Gold Digger: Will bank collapses usher in a new gold bull market?

A customer stands outside of a shuttered Silicon Valley Bank (SVB) headquarters on March 10, 2023. (Photo by Justin Sullivan/Getty Images)

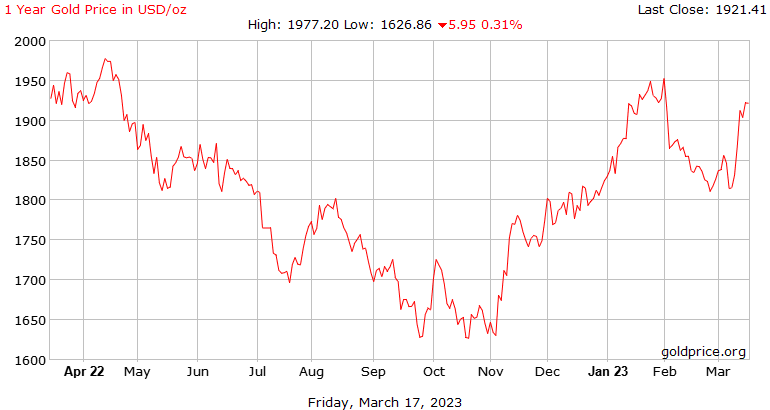

- The collapse of at least two US banks has provided a jolt to the precious metals market

- This increases possibility that US Fed may now reconsider future interest rate rises, a big driver of gold prices in recent months

- Gold’s next big test is the Fed’s rates decision on March 22

Our Gold Digger column wraps all the news driving ASX stocks with exposure to precious metals.

The collapse of at least two US banks has provided a jolt to the precious metals market.

Concerns about contagion within the global banking sector are very real, with several other necks hovering over the proverbial chopping block.

BREAKING: First Republic Bank crashes 35% on the open as they announce exploring strategic options, including a sale.

Here we go again. pic.twitter.com/gmFXeeWsSj

— Genevieve Roch-Decter, CFA (@GRDecter) March 16, 2023

Bank Run Continues pic.twitter.com/TeSKc4skUf

— Wall Street Silver (@WallStreetSilv) March 17, 2023

But why would this boost precious metals prices?

There are two reasons; one, the rush to safe haven assets (of which gold is one) and two, the possibility that the Fed may now reconsider future interest rate rises.

Fed policy – and market expectations around Fed policy – has been a particularly important driver of gold prices in recent months, says Metals Focus.

“Much of the price upside seen in Q4.22 reflected investor expectations that the Fed would turn more dovish, anticipating modest rate increases in H1.23, before seeing cuts emerge during H2,” it says.

“However, in the past couple of months, as US economic data pointed to a still robust economy, expectations were adjusted to the Fed remaining hawkish for longer.

“Meanwhile, rising nominal and real rates increasingly acted as a headwind to institutional investors who could secure around 4% in risk-free vehicles, like 10-year Treasuries.

“This, combined with a strong dollar, again due to a hawkish Fed, had weighed on gold.”

The collapse of SVB has once again changed the market narrative around Fed interest rates, says Metals Focus.

“Leaving aside the bank’s risk-management and governance failings, there is no doubt that the rising interest rate environment has played a key role it its demise,” it says.

“From its side, the Fed has not as yet commented on how SBV’s failure may affect its interest rate policy over the rest of the year.”

Gold’s next big test: the March rates decision in the US

The US Fed makes its next rates decision on March 22.

This decision, and the messaging that accompanies it, will be crucial to the outlook for gold over the rest of 2023, says Metals Focus.

“It is of course tempting to adopt the dovish expectation [lower rates] that is fast becoming the consensus. However, we are not convinced this is right,” it says.

Investors should weigh up other factors that have underpinned the Fed’s hawkish [higher rates] stance, namely that inflation is stubbornly high, the US labour market is robust and equity valuations are historically high, despite the past couple of months’ declines, it says.

“As such, in our base case, we would still not rule out some further rate hikes in the next few months and certainly struggle with the idea of cuts within 2023.”

Yesterdays CPI report clearly shows inflation is still a problem despite the SVB collapse and wider banking situation.

What do you think Jerome Powell will do to US interest rates when he announces the rate decision at the Fed Meeting next week March 21st /22nd?

