Gold Digger: Gold vs Bitcoin, analysts vs analysts – store of value narratives get in the ring

Reminds me of the last time I attempted boxing training. And dancing, for that matter. (Pic via Getty Images)

- Gold hit a US ATH, then dipped a tad, but not by much. In fact, it’s doing pretty well on the whole…

- … It’s less volatile than Bitcoin, anyway, which is a good or bad thing depending on outlook

- Speaking of which, RBC has some fairly cautious perspective on gold right now

- ASX gold stocks performing well lately include: XAM and KAL, among others

What’s happening in the world near and far pertaining to gold on Friday March 22? Let’s take a squizz.

The most stoic of metals, the shiny yellow one is up a tad further than this time last week. Which is good, obvs. The US Fed’s reasonably doveish tone earlier in the week, keeping rates unchanged for now and suggesting three rate cuts at some point this year, kinda helped matters.

Here’s where gold’s at, then – at last check.

In Yankee Doodle Dandy dollars, it’s trading at $2,184, having actually hit $2,222 not long after the Fed’s Jerome Powell spoke in the week.

In plastic fantastic Aussie buckeroos, it’s fanged up to $3,325. Which, if isn’t an all-time-high (it isn’t), is pretty darn close to it.

Here’s the Schiff-meister with a take or two…

Overnight weakness in foreign currencies ultimately caused #gold to surrender early morning gains to a new record-high price. But the sell-off won't last, as dovish foreign central banks are also bullish for gold. Foreign central bank's mistakes don't let the #Fed off the hook.

— Peter Schiff (@PeterSchiff) March 21, 2024

Checking in on… Gold vs Bitcoin

Compared with one of its chief rivals/pretenders/wannabes for a store of value narrative – gold 2.0, that’d be Bitcoin – the yellow metal is a nice, safe ride at Luna Park with non-Death Metal music.

Bitcoin, on the other hand, has a lot more opportunity for potential, outsized gains, but is more volatile than the combined energies of Joe Pesci’s character in Goodfellas, a rugby league player hepped up on horse steroids and buckets of Mad Monday booze, and a 14-year-old who just lost his internet connection in the middle of the, like, most important Fortnite battle, like, f**kin’ ever and stuff.

Store of value? Hmm… if you’ve been in it for the long haul, then yes, but you take the good with the bad, there. Every. Single. Day.

#Bitcoin vs Gold pic.twitter.com/yB6wYv0C8V

— Darko (@Tech1Alchemy) March 21, 2024

Wrong column, so we’ll shut up about Bitcoin in a second or three, but by the way, it’s been staging a bit of a late-week recovery after its dramatic near 20% dip from recently recorded all-time high of just north of US$73k. It’s currently changing sweaty hands for about US$66k. (Aw nuts, another quick check and it’s now $65k.)

Schiff again…

To the extent that #Bitcoin has distracted attention and buying from #gold, it's the best thing that's happend to big government and central banks. Gold is the primary threat to the fiat based monetary system and U.S. dollar hegemony. That may be why those new ETFs were approved.

— Peter Schiff (@PeterSchiff) March 21, 2024

And here’s something Peter Schiff will hate, from a Bitcoin bug investooor / influencooor…

#GOLD vs #Bitcoin

Got it yet? https://t.co/Yjbb6EtIiG— InvestAnswers (@invest_answers) March 20, 2024

But sticking to the actual topic at hand, regarding gold commodity investing, frankly, it’s mostly been very decent indeed this year, if not out and out spectacular.

Digging deep into gold company equities, of course, is the far trickier and more volatile area. But there’s the odd sick, crypto-like gainz to be found here and there, we’re reasonably sure, if you’re diligently due and possibly also a bit lucky. (See further below for some of the latest on the ASX.)

That said… that said… not all gold miners are doing amazingly right now. Heavy rain over in WA has proved a pain in the butt for some of the state’s gold production, according to various reports, with Regis Resources (ASX:RRL), Gold Road Resources (ASX:GOR), Capricorn Metals (ASX:CMM) and Westgold Resources (ASX:WGX) , for example, among those dealing with challenging conditions.

Also, the ASX Gold Miners ETF has underperformed gold prices by more than 30% over the past three years, according to UBS analysis.

It’s definitely a tricky area to navigate, like pretty much all resources equities.

https://twitter.com/naiivememe/status/1770831564512838012

Let’s check in with some of the latest pro analysis, however, that we’ve been seeing around the traps. Here’s RBC Capital…

RBC Capital isn’t overly sold on gold… for now

Which is to say, it probably isn’t buying it up in droves necessarily right now.

What’s RBC Capital? It’s a global investment bank affiliated to the Royal Bank of Canada, providing services in banking, finance, and capital markets to corporations, institutional investors, asset managers, and governments. As well as North America, it has a strong European, Asian and Aussie presence, too.

Now you kinda know what it is, what is it saying about gold? Among other things, this:

“For gold, most eyes were on the Fed today [March 20], but in our eyes there remain questions. Putting aside the slightly more gold-positive rate narrative, the ongoing lack of investor inflows remains a key concern. Where are those flows going and when will they return?”

