Gold hits keep coming for Meeka at ‘development-ready’ Murchison project

Meeka Metals has hit more high-grade gold at its development-ready Murchison gold project. Pic via Getty Images

- Grades of up to 14.2g/t gold intersected in latest drilling at the “development-ready” Murchison gold project in Western Australia

- Updated resource, grade control model and production plan expected in early 2024

- Last remaining approvals to be prepared and submitted next month

Special Report: Meeka Metals continues to strike high-grade gold in the Murchison as it prepares to submit the last remaining approvals for its flagship 1.2Moz asset.

It has been all systems go for Meeka Metals (ASX: MEK) since the release of a robust feasibility study on the Murchison gold project in July with drilling completed around the periphery of the open pit designs at Turnberry and infill holes punched into the high-grade St Anne’s discovery.

All activities are focused on finalising the “development-ready” status of the 1.2Moz project for early in the new year.

In accordance with those plans, MEK expects to submit the remaining development approval documentation next month.

The feasibility study supported average gold production of 80,000ozpa for eight years with a peak output of 103,000oz in the sixth year of operation. Key financial estimates include undiscounted free cash flow of $521 million, NPV of $371 million and IRR of 56% (all pre-tax) with payback achieved 16 months post commissioning.

Key deposit only constrained by drilling density

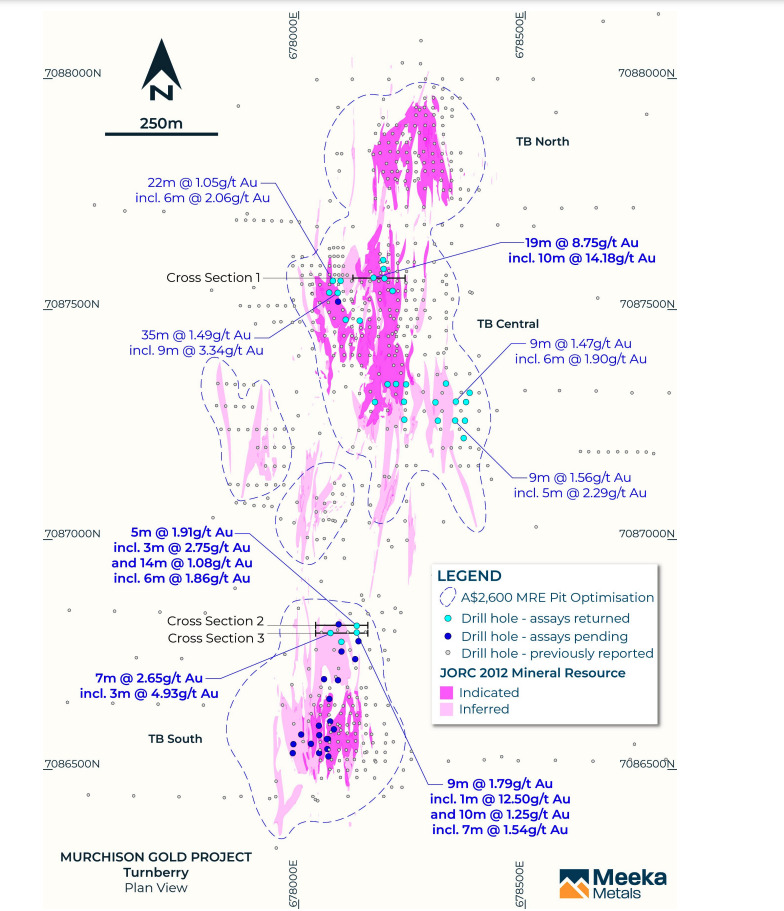

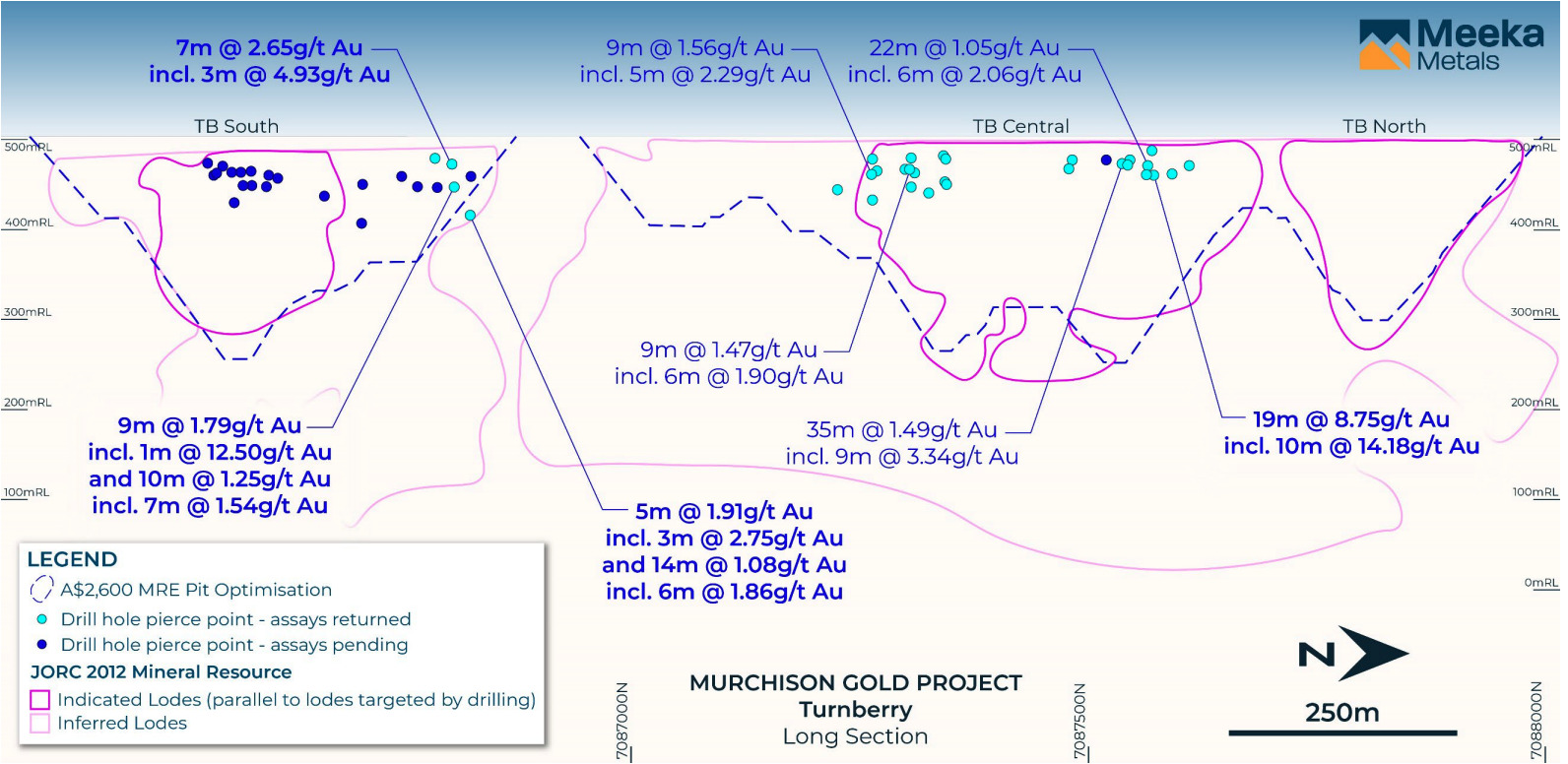

MEK today reported more shallow, high-grade assays from infill drilling of the 685,000oz @ 2g/t gold resource at the unmined Turnberry deposits.

