Gold Digger: Gold hits new record. Does the party stop here, or keep on going?

Gold bulls are winning the day again. Pic: Getty Images

- Gold smashes through all time high as ECB cuts rates and US GDP disappoints

- Demand for physical gold surging as world gets jittery on Trump agenda and global geopolitical uncertainty

- Aston up big on Torque merger, Emmerson gets love for NT resource update

Read it and weep, the only colour that matters on the markets today is beautiful, glistening gold.

Futures have pushed as high as US$2849/oz in New York, US investors having upped their purchases of bullion from vaults in Switzerland by a factor of 11 in the past month.

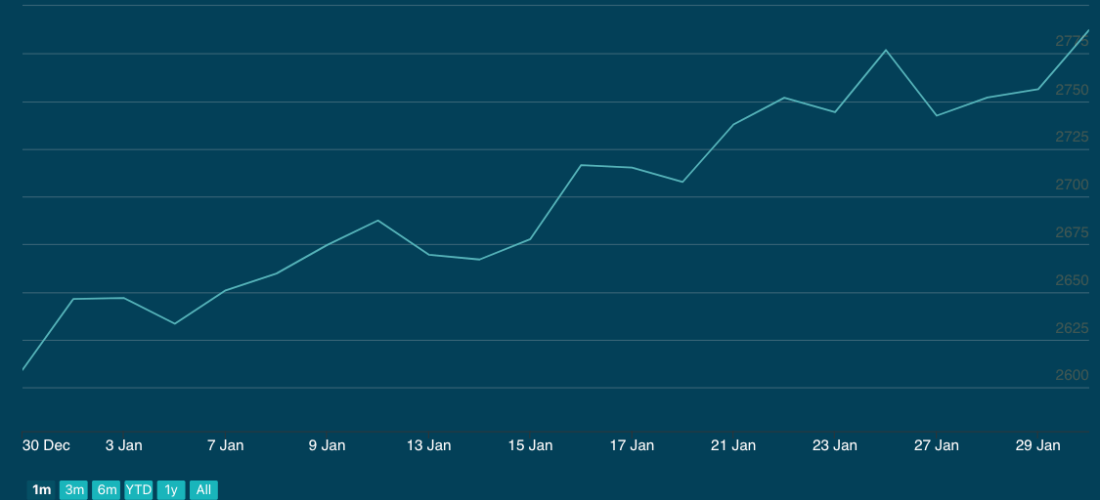

It puts paid to any concerns gold was overheated after hitting 41 new all time highs in 2024 after breaking the mark again, with official LBMA prices hitting US$2787/oz. In Aussie dollar terms that clocked up to over $4500/oz, yet another milestone with the promise of handsome rewards for gold miners, who are sitting on costs at the moment in the range of $2150/oz.

ANZ Research’s Jack Chambers, Brian Martin and commodities guru Daniel Hynes summarised the factors that pushed gold beyond the previous mark set ahead of the fractious 2024 US Presidential Election on October 30 last year, an event that returned the erratic Donald Trump to the White House.

“Gold surged to a new record high as a weaker USD and ongoing concerns of Trump’s tariffs increased investor demand. The USD fell after the ECB cut interest rates by 25bp and the latest economic data showed inflation adjusted gross domestic product in the US increased at an annualised rate of 2.3% in Q4,” they said in a note.

“Trump’s tariffs are likely to lead to measurably higher inflation, a concern the broader market continues to hold. This was borne out in trade data released yesterday.

“Swiss exports of gold to the US surged to the highest level since Russia’s invasion of Ukraine, in a sign that investors were keen to protect themselves from the impact of Trump’s economic policies. Switzerland shipped 64.2t of gold to the US in December, the most since March 2022. That was 11 times more than it shipped in the previous month. Swiss exports to the UK jumped more than 13-fold to 14t in the December from the previous month.”

Beating analyst projections

It was only two weeks ago that UBS tipped $4500/oz gold by mid year. To be fair, the capitulation of the Aussie dollar has played a role. In the bank’s estimation the $4500 equivalent in benchmark USD was US$2900.

Five months ahead of UBS’ prediction! #gold https://t.co/ShLgjBGguf pic.twitter.com/C9xwD26Rwy

— Kristie Batten (@kristiebatten) January 30, 2025

But it still goes to show the capacity of gold to outshine predictions, a regular occurrence for several years.

ASX gold stocks were buoyed by the news, with the All Ords gold sub-index up 2.67% on Friday and 44.7% for the past year. In fact, the sub-index has only held a higher value once, on October 25 last year.

It’s been an outlier against other commodities. The ASX 300 Metals and Mining sector is down over 10% over the same period and fundies we’ve spoken to are mulling where to head next if they take some of their gold winnings off the table.

Catalyst Metals (ASX:CYL) and Emerald Resources (ASX:EMR) led the more established producers with 4% and 4.3% gains on Friday. Speccy names like small producer Beacon Minerals (ASX:BCN) pulled out even bigger gains, with the Coolgardie gold miner up 8%.

The question remains where gold can go next, and numerous experts have US$3000/oz pegged for sometime this year.

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

| CODE | COMPANY | PRICE | WEEK% | MONTH % | 6 MONTH % | YEAR % | YTD % | MARKET CAP |

|---|---|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.01 | 0% | 0% | -11% | -38% | 14% | $ 8,678,940.02 |

| NPM | Newpeak Metals | 0.02 | -11% | 45% | 14% | 19% | 45% | $ 4,186,932.50 |

| ASO | Aston Minerals Ltd | 0.01 | 44% | 44% | 30% | -24% | 44% | $ 18,130,899.77 |

| MTC | Metalstech Ltd | 0.13 | -7% | -11% | -40% | -43% | -11% | $ 23,704,737.96 |

| GED | Golden Deeps | 0.02 | -4% | -12% | -30% | -38% | -8% | $ 3,333,491.68 |

| G88 | Golden Mile Res Ltd | 0.01 | -10% | -10% | -10% | -40% | 0% | $ 4,466,005.70 |

| LAT | Latitude 66 Limited | 0.04 | -23% | -18% | -69% | -82% | -5% | $ 5,162,425.38 |

| NMR | Native Mineral Res | 0.04 | -2% | 3% | 105% | 52% | 5% | $ 22,308,454.63 |

| AQX | Alice Queen Ltd | 0.01 | 14% | 0% | 14% | 33% | 0% | $ 10,322,010.61 |

| SLZ | Sultan Resources Ltd | 0.01 | -13% | 17% | -13% | -53% | 17% | $ 1,620,289.37 |

| MKG | Mako Gold | 0.01 | -29% | -23% | 0% | -9% | -23% | $ 10,852,809.83 |

| KSN | Kingston Resources | 0.08 | 3% | 6% | -1% | -1% | 7% | $ 59,899,004.34 |

| AMI | Aurelia Metals Ltd | 0.19 | 9% | 9% | 12% | 81% | 12% | $ 329,855,093.49 |

| GIB | Gibb River Diamonds | 0.04 | -10% | 0% | 6% | 15% | -5% | $ 8,151,358.91 |

| KCN | Kingsgate Consolid. | 1.26 | -13% | -2% | -17% | -12% | -2% | $ 323,478,373.46 |

| TMX | Terrain Minerals | 0.01 | 25% | 67% | 43% | 0% | 67% | $ 9,053,477.34 |

| BNR | Bulletin Res Ltd | 0.04 | 17% | 8% | -16% | -51% | 8% | $ 11,157,306.27 |

| NXM | Nexus Minerals Ltd | 0.05 | 13% | 18% | 39% | 39% | 18% | $ 23,913,232.84 |

| SKY | SKY Metals Ltd | 0.06 | 2% | 2% | 90% | 77% | 2% | $ 39,088,674.13 |

| LM8 | Lunnonmetalslimited | 0.21 | 3% | -13% | 21% | -32% | -18% | $ 45,228,775.67 |