Sigh… okay RBC, guess we’ll bite… when, then?

Elevated prices vulnerable

“Indeed, a rate cut narrative is gold positive, and indeed, there are wildly under-appreciated geopolitical risks in our view,” continued the RBC analysis, not yet answering our question and then continuing with more questions, that they then quickly answer…

“However, has the rate cut narrative grown as incrementally more gold positive as price moves indicate? In our view, not really.

“In terms of geopolitical or crisis hedging, are we seeing evidence of geopolitical allocations in other assets? No. Thus, in terms of durability, where are the drivers… or is gold simply destined for higher prices?”

To answer that question, the RBC spoilsports said they believe the gold commodity elevated pricing is actually “more vulnerable” than it perhaps seems right now.

The analysts are not expecting up only [who does? Oh yeah, crypto folk], but a better entry or re-entry point than current levels.

If a downwards catalyst materialises, RBC views “Q1 and Q2 middle scenario forecasts as better prices to allocate into if they materialize ($2007/oz and $2068/oz, respectively), and think that in most cases, gold will lose steam around our high

scenario prices ($2,226/oz and $2,282/oz in Q1 and Q2, respectively) if/when it gets there.”

ETP inflows weakened

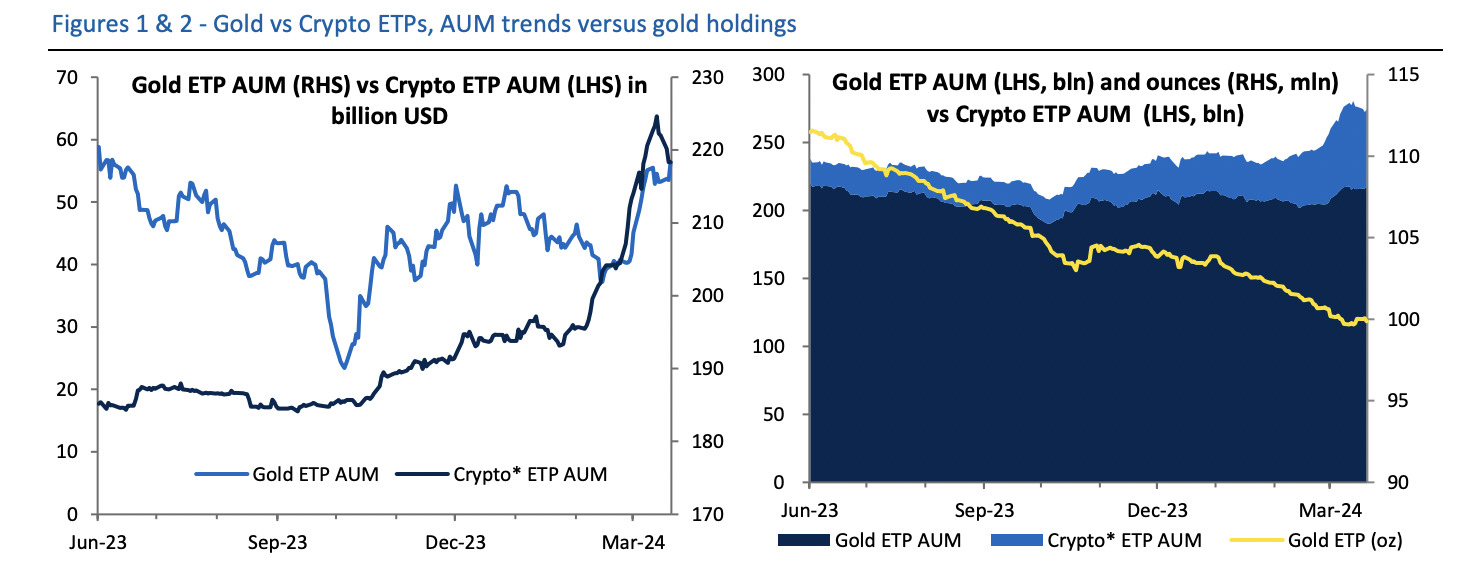

Weak investor allocations is RBC’s chief thesis here, citing weakening gold-backed ETP inflows since the middle of last year.

Interestingly, back on the Bitcoin and crypto angle for just a moment, RBC also noted:

“Some have posited that cryptocurrencies and now the budding bitcoin ETP space could be absorbing those flows,” but countered with:

“We see little evidence of that. The AUM numbers do not neatly stack-up (Figure 1). Likewise, the correlation between gold and crypto currencies remains weak and generally, we still think that there are more diversification reasons to hold both in a portfolio rather than one or the other.”

Fair enough, can’t argue with that last point.

Re the ETP flows, RBC reckons investors are probably “holding their holdings” flat in value terms rather than tonnage.

Explaining that further: “Given gold’s price gains on average this has meant a heavy outflow in tonnage terms, likely moving into risk assets in our view.”

The analysts concluded with the thought that, if investor flows were actually to perk up, then so would RBC’s confidence in the current elevated prices remaining relatively intact and potentially moving higher.

