Gold Digger: Record prices, bumper global demand and yep, gold is still a safe haven

The WGC says gold demand is expected to continue in a complex economic and geopolitical environment. Pic: via Getty images.

- WGC flags record gold price for Q2, up 18% year-on-year

- Ongoing economic headwinds not expected to dent demand too much

- RBC Capital Markets says gold is still a safe haven in a crisis

Our Gold Digger column wraps all the news driving ASX stocks with exposure to precious metals.

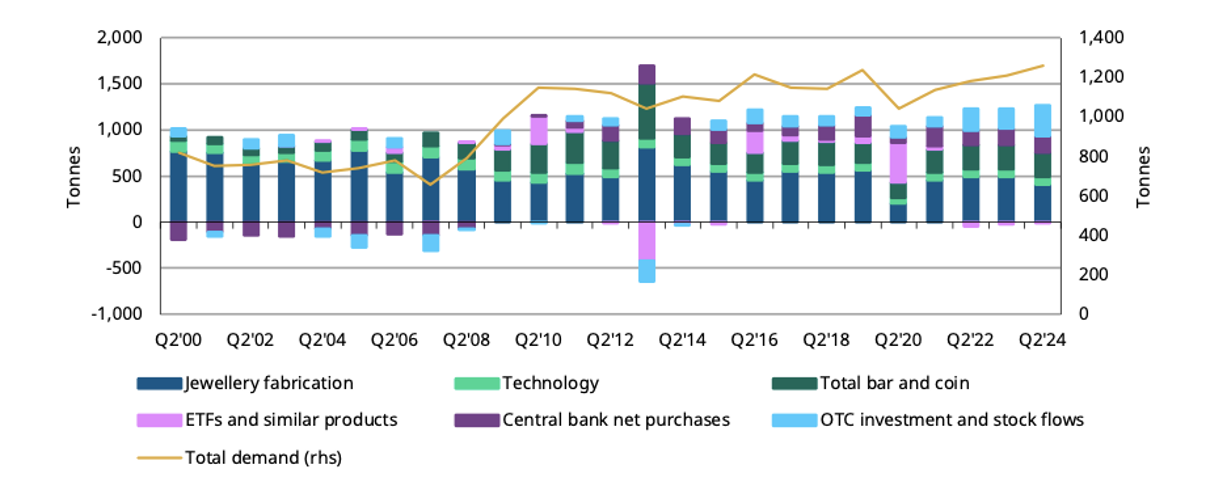

According to the World Gold Council (WGC), second quarter gold demand hit record highs, up 4% year-on-year to 1,258t.

Total demand was supported by healthy over-the-counter (OTC) transactions, up a notable 53% year-on-year at 329t.

Interestingly, demand for gold in technology continued to increase, jumping 11% year-on-year driven primarily by the AI boom in the electronics sector, which saw an increase of 14% year-on-year.

But most notably of all is the increased OTC demand, along with continued buying from central banks, and improved ETF flows which drove record-high gold prices in Q2, with the gold price averaging US$2,338/oz.

That’s 18% higher year-on-year, reaching a record of US$2,427/oz during the quarter.

The supply side wasn’t bad, either. Total gold supply rose 4% year-on-year, with mine production increasing to 929t.

In Australia however, record gold prices, a strong AUD and economic pressures contributed to a 25% fall in gold consumption in Q2, though ETF investment remained stable.

“The elevated gold price and high living costs continued to weigh on jewellery purchases while a strong local currency and tight financial conditions likely dented investment demand for gold,” WGC head of Asia-Pacific (ex China) and global head of central banks Shaokai Fan said.

Headwinds won’t dent demand too much

Looking forwards, the WGC says an annual central bank survey confirms that reserve managers believe gold allocations will continue to rise over the next 12 months, driven by the need for portfolio protection and diversification in a complex economic and geopolitical environment.

“The OTC market has seen continued appetite for gold from institutional and high-net-worth investors, as well as family offices, as they turn to gold for portfolio diversification,” WGC senior markets analyst Louise Street said.

“With a long-awaited rate cut from the US Fed on the horizon, inflows into gold ETFs have increased thanks to renewed interest from Western investors.

“A sustained revival of investment from this group could change demand dynamics in the second half of 2024.

“In India, the recently announced import duty cut should create positive conditions for gold demand, where high prices have hampered consumer buying.

“While there are potential headwinds for gold ahead, there are also changes taking place in the global market that should support and elevate gold demand.”

