Gold miner Kingsgate flags bigger $76.1m loss but investors shrug it off

Pic: Schroptschop / E+ via Getty Images

Kingsgate Consolidated says it will have to write-down its Nueva Esperanza gold and silver project in Chile to the tune of $42.7 million, which will force it to a much bigger FY18 loss.

The gold miner (ASX:KCN) will now deliver a loss of $76.1 million – sinking from a profit of $7.1 million in the previous year, and a 127 per cent increase on the $33.5 million loss it initially expected to report.

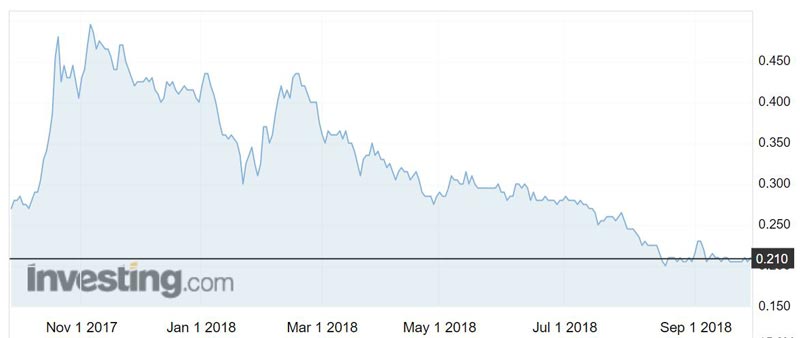

Investors didn’t seem too worried though, with the share price advancing over 7 per cent to an intra-day high of 22c on Thursday morning.

The reason for the big FY18 loss is Kingsgate did not generate any revenue in FY18, while it made $176.1 million in revenue in FY17.

Kingsgate has been fighting the Thai government and its insurers over the premature closure of its Chatree gold mine.

Chatree was closed after the Thai government decided not to renew the metallurgical licence after 2016. Kingsgate’s lease for Chatree was due to run to 2028.

Kingsgate began legal action against its insurers in October last year over a $US200 million ($275.8 million) political risk insurance policy it was denied when Chatree was closed.

The company is still battling it out in court.

- Subscribe to our daily newsletter

- Bookmark this link forsmall cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Kingsgate is also trying to sell the Nueva Esperanza project and has determined it has a “carrying value” of $57.9 million.

Carrying value determines the value of an asset or a company based on the figures in the company’s balance sheet.

Kingsgate says the carrying value of Nueva Esperanza, after the impairment, is at the lower end of the range of indicative offers received from potential buyers.

The company plans to continue talks with the bidders to try and get a price better than the current book value.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.