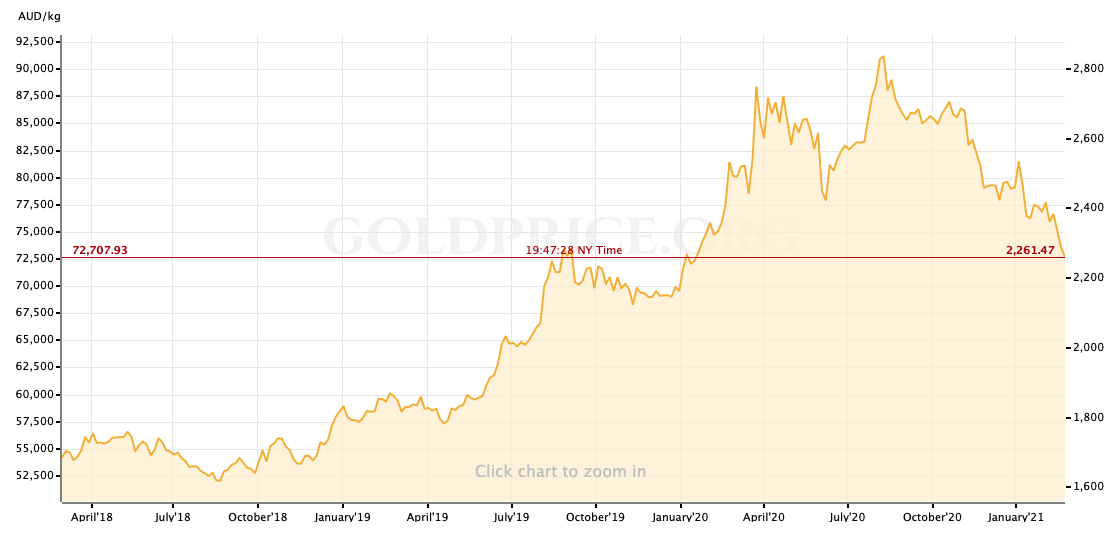

Gold was back to testing its $US1,800 per ounce ($2,260/ounce) support level this week as the yellow metal struggled against the headwind of rising US bond yields.

Elevated yields of 1.4 per cent on US 10-year Treasury bonds have dampened gold’s allure as a hedge against inflation, said stockbroker Argonaut in a note.

The US 10-year government bond is now trading at levels seen before the worldwide spread of the COVID-19 pandemic in February 2020, rising from a low of 0.5 per cent in August.

Meanwhile, investment in physical gold bars and bullion soared to $US3.8bn in the US and its highest since the last gold price boom of 2011, said the World Gold Council.

At the US Mint, sales of its gold Eagle bullion coins topped 220,000 ounces in January or around 6 tonnes, the highest since December 2009.

Inflation goals still distant

US Federal Reserve chairman Jerome Powell gave some important insights into the health of the US economy in his testimony to the US Senate’s Banking Committee mid-week.

“The economy is a long way from our employment and inflation goals,” he said, and added that rising US bond yields were “a statement of confidence” in an improving US economy.

The US central bank’s loose monetary policy has expanded the US money supply by 25 per cent in the past year and seen the US dollar weaken to three-year lows.

“We do expect inflation to move up both because of base effects and also because we could have a surge in spending as the economy reopens,” he said.

Famous investor Michael Burry who was portrayed by actor Christian Bale in the film ‘The Big Short’ about the 2007 US mortgage crisis, commented on central bank monetary policy.

“The US government is inviting inflation with its MMT-tinged policies,” Burry said on his Twitter account at the weekend, reported Kitco news.

He added that before the COVID-19 pandemic, $3 of debt injected into the economy created only $1 of economic growth, and the effect was even weaker now.

Silver prices stick at eight-year high

Silver was trading at eight-year highs this week at $US27.90 per ounce ($35/ounce), as demand for physical silver bullion runs into tight supply availability.

“Optimism towards silver’s industrial demand outlook may well encourage fresh inflows [of the physical metal],” said precious metals research firm Metals Focus in a report.

Industry body The Silver Institute gave a detailed outlook for the white metal in terms of its growing use in green technologies such as solar power and EVs.

Macarthur Minerals looks at gold assets spin-off

Exploration company Macarthur Minerals (ASX:MIO) is carrying out due diligence on 10 historic prospecting and mining lease tenements in WA’s Leonora goldfield.

The company is assessing whether to merge the assets with its Pilbara gold, lithium and copper tenements and to demerge these assets into a separate ASX company.

The package of 10 prospecting and mining lease tenements are located 237km north of Kalgoorlie and are near to active gold mines such as Gwalia and Sunrise.

“The main focus for the company is ‘first and foremost’ the ongoing development of the Lake Giles iron ore assets,” managing director, Alan Phillips, said.

“If these tenements demonstrate value, Macarthur will consider spinning out this portfolio as part of a wider Pilbara/Central Goldfields transaction,” he added.

New Age Exploration targets ‘Hemi style’ prospects

New Age Exploration (ASX:NAE) is preparing to roll out a drilling program for its Pilbara gold prospects after completing a detailed aeromagnetic survey of the area.

The exploration tenements are located 50km south of De Grey Mining’s (ASX:DEG) Hemi gold discovery near Port Hedland in WA’s Pilbara region.

Aeromagnetic data highlighted several ‘Hemi style’ intrusive gold targets at New Age Exploration’s Pilbara gold prospects, and the maiden drilling program will assess these.

“We are now moving at pace to finalise all preparations to commence the drill program,” executive director, Joshua Wellisch, said.

“This will provide a continuous exploration pipeline within our Pilbara portfolio,” he said.

Predictive Discovery reports Guinea gold results

Africa-focused gold explorer Predictive Discovery (ASX:PDI) has announced some assay results from drilling at its Bankan gold project in the west African country of Guinea.

Hits for Bankan included 42m at 2.2 grams per tonne gold from 165m, including 2m at 19.3 g/t gold from 189m, and step-out drilling shows hole-to-hole mineralisation extensions.

“The latest results from Bankan continue to highlight the potential for a large open-pit gold deposit, with deeper drilling demonstrating very broad widths in fresh rock and excellent hole-to-hole and depth continuity,” managing director, Paul Roberts, said.

ASX share prices for Macarthur Minerals (ASX:MIO), New Age Exploration (ASX:NAE), and Predictive Discovery (ASX:PDI)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.