Gold fever still gripping explorers and speculators in 2018

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

There is a flurry of activity in the gold space to kick off 2018 — from record gold production to more project acquisitions.

To ring in its new year, producer Ramelius Resources (ASX:RMS) announced it beat its guidance for the December quarter, with output from its Western Australian mines reaching a record 58,012 ounces.

The company had been expecting between 51,000 and 55,000 ounces.

“Ramelius has attained our targeted annualised production rate of over 200,000 ounces,” boss Mark Zeptner said.

“This record quarter exceeded guidance due to the hard work and focus by our operations

teams across our three sites, including the newly acquired Edna May gold mine.”

The Edna May mine, which Ramelius bought from larger rival Evolution Mining in October last year for $90 million, contributed 21,377 ounces to production.

Evolution made the decision to sell Edna May because it was too high cost for the mid-tier miner.

Ramelius also expects its all-in sustaining costs — that is, costs including all expenses — to come in lower than its $1250-per-ounce forecast for the December quarter.

The company had cash and gold worth $61.8 million at the end of the quarter.

Closing in on first gold

On the development front, Gascoyne Resources (ASX:GCY) is less than five months away from first production at its flagship Dalgaranga gold mine.

The company said it is within budget and on time, with first production scheduled for the second quarter of this year.

Gascoyne awarded NRW Holdings a $300 million contract in October last year covering open pit mining, including drilling and blasting of four pits over a six-year period.

Dalgaranga has an initial mine life of six years, producing an average of around 100,000 ounces per annum at a cost of about A$1,000/oz. Commissioning of the 2.5-million-tonne-per-annum process plant is slated for May.

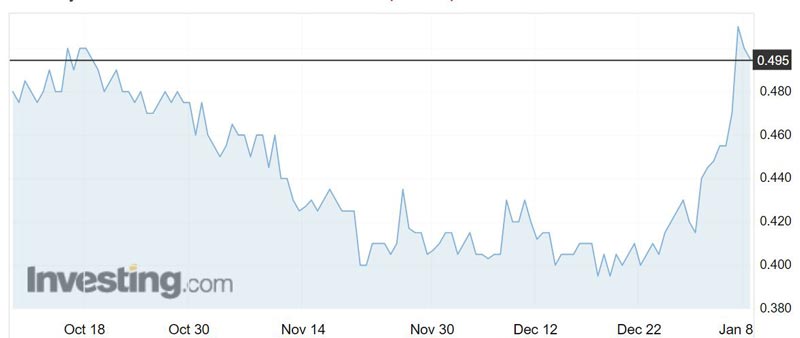

Investors shrugged off Monday’s news, pushing the share price down nearly 4 per cent to an intra-day low of 49c. Gascoyne closed the day out at 49.5c.

Meanwhile, merger and acquisition activity in the gold space is also off to a promising start this year.

Junior explorer BMG Resources (ASX:BMG) told investors on Monday it would remain in a trading halt until at least Wednesday — when it expected to reveal news of a “significant gold exploration asset”.

BMG has been on the hunt for new investments with the potential for near term production and/or near term cash-flow in the resources and non-resources sectors after it divested its majority interest in a copper and gold project in the Republic of Cyprus in 2016.

Gold the ‘dark horse’ for 2018?

There was somewhat of a renaissance in the gold sector last year thanks in large part to a nuggetty gold discovery made in July by Artemis Resources (ASX:ARV) and Canadian partner Novo Resources in the Pilbara region of north Western Australia.

The view on gold for this year, however, is mixed.

While UBS says the outlook for gold has deteriorated, resource expert Gavin Wendt believes gold can be the “Commodity Dark Horse of 2018”.

Mr Wendt sees rising interest rates and U.S. dollar weakness having positive implications for gold’s future direction.

“Gold has finished the past three calendar years in the relative doldrums, but burst out of the blocks at the beginning of both 2016 and 2017 — and I believe we’ll see a similar performance during 2018,” he said.

In the past 12 months, the price of gold has gained 11.6 per cent, climbing from $US1183.50 ($1507.71) to $US1320.90.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.