Gold: Laneway’s North Queensland project begins with a blast and 300% share price surge

Pic: Getty Images

Laneway Resources (ASX: LNY) began exploration at its Agate Creek Gold Project yesterday, two months after being granted a mining lease by the Queensland government.

The company was hindered by recent wild weather in North Queensland including cyclones Orma and Trevor. But now with the wet season rescinding, operations were christened with an ore blast in the afternoon.

The ore will be processed through a nearby processing owned by private mining company Maroon Gold and Laneway anticipates the first ore will be transported to the plant in the next week.

- Scroll down for more ASX gold news >>>

Laneway have told shareholders it expects “material positive cash flow” from the mine this year, although it admits it was aided by higher gold prices.

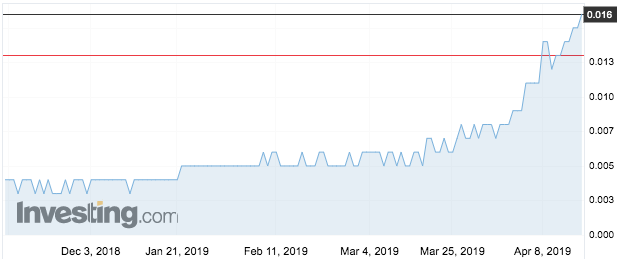

Since mid-January the stock has surged four times from 4 cents to 1.6 cents, a run which began when the company announced strong assay results, which validated historic survey results. It was also aided by the granting of the mining licence.

At market open, Laneway rose from 1.4 cents to 1.6 cents (14 percent) upon announcement that the campaign was underway, which is insignificant compared to the rise it has seen this year, now at 300 per cent.

The company also owns gold assets in New Zealand and a coking coal project in the NSW Northern Tablelands.

In other ASX gold news today

Perseus Mining (ASX: PRU), the same company we reported last week found two tonnes of gold across two of its African gold mines, have hit a stumbling block in being granted an exploitation permit for a third. Namely, the government did not have enough time to consider them. At its weekly cabinet meeting there was insufficient time for the permit to be tabled, “due to more urgent government business”. But the company also told shareholders not to panic, saying they fully expected the licence to be granted “in the near future”.

Stavely Minerals (ASX: SVY) have announced a $3.2 million capital raising and a $1 million rights issue. The proceeds will be used across its diverse portfolio which includes projects in Queensland, Victoria and Tasmania, including a processing plant at Beaconsfield. Yes, the same Beaconsfield that was the site of the 2006 mine collapse, but the company will only run a processing plant. They have assured investors they have ‘no intention whatsoever’ of reopening the mine.

In gold results

Alloy Resources (ASX: AYR) have announced its Inferred Mineral Resources had increased by 300%. In 2015, 75,100 oz of gold was inferred at its Horse Well Project in WA. But following a recent JORC estimate conducted by mining consultants Trepanier, the total is 237,800 oz. Alloy chairman Andy Viner declared the company was, “very excited” about the results.

Another West Australian miner, Calidus Resources (ASX: CAI), announced sampling results as it undertakes its Preliminary Feasibility Study. Not only was the company pleased with results (which included 2.24 g/t of gold at 12 metres) but by the shallow mineralisation. Managing director Dave Reeves has said the results are critical because they showed mineralisation would be seen “from day one” of any open pit operation. Shareholders have been promised the PFS will be delivered in the September quarter.

Oklo Resources (ASX: OKU) are undertaking assays at its West Mali Kouroufing project and have announced several significant gold intersections that are shallow. These include 12.60g/t of gold from 18 metres and 42.20g/t at 12 metres. Oklo’s managing director Simon Taylor said the company was, “particularly impressed” by the results and hoped the positive news would continue in conjunction with the drilling program at Kouroufing and also at its other project, Dandoko.

Bellevue Mining (ASX: DRG) has long called the Bellevue Gold deposit a “forgotten treasure”, due to historic grades which are among Australia’s highest ever (15g/t of gold) – and it might just be right. It has identified three target ares within 20km of the deposit. Some rock chips results are even higher than previous survey estimates, with the most extreme being 102 g/t of gold at the Bellevue North West Prospect. The company has told shareholders drilling will start soon.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.