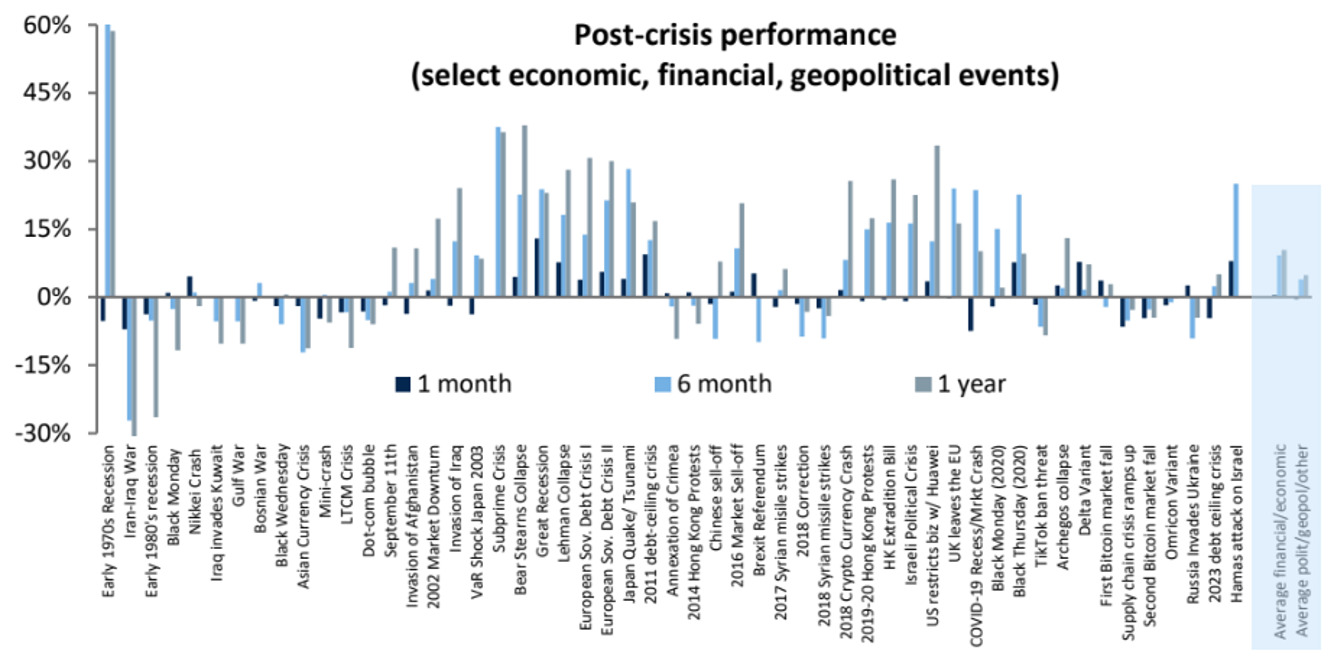

Gold still a safe haven in crisis

Christopher Louney, RBC Capital Markets’ commodity strategist, reckons central bank demand will hold strong in 2024 but that consumer demand is slowing.

“With bar premiums turning to discounts and gold imports into China faltering, there are signs that the consumer side of gold demand there is not invincible to higher prices and other themes,” he said.

“Similarly, we were reminded of the fickle nature of consumer demand for gold, as there was an observed 19% y/y drop in jewellery demand in Q2 in the WGC’s Gold Demand Trends report this week.

“Generally, we think OTC demand and investors will be left to pick up the slack (in Asia as well as in North America and Europe) – but how heavy a burden this proves remains to be seen, even as investors could be warming back up to gold.

“Our view on gold’s crisis performance, largely driven by its status as a perceived safe haven, remains.”

