Gold hits five-month low, but upside looms on weaker USD, stimulus hopes

Australian decathlon athlete Kyle Cranston heads for the crash mat after pole vaulting. Image: Getty

- The price of gold in USD is at a 5-month low, but analysts see upside into 2021

- ‘Gold has found its floor and there is some evidence of good buying at these lower levels’

- ASX Gold Stocks Guide: Everything you need to know

Gold’s price is trading at a five-month low of $US1,811 per ounce ($2,461/oz) as reported progress in COVID-19 vaccines has turned short-term market sentiment bearish for the yellow metal.

“With the prospects of an imminent coronavirus vaccine, the likelihood of a strong global recovery and a rally in risk assets continues to improve,” analysts at Australia and New Zealand Banking Group told Kitco.

The ANZ analysts stressed longer-term drivers for the gold price, such as low interest rates and a weak US dollar, are still very much in place.

“Our gold valuation model suggests gold should trade around $US2,100 per ounce next year, assuming US inflation rises to 1.7 per cent, the US dollar index falls to 90, and yields on 30-year bonds hold steady around 1.6 per cent,” said the ANZ analysts.

Some analysts suggest a weak US dollar is cushioning the price of gold from further falls.

“Gold has found its floor and there is some evidence of good buying at these lower levels,” independent analyst, Ross Norman, told Reuters.

Yellen appointment as US Treasury Secretary seen as bullish for gold

President-elect Joe Biden’s appointment of former Federal Reserve chairman Janet Yellen as his Treasury Secretary is seen by some analysts as positive for gold prices.

“Janet Yellen’s stated economic policy goals ranging from financial help for municipalities, states, businesses and individuals will require money, which will likely be borrowed,” a report from TD Securities said, according to FXStreet.

The analysts believe that a price target of $US2,000 per ounce for gold is feasible.

Another positive note for gold was sounded in a report by the Bank of International Settlements, which encourages cooperation among the world’s central banks.

Report author, Omar Zulaica, outlined a number of challenging scenarios that may justify central banks increasing their gold holdings to 10 or 20 per cent of total foreign exchange reserves.

“The possibility of large-scale, adverse non-financial events may lead to further reflection,” he said.

“For example, a major war, a period of very high inflation, or speaking to more recent events, a systematic cyber attack or a global pandemic may give central banks enough reason to hold on — if not add – to their bars of gold,” said Zulaica, according to Kitco.

Silver’s price is trading at $US23.28 per ounce ($31.63/oz), Friday, and off its August high of $US29.25/oz.

African Gold makes its move on Côte d’Ivoire project

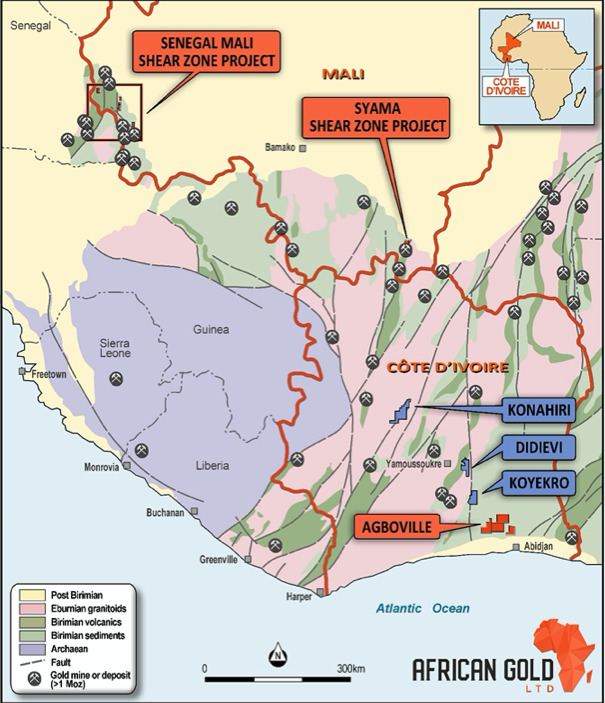

African Gold (ASX:A1G) has agreed to acquire a high-grade gold project in the west African country of Côte d’Ivoire (Ivory Coast) that covers a 1,534sqkm exploration tenement.

The landholding adds to the company’s exploration activity in the country and neighbouring Mali, and includes the Didievi project and Blaffo Gueto prospect.

Didievi is in Côte d’Ivoire’s underexplored Oume-Fetekro birimian greenstone belt that is host to several mines including Allied Gold’s Bonikro-Hire 3 million-ounce mine and Endeavor’s Agbaou 1 million-ounce mine.

The acquisition is through a farm-in agreement for 80 per cent of Kouroufaba Gold.

“African Gold is now in a position to implement a multi-pronged strategy with potential resource definition from its new brownfields projects, drilling of its advanced targets and new discoveries from its impressive and highly prospective portfolio,” chief executive, Glen Edwards, said.

Great Boulder Resources extends WA project’s strike length

Great Boulder Resources (ASX:GBR) has extended the strike length of mineralisation for its Mulga Bill corridor within its Side Well gold project in near Meekatharra in WA.

Gold has now been identified along more than 3.7km of strike, and mineralisation at Mulga Bill remains open to the north and south.

Infill drilling for 4,000m at Mulga Bill will further increase geological confidence in the zone.

“The auger results east of Mulga Bill highlight gold potential in an area that has never been explored before, and appear to be the northern continuation of structures coming north from the Gabanintha gold project,” managing director, Andrew Paterson, said.

Great Boulder Resources has another gold WA project in Whiteheads near Kalgoorlie.

New Zealand-focused gold explorer Santana Minerals (ASX:SMI) has started drilling at its Bendigo Ophir project’s three deposits.

The project on New Zealand’s South Island is 90km northwest of Oceana Gold’s (ASX:OGC) Macraes gold mine which has a 3 million-ounce resource.

The drilling’s aim is to extend the project’s existing mineral resource of 253,000 ounces of gold.

ASX share prices for African Gold (ASX:A1G), Great Boulder Resources (ASX:GBR), Santana Minerals (ASX:SMI)

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.