New high-grade oxide gold intersections include:

- 19m @ 8.75g/t gold from 48m, including 10m @ 14.18g/t gold

- 5m @ 1.91g/t gold from 70m, including 3m @ 2.75g/t gold

- 14m @ 1.08g/t gold from 97m, including 6m @ 1.86g/t gold

- 7m @ 2.65 g/t gold from 35m, including 3m @ 4.93 g/t gold

- 9m @ 1.79 g/t gold from 60m, including 1m @ 12.50g/t gold

Assays for an additional 21 holes from Turnberry and a further 17 shallow infill holes at St Anne’s are due next month. Results are expected to support an open pit grade control model in the March 2024 quarter.

An updated resource is also on the cards given this drilling has demonstrated the continuity of mineralisation in the areas under the microscope.

Turnberry has a reported strike length of 1.7km with the resource averaging ~1,600oz per vertical metre from surface to a depth of 200m and is only constrained by the density of drilling.

More assays to come before project launch

MEK managing director Tim Davidson said the company’s development strategy for the Murchison gold project was tracking to schedule.

“Assays from this infill program continue to confirm, and in some places expand, the broad zones of high-grade gold in the mineral resource,” he said.

“Further assays are expected in December 2023, which will inform the open pit grade control model and updated production plan.

“We are also on track to submit the remaining development approval documentation in December 2023, further supporting the development-ready status of the Murchison project in early 2024.”

This article was developed in collaboration with Meeka Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.