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

| Code | Company | Price | %Wk | % Month | YTD+/- | Market Cap |

|---|---|---|---|---|---|---|

| XTC | XTC Lithium Limited | 0.2 | 19900% | 0% | 20% | $17,528,272 |

| AME | Alto Metals Limited | 0.06 | 82% | 82% | 2% | $23,810,265 |

| NAG | Nagambie Resources | 0.012 | 71% | -8% | -2% | $9,559,628 |

| AAJ | Aruma Resources Ltd | 0.017 | 55% | 31% | -1% | $3,544,047 |

| BEZ | Besragoldinc | 0.082 | 52% | -17% | -7% | $36,374,779 |

| SLZ | Sultan Resources Ltd | 0.008 | 33% | -11% | -1% | $1,580,692 |

| BMO | Bastion Minerals | 0.008 | 33% | 33% | -1% | $3,045,587 |

| NAE | New Age Exploration | 0.0045 | 29% | 50% | 0% | $8,969,495 |

| GPR | Geopacific Resources | 0.027 | 29% | 35% | 1% | $24,624,161 |

| PNX | PNX Metals Limited | 0.005 | 25% | 25% | 0% | $29,851,074 |

| QML | Qmines Limited | 0.05 | 25% | -9% | -3% | $11,945,830 |

| KAI | Kairos Minerals Ltd | 0.01 | 25% | 5% | 0% | $26,209,122 |

| MAU | Magnetic Resources | 1.475 | 21% | 25% | 46% | $381,840,878 |

| OZM | Ozaurum Resources | 0.064 | 21% | 28% | -9% | $10,160,000 |

| CDR | Codrus Minerals Ltd | 0.03 | 20% | -30% | -3% | $4,961,625 |

| PUR | Pursuit Minerals | 0.003 | 20% | 0% | -1% | $10,906,200 |

| GMN | Gold Mountain Ltd | 0.0035 | 17% | 17% | 0% | $11,122,102 |

| LRL | Labyrinth Resources | 0.015 | 15% | 275% | 1% | $21,174,033 |

| MXR | Maximus Resources | 0.031 | 15% | 7% | 0% | $13,265,758 |

| AAU | Antilles Gold Ltd | 0.004 | 14% | 0% | -2% | $5,845,711 |

| VKA | Viking Mines Ltd | 0.008 | 14% | 0% | -1% | $8,202,067 |

| SMS | Starmineralslimited | 0.034 | 13% | 17% | -1% | $3,220,575 |

| MEK | Meeka Metals Limited | 0.043 | 13% | 26% | 0% | $54,327,193 |

| MVL | Marvel Gold Limited | 0.009 | 13% | 0% | 0% | $7,774,116 |

| GBZ | GBM Rsources Ltd | 0.009 | 13% | 0% | 0% | $10,410,200 |

| A1G | African Gold Ltd. | 0.028 | 12% | 33% | 0% | $6,698,040 |

| SMI | Santana Minerals Ltd | 1.25 | 11% | 21% | 24% | $268,409,616 |

| NMR | Native Mineral Res | 0.022 | 10% | 5% | 0% | $5,770,889 |

| AS1 | Asara Resources Ltd | 0.011 | 10% | 10% | 0% | $9,703,929 |

| MEG | Megado Minerals Ltd | 0.011 | 10% | 10% | -2% | $2,799,011 |

| LEX | Lefroy Exploration | 0.079 | 10% | -25% | -10% | $16,036,679 |

| RXL | Rox Resources | 0.145 | 9% | 12% | -4% | $61,086,336 |

| DLI | Delta Lithium | 0.235 | 9% | -11% | -24% | $171,217,714 |

| AM7 | Arcadia Minerals | 0.036 | 9% | -14% | -4% | $4,213,804 |

| MM8 | Medallion Metals. | 0.06 | 9% | 13% | -1% | $18,461,049 |

| GSM | Golden State Mining | 0.012 | 9% | 20% | 0% | $3,352,448 |

| HRN | Horizon Gold Ltd | 0.305 | 9% | 2% | 1% | $44,176,177 |

| CAZ | Cazaly Resources | 0.025 | 9% | 32% | 0% | $11,993,878 |

| TTMDD | Titan Minerals - Deferred Settlement | 0.5 | 9% | -9% | 22% | $86,339,816 |