Wait, here are some more bullish takes

In a note on Thursday, UBS, another prominent multinational investment bank (mentioned above re Gold Miner ETF), noted that, while it’s a fact that ETF has been underperforming…

“With gold trading at A$3,340/oz (US$2,180/oz), we remain positive the sector with our forecasts calling for A$3,400/oz (US$2,200/oz) by year end on the US rate easing cycle … Lifting our long-term price could add 10-30% to our net present values; however, pressure continues on delivery for the gold miners.”

UBS’s ASX gold stonks picks right now, by the way, (also per a Market Index summary) are, in the larger end of town:

• Evolution Mining (ASX:EVN) (buy – “on a turnaround”)

• Northern Star Resources (ASX:NST) (neutral – “copper leverage”)

• Newmont Corporation (ASX:NEM) (neutral – despite being “still disappointing”)

And in the smaller end:

De Grey Mining (ASX:DEG) (buy – based on large inventory, geology, lots of “optionality to high prices”)

Gold Road Resources (ASX:GOR) (as above)

Bellevue Gold (ASX:BGL) (neutral)

Further positive analysis, as seen on Bloomberg, came from Chris Weston, head of research for Pepperstone Group Ltd:

“What we saw last night was the green light really for gold traders to come back in… They’re tolerant of the inflation that we’ve seen, they’re tolerant that the labor market strength is not going to be the impediment.”

And Marcus Garvey, head of commodities strategy at Macquarie Group Ltd, who said that gold’s move toward $2,300 an ounce is a “reasonable technical target”, adding:

“I think the Fed not taking the opportunity of recently firmer inflation to lean hawkish at their meeting yesterday means gold is now going into a short-term overshoot scenario.”

ASX Winners & Losers

Here’s how ASX-listed precious metals stocks are performing, circa 3pm March 22:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Please email [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.014 | 4% | 8% | -33% | $14,103,278 |

| NPM | Newpeak Metals | 0.011 | 0% | -15% | -89% | $999,517 |

| ASO | Aston Minerals Ltd | 0.015 | 0% | -12% | -86% | $19,425,964 |

| MTC | Metalstech Ltd | 0.16 | -9% | -18% | -53% | $32,122,280 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| GED | Golden Deeps | 0.049 | 7% | 17% | -39% | $5,314,028 |