— The Biz Doc (@TomEllsworth) March 15, 2023

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| CODE | COMPANY | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | YEAR TO DATE RETURN % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|---|

| GWR | GWR Group | 75% | 93% | 33% | -29% | 86% | 0.11 | $35,333,832 |

| MBK | Metal Bank | 38% | 26% | -28% | -59% | -15% | 0.029 | $7,188,624 |

| ADG | Adelong Gold | 38% | 10% | 10% | -63% | 57% | 0.011 | $5,338,223 |

| PUA | Peak Minerals | 25% | -17% | -44% | -58% | -17% | 0.005 | $5,206,883 |

| RMS | Ramelius Resources | 21% | 37% | 79% | -23% | 25% | 1.165 | $978,038,512 |

| WGX | Westgold Resources | 21% | 9% | 38% | -43% | 26% | 1.1 | $513,880,662 |

| IVR | Investigator Res | 20% | 8% | -13% | -37% | 0% | 0.042 | $57,486,546 |

| RSG | Resolute Mining | 20% | 35% | 64% | 12% | 65% | 0.33 | $670,637,069 |

| KCN | Kingsgate Consolid. | 19% | 18% | 16% | 33% | 4% | 1.79 | $334,193,884 |

| CMM | Capricorn Metals | 19% | 13% | 56% | 15% | -3% | 4.47 | $1,728,487,605 |

| STN | Saturn Metals | 18% | 0% | -42% | -57% | -8% | 0.165 | $24,247,764 |

| AGG | AngloGold Ashanti | 16% | 9% | 47% | -12% | -1% | 5.83 | $510,268,416 |

| RXL | Rox Resources | 15% | 66% | 0% | -34% | 51% | 0.265 | $57,210,336 |

| GNM | Great Northern | 14% | 0% | 0% | -20% | 0% | 0.004 | $5,981,678 |

| OBM | Ora Banda Mining | 13% | 31% | 106% | 165% | 55% | 0.13 | $185,352,990 |

| SLR | Silver Lake Resource | 13% | -2% | -3% | -47% | -8% | 1.0875 | $1,027,367,488 |

| MOH | Moho Resources | 12% | -5% | -47% | -67% | -10% | 0.019 | $3,945,582 |

| PNM | Pacific Nickel Mines | 11% | 7% | -21% | -35% | -6% | 0.078 | $29,332,785 |

| FAL | Falconmetals | 11% | 16% | 103% | 7% | 41% | 0.395 | $66,375,000 |

| TBR | Tribune Res | 11% | 0% | -2% | -23% | -11% | 3.59 | $181,539,546 |

| TUL | Tulla Resources | 10% | -19% | -53% | -59% | -31% | 0.23 | $50,019,386 |

| WWI | West Wits Mining | 9% | -11% | -33% | -67% | -25% | 0.012 | $25,826,166 |

| CWX | Carawine Resources | 9% | -11% | -2% | -54% | -2% | 0.098 | $19,288,112 |

| GOR | Gold Road Res | 8% | 4% | 21% | -10% | -11% | 1.5125 | $1,681,499,765 |

| CEL | Challenger Exp | 8% | -7% | -30% | -61% | -26% | 0.13 | $141,185,030 |

| SPD | Southernpalladium | 8% | -18% | -49% | 0% | -35% | 0.53 | $22,831,513 |

| ARL | Ardea Resources | 8% | -16% | -39% | -34% | -24% | 0.54 | $79,748,789 |

| MEK | Meeka Metals | 8% | -17% | -38% | -9% | -37% | 0.043 | $45,907,184 |

| MGV | Musgrave Minerals | 7% | -1% | -21% | -47% | -13% | 0.1825 | $106,417,431 |

| REZ | Resourc & En Grp | 7% | 15% | -38% | -63% | -6% | 0.015 | $7,497,087 |

| SBR | Sabre Resources | 7% | -12% | -50% | -45% | -21% | 0.03 | $7,870,127 |

| RRL | Regis Resources | 7% | -8% | 22% | -14% | -14% | 1.7775 | $1,355,271,535 |

| CLA | Celsius Resource | 7% | 0% | 19% | -16% | 0% | 0.016 | $29,715,265 |

| QML | Qmines | 7% | -11% | 14% | -35% | -3% | 0.16 | $14,433,445 |

| TAR | Taruga Minerals | 6% | -6% | -48% | -43% | -29% | 0.017 | $11,296,429 |

| SBM | St Barbara | 6% | -11% | -29% | -63% | -27% | 0.5675 | $489,924,987 |

| PDI | Predictive Disc | 6% | 9% | 0% | -20% | -3% | 0.175 | $321,413,766 |

| NST | Northern Star | 6% | -3% | 49% | 4% | 1% | 10.99 | $12,821,891,879 |

| AAR | Astral Resources NL | 6% | -1% | -7% | -32% | 3% | 0.074 | $49,240,338 |

| KSN | Kingston Resources | 5% | -15% | -1% | -42% | 10% | 0.0895 | $36,577,522 |