| LAT | Latitude 66 Limited | 0.13 | 8% | -35% | -7% | $17,113,929 |

| CHN | Chalice Mining Ltd | 1.115 | 8% | -29% | -58% | $455,161,342 |

| TCG | Turaco Gold Limited | 0.22 | 7% | 10% | 9% | $168,818,094 |

| KZR | Kalamazoo Resources | 0.074 | 7% | -4% | -5% | $13,310,145 |

| SFR | Sandfire Resources | 8.725 | 7% | 1% | 139% | $4,157,453,622 |

| WGX | Westgold Resources. | 2.8 | 7% | 15% | 62% | $1,256,638,631 |

| BTR | Brightstar Resources | 0.016 | 7% | 0% | 0% | $70,833,354 |

| ORN | Orion Minerals Ltd | 0.016 | 7% | 7% | 0% | $109,346,335 |

| MDI | Middle Island Res | 0.018 | 6% | 38% | 0% | $3,931,212 |

| ZAG | Zuleika Gold Ltd | 0.018 | 6% | 13% | 0% | $14,076,719 |

| AGC | AGC Ltd | 0.295 | 5% | 2% | 22% | $71,901,519 |

| CWX | Carawine Resources | 0.09 | 5% | 5% | -2% | $21,251,290 |

| WAF | West African Res Ltd | 1.4475 | 4% | -9% | 50% | $1,683,197,972 |

| TBR | Tribune Res Ltd | 3.94 | 4% | 15% | 99% | $206,724,223 |

| RSG | Resolute Mining | 0.6375 | 4% | 23% | 19% | $1,383,882,508 |

| IDA | Indiana Resources | 0.088 | 4% | 4% | 1% | $56,459,044 |

| SVL | Silver Mines Limited | 0.15 | 3% | -3% | -1% | $226,205,439 |

| LM8 | Lunnonmetalslimited | 0.16 | 3% | -20% | -44% | $34,854,939 |

| SKY | SKY Metals Ltd | 0.033 | 3% | -3% | 0% | $19,455,254 |

| SFM | Santa Fe Minerals | 0.033 | 3% | 3% | -1% | $2,403,020 |

| KAU | Kaiser Reef | 0.165 | 3% | -3% | -1% | $32,711,023 |

| TMS | Tennant Minerals Ltd | 0.0195 | 3% | -11% | -1% | $18,639,863 |

| PNR | Pantoro Limited | 0.086 | 2% | -9% | 3% | $574,408,716 |

| SBM | St Barbara Limited | 0.22 | 2% | 7% | 1% | $184,043,336 |

| CMM | Capricorn Metals | 5.36 | 2% | 10% | 65% | $2,053,752,489 |

| BNR | Bulletin Res Ltd | 0.05 | 2% | 19% | -9% | $14,680,666 |

| DEG | De Grey Mining | 1.2125 | 2% | 4% | -2% | $2,947,919,998 |

| ERM | Emmerson Resources | 0.055 | 2% | -4% | 0% | $29,959,038 |

| HAW | Hawthorn Resources | 0.072 | 1% | 20% | -2% | $22,781,062 |

| AAR | Astral Resources NL | 0.074 | 1% | -11% | 0% | $69,204,618 |

| RND | Rand Mining Ltd | 1.49 | 0% | -1% | 12% | $84,745,182 |

| MRR | Minrex Resources Ltd | 0.009 | 0% | 0% | -1% | $9,763,808 |

| NPM | Newpeak Metals | 0.014 | 0% | -22% | 0% | $4,166,938 |

| ASO | Aston Minerals Ltd | 0.009 | 0% | -10% | -2% | $11,655,578 |

| MKG | Mako Gold | 0.01 | 0% | 11% | 0% | $9,760,082 |

| CST | Castile Resources | 0.08 | 0% | 11% | 0% | $19,110,292 |

| FAU | First Au Ltd | 0.002 | 0% | 0% | 0% | $3,323,987 |

| IVR | Investigator Res Ltd | 0.045 | 0% | -2% | 1% | $74,442,340 |

| GTR | Gti Energy Ltd | 0.004 | 0% | 0% | 0% | $10,199,788 |

| IPT | Impact Minerals | 0.014 | 0% | -7% | 0% | $44,361,789 |

| BCM | Brazilian Critical | 0.016 | 0% | -6% | -1% | $12,461,091 |

| MRZ | Mont Royal Resources | 0.06 | 0% | -17% | -9% | $5,101,788 |

| PRX | Prodigy Gold NL | 0.003 | 0% | 50% | 0% | $6,353,323 |

| BMR | Ballymore Resources | 0.14 | 0% | -13% | 2% | $22,974,976 |

| REZ | Resourc & En Grp Ltd | 0.023 | 0% | 92% | 1% | $14,872,700 |

| MLS | Metals Australia | 0.019 | 0% | 0% | -2% | $13,788,671 |

| ADN | Andromeda Metals Ltd | 0.019 | 0% | 19% | -1% | $65,315,690 |

| SIH | Sihayo Gold Limited | 0.002 | 0% | -20% | 0% | $24,408,512 |

| HMX | Hammer Metals Ltd | 0.039 | 0% | 11% | -1% | $34,569,887 |

| WCN | White Cliff Min Ltd | 0.017 | 0% | 13% | 1% | $27,699,586 |

| ASR | Asra Minerals Ltd | 0.006 | 0% | 20% | 0% | $12,216,476 |

| MCT | Metalicity Limited | 0.002 | 0% | 0% | 0% | $8,971,705 |

| GUL | Gullewa Limited | 0.07 | 0% | -5% | 2% | $14,334,117 |

| CY5 | Cygnus Metals Ltd | 0.064 | 0% | 52% | -7% | $22,714,977 |

| MTH | Mithril Resources | 0.14 | 0% | -22% | -6% | $14,360,671 |

| ADG | Adelong Gold Limited | 0.004 | 0% | -33% | 0% | $3,353,967 |

| NML | Navarre Minerals Ltd | 0.019 | 0% | 0% | 0% | $28,555,654 |

| BYH | Bryah Resources Ltd | 0.005 | 0% | 0% | -1% | $2,516,434 |

| MEU | Marmota Limited | 0.041 | 0% | -13% | 0% | $46,722,869 |

| PGD | Peregrine Gold | 0.19 | 0% | 0% | -5% | $14,254,468 |

| AL8 | Alderan Resource Ltd | 0.004 | 0% | 0% | 0% | $4,427,445 |

| HMG | Hamelingoldlimited | 0.1 | 0% | 27% | 2% | $15,750,000 |

| TBA | Tombola Gold Ltd | 0.026 | 0% | 0% | 0% | $33,129,243 |

| ARV | Artemis Resources | 0.009 | 0% | -25% | -1% | $17,251,942 |

| RDN | Raiden Resources Ltd | 0.024 | 0% | -25% | -2% | $67,971,562 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | 0% | $130,184,182 |

