Gold: Intermin’s plan for Goldfields domination hits a small snag

Pic: John W Banagan / Stone via Getty Images

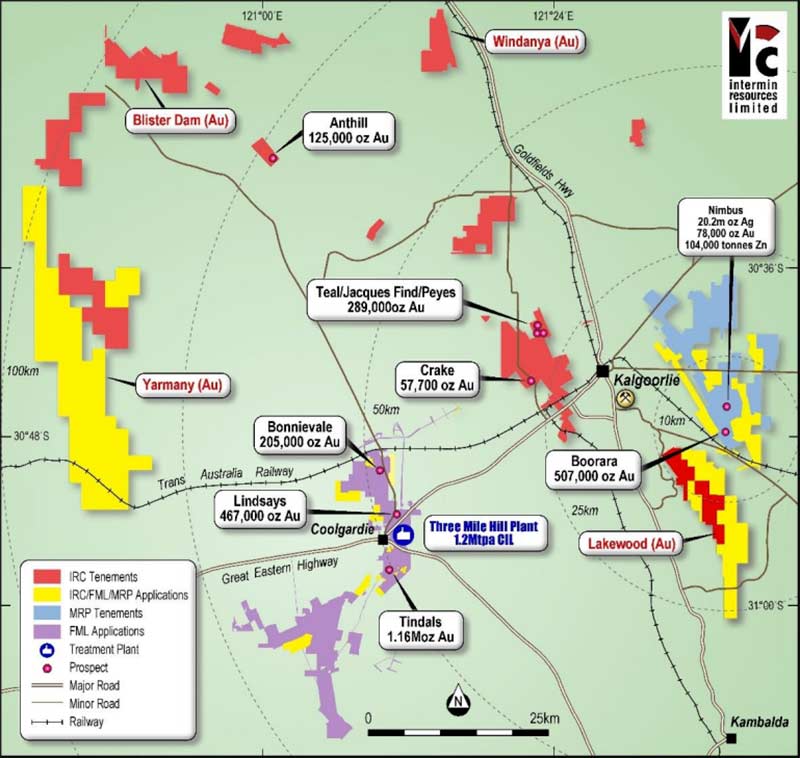

Intermin Resources’ (ASX:IRC) $40m purchase of Focus Minerals’ (ASX:FML) 2.1 million-ounce Coolgardie gold project has been delayed by three months, ostensibly to “finalise formal documents”.

Intermin, which has just merged with fellow explorer McPhersons Resources, is on an ambitious growth path.

- Scroll down for more ASX gold news >>>

The newly merged entity would create a standalone gold producer in the Kalgoorlie region called Horizon Minerals (subject to shareholders liking the name).

Horizon has a 1.25moz gold resource base and and a decent portfolio of highly prospective growth assets in the WA goldfields.

But the potential acquisition of the Coolgardie gold project, if it proceeds, doesn’t just add additional high-grade resources (including the new Bonnie Vale underground discovery) — it comes with a mothballed 1.2-million-tonne-per-annum processing plant.

Intermin and Focus have signed a three-month extension to “finalise formal documents for the proposed deal and secure all necessary approvals”.

“Both parties remain fully committed to completing the proposed transaction. However, there is no assurance that the proposed transaction will proceed,” says Focus, covering all the bases.

Intermin managing director Jon Price says, assuming that the deal goes through, the explorer will incorporate the Coolgardie gold project assets into the company’s consolidated feasibility study due in the March quarter next year.

In other ASX gold news today:

Cambodia-focussed Emerald Resources (ASX:EMR) was hunting potential gold “feeder zones” when it hit 8m at 19.98 grams per tonne (g/t) from 172m at the flagship Okvau project.

More work is currently planned to understand the significance of the potential feeder zone, Emerald says, which could boost Okvau’s economics.

“The tenor of grade and widths in the recent drilling campaign gives Emerald great confidence in the potential for increasing reserves beyond the current levels at Okvau,” managing director Morgan Hart says. “In addition, the continued progress on the early development aspects of the Okvau gold project, including the upgraded road access and high voltage power line construction are very positive developments in the construction schedule.”

READ:Emerald starts to shine, as we said it would

Bardoc Gold (ASX:BDC) strikes 53.3g/t gold outside the high-grade, 428,000oz Zoroastrian deposit resource model.

Zoroastrian is the second-largest deposit at the 2.6moz Bardoc project, near Kalgoorlie in WA.

“These new high-grade intercepts … at Zoroastrian continue to extend the multiple mineralised lodes at depth, showing that the system remains open down-plunge and highlighting strong potential to increase the current 428koz resource,” chief executive Robert Ryan says. “With a further three holes awaiting assay and an additional hole added to the program, more results will be announced in the coming weeks.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Vango Mining (ASX:VAN) continues its golden run of shallow, high-grade drilling results from the Marymia project in WA’s Mid-West region.

Vango is aiming for a decent-sized high‐grade gold resource to support a future large‐scale, stand‐alone, mining and processing operation. Fresh results from the Wedgetail deposit included 1m at 30.6g/t gold, inside a larger 3m section grading 11.7g/t gold – just 25m from surface.

Vango says shallow high-grade gold hits at Wedgetail, MarEast and Mars could “contribute to a major upgrade of the recently released high‐grade gold resource at the Trident Deposit (410,000oz), within the Marymia project”.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.