| SVL | Silver Mines | 5% | 2% | -10% | -35% | -24% | 0.1525 | $217,623,045 |

| AUT | Auteco Minerals | 5% | -5% | -7% | -45% | -20% | 0.041 | $94,826,288 |

| GTR | Gti Energy | 5% | 5% | -50% | -50% | -5% | 0.0105 | $13,549,352 |

| NCM | Newcrest Mining | 5% | 2% | 47% | -6% | 18% | 24.39 | $22,119,293,345 |

| CPM | Coopermetals | 4% | -16% | -35% | -41% | 0% | 0.235 | $9,657,325 |

| PRU | Perseus Mining | 4% | 12% | 50% | 12% | 0% | 2.11 | $2,940,045,693 |

| ALK | Alkane Resources | 4% | 6% | -6% | -35% | 26% | 0.675 | $404,185,000 |

| USL | Unico Silver | 4% | 0% | -16% | -39% | -21% | 0.135 | $33,663,218 |

| NSM | Northstaw | 4% | -24% | -3% | -55% | -10% | 0.14 | $16,817,780 |

| BRB | Breaker Res NL | 4% | 0% | 16% | 21% | -11% | 0.285 | $90,698,329 |

| GIB | Gibb River Diamonds | 3% | -2% | 3% | -2% | 0% | 0.06 | $12,690,567 |

| BMR | Ballymore Resources | 3% | 3% | -17% | -6% | 0% | 0.15 | $14,929,206 |

| TG1 | Techgen Metals | 3% | -26% | -66% | -52% | -24% | 0.062 | $3,484,961 |

| AME | Alto Metals | 3% | -6% | -9% | -30% | -4% | 0.064 | $37,381,744 |

| DEG | De Grey Mining | 3% | 7% | 43% | 10% | 13% | 1.455 | $2,263,692,027 |

| SSR | SSR Mining Inc. | 3% | 0% | 3% | -32% | -12% | 20.17 | $383,098,683 |

| KAU | Kaiser Reef | 3% | -1% | -3% | -10% | 6% | 0.175 | $24,088,606 |

| TAM | Tanami Gold NL | 3% | -10% | -14% | -38% | -8% | 0.036 | $43,478,591 |

| POL | Polymetals Resources | 3% | -5% | 0% | 50% | -27% | 0.18 | $8,584,711 |

| WAF | West African Res | 3% | 1% | -16% | -23% | -18% | 0.965 | $982,575,715 |

| BNZ | Benzmining | 3% | -12% | -26% | -32% | -2% | 0.4 | $29,384,247 |

| MZZ | Matador Mining | 3% | -13% | -29% | -70% | -29% | 0.082 | $25,847,944 |

| GCY | Gascoyne Res | 2% | -36% | -59% | -62% | -36% | 0.1075 | $63,913,872 |

| GCY | Gascoyne Res | 2% | -36% | -59% | -62% | -36% | 0.1075 | $63,913,872 |

| EMR | Emerald Res NL | 2% | 0% | 26% | 40% | 27% | 1.505 | $893,670,479 |

| FG1 | Flynngold | 1% | -5% | -17% | -42% | -17% | 0.083 | $8,538,504 |

| CAI | Calidus Resources | 1% | -7% | -60% | -74% | -18% | 0.2225 | $101,096,693 |

| NPM | Newpeak Metals | 0% | 0% | 0% | 0% | 0% | 0.001 | $9,145,132 |

| FFX | Firefinch | 0% | 0% | 0% | -29% | 0% | 0.2 | $236,569,315 |

| DCX | Discovex Res | 0% | -14% | -40% | -65% | 0% | 0.003 | $9,907,704 |

| AQX | Alice Queen | 0% | -33% | -67% | -88% | -50% | 0.001 | $2,530,288 |

| PNX | PNX Metals | 0% | -25% | -36% | -20% | -29% | 0.003 | $16,141,874 |

| YRL | Yandal Resources | 0% | 3% | -39% | -62% | -7% | 0.091 | $14,517,883 |

| CAZ | Cazaly Resources | 0% | -7% | -33% | -30% | -18% | 0.028 | $10,039,188 |

| ERM | Emmerson Resources | 0% | -1% | -11% | -46% | -3% | 0.073 | $40,308,524 |

| GMR | Golden Rim Resources | 0% | -6% | -39% | -68% | -3% | 0.03 | $17,156,063 |

| WCN | White Cliff Min | 0% | -17% | -60% | -62% | -29% | 0.01 | $7,840,544 |

| MCT | Metalicity | 0% | -17% | -38% | -57% | -17% | 0.0025 | $7,009,079 |

| CTO | Citigold Corp | 0% | 0% | -17% | -38% | -17% | 0.005 | $14,168,295 |

| TRY | Troy Resources | 0% | 0% | 0% | 0% | 0% | 0.0295 | $62,920,961 |

| CGN | Crater Gold Min | 0% | 0% | 0% | 0% | 0% | 0.014499 | $17,965,037 |

| SVG | Savannah Goldfields | 0% | -13% | -31% | -28% | -13% | 0.165 | $31,159,992 |

