Gold: If exploration is like gambling, then Predictive Discovery is increasing the odds of a big win

Pic: Schroptschop / E+ via Getty Images

Last Tuesday, micro-cap explorer Predictive Discovery (ASX: PDI) led the market post-to-post after announcing a gold discovery at its Ferkessedougou North project in Cote D’Ivoire.

A series of excellent diamond drill results from the Ouarigue South prospect included 9m at 10.31g/t gold inside a larger 45m section grading 3.16g/t. The stock rose as much as 200 per cent before closing 144 per cent higher at 2 cents. The share price is now up about 60 per cent since the end of May.

- Scroll down for more ASX gold news >>>

Predictive has a pretty interesting business model.

Called Prospect Generation, it allows a small, $5m market cap company like Predictive to have a stake in a numerous exciting projects at the same time.

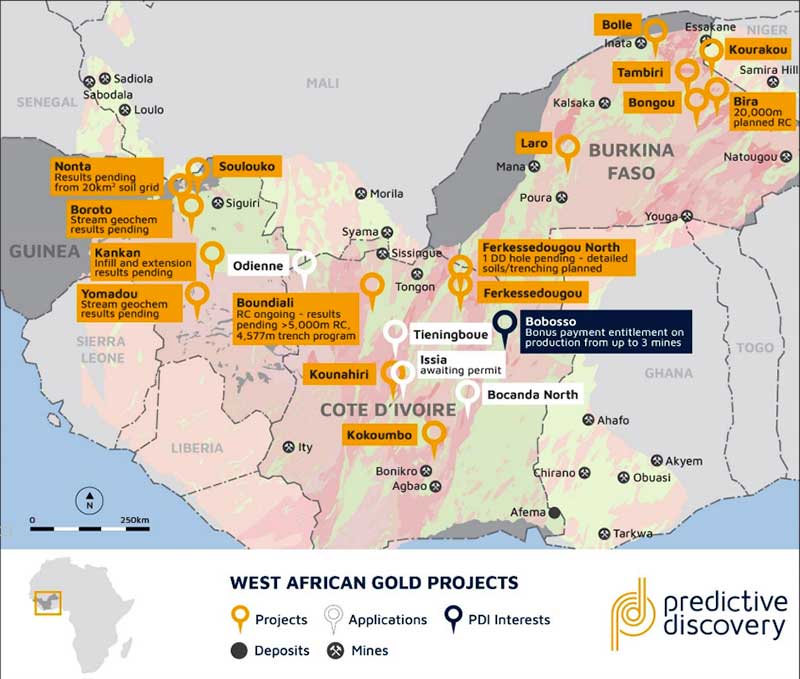

In recent years, Predictive has managed to amass a large portfolio of active properties across the world-class Birimian greenstone belts of Cote D’Ivoire, Guinea and Burkina Faso.

Look at all of these:

How do they do it?

By doing the initial inexpensive exploration work then attracting a cashed-up joint venture partner to fund much of the expensive later stage exploration and development costs.

The company holds significant minority interests (30-49 per cent) in these projects with most exploration activity funded by its partners. This approach has already yielded gold discoveries in Cote D’Ivoire and Burkina Faso, including the recently announced Ouarigue South.

And there’s plenty of newsflow to come across its bulging portfolio.

At Ferkessedougou North, JV partner Toro Gold has started a large-scale soil sampling program over the 17km-long anomalous gold zone.

This program is designed to find another Ouarigue South. After the rainy season, a large-scale trenching program aimed at further delineating “multiple mineralised granitic bodies” within this 17km zone.

Drilling and trenching programs are also ongoing at a number of other projects across the portfolio.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

The really big endgame for a prospect generator is find a monster deposit – and go out with a bang, Predictive managing director Paul Robert told Stockhead in March this year.

“Find a tier one, sell yourself for $100s of millions to the company that wants to build this mine,” he says.

“Everyone who has invested in you makes an awful lot of money.”

In other gold news:

Peel Mining spin-out Saturn Metals (ASX:STN) is “aggressively” targeting high grade gold at Apollo Hill. A new 10,000m campaign will “target the newly discovered high grade zones at Apollo Hill, following up on high grade hits like 5m at 11g/t gold, inside a large 10m section grading 5.78g/t.

“This new program of drilling will further test the potential of those zones and could deliver a step change in the size and grade of the Apollo Hill Mineral Resource,” Saturn managing director Ian Bamborough said.

Yandal Resources (ASX:YRL) says it’s on track to define oxide (shallow) gold resources over a 1.7km stretch at the Flushing Meadows prospect. New drilling at the Flushing Meadows prospect, near Kalgoorlie in WA, returned significant oxide (shallow) gold in most holes, with particularly strong results returned from a continuous 800m zone. But the deepest hole in the program also hit an 96m-long, 0.26g/t mineralised interval in fresh rock to the end of hole “which suggests a substantial target for follow up at depth”.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.