Gold explorer Indiana has huge upside and, so far, investors are missing it

Pic: Tyler Stableford / Stone via Getty Images

A ‘belt scale’ land package in an underexplored Aussie gold province, an aggressive exploration strategy, and a ‘free hit’ at $US95m. This is why $20m market cap Indiana Resources believes it is flying under the radar.

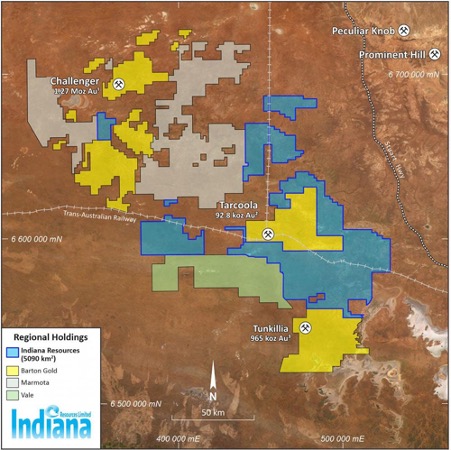

Last year, Indiana (ASX:IDA) picked up 5,090km2 of gold-rich exploration ground in South Australia’s Central Gawler Craton.

The Harris Greenstone Belt is similar in nature to the prolific Archean Greenstone Belt in the Goldfields of WA.

These are historic gold workings, and prospects that have been drilled previously. The more advanced exploration targets.

But, Indiana exec chairman and major shareholder Bronwyn Barnes says, “when you look across the tenement package there is so much ground which hasn’t been sampled at all.”

“We’re excited about going into these areas that have never been looked at.

“The potential is huge.”

This is the type of landholding where big gold deposits are found.

Indiana is surrounded by some high profile names, like Brazilian mega cap Vale and the soon-to be listed Barton Gold. A bunch of other small caps are also snatching up ground in the Gawler.

“To the north and south of us is Barton Gold,” Barnes says.

“They own both Tarcoola and Tunkillia (965,000oz) and then Challenger mine (+1moz historic production) further to the north.

“We hold all the ground in between.”

Barton plans to list on the ASX very soon.

“I think we are all waiting pretty excitedly to see what happens when they list,” Barnes says.

“It is a fantastic market for IPOs, especially gold IPOs. I am looking forward to seeing what number the market puts on Barton.

“I think it could herald a bit of a re-rate for the entire region.”

‘A belt scale opportunity’

Indiana’s initial focus is the advanced Minos prospect, where mineralisation has already been found over wide intervals along 400m length from just 12m depth.

Historic intersections include:

- 12m @ 10.36 g/t gold from 120m

- 6m @ 12.37 g/t gold from 136m

- 24m @ 2.18 g/t gold from 44m

- 10m @ 4.64 g/t gold from 130m, and

- 5m @ 7.32 g/t gold from 105m

Thick, shallow, and high grade – these hits tick all the boxes.

In January, Indiana also discovered old Minos drill core at the South Australian Drill Core Reference Library which had never been assayed, until now.

Results from the lab confirmed thick and shallow gold with high-grade intercepts.

Indiana recently completed a 10 hole 1,600m drilling program at Minos.

Results from the first five holes were spectacular, sending the stock up +30 per cent in morning trade Monday, February 22.

Highlights include:

- 2m at 59 g/t gold from 106m (including 1m at 84g/t and 1m at 34 g/t)

- 3m at 18.33 g/t from 189m (including 1m at 42.1 g/t)

- 22m at 3.07 g/t from 125m (including 1m at 21.5 g/t and 1m at 23.0 g/t)

The remaining assay results are expected within one week.

After that, an ‘infill’ drilling program is planned in the coming months to produce a maiden resource for Minos.

“Our next program of drilling will be a combination of RC and diamond so we can look at releasing a resource at Minos — a good early win for shareholders,” Barnes says.

Over the past few months, Indiana has also undertaken a technical review to look at the project from a regional perspective.

Indiana’s project is not an assortment of exploration tenements spread over different areas: this is a belt scale opportunity which has seen only limited and sporadic exploration over the past 20 years.

There aren’t many addresses in Australia where you can pick up ground that looks like this, Barnes says.

“When I was running Windward Resources there was large number of companies with postage stamp tenements in the Fraser Range,” she says.

“This led to an ‘ad hoc’ approach to exploration across a regional belt.

“Compare that with my last experience where I was on the Board of MOD Resources, where we controlled 11000sqkm of the Botswana copper belt.

“There is huge strategic value in a contiguous and extensive land package.”

Established copper miner Sandfire (ASX:SFR) acquired MOD and its advanced T3 project for $167m in 2019.

New Indiana exploration manager Gary Ferris is a well-known geologist in South Australia, where he has worked for a long time.

“He is putting together an exploration strategy which will cover the entire tenement package,” Barnes says.

“Minos, Ariadne, Double Dutch, Earea Dam,– those are our key areas we are focusing on this year for an expanded drilling programs, which we will start rolling out over the next couple of months. Along with that, we will commence regional exploration activities, including soil geochem, geological mapping and airborne magnetics focused on the priority greenstone belts within the tenement package.”

How about that $US95m?

Once considered investment-friendly, the east-African nation of Tanzania stunned ASX resource plays in July 2017 with sweeping changes to its Mining Act.

As part of these changes, Indiana had its Retention Licence for its advanced Ntaka Hill nickel sulphide project cancelled by the Tanzanian government.

Indiana is now pursuing minimum $US95m in compensation from the Tanzanian government for the loss of the asset and its historic investment of more than US$60m in exploration and development costs.

The kicker is this: all litigation costs will be paid for by Litigation Capital Management (LCM), a firm listed on the Alternative Investment Market (AIM) of the London Stock Exchange.

LCM, which only get paid in the event of a successful claim, are used to winning.

By the end of 2019 the firm had completed 205 cases over 21 years – 87 per cent of these were profitable.

“They are one of the highest profile, most successful litigation funding firms in the world,” Barnes says.

“That sometimes gets lost on people – they don’t back claims they don’t research fully, and don’t expect to win.”

This article was developed in collaboration with Indiana Resources,a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.