| G88 | Golden Mile Res Ltd | 0.012 | 0% | 0% | -20% | $4,934,674 |

| DCX | Discovex Res Ltd | 0.002 | 0% | 0% | -33% | $6,605,136 |

| NMR | Native Mineral Res | 0.025 | 19% | 25% | -55% | $4,614,511 |

| AQX | Alice Queen Ltd | 0.006 | 20% | 0% | -65% | $4,145,905 |

| SLZ | Sultan Resources Ltd | 0.012 | -14% | -8% | -78% | $2,371,038 |

| MKG | Mako Gold | 0.014 | 17% | 17% | -68% | $13,664,115 |

| KSN | Kingston Resources | 0.082 | 0% | 12% | -12% | $41,828,794 |

| AMI | Aurelia Metals Ltd | 0.14 | -3% | 27% | 40% | $253,465,111 |

| PNX | PNX Metals Limited | 0.005 | -9% | -17% | 67% | $26,903,124 |

| GIB | Gibb River Diamonds | 0.025 | -7% | -22% | -58% | $5,287,736 |

| KCN | Kingsgate Consolid. | 1.21 | -11% | 0% | -34% | $323,478,373 |

| TMX | Terrain Minerals | 0.004 | 0% | -20% | -20% | $5,726,683 |

| BNR | Bulletin Res Ltd | 0.07 | -9% | -15% | -20% | $18,204,026 |

| NXM | Nexus Minerals Ltd | 0.049 | 7% | 36% | -69% | $18,674,886 |

| SKY | SKY Metals Ltd | 0.033 | -3% | -15% | -27% | $14,764,739 |

| LM8 | Lunnonmetalslimited | 0.275 | -7% | 22% | -73% | $57,726,603 |

| CST | Castile Resources | 0.077 | -3% | 3% | -14% | $19,110,292 |

| YRL | Yandal Resources | 0.09 | -5% | -14% | -1% | $24,102,685 |

| FAU | First Au Ltd | 0.002 | 0% | -33% | -33% | $3,323,987 |

| ARL | Ardea Resources Ltd | 0.69 | 5% | 60% | 52% | $136,926,756 |

| GWR | GWR Group Ltd | 0.1 | -5% | 5% | -9% | $32,121,666 |

| IVR | Investigator Res Ltd | 0.041 | -2% | 17% | -2% | $68,106,822 |

| GTR | Gti Energy Ltd | 0.008 | -6% | -11% | -26% | $16,399,577 |

| IPT | Impact Minerals | 0.016 | 14% | 33% | 60% | $40,105,854 |

| BNZ | Benzmining | 0.195 | 50% | 50% | -51% | $17,804,476 |

| MOH | Moho Resources | 0.006 | 20% | -14% | -63% | $3,235,069 |

| BCM | Brazilian Critical | 0.023 | 10% | 5% | -80% | $17,019,007 |

| PUA | Peak Minerals Ltd | 0.003 | 0% | 20% | -40% | $3,124,130 |

| MRZ | Mont Royal Resources | 0.085 | 25% | -9% | -48% | $7,227,532 |

| SMS | Starmineralslimited | 0.034 | -3% | -11% | -51% | $2,581,375 |

| MVL | Marvel Gold Limited | 0.01 | 11% | 0% | -44% | $8,637,907 |

| PRX | Prodigy Gold NL | 0.005 | 0% | 67% | -55% | $8,755,539 |

| AAU | Antilles Gold Ltd | 0.02 | -5% | -9% | -47% | $17,967,690 |

| CWX | Carawine Resources | 0.105 | 0% | 6% | 9% | $24,793,172 |

| RND | Rand Mining Ltd | 1.36 | -1% | 7% | -1% | $77,351,307 |

| CAZ | Cazaly Resources | 0.018 | -5% | -14% | -31% | $8,183,454 |

| BMR | Ballymore Resources | 0.13 | 0% | 30% | -19% | $22,922,976 |

| DRE | Dreadnought Resources Ltd | 0.017 | -6% | -15% | -72% | $59,186,740 |

| ZNC | Zenith Minerals Ltd | 0.091 | -9% | -4% | -52% | $33,476,184 |

| REZ | Resourc & En Grp Ltd | 0.009 | -10% | -10% | -31% | $4,498,252 |

| LEX | Lefroy Exploration | 0.1 | -13% | -26% | -51% | $23,052,725 |

| ERM | Emmerson Resources | 0.05 | -4% | -9% | -35% | $27,235,489 |

| AM7 | Arcadia Minerals | 0.07 | 0% | 21% | -67% | $7,633,507 |

| ADT | Adriatic Metals | 3.92 | 3% | 26% | 7% | $972,149,601 |

| AS1 | Asara Resources Ltd | 0.009 | -18% | -10% | -70% | $7,939,578 |

| CYL | Catalyst Metals | 0.655 | -4% | 35% | -34% | $151,908,705 |

| CHN | Chalice Mining Ltd | 1.105 | -8% | 7% | -83% | $439,528,534 |

| KAL | Kalgoorliegoldmining | 0.024 | 20% | 4% | -52% | $3,962,518 |

| MLS | Metals Australia | 0.023 | -4% | -21% | -36% | $16,976,869 |

