Gold Digger: Gold slides 5% for July, recovery hinges on recession fears

Pic: sturti / iStock / Getty Images Plus via Getty Images

- Gold is down 5% for July and on a broader downward trajectory, Metals Focus says

- Aeris Resources’ Golden Plateau deposit could extend the mine life at Cracow

- Golden State Mining has kicked off drilling at the Yule project in WA

Our Gold Digger column wraps all the news driving ASX stocks with exposure to precious metals.

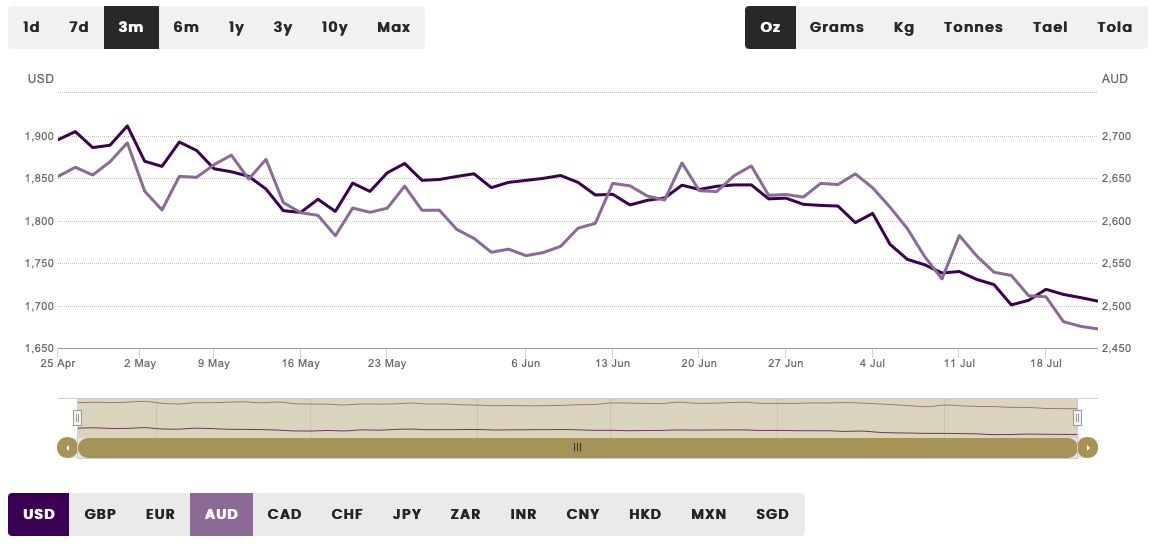

Gold had quite the rally in the wake of the start of the Russia-Ukraine war, but the yellow metal is down more than 5% for July so far, currently trading at US$1,717.55.

“With respect to gold, even as economic uncertainty abounds, dollar strength has undermined its prospects this year,” Metals Focus says.

Another key narrative that has worked against gold is that the possibility of stagflation – especially in the US – has faded in recent months as the labour market remains strong at a time when inflation is potentially cooling.

After a strong rally in the early part of the year, commodity prices have corrected sharply over the last two months which has led to a fall in forward inflation expectations and the anticipation that the Fed will keep hiking in the short to medium term.

“This is likely to keep the possibility of a further price correction in gold relatively high in the short term,” Metals Focus said.

“That aside, if other central banks, mainly the ECB, starts raising interest rates meaningfully, the dollar index could start to retrace some of the gains seen this year and in turn help gold prices stage a rebound.

“A short-term recovery aside, this scenario is however unlikely to alter the broader downside trajectory for gold.”

Upside risks could help gold recover

But Metals Focus says there are several upside risks remaining which could help the gold price recover meaningfully from current levels.

“These include a broad recession, or a synchronised global slowdown exacerbated by COVID worries in China or energy shortages in Europe during the winter months,” it said.

“This in turn could mean that rate hikes may peak early next year, and central banks may potentially start cutting interest rates to prevent a major slowdown.

“While current expectations of Fed policy derived from Fed Fund futures do suggest that rate cuts are possible next year, gold prices have so far not reacted positively to such possibilities.

“This could however change if economic data start pointing out that recessionary pressures are building in earnest.”

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

> Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Year | % Six Month | % Month | % Week | Market Cap |

|---|---|---|---|---|---|---|---|

| HMX | Hammer Metals Ltd | 0.067 | -20% | 2% | 31% | 43% | $49,739,072.00 |

| ADV | Ardiden Ltd | 0.0085 | 6% | -50% | 6% | 42% | $24,015,018.20 |

| AWV | Anova Metals Ltd | 0.012 | -33% | -40% | 33% | 33% | $16,479,036.20 |

| ARL | Ardea Resources Ltd | 1.12 | 155% | 79% | 34% | 32% | $193,501,060.08 |

| AXE | Archer Materials | 0.765 | -40% | -37% | 32% | 31% | $180,138,725.08 |

| BAT | Battery Minerals Ltd | 0.0065 | -62% | -46% | 18% | 30% | $17,426,838.70 |

