Gold: Is Ora Banda about to make a comeback?

Pic: Getty

Ora Banda Mining (ASX:OBM) is starting anew after going into administration or, as they call it, “a period of instability”.

Constant problems at its Davyhurst operation near Kalgoorlie and a failed $75m recapitalisation deal saw Ora Banda — formerly Eastern Goldfields — finally raise the white flag in November last year.

- Scroll down for more ASX gold news >>>

In late June the company relisted and reskinned as Ora Banda with $15m in the bank to undertake resource drill out, detailed mine planning, and regional exploration programs at its flagship project.

And it appears to be going well.

Last month, the company hit thick, high grades like 23m at 9.1g/t from 128 metres at the Waihi prospect, 3km west of the Davyhurst Mill.

Wahai currently hosts a near surface resource of 914,000 tonnes at 2.4g/t gold for a total of 71,000oz; however the three main lodes in this area had been largely unexplored at depth.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Then today, Ora Banda announced that the cost of fixing the Davyhurst processing plant would be $8.4m — 43 per cent lower than initially thought.

This $8.4m also includes a ‘contingency’ of $840,000 just in case things go pear-shaped.

That news sent the stock up 14.3 per cent to 24c in early trade. The stock is now up over 30 per cent since relisting.

Ora Banda says it would take about 24 weeks to complete the remedial works program and recommission the Davyhurst processing plant.

“We are pleased that our previous estimate of $15 million for this remedial work program has proven to be conservative and believe these projected capital cost savings will significantly enhance the overall economics of this project,” Ora Banda managing director David Quinlivan says.

In other gold news today:

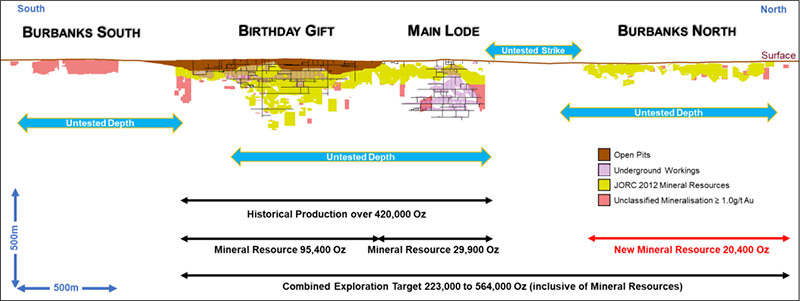

Barra Resources (ASX:BAR) will launch a mining study at the historic Burbanks gold project, a stone’s throw from Coolgardie in WA. The explorer announced a maiden 20,400oz gold resource for the Burbanks North trend, just 700m from the main mining centre which includes several old open pit and underground mines. The total Burbanks mineral resource increased 16 per cent to 145,700oz.

“With gold now trading above $2000 per ounce and with Burbanks status as a granted mining lease, Barra now has an outstanding opportunity to consider mining options for this historically productive high-grade gold mining centre,” Barra’s Sean Gregory says.

The stock was up 17 per cent in early trade.

Producer Alkane Resources (ASX:ALK) will invest another $6m in Genesis Minerals (ASX:GMD) — part of a strategy to invest in junior gold companies “with projects that meet Alkane’s investment criteria”.

“Alkane has maintained a small stake in Genesis since 2018, and we have followed the recent progress of its flagship [760,000oz] Ulysses gold project in particular,” Alkane’s Nic Earner says. “We welcome the opportunity to expand our investment to become a supportive strategic shareholder.”

Following the completion of the Investment, Alkane will become Genesis’ largest shareholder. Genesis and Alkane were up 6 per cent and 6.5 per cent, respectively, in early trade.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.