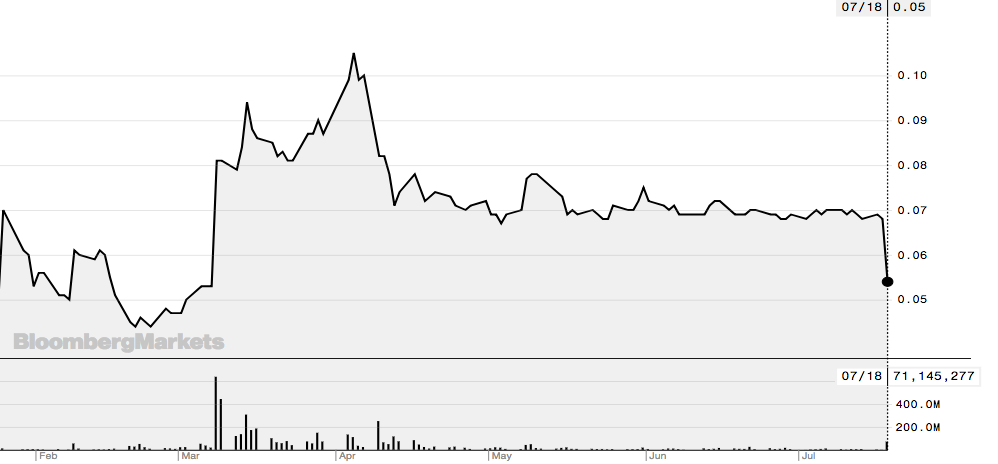

Gold miner Blackham warns of higher costs; shares fall 21pc

Gold miner Blackham Resources warned on Wednesday of another year of higher costs — and shareholders responded by driving down the stock 20 per cent.

Shareholders — wooed earier this year with a new direction, a $28 million cap raise and record production — today showed how peeved they were at a return to higher costs and lower production.

The shares (ASX:BLK) were sold down to 5.4c from yesterday’s close of 6.8c.

The gold miner presented another upbeat half year result on Wednesday, however.

It said all-in sustaining costs for the mine — that’s all of the company’s expenses and costs to produce gold — were $1,294/oz in the last six months, down from $2,063/oz for the December 2017 half.

Around $1000/oz is considered a reasonable level for costs in Australian gold mines.

And they were selling gold for an average of $1,685/oz.

Half-year production came in at the bottom end of guidance at 40,024 oz, but they still reckon they can get 77,000‐89,000 oz in fiscal 2019.

“The June half’s operational results demonstrate significantly stronger production and a step-change in the operation’s economics that commenced in December 2017,” said Blackham chairman Milan Jerkovic.

“Record production and significantly reduced costs underpinned stronger operational cash flows for the half.”

Rising costs

But after the company finished capitalising earlier this year on stockpiling work done in December, costs began to rise in the second quarter and production dipped.

Costs rose 38 per cent and production slid 6 per cent in the June quarter.

For fiscal 2019, the company is forecasting total costs of $1,250‐$1,450/oz and has locked in a price of over $1700/oz for part of their production.

For the remainder of production, they’ll have to rely on a wavering gold spot price.

Gold futures have slid to an 18 month low at just over $1600/oz.

Commentators are split over whether their tea leaves say it will rise, fall, or remain flat this year.

Blackham also has to deal with persistently low grades of ore of around 1.4 g/t.

Anything about 5 g/t is considered high grade and anything below 1.5 g/t is considered low.

Debt still stands at $32 million though the company has cash and bullion on hand worth $23.9 million.

Still, it’s not as bad as 2017

Blackham began raising funds to develop the Wiluna gold mine — a project that has eaten more than one company over the decades — in 2016.

But it failed to come through on targets of 60,000 to 70,000 oz, reaching about half of that forecast.

Costs blew out to over $2000/oz while they were selling their gold for similar prices they’re getting now: just over $1600/oz.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.