| E2M | E2 Metals | 0.16 | -47% | -43% | 28% | 28% | $29,869,848.45 |

| KTA | Krakatoa Resources | 0.06 | 20% | 3% | 9% | 28% | $20,337,885.10 |

| CLA | Celsius Resource Ltd | 0.019 | -42% | -41% | 46% | 27% | $20,764,918.06 |

| CEL | Challenger Exp Ltd | 0.195 | -29% | -34% | -11% | 26% | $205,542,716.00 |

| LNY | Laneway Res Ltd | 0.005 | 4% | -13% | 25% | 25% | $31,510,082.05 |

| LM8 | Lunnonmetalslimited | 0.86 | 91% | -5% | 14% | 24% | $93,394,707.95 |

| KAU | Kaiser Reef | 0.195 | -21% | -5% | 22% | 22% | $25,318,939.23 |

| LCL | Los Cerros Limited | 0.034 | -80% | -70% | -8% | 21% | $21,471,412.22 |

| PKO | Peako Limited | 0.017 | -50% | -15% | 13% | 21% | $5,243,719.72 |

| ZNC | Zenith Minerals Ltd | 0.315 | 21% | -10% | 17% | 21% | $98,257,249.52 |

| TIE | Tietto Minerals | 0.475 | 36% | -3% | 44% | 20% | $426,983,375.78 |

| ADN | Andromeda Metals Ltd | 0.09 | -42% | -61% | 20% | 20% | $289,044,784.18 |

| MTH | Mithril Resources | 0.006 | -68% | -59% | 20% | 20% | $17,581,398.25 |

| ALY | Alchemy Resource Ltd | 0.018 | 23% | 38% | 20% | 20% | $17,155,333.03 |

| GSM | Golden State Mining | 0.05 | -67% | -58% | 14% | 19% | $5,588,223.31 |

| KCC | Kincora Copper | 0.064 | -73% | -51% | 7% | 19% | $4,709,383.62 |

| NWM | Norwest Minerals | 0.033 | -60% | -54% | 18% | 18% | $5,779,436.38 |

| AQX | Alice Queen Ltd | 0.0035 | -73% | -65% | -13% | 17% | $5,948,301.37 |

| PRX | Prodigy Gold NL | 0.014 | -64% | -58% | -7% | 17% | $8,156,786.48 |

| WCN | White Cliff Min Ltd | 0.014 | -7% | -44% | -18% | 17% | $9,150,447.07 |

| VKA | Viking Mines Ltd | 0.007 | -61% | -56% | 17% | 17% | $7,176,809.02 |

| RML | Resolution Minerals | 0.0105 | -58% | -42% | 40% | 17% | $8,323,850.80 |

| GMN | Gold Mountain Ltd | 0.007 | -71% | -50% | 40% | 17% | $8,352,044.19 |

| AVW | Avira Resources Ltd | 0.0035 | -30% | -30% | 0% | 17% | $8,475,160.00 |

| CDR | Codrus Minerals Ltd | 0.08 | -57% | -38% | 5% | 16% | $3,360,000.00 |

| MRR | Minrex Resources Ltd | 0.038 | 100% | -43% | 9% | 15% | $36,044,996.67 |

| GRL | Godolphin Resources | 0.115 | -34% | -18% | 21% | 15% | $8,414,770.10 |

| A8G | Australasian Metals | 0.23 | 77% | -63% | 12% | 15% | $9,675,066.09 |

| CST | Castile Resources | 0.16 | -18% | -20% | -3% | 14% | $28,957,967.55 |

| IPT | Impact Minerals | 0.008 | -41% | -41% | 0% | 14% | $17,369,593.89 |

| MOH | Moho Resources | 0.024 | -62% | -61% | -14% | 14% | $3,831,860.71 |

| XTC | Xantippe Res Ltd | 0.008 | 300% | -33% | 14% | 14% | $63,689,188.51 |

| BYH | Bryah Resources Ltd | 0.032 | -44% | -48% | 3% | 14% | $7,012,422.43 |

| SI6 | SI6 Metals Limited | 0.008 | -43% | -27% | 60% | 14% | $11,905,512.63 |

| TMZ | Thomson Res Ltd | 0.024 | -78% | -71% | 0% | 14% | $15,511,472.06 |

| IVR | Investigator Res Ltd | 0.043 | -35% | -39% | 2% | 13% | $55,957,173.59 |

| MLS | Metals Australia | 0.052 | 30% | 30% | 13% | 13% | $26,129,664.79 |

| ASO | Aston Minerals Ltd | 0.105 | -25% | -30% | 31% | 13% | $116,920,748.07 |

| MAT | Matsa Resources | 0.045 | -38% | -30% | 0% | 13% | $15,076,094.04 |

| MBK | Metal Bank Ltd | 0.0045 | -48% | -25% | -10% | 13% | $11,735,181.72 |

| CHN | Chalice Mining Ltd | 4.46 | -28% | -46% | 17% | 12% | $1,648,181,709.72 |