| ADV | Ardiden | 0% | 0% | 0% | -46% | 0% | 0.007 | $18,818,347 |

| MTH | Mithril Resources | 0% | -33% | -60% | -80% | -43% | 0.002 | $3,263,090 |

| RMX | Red Mount Min | 0% | -27% | -33% | -50% | -20% | 0.004 | $9,087,404 |

| NML | Navarre Minerals | 0% | -18% | -35% | -68% | -24% | 0.031 | $43,583,495 |

| MEU | Marmota | 0% | -17% | -21% | -16% | -23% | 0.037 | $42,352,023 |

| RML | Resolution Minerals | 0% | -25% | -40% | -65% | -25% | 0.006 | $6,478,477 |

| AL8 | Alderan Resource | 0% | 0% | -22% | -63% | 0% | 0.007 | $4,047,863 |

| GMN | Gold Mountain | 0% | -20% | -33% | -60% | -43% | 0.004 | $7,879,730 |

| HMG | Hamelingold | 0% | -14% | -44% | -44% | -38% | 0.09 | $9,900,000 |

| TBA | Tombola Gold | 0% | 0% | -26% | -28% | 0% | 0.026 | $33,129,243 |

| FML | Focus Minerals | 0% | 0% | 38% | -28% | -29% | 0.18 | $48,714,970 |

| GSR | Greenstone Resources | 0% | -19% | -69% | -46% | -34% | 0.021 | $25,361,258 |

| HRN | Horizon Gold | 0% | -12% | -9% | -29% | -3% | 0.3 | $37,554,492 |

| RDN | Raiden Resources | 0% | 0% | -41% | -58% | 0% | 0.005 | $7,445,621 |

| EMU | EMU NL | 0% | -50% | -68% | -84% | -59% | 0.002 | $2,900,043 |

| SFM | Santa Fe Minerals | 0% | -9% | -20% | -60% | -15% | 0.068 | $4,951,678 |

| X64 | Ten Sixty Four | 0% | -2% | -7% | -33% | -11% | 0.57 | $130,184,182 |

| RVR | Red River Resources | 0% | 0% | -21% | -68% | 0% | 0.073 | $37,847,908 |

| TMZ | Thomson Res | 0% | -38% | -79% | -90% | -74% | 0.005 | $4,349,755 |

| WMC | Wiluna Mining Corp | 0% | 0% | 0% | -74% | 0% | 0.205 | $74,238,031 |

| RED | Red 5 | 0% | -21% | -43% | -64% | -34% | 0.135 | $433,584,795 |

| RDS | Redstone Resources | 0% | 0% | 11% | 0% | 25% | 0.01 | $7,368,324 |

| CXU | Cauldron Energy | 0% | -13% | -44% | -60% | 0% | 0.007 | $7,452,544 |

| ALY | Alchemy Resource | 0% | -12% | -35% | 25% | -35% | 0.015 | $17,671,144 |

| LCY | Legacy Iron Ore | 0% | 20% | -10% | -5% | -5% | 0.018 | $115,322,872 |

| ZAG | Zuleika Gold | 0% | -21% | -38% | -59% | -38% | 0.013 | $6,799,658 |

| GML | Gateway Mining | 0% | -18% | -49% | -62% | -23% | 0.046 | $13,050,344 |

| XAM | Xanadu Mines | 0% | 3% | -2% | 14% | 10% | 0.032 | $54,048,198 |

| CHZ | Chesser Resources | 0% | 0% | 14% | -22% | 6% | 0.09 | $54,151,324 |

| ARN | Aldoro Resources | 0% | 13% | -8% | -32% | 38% | 0.22 | $26,534,394 |

| DTR | Dateline Resources | 0% | -41% | -79% | -79% | -49% | 0.019 | $11,151,891 |

| NES | Nelson Resources. | 0% | -17% | -62% | -66% | -29% | 0.005 | $2,942,972 |

| TLM | Talisman Mining | 0% | -13% | -7% | -18% | -4% | 0.135 | $25,344,832 |

| BEZ | Besragoldinc | 0% | -9% | 13% | -47% | -23% | 0.04 | $14,154,476 |

| OAU | Ora Gold | 0% | -58% | -56% | -78% | -50% | 0.0025 | $11,810,775 |

| DEX | Duke Exploration | 0% | 0% | 10% | -72% | 0% | 0.053 | $5,587,240 |

| AYM | Australia United Min | 0% | -25% | -50% | -40% | 0% | 0.003 | $5,527,732 |