| ADN | Andromeda Metals Ltd | 0.023 | -15% | 0% | -48% | $74,646,502 |

| MEI | Meteoric Resources | 0.2425 | 3% | 39% | 111% | $477,628,763 |

| SRN | Surefire Rescs NL | 0.0105 | 5% | -13% | -42% | $20,856,232 |

| SIH | Sihayo Gold Limited | 0.0015 | 50% | 50% | 50% | $18,306,384 |

| WA8 | Warriedarresourltd | 0.049 | -2% | 53% | -65% | $26,113,193 |

| HMX | Hammer Metals Ltd | 0.038 | 6% | -19% | -30% | $32,797,072 |

| WCN | White Cliff Min Ltd | 0.0145 | -3% | -9% | 45% | $22,741,424 |

| AVM | Advance Metals Ltd | 0.038 | 6% | -5% | -76% | $1,523,228 |

| WRM | White Rock Min Ltd | 0.063 | 0% | 0% | 0% | $17,508,200 |

| ASR | Asra Minerals Ltd | 0.005 | 25% | 0% | -55% | $8,319,979 |

| MCT | Metalicity Limited | 0.002 | 0% | 0% | -33% | $11,212,634 |

| AME | Alto Metals Limited | 0.03 | 0% | 3% | -55% | $23,088,742 |

| CTO | Citigold Corp Ltd | 0.004 | 0% | 0% | -20% | $15,000,000 |

| TIE | Tietto Minerals | 0.6075 | -1% | -1% | 5% | $694,882,627 |

| SMI | Santana Minerals Ltd | 1.3 | -2% | 17% | 73% | $234,797,637 |

| M2R | Miramar | 0.018 | 20% | -5% | -58% | $2,828,521 |

| MHC | Manhattan Corp Ltd | 0.003 | 20% | 0% | -40% | $7,342,449 |

| GRL | Godolphin Resources | 0.033 | -8% | -23% | -49% | $5,584,987 |

| SVG | Savannah Goldfields | 0.027 | -13% | -10% | -85% | $7,870,378 |

| EMC | Everest Metals Corp | 0.08 | 0% | -1% | 7% | $13,142,649 |

| GUL | Gullewa Limited | 0.055 | 0% | -2% | -2% | $11,262,521 |

| CY5 | Cygnus Metals Ltd | 0.054 | 6% | -19% | -77% | $15,744,194 |

| G50 | Gold50Limited | 0.145 | 51% | 67% | -34% | $10,929,000 |

| ADV | Ardiden Ltd | 0.15 | 7% | -9% | -46% | $9,690,213 |

| AAR | Astral Resources NL | 0.059 | -3% | -3% | -21% | $47,585,852 |

| VMC | Venus Metals Cor Ltd | 0.089 | -1% | -7% | 2% | $16,885,853 |

| NAE | New Age Exploration | 0.004 | 0% | 0% | -33% | $7,175,596 |

| VKA | Viking Mines Ltd | 0.011 | 10% | -8% | 10% | $11,277,843 |

| LCL | LCL Resources Ltd | 0.013 | 0% | 18% | -59% | $11,462,706 |

| MTH | Mithril Resources | 0.002 | 0% | 0% | 0% | $6,737,609 |

| ADG | Adelong Gold Limited | 0.004 | -11% | 0% | -60% | $3,521,956 |

| RMX | Red Mount Min Ltd | 0.002 | 0% | 0% | -50% | $5,347,152 |

| PRS | Prospech Limited | 0.038 | 9% | 27% | 64% | $9,455,205 |

| TTM | Titan Minerals | 0.031 | 15% | 48% | -49% | $51,944,086 |

| NML | Navarre Minerals Ltd | 0.019 | 0% | 0% | -34% | $28,555,654 |

| MZZ | Matador Mining Ltd | 0.042 | 5% | 15% | -48% | $21,511,104 |

| KZR | Kalamazoo Resources | 0.087 | -5% | -13% | -38% | $15,033,104 |

| BCN | Beacon Minerals | 0.024 | -4% | 9% | -14% | $90,162,436 |

| MAU | Magnetic Resources | 1.005 | 0% | 2% | 52% | $253,230,614 |

| BC8 | Black Cat Syndicate | 0.205 | -13% | 3% | -41% | $66,107,485 |

| EM2 | Eagle Mountain | 0.06 | -19% | -8% | -63% | $21,042,714 |

| EMR | Emerald Res NL | 2.8 | -12% | -1% | 77% | $1,833,838,632 |

| BYH | Bryah Resources Ltd | 0.011 | 38% | 38% | -38% | $4,354,535 |

| HCH | Hot Chili Ltd | 1.1 | 8% | 1% | 20% | $136,167,535 |

| WAF | West African Res Ltd | 1.08 | 7% | 26% | 8% | $1,129,231,613 |

| MEU | Marmota Limited | 0.046 | -10% | -4% | 21% | $50,822,428 |

| NVA | Nova Minerals Ltd | 0.285 | 0% | 6% | -35% | $59,049,217 |

| SVL | Silver Mines Limited | 0.16 | -3% | 19% | -3% | $263,906,345 |

| PGD | Peregrine Gold | 0.21 | -9% | -21% | -42% | $14,191,468 |