| OBM | Ora Banda Mining Ltd | 0.049 | -64% | -15% | 75% | 11% | $67,325,377.85 |

| M2R | Miramar | 0.1 | -43% | -47% | 12% | 11% | $5,584,239.68 |

| BGD | Bartongoldholdings | 0.2 | 0% | -9% | 5% | 11% | $17,621,640.72 |

| THR | Thor Mining PLC | 0.01 | -33% | -23% | 25% | 11% | $10,689,009.73 |

| S2R | S2 Resources | 0.15 | 15% | -29% | 7% | 11% | $55,238,102.53 |

| TLM | Talisman Mining | 0.15 | -19% | -9% | 7% | 11% | $28,160,924.55 |

| KNB | Koonenberrygold | 0.08 | 0% | -48% | 4% | 11% | $5,980,727.04 |

| MI6 | Minerals260Limited | 0.3 | 0% | -52% | 3% | 11% | $69,300,000.00 |

| TCG | Turaco Gold Limited | 0.051 | -49% | -58% | -27% | 11% | $21,813,550.12 |

| YRL | Yandal Resources | 0.155 | -71% | -59% | -14% | 11% | $18,574,648.48 |

| GCY | Gascoyne Res Ltd | 0.26 | -16% | -7% | 13% | 11% | $106,508,813.50 |

| GCY | Gascoyne Res Ltd | 0.26 | -16% | -7% | 13% | 11% | $106,508,813.50 |

| LRL | Labyrinth Resources | 0.022 | -29% | -45% | 10% | 10% | $19,214,068.61 |

| CDT | Castle Minerals | 0.0285 | 104% | -38% | 14% | 10% | $26,986,310.57 |

| NXM | Nexus Minerals Ltd | 0.23 | 156% | -41% | 10% | 10% | $63,728,616.82 |

| NAG | Nagambie Resources | 0.069 | -19% | 0% | 53% | 10% | $34,380,792.59 |

| MTC | Metalstech Ltd | 0.355 | 99% | 20% | 3% | 9% | $53,332,668.80 |

| MEI | Meteoric Resources | 0.012 | -76% | -33% | 0% | 9% | $19,078,717.14 |

| HXG | Hexagon Energy | 0.024 | -67% | -66% | 14% | 9% | $12,822,897.53 |

| SFR | Sandfire Resources | 4.155 | -30% | -40% | -15% | 9% | $1,734,223,407.39 |