| ANL | Amani Gold | 0% | 0% | 0% | -50% | 0% | 0.001 | $24,693,441 |

| PNT | Panthermetals | 0% | -32% | -32% | -41% | -35% | 0.13 | $3,690,000 |

| BGL | Bellevue Gold | -1% | -1% | 52% | 23% | -1% | 1.1225 | $1,275,910,992 |

| SFR | Sandfire Resources | -1% | -10% | 48% | 8% | 4% | 5.645 | $2,540,319,120 |

| TCG | Turaco Gold | -2% | -3% | 21% | -40% | 9% | 0.063 | $27,801,583 |

| GUL | Gullewa | -2% | 8% | -8% | -18% | -7% | 0.056 | $10,963,294 |

| SPQ | Superior Resources | -2% | -10% | -4% | 10% | -4% | 0.054 | $88,463,462 |

| IDA | Indiana Resources | -2% | -7% | -22% | -12% | -5% | 0.052 | $26,563,855 |

| AUC | Ausgold | -2% | 0% | 14% | 4% | 4% | 0.049 | $101,473,727 |

| TIE | Tietto Minerals | -2% | -15% | 12% | 0% | -20% | 0.5675 | $630,765,944 |

| AMI | Aurelia Metals | -2% | -11% | -54% | -78% | -18% | 0.1025 | $142,305,280 |

| PGD | Peregrine Gold | -2% | -2% | -31% | -11% | 8% | 0.415 | $15,633,347 |

| MKG | Mako Gold | -3% | -3% | -39% | -58% | -3% | 0.039 | $17,922,752 |

| MAT | Matsa Resources | -3% | -17% | -7% | -33% | 5% | 0.039 | $16,068,180 |

| STK | Strickland Metals | -3% | 16% | -24% | -34% | -8% | 0.037 | $60,642,222 |

| LM8 | Lunnonmetals | -3% | -4% | 3% | -2% | 2% | 0.91 | $104,382,321 |

| NXM | Nexus Minerals | -3% | -15% | -23% | -60% | -18% | 0.165 | $56,954,329 |

| NWM | Norwest Minerals | -3% | -48% | -30% | -52% | -39% | 0.033 | $7,107,436 |

| ORN | Orion Minerals | -3% | -9% | -11% | -36% | 0% | 0.016 | $71,330,245 |

| HAW | Hawthorn Resources | -3% | -13% | -9% | 9% | -24% | 0.087 | $28,643,835 |

| BCN | Beacon Minerals | -3% | 4% | 22% | -22% | 0% | 0.028 | $105,189,509 |

| GMD | Genesis Minerals | -3% | -14% | -6% | -38% | -22% | 0.98 | $417,182,574 |

| AZS | Azure Minerals | -4% | -14% | 29% | -29% | 20% | 0.27 | $105,363,739 |

| KNB | Koonenberrygold | -4% | -12% | -40% | -44% | -15% | 0.053 | $4,015,092 |

| S2R | S2 Resources | -4% | -16% | -13% | -21% | -24% | 0.13 | $55,362,355 |

| ENR | Encounter Resources | -4% | -7% | -10% | -16% | -28% | 0.13 | $44,440,723 |

| PNR | Pantoro | -4% | -15% | -74% | -83% | -48% | 0.05 | $102,282,183 |

| AGC | AGC | -4% | -12% | -29% | -45% | -17% | 0.05 | $4,900,000 |

| CDR | Codrus Minerals | -4% | -21% | 27% | -14% | -27% | 0.095 | $3,840,850 |

| ASO | Aston Minerals | -4% | 25% | 25% | -27% | 38% | 0.11 | $108,012,501 |

| HAV | Havilah Resources | -4% | -11% | -8% | 86% | -2% | 0.325 | $98,158,155 |

| LEX | Lefroy Exploration | -4% | -10% | -27% | -32% | -17% | 0.215 | $34,498,470 |

| WRM | White Rock Min | -5% | -2% | -27% | -69% | -5% | 0.063 | $17,373,121 |

| BYH | Bryah Resources | -5% | -16% | -28% | -54% | -19% | 0.021 | $5,625,069 |

| PUR | Pursuit Minerals | -5% | -28% | 50% | 5% | 31% | 0.021 | $26,119,519 |

| SXG | Southern Cross Gold | -5% | -12% | 82% | 0% | -24% | 0.61 | $53,446,449 |

| VKA | Viking Mines | -5% | -9% | 25% | -9% | 0% | 0.01 | $10,252,584 |

| TTM | Titan Minerals | -5% | -13% | 7% | -43% | -10% | 0.06 | $80,442,572 |

| MEG | Megado Minerals | -5% | -7% | -53% | -50% | -11% | 0.04 | $5,436,111 |

| CBY | Canterbury Resources | -5% | -2% | 14% | -43% | -2% | 0.04 | $5,760,941 |