| CST | Castile Resources | 0.06 | 3% | -21% | -18% | -28% | -21% | $ 18,298,740.35 |

| YRL | Yandal Resources | 0.16 | 19% | -14% | 3% | 90% | -9% | $ 49,477,597.12 |

| FAU | First Au Ltd | 0.00 | 33% | 0% | 0% | -20% | 0% | $ 4,143,986.55 |

| ARL | Ardea Resources Ltd | 0.39 | 8% | 17% | -14% | 0% | 17% | $ 72,884,263.98 |

| GWR | GWR Group Ltd | 0.09 | 5% | 11% | 11% | -5% | 11% | $ 28,588,282.30 |

| IVR | Investigator Res Ltd | 0.02 | 0% | 21% | -50% | -36% | 15% | $ 34,955,350.63 |

| GTR | Gti Energy Ltd | 0.00 | 0% | -14% | -25% | -67% | -14% | $ 10,370,323.82 |

| IPT | Impact Minerals | 0.01 | 0% | 10% | -31% | -8% | 10% | $ 33,653,770.90 |

| BNZ | Benzmining | 0.39 | 0% | 8% | 255% | 100% | 13% | $ 59,983,051.50 |

| MOH | Moho Resources | 0.01 | 0% | 0% | 0% | -44% | 0% | $ 3,582,372.87 |

| BCM | Brazilian Critical | 0.01 | -11% | -11% | -47% | -69% | -11% | $ 8,928,898.00 |

| PUA | Peak Minerals Ltd | 0.01 | -14% | 33% | 300% | 383% | 50% | $ 28,073,212.90 |

| MRZ | Mont Royal Resources | 0.03 | -21% | -30% | -50% | -73% | -30% | $ 2,550,893.79 |

| SMS | Starmineralslimited | 0.03 | -6% | -14% | 1% | -2% | -11% | $ 4,019,619.55 |

| MVL | Marvel Gold Limited | 0.01 | 25% | 11% | 25% | 0% | 11% | $ 8,637,907.03 |

| PRX | Prodigy Gold NL | 0.00 | 0% | 0% | -25% | -44% | 0% | $ 6,350,111.10 |

| AAU | Antilles Gold Ltd | 0.00 | 0% | 0% | 33% | -83% | 33% | $ 7,431,504.23 |

| CWX | Carawine Resources | 0.11 | 0% | 5% | 17% | 0% | 5% | $ 24,793,172.15 |

| RND | Rand Mining Ltd | 1.58 | 3% | 5% | 6% | 17% | 4% | $ 89,864,018.38 |

| CAZ | Cazaly Resources | 0.01 | 0% | 0% | -48% | -40% | -14% | $ 5,074,332.90 |

| BMR | Ballymore Resources | 0.16 | 24% | 29% | 11% | 11% | 29% | $ 22,974,976.05 |

| DRE | Dreadnought Resources Ltd | 0.01 | 0% | 0% | -44% | -43% | 0% | $ 45,213,600.00 |

| ZNC | Zenith Minerals Ltd | 0.05 | 0% | 13% | -10% | -67% | 13% | $ 17,112,539.72 |

| REZ | Resourc & En Grp Ltd | 0.03 | -11% | 35% | 48% | 210% | 35% | $ 19,477,534.54 |

| LEX | Lefroy Exploration | 0.08 | 3% | 7% | -4% | -46% | 7% | $ 17,363,972.50 |

| ERM | Emmerson Resources | 0.11 | 27% | 40% | 98% | 119% | 36% | $ 62,290,650.14 |

| AM7 | Arcadia Minerals | 0.02 | 0% | 5% | -44% | -71% | 5% | $ 2,347,668.66 |

| ADT | Adriatic Metals | 4.16 | 2% | 7% | 33% | 20% | 7% | $ 1,138,660,509.66 |

| AS1 | Asara Resources Ltd | 0.02 | -15% | 21% | 109% | 92% | 21% | $ 24,916,507.68 |

| CYL | Catalyst Metals | 3.51 | 0% | 33% | 79% | 440% | 36% | $ 754,785,036.96 |

| CHN | Chalice Mining Ltd | 1.14 | -5% | 2% | 8% | 3% | 3% | $ 418,203,797.10 |

| KAL | Kalgoorliegoldmining | 0.02 | 14% | -16% | -33% | -41% | -11% | $ 4,369,734.43 |

| MLS | Metals Australia | 0.02 | 0% | -4% | 5% | -29% | -4% | $ 15,303,110.00 |

| ADN | Andromeda Metals Ltd | 0.01 | -14% | 0% | -71% | -75% | -14% | $ 20,572,366.13 |

| MEI | Meteoric Resources | 0.08 | -2% | -7% | -22% | -58% | -4% | $ 181,926,159.78 |

| SRN | Surefire Rescs NL | 0.00 | 0% | 0% | -50% | -60% | 14% | $ 9,665,231.25 |

| WA8 | Warriedarresourltd | 0.05 | 0% | 9% | -24% | 17% | 9% | $ 46,828,418.44 |

| HMX | Hammer Metals Ltd | 0.03 | -3% | -14% | -21% | -23% | -9% | $ 27,520,519.70 |

| WCN | White Cliff Min Ltd | 0.02 | 0% | 25% | 33% | 33% | 25% | $ 37,909,414.96 |

| AVM | Advance Metals Ltd | 0.04 | 8% | 21% | 52% | 20% | 21% | $ 6,571,467.79 |

| ASR | Asra Minerals Ltd | 0.00 | -17% | -17% | -58% | -58% | -17% | $ 6,937,890.37 |

| ARI | Arika Resources | 0.03 | 4% | 7% | 16% | 45% | 7% | $ 17,738,241.86 |

| CTO | Citigold Corp Ltd | 0.01 | 43% | 25% | 0% | 0% | 25% | $ 12,000,000.00 |

| SMI | Santana Minerals Ltd | 0.52 | 13% | 7% | 27% | 11% | 7% | $ 310,689,867.70 |

| M2R | Miramar | 0.00 | 0% | 33% | -43% | -82% | 33% | $ 1,587,293.14 |

| MHC | Manhattan Corp Ltd | 0.02 | -8% | 22% | -12% | -56% | 16% | $ 5,402,674.65 |

| GRL | Godolphin Resources | 0.01 | 0% | -3% | -7% | -67% | -3% | $ 4,668,282.45 |

| SVG | Savannah Goldfields | 0.02 | 5% | -5% | -9% | -46% | -5% | $ 5,621,698.32 |

| EMC | Everest Metals Corp | 0.15 | 0% | 12% | 26% | 84% | 7% | $ 32,448,656.22 |

| GUL | Gullewa Limited | 0.06 | 0% | 0% | -20% | 2% | 0% | $ 12,209,241.63 |

| CY5 | Cygnus Metals Ltd | 0.13 | -7% | 30% | 103% | 97% | 30% | $ 110,281,554.50 |

| G50 | G50Corp Ltd | 0.18 | -3% | 6% | 24% | 80% | 16% | $ 28,504,875.11 |

| ADV | Ardiden Ltd | 0.15 | 0% | 7% | 12% | -17% | 7% | $ 8,752,450.84 |

| AAR | Astral Resources NL | 0.15 | 3% | 7% | 95% | 124% | 11% | $ 186,473,264.70 |

| VMC | Venus Metals Cor Ltd | 0.06 | -2% | -4% | -23% | -36% | -4% | $ 12,356,107.03 |

| NAE | New Age Exploration | 0.00 | -14% | -25% | -25% | -40% | -14% | $ 6,431,696.73 |