| SI6 | SI6 Metals Limited | 0.002 | 0% | 0% | 0% | $4,737,719 |

| BGD | Bartongoldholdings | 0.24 | 0% | -14% | -3% | $52,478,141 |

| TSO | Tesoro Gold Ltd | 0.028 | 0% | 0% | 0% | $42,380,260 |

| GUE | Global Uranium | 0.063 | 0% | -23% | -4% | $18,066,732 |

| CPM | Coopermetalslimited | 0.068 | 0% | -6% | -27% | $5,328,184 |

| TMZ | Thomson Res Ltd | 0.005 | 0% | 0% | 0% | $4,881,018 |

| THR | Thor Energy PLC | 0.017 | 0% | 21% | -1% | $3,995,417 |

| GBR | Greatbould Resources | 0.048 | 0% | -17% | -2% | $29,112,350 |

| HRZ | Horizon | 0.036 | 0% | 0% | -1% | $41,386,687 |

| CAI | Calidus Resources | 0.115 | 0% | 0% | -10% | $93,678,206 |

| CDT | Castle Minerals | 0.004 | 0% | -11% | -1% | $5,311,305 |

| EVN | Evolution Mining Ltd | 3.96 | 0% | 16% | 0% | $7,963,369,810 |

| HXG | Hexagon Energy | 0.013 | 0% | 30% | 0% | $6,667,907 |

| AVW | Avira Resources Ltd | 0.001 | 0% | 0% | 0% | $2,938,790 |

| MAT | Matsa Resources | 0.025 | 0% | -4% | 0% | $13,761,879 |

| STK | Strickland Metals | 0.092 | 0% | -16% | 0% | $209,419,400 |

| ION | Iondrive Limited | 0.009 | 0% | 0% | 0% | $6,376,568 |

| TG1 | Techgen Metals Ltd | 0.03 | 0% | 7% | -5% | $3,843,977 |

| XAM | Xanadu Mines Ltd | 0.056 | 0% | 0% | 0% | $99,528,349 |

| A8G | Australasian Metals | 0.084 | 0% | 15% | -9% | $4,430,242 |

| NES | Nelson Resources. | 0.003 | 0% | 0% | 0% | $1,840,783 |

| GNM | Great Northern | 0.011 | 0% | 0% | -1% | $1,700,920 |

| TRM | Truscott Mining Corp | 0.06 | 0% | -2% | 1% | $10,470,960 |

| STN | Saturn Metals | 0.18 | 0% | 6% | 1% | $51,733,216 |

| USL | Unico Silver Limited | 0.16 | 0% | 7% | 4% | $54,729,286 |

| PNM | Pacific Nickel Mines | 0.024 | 0% | -29% | -6% | $10,038,075 |

| AYM | Australia United Min | 0.003 | 0% | 50% | 0% | $5,527,732 |

| ANL | Amani Gold Ltd | 0.001 | 0% | 0% | 0% | $25,743,441 |

| HAV | Havilah Resources | 0.2 | 0% | 3% | 1% | $63,327,842 |

| PNT | Panthermetalsltd | 0.036 | 0% | 57% | -2% | $3,137,982 |

| PGO | Pacgold | 0.135 | 0% | 23% | -6% | $11,359,634 |

| GAL | Galileo Mining Ltd | 0.175 | 0% | -15% | -11% | $34,584,362 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -5% | $1,253,842 |