| GSR | Greenstone Resources | 0.05 | 138% | 72% | 6% | 9% | $50,222,730.76 |

| MXR | Maximus Resources | 0.05 | -31% | -32% | 9% | 9% | $14,941,571.10 |

| ENR | Encounter Resources | 0.13 | -7% | -16% | 0% | 8% | $38,066,019.12 |

| BRB | Breaker Res NL | 0.2 | 25% | -22% | 5% | 8% | $66,797,390.45 |

| BC8 | Black Cat Syndicate | 0.335 | -42% | -44% | 2% | 8% | $65,158,423.38 |

| GTR | Gti Energy Ltd | 0.014 | -21% | -39% | 8% | 8% | $22,387,253.69 |

| NAE | New Age Exploration | 0.007 | -42% | -56% | 0% | 8% | $9,333,342.92 |

| RMX | Red Mount Min Ltd | 0.007 | -30% | -36% | 17% | 8% | $11,496,547.01 |

| KAL | Kalgoorliegoldmining | 0.15 | 0% | 3% | 36% | 7% | $10,865,190.00 |

| CHZ | Chesser Resources | 0.09 | -18% | -22% | 13% | 7% | $52,931,079.90 |

| RSG | Resolute Mining | 0.2675 | -55% | -25% | 7% | 7% | $281,575,939.10 |

| CMM | Capricorn Metals | 3.375 | 86% | -5% | -4% | 7% | $1,219,914,606.80 |

| SVL | Silver Mines Limited | 0.16 | -29% | -30% | 0% | 7% | $200,233,982.17 |

| AAJ | Aruma Resources Ltd | 0.064 | 14% | -32% | -4% | 7% | $10,830,343.71 |

| AWJ | Auric Mining | 0.065 | -55% | -46% | -13% | 7% | $3,951,111.97 |

| RED | Red 5 Limited | 0.245 | 40% | -13% | -23% | 7% | $565,625,457.60 |

| NSM | Northstaw | 0.165 | -53% | -44% | 0% | 6% | $6,620,955.00 |

| VMC | Venus Metals Cor Ltd | 0.17 | 0% | -15% | 6% | 6% | $27,213,376.11 |

| RDS | Redstone Resources | 0.0085 | -29% | -39% | 42% | 6% | $5,894,659.17 |

| PUR | Pursuit Minerals | 0.017 | -71% | -37% | -6% | 6% | $16,886,086.30 |

| KRM | Kingsrose Mining Ltd | 0.054 | -2% | -43% | -5% | 6% | $40,636,432.03 |

| TBR | Tribune Res Ltd | 3.9 | -22% | -20% | -1% | 5% | $206,199,542.61 |

| WWI | West Wits Mining Ltd | 0.02 | -74% | -52% | -13% | 5% | $39,195,552.98 |

| ANX | Anax Metals Ltd | 0.08 | 16% | -18% | -7% | 5% | $32,450,252.80 |

| PDI | Predictive Disc Ltd | 0.2 | 48% | -23% | 8% | 5% | $312,214,275.95 |

| STK | Strickland Metals | 0.06 | 18% | -8% | 0% | 5% | $80,710,224.02 |

| SPQ | Superior Resources | 0.04 | 167% | -30% | 21% | 5% | $62,945,155.47 |

| GOR | Gold Road Res Ltd | 1.21 | -9% | -21% | 2% | 5% | $1,268,592,804.44 |

| WGX | Westgold Resources. | 1.22 | -33% | -40% | -4% | 5% | $577,819,730.60 |

| WMC | Wiluna Mining Corp | 0.205 | -76% | -79% | -31% | 5% | $74,238,030.68 |

| PRU | Perseus Mining Ltd | 1.6975 | 11% | 10% | -3% | 5% | $2,326,707,431.95 |

| AUC | Ausgold Limited | 0.042 | -2% | -11% | -15% | 5% | $85,237,930.72 |

| RMS | Ramelius Resources | 1.0025 | -41% | -37% | -9% | 5% | $884,732,811.18 |

| SRN | Surefire Rescs NL | 0.022 | 57% | 69% | 5% | 5% | $33,208,633.02 |

| EM2 | Eagle Mountain | 0.22 | -71% | -65% | -12% | 5% | $55,665,000.57 |

| PGD | Peregrine Gold | 0.44 | -6% | -30% | 13% | 5% | $16,271,834.33 |

| KWR | Kingwest Resources | 0.067 | -21% | -67% | -4% | 5% | $16,279,192.68 |

| AUT | Auteco Minerals | 0.045 | -61% | -48% | 22% | 5% | $93,028,597.56 |

| BNR | Bulletin Res Ltd | 0.115 | 92% | -18% | -12% | 5% | $32,185,021.00 |

| XAM | Xanadu Mines Ltd | 0.023 | -36% | -26% | 0% | 5% | $32,481,984.95 |

| HRZ | Horizon | 0.07 | -42% | -46% | -30% | 4% | $41,644,535.86 |

| NML | Navarre Minerals Ltd | 0.047 | -52% | -50% | -10% | 4% | $67,498,309.80 |

| BGL | Bellevue Gold Ltd | 0.715 | -25% | -14% | -3% | 4% | $716,845,119.07 |

| AGC | AGC Ltd | 0.072 | -50% | -27% | -3% | 4% | $4,876,364.45 |

| AGC | AGC Ltd | 0.072 | -50% | -27% | -3% | 4% | $4,876,364.45 |

| SLR | Silver Lake Resource | 1.345 | -23% | -28% | -6% | 4% | $1,258,678,685.70 |