| ICL | Iceni Gold | 0.024 | -4% | -33% | -73% | $5,670,904 |

| FG1 | Flynngold | 0.041 | -5% | -21% | -47% | $6,729,777 |

| WWI | West Wits Mining Ltd | 0.014 | -7% | 8% | 17% | $36,455,875 |

| RML | Resolution Minerals | 0.003 | -14% | -25% | -50% | $3,779,990 |

| AAJ | Aruma Resources Ltd | 0.017 | 0% | 13% | -69% | $3,544,047 |

| AL8 | Alderan Resource Ltd | 0.0045 | 0% | 13% | -36% | $4,980,876 |

| GMN | Gold Mountain Ltd | 0.004 | 0% | -20% | 0% | $14,877,528 |

| MEG | Megado Minerals Ltd | 0.011 | 0% | -15% | -71% | $2,544,556 |

| HMG | Hamelingoldlimited | 0.074 | 0% | 1% | -18% | $11,655,000 |

| TBA | Tombola Gold Ltd | 0.026 | 0% | 0% | 0% | $33,129,243 |

| BM8 | Battery Age Minerals | 0.1 | -26% | -38% | -72% | $9,634,833 |

| TBR | Tribune Res Ltd | 3.61 | 6% | 24% | 2% | $198,329,331 |

| FML | Focus Minerals Ltd | 0.19 | 12% | 19% | 3% | $51,580,556 |

| GSR | Greenstone Resources | 0.008 | 14% | 14% | -64% | $9,576,794 |

| VRC | Volt Resources Ltd | 0.006 | 9% | 0% | -40% | $20,650,533 |

| ARV | Artemis Resources | 0.018 | 0% | 6% | 20% | $30,441,531 |

| HRN | Horizon Gold Ltd | 0.3 | 3% | 9% | -11% | $42,727,777 |

| CLA | Celsius Resource Ltd | 0.014 | 8% | 17% | -7% | $31,444,723 |

| QML | Qmines Limited | 0.07 | 8% | -5% | -56% | $15,605,497 |

| RDN | Raiden Resources Ltd | 0.026 | 8% | 4% | 584% | $66,414,628 |

| TCG | Turaco Gold Limited | 0.17 | 3% | 48% | 158% | $99,975,111 |

| KCC | Kincora Copper | 0.037 | 6% | 9% | -47% | $6,135,504 |

| GBZ | GBM Rsources Ltd | 0.009 | 0% | 0% | -71% | $10,183,648 |

| DTM | Dart Mining NL | 0.017 | 13% | 21% | -55% | $4,096,433 |

| MKR | Manuka Resources. | 0.077 | -13% | 3% | 43% | $50,676,964 |

| AUC | Ausgold Limited | 0.031 | 0% | 24% | -38% | $71,180,377 |

| ANX | Anax Metals Ltd | 0.022 | 0% | 10% | -63% | $12,476,303 |

| EMU | EMU NL | 0.001 | 0% | 0% | -50% | $2,024,771 |

| SFM | Santa Fe Minerals | 0.045 | 0% | 0% | -22% | $3,276,846 |

| SSR | SSR Mining Inc. | 6.04 | -3% | -12% | -72% | $30,572,113 |

| PNR | Pantoro Limited | 0.0635 | 15% | 51% | -5% | $301,833,770 |

| CMM | Capricorn Metals | 4.97 | 2% | 13% | 5% | $1,894,688,716 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | 0% | $130,184,182 |

| SI6 | SI6 Metals Limited | 0.004 | 0% | 0% | -20% | $9,475,438 |

| HAW | Hawthorn Resources | 0.075 | 1% | -9% | -14% | $25,126,171 |

| BGD | Bartongoldholdings | 0.275 | -2% | 10% | 25% | $55,042,953 |

| SVY | Stavely Minerals Ltd | 0.03 | -12% | -3% | -84% | $11,458,203 |

| AGC | AGC Ltd | 0.076 | 9% | -5% | 46% | $16,888,889 |

| RGL | Riversgold | 0.008 | 0% | -11% | -47% | $7,741,292 |

| TSO | Tesoro Gold Ltd | 0.029 | -17% | 26% | 0% | $36,887,421 |

| GUE | Global Uranium | 0.105 | 0% | -19% | -28% | $27,668,899 |

| CPM | Coopermetalslimited | 0.12 | -14% | -53% | -50% | $9,794,456 |

| MM8 | Medallion Metals. | 0.057 | -2% | 0% | -53% | $17,536,144 |

| FFM | Firefly Metals Ltd | 0.7075 | 19% | 40% | 10% | $259,326,382 |

| CBY | Canterbury Resources | 0.033 | 10% | 27% | -18% | $5,667,450 |

| LYN | Lycaonresources | 0.16 | 10% | -16% | -18% | $7,489,563 |

| SFR | Sandfire Resources | 8.65 | 2% | 18% | 54% | $3,971,263,991 |

| TMZ | Thomson Res Ltd | 0.005 | 0% | 0% | 0% | $4,881,018 |

| TAM | Tanami Gold NL | 0.034 | 3% | 13% | -3% | $38,778,203 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | $74,238,031 |