| EVN | Evolution Mining | -5% | -12% | 28% | -42% | -13% | 2.605 | $4,991,244,388 |

| AAJ | Aruma Resources | -5% | -14% | -12% | -30% | 8% | 0.057 | $9,260,729 |

| CST | Castile Resources | -5% | -6% | -25% | -47% | -5% | 0.09 | $22,013,121 |

| CHN | Chalice Mining | -5% | -2% | 54% | -11% | -3% | 6.125 | $2,266,212,108 |

| MVL | Marvel Gold | -6% | -19% | -45% | -62% | -35% | 0.017 | $13,396,793 |

| SRN | Surefire Rescs NL | -6% | 13% | 13% | 31% | 42% | 0.017 | $28,464,543 |

| KCC | Kincora Copper | -6% | -3% | -3% | -55% | -7% | 0.068 | $8,228,958 |

| MRZ | Mont Royal Resources | -6% | -23% | -35% | -41% | -6% | 0.165 | $13,011,707 |

| MXR | Maximus Resources | -6% | -11% | -31% | -48% | -18% | 0.033 | $10,847,896 |

| IPT | Impact Minerals | -6% | -11% | 7% | -25% | 14% | 0.008 | $19,850,964 |

| KRM | Kingsrose Mining | -6% | -3% | 25% | -15% | -2% | 0.064 | $46,656,644 |

| HCH | Hot Chili | -6% | 2% | -25% | -34% | 0% | 0.875 | $103,917,329 |

| VAN | Vango Mining | -6% | -2% | 24% | 21% | 27% | 0.047 | $59,217,069 |

| AWJ | Auric Mining | -6% | -27% | -42% | -48% | -28% | 0.046 | $6,019,541 |

| LCL | Los Cerros | -6% | -22% | 2% | -72% | -47% | 0.03 | $20,896,227 |

| TSO | Tesoro Gold | -6% | 11% | -13% | -63% | -17% | 0.03 | $31,605,377 |

| BTR | Brightstar Resources | -6% | -29% | -6% | -44% | -12% | 0.015 | $10,778,675 |

| NVA | Nova Minerals | -6% | -28% | -43% | -28% | -35% | 0.445 | $89,628,155 |

| G50 | Gold50 | -6% | 16% | 57% | -8% | -12% | 0.22 | $12,527,460 |

| A8G | Australasian Metals | -6% | -26% | -51% | -68% | -24% | 0.145 | $5,969,722 |

| RND | Rand Mining | -6% | -8% | -9% | -17% | -4% | 1.3 | $73,938,749 |

| VMC | Venus Metals Cor | -7% | -3% | -20% | -22% | 4% | 0.14 | $24,931,016 |

| MAU | Magnetic Resources | -7% | -1% | -32% | -53% | -21% | 0.68 | $156,068,419 |

| SMI | Santana Minerals | -7% | -11% | -3% | 40% | 13% | 0.74 | $101,168,767 |

| SMS | Starminerals | -7% | -7% | -30% | -69% | -10% | 0.065 | $1,959,217 |

| DRE | Dreadnought Resources | -7% | -29% | -43% | 67% | -38% | 0.065 | $214,092,334 |

| MLS | Metals Australia | -7% | -25% | -24% | -52% | -15% | 0.038 | $23,674,411 |

| BBX | BBX Minerals | -7% | -17% | 79% | -11% | 19% | 0.125 | $58,886,577 |

| ANX | Anax Metals | -7% | -9% | -5% | -33% | 17% | 0.062 | $27,020,059 |

| AAU | Antilles Gold | -8% | -3% | -23% | -50% | 23% | 0.037 | $19,492,425 |

| OKR | Okapi Resources | -8% | -12% | -48% | -49% | 0% | 0.15 | $23,947,109 |

| KAL | Kalgoorliegoldmining | -8% | -19% | -63% | -64% | -30% | 0.058 | $4,800,945 |

| SKY | SKY Metals | -8% | -10% | -25% | -44% | -6% | 0.045 | $16,955,256 |

| TMX | Terrain Minerals | -8% | -8% | -21% | -21% | -8% | 0.0055 | $5,415,997 |

| ADT | Adriatic Metals | -8% | 8% | 58% | 62% | 12% | 3.52 | $753,523,928 |

| ASR | Asra Minerals | -8% | -27% | -56% | -61% | -45% | 0.011 | $14,671,187 |

| NAE | New Age Exploration | -8% | -21% | -54% | -54% | -21% | 0.0055 | $8,615,393 |