| MGV | Musgrave Minerals | 0.245 | -28% | -27% | -18% | 4% | $134,293,237.25 |

| MAU | Magnetic Resources | 1.015 | -34% | -29% | -20% | 4% | $232,368,014.57 |

| HRN | Horizon Gold Ltd | 0.385 | -2% | -10% | 17% | 4% | $47,626,440.02 |

| HAW | Hawthorn Resources | 0.084 | 83% | -16% | 4% | 4% | $28,015,311.49 |

| RGL | Riversgold | 0.028 | -14% | 55% | -3% | 4% | $21,178,527.97 |

| AM7 | Arcadia Minerals | 0.145 | -15% | -47% | -28% | 4% | $7,004,683.80 |

| TTM | Titan Minerals | 0.058 | -52% | -50% | -12% | 4% | $83,203,011.45 |

| ARN | Aldoro Resources | 0.145 | -65% | -61% | 0% | 4% | $14,418,410.97 |

| CY5 | Cygnus Gold Limited | 0.15 | 11% | -17% | -3% | 3% | $17,697,797.25 |

| FML | Focus Minerals Ltd | 0.15 | -44% | -47% | -3% | 3% | $42,983,796.75 |

| SAU | Southern Gold | 0.033 | -51% | -47% | -13% | 3% | $7,039,848.95 |

| RRL | Regis Resources | 1.575 | -38% | -25% | -10% | 3% | $1,192,864,273.04 |

| RND | Rand Mining Ltd | 1.44 | -3% | -1% | 2% | 3% | $82,185,763.65 |

| BMR | Ballymore Resources | 0.185 | 0% | -8% | -5% | 3% | $14,328,225.80 |

| OKR | Okapi Resources | 0.185 | -42% | -37% | -8% | 3% | $20,499,355.28 |

| PNM | Pacific Nickel Mines | 0.074 | 32% | -38% | 0% | 3% | $20,481,327.13 |

| NMR | Native Mineral Res | 0.16 | -28% | -27% | 3% | 3% | $7,060,550.40 |

| LCY | Legacy Iron Ore | 0.019 | 15% | -14% | -5% | 3% | $121,729,697.78 |

| X64 | Ten Sixty Four Ltd | 0.595 | -35% | -18% | -19% | 3% | $133,354,436.09 |

| BBX | BBX Minerals Ltd | 0.086 | -62% | -54% | -28% | 2% | $40,339,782.43 |

| CBY | Canterbury Resources | 0.043 | -57% | -49% | -12% | 2% | $5,297,536.79 |

| AZS | Azure Minerals | 0.215 | -12% | -48% | -14% | 2% | $68,361,858.62 |

| GIB | Gibb River Diamonds | 0.044 | -24% | -45% | -12% | 2% | $9,306,415.58 |

| VAN | Vango Mining Ltd | 0.046 | -32% | -4% | -10% | 2% | $54,177,318.18 |

| ERM | Emmerson Resources | 0.094 | 38% | -33% | 6% | 2% | $50,113,300.50 |

| SLZ | Sultan Resources Ltd | 0.095 | -50% | -54% | -5% | 2% | $7,912,016.96 |

| NVA | Nova Minerals Ltd | 0.72 | -35% | -33% | 20% | 2% | $132,448,679.48 |

| HAV | Havilah Resources | 0.24 | 14% | 33% | -6% | 2% | $75,983,810.40 |

| NST | Northern Star | 7.065 | -31% | -28% | -13% | 2% | $8,132,581,029.56 |

| GMD | Genesis Minerals | 1.24 | 66% | -27% | -8% | 2% | $356,787,096.30 |

| DCN | Dacian Gold Ltd | 0.1 | -63% | -51% | 23% | 2% | $119,689,762.90 |

| ADT | Adriatic Metals | 1.755 | -28% | -33% | -10% | 2% | $369,175,719.78 |

| TUL | Tulla Resources | 0.54 | -2% | -11% | 10% | 2% | $85,716,026.52 |

| IDA | Indiana Resources | 0.055 | -21% | -14% | -8% | 2% | $26,389,265.05 |

| PGO | Pacgold | 0.55 | 112% | -27% | -8% | 2% | $28,305,334.73 |

| BCN | Beacon Minerals | 0.0295 | -16% | -11% | 2% | 2% | $98,319,704.15 |

| AAU | Antilles Gold Ltd | 0.06 | -18% | -22% | -6% | 2% | $21,911,107.58 |

| FEG | Far East Gold | 0.335 | 0% | 0% | 16% | 2% | $40,882,465.35 |

| DEX | Duke Exploration | 0.07 | -78% | -61% | -7% | 1% | $6,314,780.64 |

| ALK | Alkane Resources Ltd | 0.72 | -37% | -16% | -2% | 1% | $413,930,476.90 |

| M24 | Mamba Exploration | 0.08 | -61% | -67% | 4% | 1% | $3,374,000.24 |

| GBR | Greatbould Resources | 0.081 | -7% | -52% | 14% | 1% | $32,138,285.15 |

| HCH | Hot Chili Ltd | 0.695 | -62% | -60% | -18% | 1% | $83,611,644.20 |

| SBM | St Barbara Limited | 0.9 | -52% | -36% | -20% | 1% | $734,161,291.20 |

| NPM | Newpeak Metals | 0.001 | -50% | -50% | 0% | 0% | $8,853,750.03 |

| FFX | Firefinch Ltd | 0.2 | 44% | -23% | -9% | 0% | $236,248,644.20 |

| GED | Golden Deeps | 0.012 | 0% | 0% | -14% | 0% | $15,017,947.28 |

| DCX | Discovex Res Ltd | 0.005 | 5% | -52% | 16% | 0% | $15,024,304.58 |

| TMX | Terrain Minerals | 0.008 | 0% | 0% | 14% | 0% | $6,086,088.07 |

| PUA | Peak Minerals Ltd | 0.0095 | -41% | -37% | -14% | 0% | $9,893,022.13 |

| DRE | Dreadnought Resources Ltd | 0.049 | 4% | 20% | 14% | 0% | $144,772,861.10 |