| VKA | Viking Mines Ltd | 0.01 | -20% | 0% | 0% | -33% | 0% | $ 10,625,178.56 |

| LCL | LCL Resources Ltd | 0.01 | -11% | -20% | 14% | -38% | -20% | $ 10,155,908.01 |

| MTH | Mithril Silver Gold | 0.38 | -9% | -12% | 159% | 88% | -6% | $ 54,623,820.75 |

| ADG | Adelong Gold Limited | 0.01 | -17% | 0% | 25% | 0% | 11% | $ 5,589,944.79 |

| RMX | Red Mount Min Ltd | 0.01 | 13% | -10% | -40% | -66% | 0% | $ 3,719,662.37 |

| PRS | Prospech Limited | 0.02 | 0% | -28% | -45% | -42% | -28% | $ 6,905,343.63 |

| TTM | Titan Minerals | 0.44 | 14% | 16% | 2% | 110% | 16% | $ 99,435,564.77 |

| AKA | Aureka Limited | 0.15 | -14% | 3% | -98% | -98% | 11% | $ 15,365,234.40 |

| AAM | Aumegametals | 0.05 | 5% | 22% | -2% | 34% | 7% | $ 27,185,086.89 |

| KZR | Kalamazoo Resources | 0.08 | 1% | 4% | 18% | -16% | 7% | $ 15,416,721.75 |

| BCN | Beacon Minerals | 0.03 | 8% | 17% | 13% | 13% | 23% | $ 105,659,104.80 |

| MAU | Magnetic Resources | 1.27 | 2% | 14% | -2% | 22% | 14% | $ 330,783,826.00 |

| BC8 | Black Cat Syndicate | 0.67 | -4% | 15% | 102% | 171% | 18% | $ 391,959,037.98 |

| EM2 | Eagle Mountain | 0.01 | -11% | 9% | -83% | -85% | -11% | $ 3,205,262.21 |

| EMR | Emerald Res NL | 4.33 | 16% | 30% | 18% | 30% | 33% | $ 2,720,167,980.84 |

| BYH | Bryah Resources Ltd | 0.00 | -25% | 0% | -40% | -73% | 0% | $ 1,509,860.57 |

| HCH | Hot Chili Ltd | 0.69 | 3% | -5% | -23% | -32% | -2% | $ 100,694,599.25 |

| WAF | West African Res Ltd | 1.67 | 2% | 15% | 17% | 75% | 16% | $ 1,880,631,792.60 |

| MEU | Marmota Limited | 0.06 | 11% | 62% | 43% | 54% | 62% | $ 68,454,436.18 |

| NVA | Nova Minerals Ltd | 0.34 | 0% | -8% | 143% | -3% | -8% | $ 103,032,773.44 |

| SVL | Silver Mines Limited | 0.08 | 1% | -4% | -49% | -56% | -1% | $ 126,364,052.83 |

| PGD | Peregrine Gold | 0.15 | 0% | 11% | -19% | -50% | 7% | $ 10,181,763.15 |

| ICL | Iceni Gold | 0.08 | 11% | 10% | 44% | 66% | 10% | $ 24,015,067.36 |

| FG1 | Flynngold | 0.03 | 4% | -4% | 4% | -50% | 4% | $ 6,794,228.22 |

| WWI | West Wits Mining Ltd | 0.02 | 14% | 14% | 7% | 60% | 14% | $ 38,447,541.51 |

| RML | Resolution Minerals | 0.01 | 0% | -8% | -54% | -54% | -8% | $ 2,490,280.39 |

| AAJ | Aruma Resources Ltd | 0.01 | -10% | -18% | -36% | -57% | -25% | $ 1,998,523.55 |

| HWK | Hawk Resources. | 0.02 | -5% | -5% | -41% | -41% | -5% | $ 4,996,518.43 |

| GMN | Gold Mountain Ltd | 0.00 | 0% | -33% | -43% | -33% | -33% | $ 9,158,446.37 |

| MEG | Megado Minerals Ltd | 0.01 | -13% | -24% | 24% | -41% | -24% | $ 5,455,882.41 |

| HMG | Hamelingoldlimited | 0.07 | 8% | 2% | -34% | -13% | 2% | $ 11,383,200.00 |

| BM8 | Battery Age Minerals | 0.10 | -1% | -12% | -19% | -39% | -8% | $ 10,017,591.58 |

| TBR | Tribune Res Ltd | 4.74 | 14% | 10% | 22% | 57% | 10% | $ 241,353,154.20 |

| FML | Focus Minerals Ltd | 0.20 | -7% | 15% | 56% | 15% | 15% | $ 60,177,315.45 |

| VRC | Volt Resources Ltd | 0.00 | 0% | -14% | -25% | -50% | 0% | $ 13,224,718.57 |

| ARV | Artemis Resources | 0.01 | -11% | 0% | -20% | -56% | 0% | $ 17,643,059.41 |

| HRN | Horizon Gold Ltd | 0.46 | -9% | -4% | 53% | 67% | -4% | $ 66,626,364.58 |

| CLA | Celsius Resource Ltd | 0.01 | -10% | -10% | -25% | -18% | -18% | $ 29,361,622.97 |

| QML | Qmines Limited | 0.06 | 4% | 7% | 7% | -15% | 7% | $ 21,309,718.87 |

| RDN | Raiden Resources Ltd | 0.01 | 0% | -30% | -70% | -73% | -36% | $ 24,156,240.09 |

| TCG | Turaco Gold Limited | 0.31 | -3% | 22% | 41% | 148% | 22% | $ 268,484,711.65 |

| KCC | Kincora Copper | 0.03 | -10% | -4% | -38% | -19% | -4% | $ 6,422,661.42 |

| GBZ | GBM Rsources Ltd | 0.01 | 13% | 13% | 13% | 0% | 13% | $ 10,539,629.80 |

| DTM | Dart Mining NL | 0.01 | -20% | -11% | -49% | -38% | -11% | $ 5,382,500.19 |

| MKR | Manuka Resources. | 0.02 | -11% | -14% | -33% | -71% | -14% | $ 18,647,656.39 |

| AUC | Ausgold Limited | 0.47 | 9% | 16% | 42% | 74% | 12% | $ 158,693,586.89 |

| ANX | Anax Metals Ltd | 0.01 | 0% | -23% | -58% | -57% | -17% | $ 9,202,743.29 |

| EMU | EMU NL | 0.03 | 7% | 0% | 32% | -30% | 7% | $ 5,578,996.42 |

| SFM | Santa Fe Minerals | 0.04 | 15% | 26% | 18% | -9% | 26% | $ 2,475,838.83 |

| SSR | SSR Mining Inc. | 13.02 | 5% | 19% | 57% | -9% | 19% | $ 46,168,760.42 |

| PNR | Pantoro Limited | 0.12 | 10% | 26% | 35% | 188% | 28% | $ 677,673,203.97 |

| CMM | Capricorn Metals | 7.72 | 2% | 22% | 49% | 67% | 23% | $ 3,146,344,698.21 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | 0% | 0% | 0% | $ 129,844,903.32 |

| VRL | Verity Resources | 0.02 | -5% | -5% | -55% | -82% | -10% | $ 2,668,780.19 |

| HAW | Hawthorn Resources | 0.04 | -7% | 5% | -36% | -55% | 5% | $ 14,070,655.75 |

| BGD | Bartongoldholdings | 0.27 | 4% | 8% | 13% | 6% | 10% | $ 60,176,908.00 |

| SVY | Stavely Minerals Ltd | 0.02 | -6% | -6% | -29% | -47% | 0% | $ 8,704,673.49 |

| AGC | AGC Ltd | 0.14 | 8% | -7% | -55% | 109% | -10% | $ 33,357,638.86 |

| RGL | Riversgold | 0.00 | 0% | -25% | -40% | -70% | -25% | $ 5,892,994.08 |

| TSO | Tesoro Gold Ltd | 0.02 | 20% | 20% | -14% | -4% | 20% | $ 37,281,936.98 |