| SPD | Southernpalladium | 0.38 | 0% | 0% | 1% | $34,105,000 |

| AZY | Antipa Minerals Ltd | 0.011 | 0% | 10% | -1% | $56,520,593 |

| RMS | Ramelius Resources | 1.9225 | -1% | 3% | 24% | $2,243,382,186 |

| CYL | Catalyst Metals | 1.855 | -1% | 61% | 105% | $438,018,135 |

| ADT | Adriatic Metals | 3.12 | -1% | -19% | -89% | $898,056,970 |

| NST | Northern Star | 14.13 | -1% | 10% | 48% | $16,329,870,763 |

| KSN | Kingston Resources | 0.075 | -1% | -6% | 0% | $55,147,558 |

| SXG | Southern Cross Gold | 2.17 | -1% | -3% | 91% | $437,019,995 |

| BC8 | Black Cat Syndicate | 0.34 | -1% | 13% | 9% | $154,970,348 |

| KIN | KIN Min NL | 0.057 | -2% | 2% | -1% | $67,154,581 |

| EM2 | Eagle Mountain | 0.056 | -2% | 4% | -2% | $21,608,121 |

| GMD | Genesis Minerals | 2.08 | -2% | 18% | 29% | $2,367,412,427 |

| KCC | Kincora Copper | 0.046 | -2% | -8% | 1% | $9,435,174 |

| AWJ | Auric Mining | 0.22 | -2% | 10% | 10% | $32,681,742 |

| GOR | Gold Road Res Ltd | 1.735 | -2% | -1% | -23% | $1,863,352,648 |

| OBM | Ora Banda Mining Ltd | 0.42 | -2% | 40% | 18% | $808,832,609 |

| VMC | Venus Metals Cor Ltd | 0.08 | -2% | 14% | -2% | $15,178,295 |

| IGO | IGO Limited | 5.41 | -3% | -8% | -364% | $4,225,554,397 |

| PRS | Prospech Limited | 0.036 | -3% | 33% | 1% | $10,894,599 |

| SPR | Spartan Resources | 1.245 | -3% | 33% | 73% | $1,394,640,936 |

| MKR | Manuka Resources. | 0.035 | -3% | -5% | -4% | $27,291,868 |

| FFM | Firefly Metals Ltd | 0.785 | -3% | 6% | 16% | $389,373,449 |

| MI6 | Minerals260Limited | 0.155 | -3% | 3% | -17% | $36,270,000 |

| YRL | Yandal Resources | 0.15 | -3% | -3% | 7% | $40,171,142 |

| ARL | Ardea Resources Ltd | 0.45 | -3% | -10% | -3% | $90,855,726 |

| PRU | Perseus Mining Ltd | 2.495 | -3% | 8% | 65% | $3,521,855,437 |

| KAL | Kalgoorliegoldmining | 0.028 | -3% | 0% | 0% | $4,438,020 |

| TAM | Tanami Gold NL | 0.028 | -3% | -18% | -1% | $31,727,620 |

| FG1 | Flynngold | 0.027 | -4% | 8% | -2% | $7,127,252 |

| TGM | Theta Gold Mines Ltd | 0.13 | -4% | -16% | 2% | $92,500,179 |

| AVM | Advance Metals Ltd | 0.025 | -4% | -14% | -1% | $3,520,724 |

| BM8 | Battery Age Minerals | 0.125 | -4% | -22% | -7% | $11,628,018 |

| TLM | Talisman Mining | 0.25 | -4% | -6% | 2% | $49,904,892 |

| EMR | Emerald Res NL | 3.67 | -4% | 6% | 66% | $2,427,848,092 |

| NWM | Norwest Minerals | 0.024 | -4% | -25% | 0% | $11,642,868 |

| RRL | Regis Resources | 1.655 | -4% | -6% | -53% | $1,265,192,503 |

| EMC | Everest Metals Corp | 0.115 | -4% | -18% | 4% | $21,422,558 |

| GML | Gateway Mining | 0.023 | -4% | 5% | 0% | $9,095,567 |

| S2R | S2 Resources | 0.115 | -4% | 22% | -5% | $52,078,669 |

| TNC | True North Copper | 0.045 | -4% | -13% | -5% | $40,272,549 |

| BNZ | Benzmining | 0.11 | -4% | -15% | -14% | $11,867,727 |

| EMU | EMU NL | 0.022 | -4% | -15% | -1% | $2,760,982 |

| KTA | Krakatoa Resources | 0.0105 | -5% | -19% | -3% | $5,193,179 |

| ILT | Iltani Resources Lim | 0.21 | -5% | -28% | 5% | $7,142,206 |

| DTM | Dart Mining NL | 0.02 | -5% | 0% | 0% | $5,168,657 |

| SSR | SSR Mining Inc. | 7.67 | -5% | 13% | -815% | $35,249,419 |

| NXM | Nexus Minerals Ltd | 0.038 | -5% | -3% | -1% | $14,395,225 |

| PDI | Predictive Disc Ltd | 0.18 | -5% | 3% | -3% | $423,162,357 |

| MBK | Metal Bank Ltd | 0.018 | -5% | -25% | -1% | $8,199,645 |

| POL | Polymetals Resources | 0.26 | -5% | 6% | -5% | $52,315,380 |

| GSN | Great Southern | 0.017 | -6% | -6% | 0% | $14,374,923 |

| LCY | Legacy Iron Ore | 0.017 | -6% | 21% | 0% | $131,130,320 |

| WA8 | Warriedarresourltd | 0.066 | -6% | 16% | 1% | $45,698,135 |

| ARN | Aldoro Resources | 0.08 | -6% | 11% | -5% | $10,769,899 |

| ARD | Argent Minerals | 0.016 | -6% | -6% | 1% | $22,934,811 |