| NWM | Norwest Minerals | 0.027 | -10% | -21% | -10% | $9,702,977 |

| ALK | Alkane Resources Ltd | 0.58 | -1% | 16% | -20% | $362,062,390 |

| BMO | Bastion Minerals | 0.01 | 11% | 0% | -64% | $3,520,124 |

| IDA | Indiana Resources | 0.079 | -4% | -4% | 65% | $48,769,628 |

| GSM | Golden State Mining | 0.01 | -17% | -9% | -69% | $2,793,706 |

| NSM | Northstaw | 0.044 | 29% | 10% | -69% | $6,154,534 |

| GSN | Great Southern | 0.022 | -4% | 16% | 22% | $16,601,974 |

| RED | Red 5 Limited | 0.3575 | -2% | 21% | 155% | $1,229,649,195 |

| DEG | De Grey Mining | 1.2175 | -5% | -3% | -23% | $2,323,338,234 |

| THR | Thor Energy PLC | 0.024 | -4% | -8% | -40% | $4,420,131 |

| CDR | Codrus Minerals Ltd | 0.041 | -2% | -13% | -54% | $3,787,888 |

| MDI | Middle Island Res | 0.017 | 13% | 6% | -55% | $3,700,118 |

| WTM | Waratah Minerals Ltd | 0.088 | 35% | 6% | -27% | $12,845,347 |

| POL | Polymetals Resources | 0.3 | 13% | 15% | 62% | $47,285,342 |

| RDS | Redstone Resources | 0.004 | 0% | 0% | -60% | $3,701,514 |

| NAG | Nagambie Resources | 0.014 | -7% | -42% | -70% | $11,152,899 |

| BGL | Bellevue Gold Ltd | 1.9025 | 15% | 34% | 57% | $2,342,910,283 |

| GBR | Greatbould Resources | 0.06 | -5% | -3% | -33% | $37,212,846 |

| KAI | Kairos Minerals Ltd | 0.013 | -7% | -7% | -32% | $34,071,858 |

| KAU | Kaiser Reef | 0.13 | -4% | 0% | -28% | $20,525,267 |

| HRZ | Horizon | 0.034 | 0% | 6% | -32% | $23,833,445 |

| CAI | Calidus Resources | 0.12 | -27% | -23% | -49% | $101,086,600 |

| CDT | Castle Minerals | 0.007 | 0% | 17% | -61% | $7,959,204 |

| RSG | Resolute Mining | 0.38 | 3% | 10% | 1% | $851,620,005 |

| MXR | Maximus Resources | 0.031 | -11% | 3% | -11% | $9,949,319 |

| EVN | Evolution Mining Ltd | 3.415 | 1% | 13% | 18% | $6,890,995,820 |

| CXU | Cauldron Energy Ltd | 0.038 | -5% | 0% | 543% | $49,773,345 |

| DLI | Delta Lithium | 0.3125 | -5% | 1% | -1% | $228,290,285 |

| ALY | Alchemy Resource Ltd | 0.007 | 0% | -13% | -50% | $8,246,534 |

| HXG | Hexagon Energy | 0.023 | 44% | 77% | 109% | $11,797,066 |

| OBM | Ora Banda Mining Ltd | 0.26 | 2% | 6% | 86% | $451,749,526 |

| SLR | Silver Lake Resource | 1.1775 | -2% | 17% | 2% | $1,121,693,200 |

| AVW | Avira Resources Ltd | 0.001 | 0% | 0% | -50% | $2,133,790 |

| LCY | Legacy Iron Ore | 0.014 | -7% | -13% | -18% | $115,703,224 |

| PDI | Predictive Disc Ltd | 0.225 | -6% | 18% | 25% | $477,536,140 |

| MAT | Matsa Resources | 0.027 | -7% | -10% | -27% | $13,885,897 |

| ZAG | Zuleika Gold Ltd | 0.019 | 12% | -5% | 36% | $14,721,710 |

| GML | Gateway Mining | 0.025 | -7% | -7% | -42% | $8,636,486 |

| SBM | St Barbara Limited | 0.165 | 0% | 6% | -43% | $139,054,965 |

| SBR | Sabre Resources | 0.019 | 0% | -10% | -24% | $7,110,977 |

| STK | Strickland Metals | 0.088 | -1% | 7% | 138% | $146,174,326 |

| ION | Iondrive Limited | 0.009 | 0% | -10% | -53% | $4,376,568 |

| CEL | Challenger Gold Ltd | 0.076 | -5% | 1% | -34% | $98,371,133 |

| LRL | Labyrinth Resources | 0.005 | 0% | 0% | -42% | $7,125,262 |

| NST | Northern Star | 13.555 | -3% | 3% | 16% | $15,755,821,500 |

| OZM | Ozaurum Resources | 0.053 | -36% | -27% | 26% | $8,255,000 |

| TG1 | Techgen Metals Ltd | 0.031 | -3% | -30% | -50% | $4,068,242 |

| XAM | Xanadu Mines Ltd | 0.063 | 47% | 43% | 91% | $113,256,397 |

| AQI | Alicanto Min Ltd | 0.03 | -6% | 25% | -32% | $18,460,104 |

| KTA | Krakatoa Resources | 0.009 | -10% | -44% | -70% | $4,248,965 |

| ARN | Aldoro Resources | 0.078 | -3% | -22% | -63% | $10,500,652 |

| WGX | Westgold Resources. | 2.445 | -2% | 28% | 114% | $1,174,584,370 |

| MBK | Metal Bank Ltd | 0.023 | 5% | 35% | -22% | $8,980,564 |

| A8G | Australasian Metals | 0.072 | 0% | -18% | -54% | $3,700,555 |

| TAR | Taruga Minerals | 0.008 | 14% | 0% | -50% | $5,648,214 |

| DTR | Dateline Resources | 0.015 | 15% | 25% | -17% | $20,338,991 |

| GOR | Gold Road Res Ltd | 1.525 | -4% | 10% | -7% | $1,639,413,745 |

| S2R | S2 Resources | 0.1325 | -5% | -2% | -5% | $58,871,539 |

| NES | Nelson Resources. | 0.0035 | 17% | -13% | -13% | $2,147,580 |