| VRC | Volt Resources | -8% | -8% | -61% | -8% | -27% | 0.011 | $43,333,663 |

| SI6 | SI6 Metals | -8% | 10% | -31% | -45% | -8% | 0.0055 | $8,224,670 |

| AM7 | Arcadia Minerals | -9% | -2% | -23% | -7% | 5% | 0.215 | $10,040,047 |

| SVY | Stavely Minerals | -9% | -26% | 17% | -55% | -23% | 0.1875 | $55,445,282 |

| ADN | Andromeda Metals | -9% | 0% | -19% | -78% | -5% | 0.042 | $127,510,346 |

| AQI | Alicanto Min | -9% | -7% | -13% | -57% | -2% | 0.042 | $19,633,399 |

| MI6 | Minerals260 | -9% | 5% | 11% | -37% | -7% | 0.315 | $68,200,000 |

| ZNC | Zenith Minerals | -9% | -11% | -31% | -37% | -23% | 0.205 | $72,099,739 |

| PRX | Prodigy Gold NL | -9% | -17% | -5% | -58% | -17% | 0.01 | $17,478,828 |

| BC8 | Black Cat Syndicate | -9% | -4% | 4% | -41% | -1% | 0.35 | $94,483,943 |

| NAG | Nagambie Resources | -9% | -17% | -38% | -4% | -24% | 0.05 | $27,320,384 |

| LRL | Labyrinth Resources | -9% | -41% | -55% | -77% | -41% | 0.01 | $9,594,873 |

| ICG | Inca Minerals | -9% | -5% | -50% | -78% | -13% | 0.02 | $9,657,067 |

| KWR | Kingwest Resources | -9% | -26% | -40% | -83% | -17% | 0.029 | $8,170,078 |

| RDT | Red Dirt Metals | -9% | -20% | -51% | -28% | -24% | 0.3625 | $162,391,234 |

| DTM | Dart Mining NL | -10% | -14% | -59% | -53% | -31% | 0.038 | $5,913,581 |

| GSN | Great Southern | -10% | -14% | -47% | -60% | -34% | 0.019 | $12,606,633 |

| DCN | Dacian Gold | -10% | -13% | -5% | -65% | -16% | 0.084 | $102,211,279 |

| MTC | Metalstech | -10% | -24% | 4% | 40% | -29% | 0.37 | $70,045,188 |

| BNR | Bulletin Res | -10% | -22% | -33% | -36% | -3% | 0.09 | $26,423,199 |

| KIN | KIN Min NL | -10% | -12% | -38% | -54% | -31% | 0.045 | $53,016,775 |

| EM2 | Eagle Mountain | -10% | -13% | -29% | -67% | 3% | 0.175 | $51,844,367 |

| FEG | Far East Gold | -11% | -27% | -54% | 0% | -41% | 0.285 | $39,163,981 |

| G88 | Golden Mile Res | -11% | -21% | -50% | -74% | -21% | 0.016 | $3,068,846 |

| KAI | Kairos Minerals | -11% | -24% | -60% | -33% | -30% | 0.016 | $31,425,496 |

| IGO | IGO | -11% | -13% | -13% | 4% | -9% | 12.255 | $9,170,513,215 |

| GRL | Godolphin Resources | -11% | -39% | -35% | -63% | -34% | 0.055 | $6,510,320 |

| CDT | Castle Minerals | -11% | -15% | -37% | -61% | -7% | 0.0195 | $24,738,846 |

| PGO | Pacgold | -12% | -8% | -38% | -54% | -6% | 0.34 | $18,687,017 |

| EMC | Everest Metals Corp | -12% | -16% | -25% | -46% | -5% | 0.075 | $7,982,483 |

| BMO | Bastion Minerals | -12% | -42% | -67% | -82% | -12% | 0.03 | $4,513,883 |

| LYN | Lycaonresources | -12% | -31% | -47% | -47% | -33% | 0.185 | $6,089,969 |

| KTA | Krakatoa Resources | -12% | -36% | -57% | -33% | -34% | 0.029 | $9,651,878 |

| PRS | Prospech | -13% | -25% | -38% | -56% | -28% | 0.021 | $2,119,166 |

| BGD | Bartongoldholdings | -13% | -5% | 40% | -13% | 5% | 0.21 | $18,129,950 |

| BAT | Battery Minerals | -13% | -13% | -22% | -61% | -13% | 0.0035 | $10,273,348 |

| MOM | Moab Minerals | -13% | -22% | -75% | -75% | -22% | 0.007 | $4,773,744 |

| HMX | Hammer Metals | -13% | -27% | 0% | -44% | -19% | 0.055 | $45,177,404 |

| SNG | Siren Gold | -13% | -23% | -54% | -67% | -47% | 0.096 | $14,097,175 |

| TRM | Truscott Mining Corp | -13% | -68% | 12% | 47% | 15% | 0.047 | $7,856,382 |