| AAM | Aumegametals | 0.046 | -6% | -15% | 0% | $24,188,379 |

| CEL | Challenger Gold Ltd | 0.046 | -6% | -19% | -3% | $67,381,654 |

| CBY | Canterbury Resources | 0.045 | -6% | 0% | 2% | $7,728,340 |

| GWR | GWR Group Ltd | 0.074 | -6% | -14% | -2% | $24,412,466 |

| ENR | Encounter Resources | 0.565 | -7% | -28% | 28% | $259,226,131 |

| WWI | West Wits Mining Ltd | 0.014 | -7% | 8% | 0% | $35,584,175 |

| TMB | Tambourahmetals | 0.042 | -7% | -27% | -7% | $3,483,495 |

| DRE | Dreadnought Resources Ltd | 0.02 | -7% | -5% | -1% | $70,720,000 |

| SBR | Sabre Resources | 0.013 | -7% | -24% | -2% | $5,501,467 |

| ADV | Ardiden Ltd | 0.125 | -7% | 0% | -5% | $8,127,276 |

| TRE | Toubani Res Ltd | 0.185 | -8% | 9% | 4% | $30,993,435 |

| SVY | Stavely Minerals Ltd | 0.024 | -8% | -17% | -2% | $11,556,970 |

| PXX | Polarx Limited | 0.012 | -8% | -8% | 1% | $22,555,307 |

| AUN | Aurumin | 0.036 | -8% | -3% | 1% | $16,405,697 |

| FAL | Falconmetalsltd | 0.29 | -8% | 18% | 15% | $52,657,500 |

| BCN | Beacon Minerals | 0.023 | -8% | -12% | 0% | $90,162,436 |

| OAU | Ora Gold Limited | 0.0055 | -8% | -8% | 0% | $39,276,378 |

| KRM | Kingsrose Mining Ltd | 0.043 | -9% | 10% | 0% | $32,358,640 |

| MTC | Metalstech Ltd | 0.21 | -9% | -7% | -1% | $42,268,652 |

| GED | Golden Deeps | 0.031 | -9% | -11% | -2% | $3,759,443 |

| ZNC | Zenith Minerals Ltd | 0.05 | -9% | 4% | -10% | $17,619,044 |

| M24 | Mamba Exploration | 0.01 | -9% | -38% | -4% | $1,840,823 |

| KCN | Kingsgate Consolid. | 1.39 | -9% | -12% | 2% | $373,739,953 |

| AMI | Aurelia Metals Ltd | 0.1675 | -9% | -12% | 6% | $287,565,979 |

| HCH | Hot Chili Ltd | 0.84 | -10% | -13% | -24% | $134,697,233 |

| SPQ | Superior Resources | 0.009 | -10% | 13% | 0% | $18,010,984 |

| RED | Red 5 Limited | 0.355 | -10% | -4% | 5% | $2,516,915,151 |

| CTO | Citigold Corp Ltd | 0.004 | -11% | 0% | 0% | $12,000,000 |

| RDS | Redstone Resources | 0.004 | -11% | 0% | 0% | $3,701,514 |

| AUC | Ausgold Limited | 0.031 | -11% | -11% | 0% | $114,009,852 |

| GIB | Gibb River Diamonds | 0.036 | -12% | -16% | 1% | $7,614,340 |

| LCL | LCL Resources Ltd | 0.007 | -13% | -22% | -1% | $6,754,146 |

| TAR | Taruga Minerals | 0.007 | -13% | 0% | 0% | $4,942,187 |

| FML | Focus Minerals Ltd | 0.12 | -13% | -17% | -7% | $34,387,037 |

| SNG | Siren Gold | 0.058 | -13% | -33% | -1% | $12,396,450 |

| LYN | Lycaonresources | 0.245 | -14% | -9% | 5% | $13,246,206 |

| SRN | Surefire Rescs NL | 0.006 | -14% | -25% | 0% | $13,904,155 |

| M2R | Miramar | 0.006 | -14% | -14% | -1% | $2,368,677 |

| ALK | Alkane Resources Ltd | 0.425 | -15% | -12% | -23% | $265,535,814 |

| CLA | Celsius Resource Ltd | 0.011 | -15% | -27% | 0% | $26,707,040 |

| ANX | Anax Metals Ltd | 0.022 | -15% | -4% | -1% | $15,241,976 |

| G88 | Golden Mile Res Ltd | 0.01 | -17% | -9% | -1% | $4,112,229 |

| MEI | Meteoric Resources | 0.1 | -17% | -38% | -16% | $208,962,584 |

| RGL | Riversgold | 0.005 | -17% | -17% | -1% | $6,637,313 |

| DTR | Dateline Resources | 0.005 | -17% | -44% | -1% | $7,287,735 |

| WTM | Waratah Minerals Ltd | 0.27 | -17% | 108% | 15% | $48,608,415 |

| ICL | Iceni Gold | 0.052 | -17% | -12% | 0% | $15,001,858 |

| KNB | Koonenberrygold | 0.014 | -18% | -18% | -2% | $4,316,812 |

| FEG | Far East Gold | 0.14 | -18% | 40% | 2% | $36,062,157 |

| SVG | Savannah Goldfields | 0.026 | -19% | 37% | -2% | $7,589,293 |

| CXU | Cauldron Energy Ltd | 0.021 | -19% | -13% | 0% | $29,436,735 |

| MHC | Manhattan Corp Ltd | 0.001 | -20% | -20% | 0% | $2,936,980 |

| GRL | Godolphin Resources | 0.012 | -20% | -40% | -3% | $2,566,695 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 0% | 0% | $18,714,052 |