| TLM | Talisman Mining | 0.175 | -3% | -10% | 30% | $32,014,459 |

| BEZ | Besragoldinc | 0.14 | 0% | -7% | 133% | $58,534,127 |

| PRU | Perseus Mining Ltd | 2.045 | -3% | 22% | -11% | $2,870,748,668 |

| SPQ | Superior Resources | 0.0095 | -21% | -5% | -83% | $18,010,984 |

| PUR | Pursuit Minerals | 0.0045 | -10% | 13% | -78% | $14,719,857 |

| RMS | Ramelius Resources | 1.6825 | 5% | 21% | 52% | $1,975,073,665 |

| PKO | Peako Limited | 0.005 | -17% | 67% | -50% | $2,635,424 |

| ICG | Inca Minerals Ltd | 0.005 | -17% | -17% | -75% | $4,792,627 |

| A1G | African Gold Ltd. | 0.035 | 0% | 0% | -53% | $5,925,892 |

| OAU | Ora Gold Limited | 0.006 | 0% | 0% | 200% | $31,570,005 |

| GNM | Great Northern | 0.015 | -12% | -12% | -71% | $2,319,436 |

| KRM | Kingsrose Mining Ltd | 0.034 | 6% | 10% | -44% | $23,328,322 |

| BTR | Brightstar Resources | 0.015 | -12% | 25% | -6% | $37,926,062 |

| RRL | Regis Resources | 1.855 | -4% | -4% | -2% | $1,420,036,959 |

| M24 | Mamba Exploration | 0.026 | 4% | -19% | -71% | $4,602,057 |

| TRM | Truscott Mining Corp | 0.051 | 9% | 2% | 9% | $8,148,252 |

| TNC | True North Copper | 0.071 | -13% | -15% | 34% | $28,821,959 |

| MOM | Moab Minerals Ltd | 0.006 | -14% | -14% | -14% | $3,559,817 |

| KNB | Koonenberrygold | 0.022 | -12% | 1% | -45% | $3,305,075 |

| AWJ | Auric Mining | 0.165 | 10% | 43% | 259% | $20,937,535 |

| AZS | Azure Minerals | 3.645 | 1% | 1% | 1179% | $1,660,420,062 |

| ENR | Encounter Resources | 0.245 | -8% | 2% | 96% | $106,596,457 |

| SNG | Siren Gold | 0.057 | -5% | -2% | -40% | $11,261,960 |

| STN | Saturn Metals | 0.18 | 9% | 20% | -5% | $41,398,833 |

| USL | Unico Silver Limited | 0.125 | 14% | 30% | -11% | $37,006,449 |

| PNM | Pacific Nickel Mines | 0.034 | -15% | -11% | -53% | $13,384,099 |

| AYM | Australia United Min | 0.003 | 0% | 0% | 0% | $5,527,732 |

| ANL | Amani Gold Ltd | 0.001 | 0% | 0% | 0% | $25,143,441 |

| HAV | Havilah Resources | 0.17 | 6% | 13% | -48% | $52,245,470 |

| SPR | Spartan Resources | 0.585 | -9% | 18% | 485% | $579,187,888 |

| PNT | Panthermetalsltd | 0.035 | -8% | -22% | -75% | $3,050,816 |

| MEK | Meeka Metals Limited | 0.038 | 6% | 12% | -12% | $46,918,939 |

| GMD | Genesis Minerals | 1.795 | -5% | 15% | 72% | $2,154,112,005 |

| PGO | Pacgold | 0.155 | 3% | 15% | -59% | $13,042,543 |

| FEG | Far East Gold | 0.135 | 0% | -4% | -55% | $25,284,869 |

| MI6 | Minerals260Limited | 0.15 | 0% | -17% | -50% | $36,270,000 |

| IGO | IGO Limited | 7.21 | -7% | 2% | -40% | $5,550,773,069 |

| GAL | Galileo Mining Ltd | 0.265 | 8% | 13% | -62% | $57,311,229 |

| RXL | Rox Resources | 0.16 | 0% | 3% | -47% | $59,096,682 |

| KIN | KIN Min NL | 0.062 | -10% | 2% | 41% | $74,223,485 |

| CLZDC | Classic Min Ltd | 0.017 | -66% | -66% | -83% | $4,640,431 |

| TGM | Theta Gold Mines Ltd | 0.16 | 28% | 19% | 167% | $113,846,374 |

| FAL | Falconmetalsltd | 0.12 | 0% | 9% | -68% | $20,355,000 |

| SXG | Southern Cross Gold | 1.94 | 0% | 46% | 194% | $184,026,802 |

| SPD | Southernpalladium | 0.33 | 2% | -20% | -37% | $14,215,848 |

| ORN | Orion Minerals Ltd | 0.014 | 0% | 8% | 0% | $76,001,701 |

| TMB | Tambourahmetals | 0.078 | -19% | -11% | -22% | $6,801,109 |

| TMS | Tennant Minerals Ltd | 0.028 | 4% | -7% | -7% | $22,170,884 |

| AZY | Antipa Minerals Ltd | 0.013 | 0% | 8% | -28% | $49,617,695 |

| PXX | Polarx Limited | 0.013 | -7% | 3% | 22% | $19,675,401 |

| TRE | Toubani Res Ltd | 0.12 | -8% | 0% | -25% | $15,394,552 |

| AUN | Aurumin | 0.035 | 0% | -8% | 9% | $14,864,395 |

| GPR | Geopacific Resources | 0.019 | 12% | 23% | -23% | $15,612,630 |

| FXG | Felix Gold Limited | 0.03 | 0% | -9% | -71% | $6,216,453 |

| ILT | Iltani Resources Lim | 0.145 | -3% | -9% | 0% | $4,931,523 |

| ARD | Argent Minerals | 0.01 | 0% | 11% | -9% | $12,917,590 |

Some notable weekly gainers

Hexagon Energy Materials (ASX:HXG:) +44%

Bryah Resources (ASX:BYH) +38%

Waratah Minerals (ASX:WTM) +35%

Kalgoorlie Gold Mining (ASX:KAL) +20%

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.