| LEX | Lefroy Exploration | 0.29 | -60% | -21% | 14% | 0% | $42,303,653.72 |

| SIH | Sihayo Gold Limited | 0.003 | -67% | -63% | 50% | 0% | $18,306,384.27 |

| AVM | Advance Metals Ltd | 0.011 | -35% | -39% | 38% | 0% | $5,256,651.42 |

| MCT | Metalicity Limited | 0.003 | -74% | -61% | 0% | 0% | $10,375,180.07 |

| AME | Alto Metals Limited | 0.064 | -29% | -30% | -15% | 0% | $34,744,938.28 |

| CTO | Citigold Corp Ltd | 0.006 | -54% | -37% | 20% | 0% | $15,585,125.00 |

| TRY | Troy Resources Ltd | 0.037 | -8% | 0% | 0% | 0% | $32,235,651.78 |

| KGM | Kalnorth Gold Ltd | 0.013 | 0% | 0% | 0% | 0% | $11,625,120.78 |

| CGN | Crater Gold Min Ltd | 0.017 | 0% | 0% | 0% | 0% | $21,063,473.65 |

| TSC | Twenty Seven Co. Ltd | 0.003 | -25% | -25% | 0% | 0% | $7,982,441.72 |

| GUL | Gullewa Limited | 0.059 | -29% | -14% | -12% | 0% | $11,263,282.90 |

| AAR | Astral Resources NL | 0.08 | 3% | -33% | 7% | 0% | $47,694,339.12 |

| AGS | Alliance Resources | 0.175 | 12% | 24% | 0% | 0% | $41,303,448.03 |

| DDD | 3D Resources Limited | 0.002 | -50% | -33% | -20% | 0% | $8,863,744.18 |

| WAF | West African Res Ltd | 1.22 | 13% | -8% | 0% | 0% | $1,245,656,286.46 |

| FG1 | Flynngold | 0.1 | -41% | -46% | -5% | 0% | $6,342,043.95 |

| HMG | Hamelingoldlimited | 0.12 | 0% | -23% | 0% | 0% | $11,000,000.00 |

| HMG | Hamelingoldlimited | 0.12 | 0% | -23% | 0% | 0% | $11,000,000.00 |

| PF1 | Pathfinder Resources | 0.5 | 59% | 25% | 0% | 0% | $26,560,505.00 |

| QML | Qmines Limited | 0.17 | -48% | -41% | -11% | 0% | $11,308,685.43 |

| RDN | Raiden Resources Ltd | 0.008 | -68% | -60% | -11% | 0% | $11,339,537.06 |

| MM8 | Medallion Metals. | 0.18 | -25% | -28% | -28% | 0% | $19,102,978.08 |

| POL | Polymetals Resources | 0.09 | -38% | -31% | 0% | 0% | $3,605,090.94 |

| OKU | Oklo Resources Ltd | 0.14 | 17% | 22% | -3% | 0% | $70,629,507.06 |

| KAI | Kairos Minerals Ltd | 0.023 | -21% | -23% | 28% | 0% | $45,128,150.29 |

| CXU | Cauldron Energy Ltd | 0.008 | -75% | -69% | -20% | 0% | $4,283,290.22 |

| GML | Gateway Mining | 0.009 | -50% | -36% | -10% | 0% | $20,340,957.30 |

| SBR | Sabre Resources | 0.005 | 0% | -17% | 25% | 0% | $13,948,655.04 |

| TG1 | Techgen Metals Ltd | 0.125 | -36% | -14% | 0% | 0% | $5,083,967.84 |

| OAU | Ora Gold Limited | 0.01 | -41% | -50% | 11% | 0% | $9,842,312.83 |

| TRM | Truscott Mining Corp | 0.05 | 56% | 47% | -9% | 0% | $7,597,077.20 |

| DLC | Delecta Limited | 0.011 | 83% | 0% | 0% | 0% | $13,253,995.76 |

| MEK | Meeka Metals Limited | 0.053 | 0% | 26% | 4% | 0% | $46,939,648.52 |

| NCM | Newcrest Mining | 19.18 | -26% | -24% | -19% | 0% | $17,281,934,829.45 |

| IGO | IGO Limited | 9.93 | 18% | -22% | -5% | 0% | $7,640,832,233.17 |

| EMR | Emerald Res NL | 0.91 | 2% | -20% | -24% | -1% | $539,949,394.53 |

| DEG | De Grey Mining | 0.79 | -29% | -43% | -8% | -1% | $1,099,981,464.66 |

| SMI | Santana Minerals Ltd | 0.705 | 513% | 161% | 17% | -1% | $94,172,474.48 |

| RDT | Red Dirt Metals Ltd | 0.35 | 141% | -52% | -3% | -1% | $106,594,049.10 |

| EVN | Evolution Mining Ltd | 2.325 | -43% | -43% | -32% | -1% | $4,289,237,978.22 |

| BRV | Big River Gold Ltd | 0.33 | -13% | 29% | -3% | -1% | $82,030,987.50 |

| RVR | Red River Resources | 0.1425 | -30% | -32% | -8% | -2% | $75,177,350.76 |

| RXL | Rox Resources | 0.26 | -43% | -47% | 6% | -2% | $43,924,646.22 |

| RXL | Rox Resources | 0.26 | -43% | -47% | 6% | -2% | $43,924,646.22 |

| CPM | Coopermetalslimited | 0.48 | 0% | 81% | 17% | -2% | $12,834,500.00 |

| DTR | Dateline Resources | 0.089 | -15% | 11% | -9% | -2% | $44,119,998.48 |

| MEG | Megado Minerals Ltd | 0.079 | -44% | -12% | -10% | -2% | $8,614,855.04 |

| TBA | Tombola Gold Ltd | 0.038 | -7% | 27% | -24% | -3% | $36,299,487.61 |

| CAZ | Cazaly Resources | 0.037 | -24% | -16% | 1% | -3% | $14,462,049.93 |

| MKG | Mako Gold | 0.068 | -25% | -32% | -7% | -3% | $27,903,636.95 |

| KCN | Kingsgate Consolid. | 1.31 | 59% | -41% | -2% | -3% | $294,356,202.49 |

| CYL | Catalyst Metals | 1.28 | -37% | -32% | -6% | -3% | $123,562,465.74 |

| KSN | Kingston Resources | 0.093 | -54% | -44% | 1% | -3% | $38,800,327.27 |

| SVY | Stavely Minerals Ltd | 0.155 | -63% | -69% | -33% | -3% | $43,144,217.85 |