| ICG | Inca Minerals Ltd | 0.004 | -20% | -50% | -1% | $3,242,146 |

| MOM | Moab Minerals Ltd | 0.004 | -20% | 33% | 0% | $3,969,071 |

| G50 | G50Corp Ltd | 0.135 | -21% | -34% | 0% | $16,187,850 |

| NVA | Nova Minerals Ltd | 0.135 | -21% | -33% | -23% | $34,097,963 |

| FXG | Felix Gold Limited | 0.036 | -22% | -20% | -1% | $9,015,443 |

| ALY | Alchemy Resource Ltd | 0.007 | -22% | 27% | 0% | $8,246,534 |

| AQI | Alicanto Min Ltd | 0.019 | -24% | -10% | -1% | $13,274,311 |

| TMX | Terrain Minerals | 0.003 | -25% | -25% | 0% | $5,298,086 |

| MOH | Moho Resources | 0.0045 | -25% | -10% | -1% | $2,695,891 |

| PUA | Peak Minerals Ltd | 0.003 | -25% | 21% | 0% | $3,592,130 |

| RMX | Red Mount Min Ltd | 0.0015 | -25% | 50% | 0% | $5,135,366 |

| NSM | Northstaw | 0.015 | -25% | 36% | -4% | $2,098,137 |

| PKO | Peako Limited | 0.003 | -25% | 30% | 0% | $1,581,254 |

| BGL | Bellevue Gold Ltd | 1.365 | -25% | -24% | -31% | $1,777,391,883 |

| AQX | Alice Queen Ltd | 0.006 | -33% | -8% | 0% | $6,881,340 |

| RML | Resolution Minerals | 0.002 | -33% | -20% | 0% | $3,220,044 |

| FFX | Firefinch Ltd | 0 | -100% | -100% | -20% | $236,569,315 |

| WRM | White Rock Min Ltd | 0 | -100% | -100% | -6% | $17,508,200 |

| TIE | Tietto Minerals | 0 | -100% | -100% | -61% | $773,881,054 |

| GSR | Greenstone Resources | 0 | -100% | -100% | -1% | $15,761,980 |

| WMC | Wiluna Mining Corp | 0 | -100% | -100% | -21% | $74,238,031 |

| SLR | Silver Lake Resource | 0 | -100% | -100% | -119% | $1,496,968,932 |

| AZS | Azure Minerals | 0 | -100% | -100% | -370% | $1,692,527,632 |

| NAG | Nagambie Resources | 0.012 | 71% | -8% | -2% | $9,559,628 |

| AAJ | Aruma Resources Ltd | 0.017 | 55% | 31% | -1% | $3,544,047 |

| BEZ | Besragoldinc | 0.082 | 52% | -17% | -7% | $36,374,779 |

| SLZ | Sultan Resources Ltd | 0.008 | 33% | -11% | -1% | $1,580,692 |

| BMO | Bastion Minerals | 0.008 | 33% | 33% | -1% | $3,045,587 |

| NAE | New Age Exploration | 0.0045 | 29% | 50% | 0% | $8,969,495 |

| GPR | Geopacific Resources | 0.027 | 29% | 35% | 1% | $24,624,161 |

Besra Gold has appointed Matthew Antill as managing director of subsidiary North Borneo Gold Sdn Bhd where he will head the mining and development team.

Antill is an experienced mine development specialist and will be responsible for moving the Jugan project towards commercialisation, through pilot production and delivery of a Definitive Feasibility Study (DFS).

The Jugan pilot plant is part of Besra flagship Bau Corridor gold project, which currently has a high confidence measured resource of 3.4Mt at 1.5g/t gold, or 166,900oz of contained gold, an indicated resource of 16.4Mt at 1.57g/t gold, or 824,800oz contained gold, and an inferred resource of 47.9Mt at 1.29g/t gold, or ~1.99oz contained gold.

The Jugan plant will study the metallurgical processing of ore for Bau and has been designed to process 50 tonnes per day (tpd).

It also has the required licensing and capability to increase the processing throughput to up to 200 tpd.

New Age Exploration has started aircore drilling at its Wagyu gold project in WA’s Pilbara region, the next key step in its six-month exploration campaign.

Wagyu is in the same gold-rich region as De Grey Mining’s (ASX:DEG) district defining Hemi gold deposit, which has a major resource of 10.5Moz of gold and very attractive economics.

It sits halfway between Hemi and De Grey’s (ASX:DEG) 600,000oz Withnell deposit, which is being eyed as the potential site of a second regional concentrator alongside the main Hemi plant.

The company latest drilling follows a successful cultural heritage survey and will test high priority targets – including a Hemi-style intrusive gold target – that were identified through the use of newly acquired airborne magnetic survey data, combined with ground gravity geophysics and a passive seismic survey used in identification of targets.

Geopacific Resources has taken a huge step towards re-commencing development of its 1.56Moz Woodlark Gold Project with the release of a Scoping Study confirming its financial and technical merits.

The study released this week for its 100%-owned project forecasts robust operating margins, including significant free cash flow over 12 years and rapid payback.

The initial production target is 1.14Moz gold over the 12-year mine life from low-strip open pit mining, with a payback period of only 18 months from first production.

GPR estimates pre-tax net present value and internal rate of return – both key measures of a project’s profitability – will be a very healthy $625m and 40.5% (post-tax 37.7%), respectively.

The Undiscounted Life of Mine revenue is forecast to be $3.3 billion, with pre-tax net cashflow of $1.3 billion.

Life of mine all-in sustaining costs are modelled at A$1,534/oz gold, and all-in costs of A$1,820/oz gold.

The company has sold gold tenements to Pilbara Minerals (ASX:PLS) – which has the neighbouring Pilgangoora lithium mine – for $20m.

PLS is interested in the lithium and tantalum rights there but also gets a small 230,000oz gold resources, with Kairos to get gold and base metal rights over an additional 367km2 in the Pilbara with known gold occurrences and maintain control of its 1.38Moz main trend resource at Mt York.

“The tenure being sold represents a small and non-core part of our Mt York gold project, meaning we will retain the 1.38Moz Main Trend resource which underpins the Mt York gold project and have access to a further 1.4km of the continuous Main Trend mineralisation into the Pilbara ground that we know is well mineralised,” Kairos managing director Dr Peter Turner said.

“In the process, we intend to obtain access to all mineral rights (except lithium and tantalum) to a 367sqkm, prospective land package with known gold occurrences.

“This area has untested exploration potential which we will be targeting for accelerated resource growth as part of the upcoming drilling program.”

At Stockhead we tell it like it is. While Besra Gold, New Age Exploration and Geopacific Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.