| GUE | Global Uranium | 0.08 | 5% | 27% | 18% | -38% | 33% | $ 22,988,120.53 |

| CPM | Coopermetalslimited | 0.05 | 2% | 0% | -28% | -84% | 0% | $ 3,369,292.95 |

| MM8 | Medallion Metals. | 0.11 | -14% | -9% | 64% | 94% | -13% | $ 42,988,718.54 |

| FFM | Firefly Metals Ltd | 0.93 | 0% | 3% | 16% | 75% | 0% | $ 496,167,691.36 |

| CBY | Canterbury Resources | 0.03 | 25% | 4% | -46% | -17% | 14% | $ 5,923,226.88 |

| LYN | Lycaonresources | 0.15 | -9% | 67% | -43% | -23% | 67% | $ 7,682,799.34 |

| SFR | Sandfire Resources | 10.01 | 1% | 7% | 20% | 41% | 8% | $ 4,421,918,060.52 |

| SMG | Silvermetalgroupltd | 0.06 | 0% | 0% | 0% | 0% | 0% | $ 4,881,135.48 |

| TAM | Tanami Gold NL | 0.03 | 4% | -5% | 0% | -15% | -3% | $ 34,077,814.33 |

| NWM | Norwest Minerals | 0.01 | -20% | -14% | -54% | -50% | -14% | $ 6,306,553.63 |

| ALK | Alkane Resources Ltd | 0.59 | 12% | 16% | 34% | 5% | 16% | $ 345,158,878.44 |

| BMO | Bastion Minerals | 0.01 | 25% | 0% | -29% | -67% | 25% | $ 4,223,623.32 |

| IDA | Indiana Resources | 0.07 | 9% | 16% | 71% | 61% | 16% | $ 44,991,272.06 |

| GSM | Golden State Mining | 0.01 | 0% | 0% | -27% | -33% | 0% | $ 2,234,965.04 |

| NSM | Northstaw | 0.02 | -10% | 13% | 47% | -45% | 13% | $ 4,908,177.00 |

| GSN | Great Southern | 0.02 | 24% | 50% | 17% | 17% | 40% | $ 19,756,438.76 |

| VAU | Vault Minerals Ltd | 0.39 | 3% | 18% | 3% | 18% | 18% | $ 2,482,902,784.43 |

| DEG | De Grey Mining | 2.01 | 0% | 13% | 71% | 70% | 14% | $ 4,663,164,451.87 |

| THR | Thor Energy PLC | 0.01 | 4% | -8% | -29% | -66% | -8% | $ 2,991,280.90 |

| CDR | Codrus Minerals Ltd | 0.02 | 0% | 0% | -43% | -66% | 0% | $ 2,811,587.57 |

| MDI | Middle Island Res | 0.01 | -7% | 8% | -24% | -13% | 8% | $ 3,550,205.43 |

| WTM | Waratah Minerals Ltd | 0.15 | -3% | -9% | -50% | 45% | -6% | $ 29,346,187.36 |

| POL | Polymetals Resources | 0.90 | 3% | 10% | 221% | 221% | 13% | $ 174,912,678.83 |

| RDS | Redstone Resources | 0.00 | 0% | 20% | -33% | -40% | 20% | $ 2,776,135.38 |

| NAG | Nagambie Resources | 0.02 | -17% | -12% | 25% | -46% | -17% | $ 12,049,535.16 |

| BGL | Bellevue Gold Ltd | 1.25 | 9% | 12% | -6% | -9% | 11% | $ 1,546,933,018.41 |

| GBR | Greatbould Resources | 0.05 | 2% | 9% | -4% | -20% | 12% | $ 36,436,816.03 |

| KAI | Kairos Minerals Ltd | 0.02 | 14% | 23% | 100% | 0% | 33% | $ 34,201,858.46 |

| KAU | Kaiser Reef | 0.17 | 0% | 6% | 3% | 42% | 6% | $ 41,697,689.60 |

| HRZ | Horizon | 0.05 | -2% | 10% | 18% | 31% | 15% | $ 72,250,829.80 |

| CAI | Calidus Resources | 0.12 | 0% | 0% | 0% | -44% | 0% | $ 93,678,205.58 |

| CDT | Castle Minerals | 0.00 | 0% | 0% | -50% | -67% | 0% | $ 3,793,628.21 |

| RSG | Resolute Mining | 0.42 | 1% | 2% | -34% | -5% | 5% | $ 862,265,255.27 |

| MXR | Maximus Resources | 0.07 | 3% | 10% | 110% | 96% | 12% | $ 27,013,624.53 |

| EVN | Evolution Mining Ltd | 5.70 | 1% | 17% | 47% | 79% | 19% | $ 11,239,786,481.00 |

| CXU | Cauldron Energy Ltd | 0.01 | -8% | -8% | -51% | -65% | 0% | $ 18,998,259.92 |

| DLI | Delta Lithium | 0.18 | 3% | 3% | -26% | -40% | 3% | $ 132,560,231.52 |

| ALY | Alchemy Resource Ltd | 0.01 | -14% | -14% | -25% | -25% | -14% | $ 7,068,457.54 |

| NH3 | Nh3Cleanenergyltd | 0.02 | 17% | 11% | 40% | 62% | 17% | $ 10,992,095.70 |

| OBM | Ora Banda Mining Ltd | 0.83 | 11% | 22% | 98% | 269% | 28% | $ 1,485,820,013.33 |

| AVW | Avira Resources Ltd | 0.00 | 0% | 0% | 0% | -50% | 0% | $ 2,938,790.00 |

| LCY | Legacy Iron Ore | 0.01 | 0% | -10% | -48% | -45% | -10% | $ 87,858,383.26 |

| PDI | Predictive Disc Ltd | 0.27 | -2% | 10% | 47% | 33% | 15% | $ 587,725,495.75 |

| MAT | Matsa Resources | 0.04 | 16% | 19% | 59% | 48% | 23% | $ 26,009,500.12 |

| ZAG | Zuleika Gold Ltd | 0.01 | 0% | -8% | -33% | -43% | -8% | $ 8,902,559.12 |

| GML | Gateway Mining | 0.02 | 14% | 14% | 0% | -4% | 14% | $ 8,994,046.49 |

| SBM | St Barbara Limited | 0.26 | -2% | 9% | 21% | 50% | 13% | $ 259,883,121.84 |

| SBR | Sabre Resources | 0.01 | -6% | -27% | -43% | -68% | -20% | $ 3,536,657.40 |

| STK | Strickland Metals | 0.08 | -3% | -9% | -20% | -21% | -9% | $ 169,970,935.13 |

| CEL | Challenger Gold Ltd | 0.05 | 0% | 14% | 4% | -29% | 6% | $ 81,011,504.69 |

| LRL | Labyrinth Resources | 0.23 | -4% | -8% | 134% | 554% | -12% | $ 118,871,463.43 |

| NST | Northern Star | 17.30 | 0% | 11% | 25% | 30% | 12% | $ 19,294,541,664.54 |

| OZM | Ozaurum Resources | 0.04 | 24% | 20% | -32% | -52% | 20% | $ 6,705,192.33 |

| TG1 | Techgen Metals Ltd | 0.04 | 26% | 18% | 18% | -28% | 11% | $ 5,394,634.14 |

| XAM | Xanadu Mines Ltd | 0.05 | 2% | -8% | -18% | -10% | -4% | $ 86,048,890.02 |

| AQI | Alicanto Min Ltd | 0.04 | 0% | 0% | 76% | 26% | 0% | $ 31,177,790.04 |

| KTA | Krakatoa Resources | 0.01 | -9% | 11% | -9% | -50% | 5% | $ 5,901,340.25 |