| STN | Saturn Metals | 0.29 | -37% | -26% | -12% | -3% | $37,670,761.33 |

| AMI | Aurelia Metals Ltd | 0.28 | -38% | -37% | -2% | -3% | $383,487,501.67 |

| G88 | Golden Mile Res Ltd | 0.027 | -46% | -50% | -29% | -4% | $5,500,780.58 |

| MVL | Marvel Gold Limited | 0.026 | -50% | -55% | -13% | -4% | $18,312,303.62 |

| SSR | SSR Mining Inc. | 23.58 | 11% | -1% | -13% | -4% | $469,638,395.20 |

| BNZ | Benzmining | 0.37 | -59% | -41% | -22% | -4% | $20,549,814.87 |

| TAM | Tanami Gold NL | 0.048 | -35% | -21% | -4% | -4% | $52,879,367.07 |

| ICL | Iceni Gold | 0.095 | -42% | -32% | -14% | -4% | $11,922,267.80 |

| REZ | Resourc & En Grp Ltd | 0.023 | -23% | -62% | -8% | -4% | $11,495,533.15 |

| SMS | Starmineralslimited | 0.086 | 0% | -57% | -25% | -4% | $2,543,880.00 |

| DTM | Dart Mining NL | 0.062 | -54% | -33% | 17% | -5% | $8,386,129.92 |

| GMR | Golden Rim Resources | 0.058 | -52% | -54% | 4% | -5% | $18,520,890.36 |

| FAU | First Au Ltd | 0.0095 | -14% | -21% | -21% | -5% | $7,370,198.54 |

| MEU | Marmota Limited | 0.056 | 19% | 12% | -5% | -5% | $54,884,553.70 |

| PNR | Pantoro Limited | 0.18 | -18% | -48% | -3% | -5% | $283,706,568.18 |

| MHC | Manhattan Corp Ltd | 0.0085 | -35% | -47% | -6% | -6% | $12,973,368.89 |

| VRC | Volt Resources Ltd | 0.017 | -51% | -26% | 6% | -6% | $59,771,947.99 |

| MRZ | Mont Royal Resources | 0.32 | 45% | -10% | 7% | -6% | $21,451,504.32 |

| MKR | Manuka Resources. | 0.16 | -42% | -52% | -20% | -6% | $47,193,362.87 |

| PNT | Panthermetalsltd | 0.23 | 0% | -8% | 28% | -6% | $6,960,000.00 |

| G50 | Gold50Limited | 0.15 | 0% | -38% | -6% | -6% | $8,402,700.15 |

| KZR | Kalamazoo Resources | 0.225 | -38% | -39% | 2% | -6% | $29,038,874.80 |

| AGG | AngloGold Ashanti | 4.1 | -24% | -28% | -10% | -6% | $364,859,758.85 |

| GBZ | GBM Rsources Ltd | 0.056 | -59% | -59% | -19% | -7% | $30,610,254.36 |

| GAL | Galileo Mining Ltd | 1.175 | 292% | 411% | -17% | -7% | $236,889,912.00 |

| CAI | Calidus Resources | 0.62 | 32% | -24% | -2% | -7% | $248,776,884.38 |

| OGC | OceanaGold Corp. | 2.7 | 11% | 22% | -12% | -7% | $187,024,405.82 |

| ARV | Artemis Resources | 0.026 | -53% | -63% | -13% | -7% | $36,096,605.58 |

| TAR | Taruga Minerals | 0.026 | -45% | -42% | 24% | -7% | $14,451,206.00 |

| NES | Nelson Resources. | 0.013 | -70% | -65% | 8% | -7% | $3,825,863.13 |

| SKY | SKY Metals Ltd | 0.05 | -47% | -60% | -21% | -7% | $18,839,173.50 |

| MZZ | Matador Mining Ltd | 0.125 | -71% | -67% | -22% | -7% | $26,102,340.60 |

| LYN | Lycaonresources | 0.25 | 0% | -43% | -17% | -7% | $7,181,718.75 |

| OZM | Ozaurum Resources | 0.12 | -8% | -14% | -27% | -8% | $8,017,340.00 |

| SNG | Siren Gold | 0.225 | -2% | -21% | -20% | -8% | $20,265,581.52 |

| EMU | EMU NL | 0.011 | -62% | -50% | 22% | -8% | $6,047,959.32 |

| GSN | Great Southern | 0.0365 | -31% | -43% | -6% | -9% | $18,100,480.92 |

| TSO | Tesoro Gold Ltd | 0.041 | -75% | -50% | -13% | -9% | $31,647,750.38 |

| A1G | African Gold Ltd. | 0.095 | -53% | -60% | 6% | -10% | $11,105,160.50 |

| BTR | Brightstar Resources | 0.019 | -27% | -74% | 6% | -10% | $12,290,356.51 |

