Gold mining stocks are undervalued right now, says Metals Focus

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Gold prices have fallen to four-month lows after vaccine hopes and the prospects of a smooth Biden transition lifted risk appetite.

Gold mining stocks have followed, despite record levels of profitability in the sector.

Profits reached a record high $US4.8 billion in the September quarter, a substantial increase of $2.7 billion compared to last quarter, and an even bigger increase of $3.3 billion on this time last year.

The reason? A rising gold price combined with tight cost controls, low oil prices, and currency weakness against the US dollar.

With the December quarter spot gold price to date averaging $US1,891 and costs not expected to increase significantly, these high margins are expected to remain at similar levels in the current quarter.

Shareholder dividends remain relatively low but they should increase, says Metals Focus.

“Cash generation for our peer group has been improving since 2015, due to a rising gold price and better cost control,” it says.

“The cash has largely been used to reduce net debt which ballooned during the first half of the last decade.

“Dividends are now receiving some attention, but the sector remains a relatively low dividend payer.

“As the disruption from the COVID-19 pandemic eases and cashflow remains high, we expect further dividend increases.”

Is the sector undervalued right now? Metals Focus says yes.

“Since the end of the quarter, the NYSE Arca Gold BUGS Index (HUI) has fallen over 10 per cent,” it says.

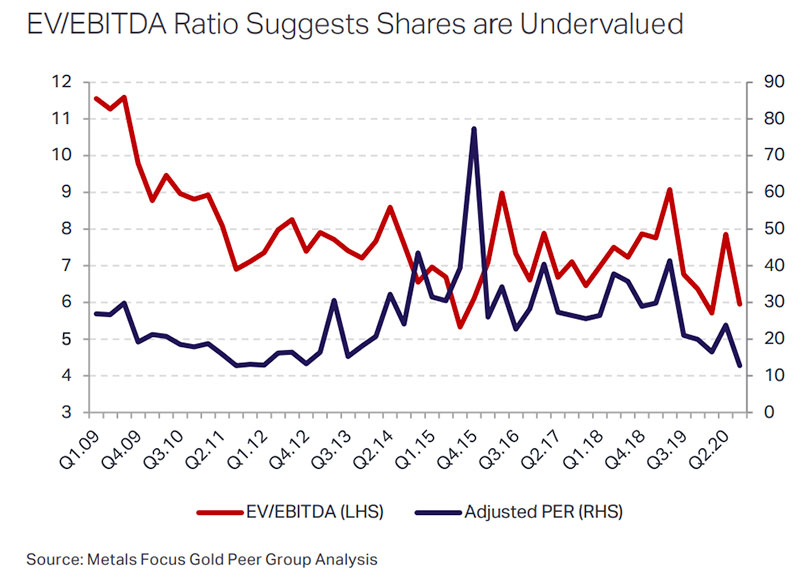

“In the graph below, we show probably the most widely used valuation measure, enterprise value (EV)/earnings before tax (EBITDA), together with the trailing price to earnings ratio for our peer group.

“These ratios in Q3.20 suggest that the sector is currently undervalued with the EV/EBITDA ratio only lower in two subsequent quarters since 2009.”

Investors are likely discounting either a lower gold price and/or higher costs into current share price valuations, believing current cash generation is unsustainable, Metals Focus says.

However, whether this proves correct or not, merger and acquisition activity might provide an incentive for revaluation.

Barrick Gold and Newmont, for instance, have leapt to a different level of profitability following their respective mergers with Randgold and Goldcorp.

“With additional cashflow now being generated by companies in the sector and apparent low valuations, this may encourage increased M&A activity to achieve similar profitability,” it says.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.