| ARN | Aldoro Resources | 0.29 | 2% | -17% | 263% | 202% | -24% | $ 48,894,648.04 |

| WGX | Westgold Resources. | 2.58 | -6% | -10% | 2% | 17% | -9% | $ 2,395,498,612.60 |

| MBK | Metal Bank Ltd | 0.02 | 0% | -6% | -28% | -39% | 0% | $ 7,461,884.97 |

| A8G | Australasian Metals | 0.08 | 3% | -1% | -10% | -36% | -3% | $ 4,457,508.83 |

| TAR | Taruga Minerals | 0.01 | 33% | 20% | 50% | 50% | 20% | $ 8,472,321.42 |

| DTR | Dateline Resources | 0.00 | 0% | -14% | -50% | -77% | -14% | $ 8,806,911.64 |

| GOR | Gold Road Res Ltd | 2.48 | 0% | 21% | 45% | 62% | 21% | $ 2,688,372,303.20 |

| S2R | S2 Resources | 0.07 | -5% | 3% | -38% | -51% | 6% | $ 33,964,349.48 |

| NES | Nelson Resources. | 0.00 | 0% | 0% | 0% | -25% | 0% | $ 6,515,782.98 |

| TLM | Talisman Mining | 0.19 | -10% | -10% | -27% | -10% | -10% | $ 34,839,264.57 |

| BEZ | Besragoldinc | 0.08 | 1% | -18% | 15% | -55% | -17% | $ 31,161,671.33 |

| PRU | Perseus Mining Ltd | 2.87 | 3% | 11% | 16% | 59% | 12% | $ 3,842,116,681.20 |

| SPQ | Superior Resources | 0.01 | 0% | 0% | -39% | -45% | 0% | $ 10,849,318.99 |

| PUR | Pursuit Minerals | 0.08 | -9% | -29% | -50% | -73% | -22% | $ 6,605,383.60 |

| RMS | Ramelius Resources | 2.47 | 6% | 16% | 32% | 56% | 19% | $ 2,772,202,656.00 |

| PKO | Peako Limited | 0.00 | -20% | 33% | 0% | 30% | 33% | $ 4,380,566.13 |

| ICG | Inca Minerals Ltd | 0.01 | -8% | 9% | 50% | -30% | 20% | $ 7,187,057.73 |

| A1G | African Gold Ltd. | 0.06 | -13% | 9% | 85% | 85% | 15% | $ 24,810,306.30 |

| NMG | New Murchison Gold | 0.01 | 0% | 0% | 67% | 67% | 11% | $ 77,203,282.26 |

| GNM | Great Northern | 0.02 | 0% | 0% | 25% | -25% | 7% | $ 2,319,436.16 |

| KRM | Kingsrose Mining Ltd | 0.04 | 0% | -3% | -20% | -3% | 0% | $ 25,619,901.65 |

| BTR | Brightstar Resources | 0.02 | 0% | 11% | 40% | 91% | 5% | $ 239,529,476.97 |

| RRL | Regis Resources | 3.06 | -5% | 17% | 88% | 45% | 20% | $ 2,243,768,869.98 |

| M24 | Mamba Exploration | 0.02 | -12% | 25% | 67% | -75% | 25% | $ 3,524,359.14 |

| TRM | Truscott Mining Corp | 0.08 | -5% | 0% | 30% | 57% | 0% | $ 17,230,370.40 |

| TNC | True North Copper | 0.37 | -14% | -88% | -92% | -95% | -88% | $ 46,560,435.92 |

| MOM | Moab Minerals Ltd | 0.00 | 0% | 0% | -60% | -71% | 0% | $ 3,133,998.73 |

| KNB | Koonenberrygold | 0.03 | 25% | 108% | 67% | -34% | 108% | $ 20,108,611.90 |

| AWJ | Auric Mining | 0.30 | -6% | -9% | 40% | 161% | -12% | $ 46,920,311.87 |

| ENR | Encounter Resources | 0.26 | -4% | -21% | -58% | 0% | -20% | $ 119,710,156.56 |

| SNG | Siren Gold | 0.05 | -6% | -29% | -28% | -21% | -26% | $ 11,167,501.06 |

| STN | Saturn Metals | 0.23 | 0% | 15% | 24% | 31% | 12% | $ 72,587,947.74 |

| USL | Unico Silver Limited | 0.19 | 3% | -5% | 15% | 90% | -3% | $ 81,019,594.68 |

| PNM | Pacific Nickel Mines | 0.02 | 0% | 0% | 0% | -50% | 0% | $ 10,103,834.52 |

| AYM | Australia United Min | 0.00 | 50% | -25% | 0% | 0% | -25% | $ 5,527,732.46 |

| HAV | Havilah Resources | 0.22 | 0% | 0% | 13% | 42% | -2% | $ 74,636,385.12 |

| SPR | Spartan Resources | 1.35 | -7% | -4% | 9% | 212% | -4% | $ 1,695,853,904.18 |

| PNT | Panthermetalsltd | 0.01 | -11% | -33% | -68% | -77% | -27% | $ 2,233,536.87 |

| MEK | Meeka Metals Limited | 0.11 | -5% | 36% | 144% | 192% | 36% | $ 261,094,920.98 |

| GMD | Genesis Minerals | 3.19 | 5% | 27% | 58% | 99% | 29% | $ 3,521,434,622.16 |

| PGO | Pacgold | 0.07 | -11% | -7% | -49% | -62% | -9% | $ 9,136,076.49 |

| FEG | Far East Gold | 0.19 | 0% | 12% | 6% | 46% | 6% | $ 61,759,836.90 |

| MI6 | Minerals260Limited | 0.13 | 0% | 0% | -16% | -26% | 0% | $ 30,420,000.00 |

| IGO | IGO Limited | 4.93 | -5% | 4% | -9% | -36% | 3% | $ 3,831,775,133.78 |

| GAL | Galileo Mining Ltd | 0.14 | -13% | 8% | -27% | -37% | 8% | $ 27,667,489.78 |

| RXL | Rox Resources | 0.22 | -2% | 5% | 43% | 20% | 8% | $ 127,655,503.08 |

| PTN | Patronus Resources | 0.06 | 0% | 14% | 0% | -7% | 16% | $ 93,331,674.83 |

| CLZ | Classic Min Ltd | 0.00 | 0% | 0% | 0% | -98% | 0% | $ 1,544,025.56 |

| TGM | Theta Gold Mines Ltd | 0.18 | 9% | -3% | 17% | 59% | -3% | $ 148,650,009.55 |

| FAL | Falconmetalsltd | 0.14 | 0% | 13% | -55% | 8% | 17% | $ 23,895,000.00 |

| SPD | Southernpalladium | 0.53 | -1% | -13% | 38% | 75% | -13% | $ 47,748,750.00 |

| ORN | Orion Minerals Ltd | 0.02 | 7% | 7% | 0% | 14% | 7% | $ 102,574,202.22 |

| TMB | Tambourahmetals | 0.03 | 8% | 17% | -39% | -69% | 29% | $ 2,985,931.24 |

| TMS | Tennant Minerals Ltd | 0.01 | 10% | 22% | -39% | -61% | 22% | $ 8,603,013.74 |

| AZY | Antipa Minerals Ltd | 0.03 | 3% | 36% | 240% | 143% | 31% | $ 181,500,946.51 |

| PXX | Polarx Limited | 0.01 | 6% | 50% | -18% | -29% | 38% | $ 23,755,009.78 |

| TRE | Toubani Res Ltd | 0.13 | -7% | -21% | -32% | 8% | -24% | $ 29,764,794.67 |

| AUN | Aurumin | 0.06 | -5% | 2% | 91% | 125% | -5% | $ 31,409,289.07 |

| GPR | Geopacific Resources | 0.02 | 15% | 15% | 8% | 58% | 15% | $ 70,014,237.17 |