| BMO | Bastion Minerals | 0.135 | -21% | -31% | -16% | -10% | $10,250,450.10 |

| PNX | PNX Metals Limited | 0.004 | -54% | -31% | 0% | -11% | $19,998,260.13 |

| BEZ | Besragoldinc | 0.037 | 0% | -63% | -26% | -12% | $6,358,448.52 |

| MDI | Middle Island Res | 0.11 | 0% | -21% | -12% | -12% | $14,690,186.64 |

| CWX | Carawine Resources | 0.096 | -53% | -45% | -26% | -13% | $13,232,097.31 |

| WRM | White Rock Min Ltd | 0.1 | -79% | -58% | -5% | -13% | $17,366,914.40 |

| ICG | Inca Minerals Ltd | 0.064 | -39% | -34% | -26% | -15% | $34,214,526.47 |

| SFM | Santa Fe Minerals | 0.085 | 4% | -59% | -11% | -15% | $6,189,597.07 |

| AQI | Alicanto Min Ltd | 0.059 | -65% | -46% | 4% | -16% | $21,871,676.17 |

| PRS | Prospech Limited | 0.025 | -81% | -58% | -29% | -17% | $1,629,525.13 |

| AYM | Australia United Min | 0.005 | -38% | -38% | 25% | -17% | $9,212,887.43 |

| ASR | Asra Minerals Ltd | 0.024 | -4% | -27% | -14% | -17% | $30,819,443.86 |

| GWR | GWR Group Ltd | 0.099 | -74% | -45% | 2% | -18% | $31,158,015.54 |

| ZAG | Zuleika Gold Ltd | 0.022 | -27% | -44% | -19% | -19% | $10,431,012.50 |

| GNM | Great Northern | 0.004 | -64% | -33% | 0% | -20% | $6,836,203.90 |

| AL8 | Alderan Resource Ltd | 0.012 | -79% | -60% | -20% | -25% | $5,106,792.96 |

| ANL | Amani Gold Ltd | 0.001 | 0% | -50% | -33% | -33% | $35,540,161.69 |

| DGO | DGO Gold Limited | 0 | -100% | -100% | -100% | -100% | $202,181,472.07 |

| AOP | Apollo Consolidated | 0 | -100% | -100% | -100% | -100% | $177,888,559.90 |

| TRN | Torrens Mining | 0 | -100% | -100% | -100% | -100% | $9,218,941.94 |

| KLA | Kirkland Lake Gold | 0 | -100% | -100% | -100% | -100% | $52,690,000.00 |

| BDC | Bardoc Gold Ltd | 0 | -100% | -100% | -100% | -100% | $154,075,451.40 |

SMALL CAP STANDOUTS

Copper and gold junior AIS has been focusing its attention lately on the Golden Plateau deposit in southeast Queensland, which executive chairman Andre Labuschagne describes as being an ‘exciting’ story for investors.

The Golden Plateau deposit is located 1km north from the Cracow mill and AIS says it is a high priority exploration area, one that holds the potential to extend the mine life at Cracow.

More high-grade intersections have been returned, with hits up to 17.9m at 6.3g/t gold including 10.7m at 9.4g/t gold and 1m at 9.2g/t gold.

Labuschagne says these latest assays reinforce the company’s geological understanding of the structural controls of mineralisation at the site as overall confidence continues to grow – including the potential to discover new lodes.

“The current drill program is targeting five lodes and a maiden resource is planned for the first half of this financial year,” he says.

“We believe that Golden Plateau offers excellent potential to become a new, high-grade ore source for Cracow.”

The Golden Plateau mine and surrounding deposits historically produced approximately 850,000 ounces of gold, within a prospective corridor extending 1km along strike and up to 270m below surface.

Resource definition drilling program will continue throughout the first quarter of FY23.

Drilling has kicked off across GSM’s Yule Project in the Western Australia’s Pilbara region targeting lithium and gold.

The Yule project sits in the Mallina Basin, a short drive from De Grey Mining’s (ASX:DEG) Hemi gold discovery.

Golden State managing director Michael Moore said the company was excited to have secured a rig and get moving on what looms as a big second half of 2022.

“We are extremely pleased to announce the commencement of our Yule Project lithium and gold focused RC drilling campaign at Target 2,” he said.

“This ~1500m program has been designed to follow up on the anomalous lithium pathfinder elements already identified in previous drilling as well as a significant arsenic anomaly that has driven the selection of key gold target areas.

“The company is progressing exploration activity across a number of our self-generated projects, including recently granted tenure at our emerging Payne’s Find project, and investors can look forward to targeted field exploration over the second half of 2022.”

AIS and GSM share prices today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.