| MEI | Meteoric Resources | -13% | -23% | 669% | 567% | 89% | 0.1 | $138,997,908 |

| MRR | Minrex Resources | -13% | -16% | -54% | -55% | -19% | 0.026 | $28,206,555 |

| SAU | Southern Gold | -14% | -21% | -46% | -65% | -24% | 0.019 | $6,005,706 |

| HRZ | Horizon | -14% | -30% | -39% | -62% | -28% | 0.044 | $27,405,233 |

| M2R | Miramar | -14% | -36% | -52% | -69% | -38% | 0.05 | $3,534,087 |

| GBR | Greatbould Resources | -14% | -1% | -15% | -45% | -7% | 0.085 | $37,062,987 |

| FAU | First Au | -14% | -25% | -57% | -67% | -25% | 0.003 | $3,284,350 |

| OZM | Ozaurum Resources | -14% | -42% | -62% | -62% | -36% | 0.042 | $6,096,000 |

| GSM | Golden State Mining | -15% | -21% | -29% | -56% | -21% | 0.034 | $4,095,497 |

| HXG | Hexagon Energy | -15% | -35% | -35% | -78% | -35% | 0.011 | $5,898,533 |

| GBZ | GBM Rsources | -16% | -20% | -37% | -76% | -31% | 0.0295 | $16,320,202 |

| TGM | Theta Gold Mines | -16% | -11% | -8% | -58% | -13% | 0.059 | $39,616,581 |

| RGL | Riversgold | -16% | -27% | -58% | -51% | -47% | 0.016 | $15,127,483 |

| MM8 | Medallion Metals. | -16% | -25% | -40% | -57% | -32% | 0.105 | $14,695,281 |

| WA8 | Warriedarresour | -16% | -32% | -13% | -28% | -24% | 0.13 | $64,658,822 |

| NMR | Native Mineral Res | -16% | -18% | -67% | -74% | -49% | 0.056 | $6,727,769 |

| MHC | Manhattan Corp | -17% | -29% | -38% | -62% | -9% | 0.005 | $8,773,307 |

| XTC | Xantippe Res | -17% | 0% | -44% | -17% | 0% | 0.005 | $52,900,498 |

| MDI | Middle Island Res | -17% | -20% | -40% | -64% | 5% | 0.04 | $4,896,729 |

| M24 | Mamba Exploration | -17% | -46% | -39% | -29% | -31% | 0.1 | $6,708,167 |

| MKR | Manuka Resources. | -17% | -38% | -64% | -81% | -36% | 0.054 | $32,179,298 |

| KZR | Kalamazoo Resources | -18% | -20% | -47% | -53% | -33% | 0.14 | $21,723,809 |

| ICL | Iceni Gold | -18% | -22% | -14% | -29% | 3% | 0.082 | $10,255,714 |

| THR | Thor Energy PLC | -18% | -25% | -57% | -68% | -25% | 0.0045 | $7,390,564 |

| A1G | African Gold . | -18% | -20% | 5% | -53% | -14% | 0.071 | $12,021,096 |

| GED | Golden Deeps | -20% | -20% | -43% | -20% | -11% | 0.008 | $9,241,814 |

| AVM | Advance Metals | -20% | -11% | -33% | -47% | -20% | 0.008 | $4,656,353 |

| SLZ | Sultan Resources | -21% | -21% | -54% | -71% | -46% | 0.046 | $4,580,641 |

| BM8 | Battery Age Minerals | -21% | -29% | -29% | -11% | -29% | 0.355 | $27,089,629 |

| GAL | Galileo Mining | -22% | -30% | -56% | 173% | -36% | 0.56 | $110,669,959 |

| CYL | Catalyst Metals | -24% | -31% | -19% | -44% | -17% | 0.9775 | $147,254,044 |

| SIH | Sihayo Gold | -25% | 50% | -40% | -77% | -25% | 0.0015 | $9,153,192 |

| PKO | Peako | -25% | -36% | -63% | -44% | -38% | 0.009 | $3,792,153 |

| CLZ | Classic Min | -25% | -70% | -92% | -99% | -84% | 0.0015 | $3,307,654 |

| CY5 | Cygnus Metals | -26% | -25% | 6% | 47% | -34% | 0.25 | $50,565,408 |

| ARV | Artemis Resources | -27% | -48% | -70% | -84% | -56% | 0.011 | $18,737,020 |

| AVW | Avira Resources | -33% | -33% | -56% | -67% | -33% | 0.002 | $4,267,580 |

| CODE | COMPANY | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | YEAR TO DATE RETURN % | PRICE | MARKET CAP |

| GWR | GWR Group | 75% | 93% | 33% | -29% | 86% | 0.11 | $35,333,832 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.