| FXG | Felix Gold Limited | 0.12 | -15% | 35% | 180% | 167% | 37% | $ 39,468,766.32 |

| ILT | Iltani Resources Lim | 0.21 | -5% | 5% | -2% | 11% | 0% | $ 9,317,205.66 |

| BRX | Belararoxlimited | 0.15 | -14% | -6% | -33% | 3% | -14% | $ 24,473,899.21 |

| TM1 | Terra Metals Limited | 0.03 | 19% | 39% | -47% | -16% | 14% | $ 13,859,592.11 |

| TOR | Torque Met | 0.07 | 24% | 41% | -45% | -65% | 36% | $ 18,225,466.60 |

| ARD | Argent Minerals | 0.02 | 17% | 24% | 31% | 133% | 24% | $ 27,467,169.12 |

| LM1 | Leeuwin Metals Ltd | 0.12 | -4% | -18% | 62% | 15% | -18% | $ 5,387,942.17 |

| CODE | COMPANY | PRICE | WEEK % | MONTH % | 6 MONTH % | YEAR % | YTD % | MARKET CAP |

| MRR | Minrex Resources Ltd | 0.008 | 0% | 7% | -11% | -27% | 14% | $ 8,678,940.02 |

| NPM | Newpeak Metals | 0.015 | 15% | 36% | 15% | -7% | 36% | $ 4,831,075.97 |

| ASO | Aston Minerals Ltd | 0.013 | -7% | 8% | 44% | -32% | 44% | $ 15,540,771.23 |

| MTC | Metalstech Ltd | 0.125 | -4% | -14% | -36% | -24% | -11% | $ 24,692,435.38 |

| GED | Golden Deeps | 0.024 | 9% | -4% | -20% | -35% | -4% | $ 3,542,514.03 |

| G88 | Golden Mile Res Ltd | 0.009 | -10% | 13% | -10% | -25% | 0% | $ 3,969,782.84 |

| LAT | Latitude 66 Limited | 0.035 | -3% | -19% | -67% | -77% | -8% | $ 5,019,024.68 |

| NMR | Native Mineral Res | 0.056 | 22% | 37% | 180% | 180% | 44% | $ 32,349,714.16 |

| AQX | Alice Queen Ltd | 0.009 | 0% | 13% | 50% | 80% | 13% | $ 9,175,120.54 |

| SLZ | Sultan Resources Ltd | 0.008 | 33% | 33% | 33% | -46% | 33% | $ 1,388,819.46 |

| MKG | Mako Gold | 0.011 | 0% | -21% | 22% | -65% | -15% | $ 10,852,809.83 |

| KSN | Kingston Resources | 0.08 | 11% | 8% | 10% | 7% | 13% | $ 66,537,987.11 |

| AMI | Aurelia Metals Ltd | 0.205 | 5% | 11% | 21% | 91% | 21% | $ 363,686,385.13 |

| GIB | Gibb River Diamonds | 0.037 | -3% | -10% | -8% | 9% | -8% | $ 7,936,849.47 |

| KCN | Kingsgate Consolid. | 1.295 | 3% | -2% | -4% | 11% | 1% | $ 350,542,301.12 |

| TMX | Terrain Minerals | 0.0045 | -10% | 13% | 13% | 13% | 50% | $ 9,016,004.70 |

| BNR | Bulletin Res Ltd | 0.04 | 5% | 5% | -13% | -52% | 3% | $ 11,744,532.92 |

| NXM | Nexus Minerals Ltd | 0.054 | 10% | 6% | 64% | 59% | 20% | $ 26,841,383.80 |

| SKY | SKY Metals Ltd | 0.051 | -7% | -2% | 46% | 59% | -6% | $ 37,667,267.80 |

| LM8 | Lunnonmetalslimited | 0.2325 | 13% | 8% | 45% | -3% | -7% | $ 48,538,198.28 |

| CST | Castile Resources | 0.073 | 20% | 6% | -8% | -19% | -9% | $ 20,098,616.45 |

| YRL | Yandal Resources | 0.16 | 0% | -9% | 10% | 45% | -9% | $ 52,569,946.94 |

| FAU | First Au Ltd | 0.002 | 0% | 0% | 0% | -20% | 0% | $ 4,143,986.55 |

| ARL | Ardea Resources Ltd | 0.415 | 14% | 26% | -15% | 5% | 26% | $ 77,876,336.85 |

| GWR | GWR Group Ltd | 0.086 | -3% | 4% | 9% | -2% | 8% | $ 29,873,148.92 |

| IVR | Investigator Res Ltd | 0.026 | 18% | 30% | -37% | -28% | 30% | $ 41,310,868.92 |

| GTR | Gti Energy Ltd | 0.003 | -14% | -14% | -25% | -73% | -14% | $ 8,888,848.99 |

| IPT | Impact Minerals | 0.011 | 10% | 10% | -21% | -8% | 10% | $ 30,594,337.18 |

| BNZ | Benzmining | 0.41 | 9% | 15% | 273% | 141% | 19% | $ 61,582,599.54 |

| MOH | Moho Resources | 0.004 | -20% | 0% | -11% | -50% | -20% | $ 2,865,898.30 |

| BCM | Brazilian Critical | 0.008 | -6% | -20% | -43% | -68% | -11% | $ 8,403,668.70 |

| PUA | Peak Minerals Ltd | 0.013 | 18% | 44% | 420% | 528% | 63% | $ 30,625,323.17 |

| MRZ | Mont Royal Resources | 0.025 | -17% | -42% | -58% | -77% | -42% | $ 2,550,893.79 |

| SMS | Starmineralslimited | 0.033 | 0% | -6% | 4% | -23% | -8% | $ 3,897,812.90 |

| MVL | Marvel Gold Limited | 0.008 | -20% | -11% | 0% | -20% | -11% | $ 7,774,116.33 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 0% | 12% | -44% | 0% | $ 7,937,638.88 |

| AAU | Antilles Gold Ltd | 0.005 | 25% | 25% | 67% | -77% | 67% | $ 7,431,504.23 |

| CWX | Carawine Resources | 0.1 | -5% | 0% | 11% | -13% | 0% | $ 23,612,544.90 |

| RND | Rand Mining Ltd | 1.625 | 3% | 10% | 12% | 20% | 7% | $ 91,570,297.21 |

| CAZ | Cazaly Resources | 0.013 | 18% | -4% | -41% | -35% | -7% | $ 5,074,332.90 |

| BMR | Ballymore Resources | 0.14 | 8% | 14% | 17% | 12% | 17% | $ 24,742,281.90 |

| DRE | Dreadnought Resources Ltd | 0.0105 | -13% | -5% | -38% | -38% | -13% | $ 41,482,466.66 |

| ZNC | Zenith Minerals Ltd | 0.044 | 5% | 5% | -2% | -63% | 10% | $ 17,519,981.15 |

| REZ | Resourc & En Grp Ltd | 0.029 | 0% | 16% | 32% | 190% | 26% | $ 20,149,173.66 |

| LEX | Lefroy Exploration | 0.085 | 20% | 20% | 17% | -39% | 21% | $ 20,787,854.41 |

| ERM | Emmerson Resources | 0.11 | 12% | 34% | 100% | 112% | 43% | $ 73,096,171.09 |

| AM7 | Arcadia Minerals | 0.02 | 0% | 0% | -50% | -70% | 5% | $ 2,347,668.66 |

| ADT | Adriatic Metals | 4.375 | 9% | 14% | 48% | 24% | 12% | $ 1,211,529,460.68 |

| AS1 | Asara Resources Ltd | 0.03 | 20% | 67% | 233% | 150% | 58% | $ 28,903,148.90 |

| CYL | Catalyst Metals | 4 | 20% | 50% | 113% | 641% | 55% | $ 897,154,669.68 |

| CHN | Chalice Mining Ltd | 1.1475 | 7% | 2% | 15% | 30% | 4% | $ 478,502,949.24 |

| KAL | Kalgoorliegoldmining | 0.087 | 444% | 358% | 295% | 295% | 383% | $ 6,281,493.25 |

| MLS | Metals Australia | 0.022 | 5% | -4% | 22% | -27% | -4% | $ 16,396,189.29 |

| ADN | Andromeda Metals Ltd | 0.0065 | 8% | -7% | -62% | -70% | -7% | $ 24,001,093.82 |

| MEI | Meteoric Resources | 0.0815 | 3% | -8% | -12% | -49% | -4% | $ 188,834,748.12 |

| SRN | Surefire Rescs NL | 0.004 | 14% | 14% | -43% | -67% | 14% | $ 9,665,231.25 |

| WA8 | Warriedarresourltd | 0.046 | -6% | 1% | -22% | 5% | 5% | $ 43,005,690.41 |

| HMX | Hammer Metals Ltd | 0.032 | 3% | -3% | -18% | -11% | -3% | $ 28,408,278.40 |

| WCN | White Cliff Min Ltd | 0.02 | 0% | 18% | 33% | 25% | 25% | $ 36,013,944.21 |

| AVM | Advance Metals Ltd | 0.05 | 28% | 32% | 108% | 51% | 47% | $ 7,582,462.83 |

| ASR | Asra Minerals Ltd | 0.0025 | -17% | -17% | -50% | -58% | -17% | $ 6,937,890.37 |

| ARI | Arika Resources | 0.034 | 21% | 31% | 70% | 70% | 26% | $ 20,905,785.05 |

| CTO | Citigold Corp Ltd | 0.004 | 0% | 0% | 0% | 0% | 0% | $ 12,000,000.00 |

| SMI | Santana Minerals Ltd | 0.52 | 9% | 14% | 21% | 13% | 7% | $ 349,556,315.54 |

| M2R | Miramar | 0.004 | 0% | 0% | -33% | -79% | 33% | $ 1,587,293.14 |

| MHC | Manhattan Corp Ltd | 0.021 | -9% | -16% | 5% | -64% | 11% | $ 5,167,775.76 |

| GRL | Godolphin Resources | 0.016 | 23% | 23% | 33% | -59% | 10% | $ 5,027,381.10 |

| SVG | Savannah Goldfields | 0.023 | 31% | 10% | -6% | -29% | 25% | $ 5,340,613.40 |

| EMC | Everest Metals Corp | 0.15 | 3% | 15% | 43% | 88% | 11% | $ 35,805,413.76 |

| GUL | Gullewa Limited | 0.056 | 0% | 0% | -20% | 2% | 0% | $ 12,209,241.63 |

| CY5 | Cygnus Metals Ltd | 0.1175 | -10% | 2% | 114% | 78% | 18% | $ 101,798,358.00 |

| G50 | G50Corp Ltd | 0.145 | -22% | -6% | 0% | 32% | -6% | $ 24,825,470.53 |

| ADV | Ardiden Ltd | 0.145 | 4% | 7% | 12% | -19% | 7% | $ 8,752,450.84 |

| AAR | Astral Resources NL | 0.14 | -7% | 0% | 97% | 106% | 4% | $ 174,041,713.72 |

| VMC | Venus Metals Cor Ltd | 0.074 | 14% | 9% | 28% | -26% | 10% | $ 14,317,393.86 |

| NAE | New Age Exploration | 0.0035 | 17% | -13% | -13% | -13% | 0% | $ 7,503,646.19 |

| VKA | Viking Mines Ltd | 0.009 | 13% | 13% | 29% | -31% | 13% | $ 11,953,325.88 |

| LCL | LCL Resources Ltd | 0.0085 | 6% | -6% | 21% | -29% | -15% | $ 9,558,501.66 |

| MTH | Mithril Silver Gold | 0.385 | 3% | -10% | 208% | 93% | -4% | $ 57,537,091.19 |

| ADG | Adelong Gold Limited | 0.005 | 0% | 0% | 25% | 11% | 11% | $ 6,148,939.27 |

| RMX | Red Mount Min Ltd | 0.009 | 13% | 0% | -10% | -66% | 0% | $ 3,719,662.37 |

| PRS | Prospech Limited | 0.028 | 33% | 4% | -22% | -15% | -3% | $ 6,576,517.74 |

| TTM | Titan Minerals | 0.45 | 11% | 20% | -6% | 137% | 18% | $ 110,483,960.85 |

| AKA | Aureka Limited | 0.155 | 3% | 3% | -98% | -98% | 15% | $ 15,877,408.88 |

| AAM | Aumegametals | 0.05 | 11% | 25% | 25% | 43% | 19% | $ 29,601,539.06 |

| KZR | Kalamazoo Resources | 0.08 | 7% | 10% | 25% | -20% | 8% | $ 15,416,721.75 |

| BCN | Beacon Minerals | 0.026 | 4% | 18% | 8% | 8% | 18% | $ 114,111,833.18 |

| MAU | Magnetic Resources | 1.2 | -3% | 3% | -25% | 21% | 9% | $ 314,778,157.00 |

| BC8 | Black Cat Syndicate | 0.705 | 8% | 22% | 124% | 236% | 25% | $ 427,863,682.68 |

| EM2 | Eagle Mountain | 0.009 | 13% | -10% | -78% | -82% | 0% | $ 3,205,262.21 |

| EMR | Emerald Res NL | 4.44 | 7% | 34% | 31% | 47% | 37% | $ 2,910,711,148.58 |

| BYH | Bryah Resources Ltd | 0.004 | 33% | 0% | 0% | -60% | 33% | $ 2,013,147.42 |

| HCH | Hot Chili Ltd | 0.66 | -1% | -6% | -14% | -35% | -6% | $ 101,451,701.50 |

| WAF | West African Res Ltd | 1.755 | 6% | 19% | 28% | 109% | 22% | $ 2,000,308,361.22 |

| MEU | Marmota Limited | 0.0535 | -15% | 34% | 37% | 1% | 37% | $ 58,675,231.01 |

| NVA | Nova Minerals Ltd | 0.335 | 5% | -23% | 158% | 14% | -9% | $ 103,032,773.44 |

| SVL | Silver Mines Limited | 0.081 | 14% | 9% | -44% | -40% | 4% | $ 147,721,357.54 |

| PGD | Peregrine Gold | 0.14 | -7% | -18% | -32% | -52% | 0% | $ 11,124,955.80 |

| ICL | Iceni Gold | 0.076 | -3% | -6% | 145% | 95% | 7% | $ 23,399,296.40 |

| FG1 | Flynngold | 0.024 | -8% | -8% | 0% | -50% | -4% | $ 6,271,595.28 |

| WWI | West Wits Mining Ltd | 0.017 | 6% | 6% | 21% | 48% | 21% | $ 46,137,049.81 |

| RML | Resolution Minerals | 0.009 | -18% | -25% | -55% | -63% | -25% | $ 2,684,377.13 |

| AAJ | Aruma Resources Ltd | 0.009 | 0% | -31% | -31% | -57% | -25% | $ 1,998,523.55 |

| HWK | Hawk Resources. | 0.026 | 24% | 13% | -3% | -16% | 18% | $ 5,710,306.78 |

| GMN | Gold Mountain Ltd | 0.002 | 0% | -33% | -33% | -43% | -33% | $ 9,158,446.37 |

| MEG | Megado Minerals Ltd | 0.013 | 0% | -13% | 24% | -20% | -24% | $ 5,455,882.41 |

| HMG | Hamelingoldlimited | 0.056 | -22% | -10% | -41% | -27% | -13% | $ 8,695,500.00 |

| BM8 | Battery Age Minerals | 0.078 | -20% | -22% | -26% | -44% | -26% | $ 8,261,931.20 |

| TBR | Tribune Res Ltd | 4.85 | 5% | 12% | 28% | 67% | 13% | $ 253,945,492.68 |

| FML | Focus Minerals Ltd | 0.2 | -5% | 14% | 67% | 18% | 18% | $ 57,311,729.00 |

| VRC | Volt Resources Ltd | 0.0035 | 17% | 17% | -13% | -30% | 17% | $ 13,588,180.10 |

| ARV | Artemis Resources | 0.008 | 0% | 0% | 0% | -47% | 0% | $ 17,643,059.41 |

| HRN | Horizon Gold Ltd | 0.53 | 15% | 4% | 89% | 93% | 10% | $ 75,316,759.96 |

| CLA | Celsius Resource Ltd | 0.0095 | -14% | -5% | -14% | -14% | -14% | $ 25,357,765.29 |

| QML | Qmines Limited | 0.056 | -10% | 10% | 10% | -28% | 4% | $ 17,185,257.15 |

| RDN | Raiden Resources Ltd | 0.007 | 0% | -30% | -68% | -67% | -36% | $ 24,156,240.09 |

| TCG | Turaco Gold Limited | 0.34 | 10% | 15% | 58% | 224% | 33% | $ 298,797,501.68 |

| KCC | Kincora Copper | 0.027 | -7% | -10% | -40% | -16% | 0% | $ 6,268,488.69 |

| GBZ | GBM Rsources Ltd | 0.008 | -11% | 0% | -11% | -11% | 0% | $ 9,368,559.82 |

| DTM | Dart Mining NL | 0.007 | -22% | -22% | -58% | -36% | -22% | $ 4,186,389.04 |

| MKR | Manuka Resources. | 0.023 | 0% | -21% | -30% | -69% | -18% | $ 20,269,191.73 |

| AUC | Ausgold Limited | 0.47 | 6% | 11% | 59% | 81% | 12% | $ 171,175,104.96 |

| ANX | Anax Metals Ltd | 0.01 | -5% | -17% | -47% | -52% | -17% | $ 8,764,517.42 |

| EMU | EMU NL | 0.026 | -10% | 0% | 37% | -6% | -4% | $ 4,617,100.49 |

| SFM | Santa Fe Minerals | 0.041 | 21% | 32% | 21% | -5% | 32% | $ 2,985,570.35 |

| SSR | SSR Mining Inc. | 14.49 | 16% | 27% | 102% | 2% | 33% | $ 50,865,751.96 |

| PNR | Pantoro Limited | 0.125 | 19% | 29% | 54% | 221% | 39% | $ 839,023,966.82 |

| CMM | Capricorn Metals | 7.91 | 4% | 24% | 44% | 82% | 26% | $ 3,323,661,634.02 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | 0% | 0% | 0% | $ 129,844,903.32 |

| VRL | Verity Resources | 0.014 | -22% | -26% | -65% | -84% | -30% | $ 2,075,717.92 |

| HAW | Hawthorn Resources | 0.049 | 17% | 20% | -18% | -46% | 20% | $ 14,070,655.75 |

| BGD | Bartongoldholdings | 0.29 | 5% | 18% | 16% | 18% | 18% | $ 63,459,284.80 |

| SVY | Stavely Minerals Ltd | 0.017 | 6% | -32% | -23% | -51% | 0% | $ 9,248,715.58 |

| AGC | AGC Ltd | 0.15 | 15% | 0% | -33% | 111% | -3% | $ 39,772,569.41 |

| RGL | Riversgold | 0.003 | -14% | -25% | -40% | -67% | -25% | $ 5,051,137.78 |

| TSO | Tesoro Gold Ltd | 0.026 | 8% | 30% | -4% | 0% | 30% | $ 43,495,593.15 |

| GUE | Global Uranium | 0.079 | 1% | 13% | 39% | -41% | 32% | $ 23,282,840.03 |

| CPM | Coopermetalslimited | 0.049 | 14% | 14% | -18% | -83% | 7% | $ 3,526,004.25 |

| MM8 | Medallion Metals. | 0.13 | 24% | 8% | 136% | 124% | 8% | $ 55,271,209.55 |

| FFM | Firefly Metals Ltd | 0.9125 | 4% | 7% | 22% | 96% | -1% | $ 507,444,229.80 |

| CBY | Canterbury Resources | 0.023 | -23% | 5% | -36% | -15% | 5% | $ 4,541,140.61 |

| LYN | Lycaonresources | 0.14 | -3% | 0% | -39% | -28% | 56% | $ 8,212,647.57 |

| SFR | Sandfire Resources | 10.59 | 10% | 14% | 26% | 52% | 14% | $ 4,738,424,643.69 |

| SMG | Silvermetalgroupltd | 0.06 | 0% | 0% | 0% | 0% | 0% | $ 4,881,135.48 |

| TAM | Tanami Gold NL | 0.029 | 0% | 0% | 4% | -12% | -3% | $ 34,077,814.33 |

| NWM | Norwest Minerals | 0.014 | 8% | -7% | -35% | -46% | 0% | $ 6,791,673.14 |

| ALK | Alkane Resources Ltd | 0.585 | 3% | 11% | 46% | 6% | 15% | $ 354,242,006.82 |

| BMO | Bastion Minerals | 0.004 | -11% | 0% | -43% | -64% | 0% | $ 3,378,898.66 |

| IDA | Indiana Resources | 0.073 | 4% | 18% | 56% | 64% | 20% | $ 48,204,934.35 |

| GSM | Golden State Mining | 0.008 | 0% | 0% | -20% | -27% | 0% | $ 2,234,965.04 |

| NSM | Northstaw | 0.02 | 11% | 25% | 53% | -49% | 25% | $ 5,453,530.00 |

| GSN | Great Southern | 0.02 | 0% | 25% | 18% | 11% | 33% | $ 21,732,082.64 |

| VAU | Vault Minerals Ltd | 0.4125 | 13% | 25% | 20% | 27% | 25% | $ 2,857,038,820.44 |

| DEG | De Grey Mining | 2.07 | 6% | 13% | 80% | 80% | 17% | $ 5,058,754,238.27 |

| THR | Thor Energy PLC | 0.011 | -8% | -15% | -21% | -66% | -15% | $ 2,951,193.75 |

| CDR | Codrus Minerals Ltd | 0.0165 | -3% | -3% | -43% | -65% | -3% | $ 2,811,587.57 |

| MDI | Middle Island Res | 0.015 | 15% | 25% | 7% | -12% | 25% | $ 4,096,390.88 |

| WTM | Waratah Minerals Ltd | 0.15 | 3% | 0% | -47% | 43% | -3% | $ 30,358,124.85 |

| POL | Polymetals Resources | 0.855 | -3% | 10% | 242% | 217% | 8% | $ 168,983,435.48 |

| RDS | Redstone Resources | 0.003 | 0% | 0% | -25% | -25% | 20% | $ 2,776,135.38 |

| NAG | Nagambie Resources | 0.016 | 7% | -11% | 78% | -36% | -11% | $ 12,852,837.50 |

| BGL | Bellevue Gold Ltd | 1.195 | -1% | 21% | -4% | -5% | 6% | $ 1,566,189,446.02 |

| GBR | Greatbould Resources | 0.055 | 15% | 22% | 15% | -7% | 28% | $ 41,750,518.37 |

| KAI | Kairos Minerals Ltd | 0.016 | 23% | 14% | 45% | 23% | 33% | $ 42,094,595.02 |

| KAU | Kaiser Reef | 0.16 | 0% | -3% | 8% | 60% | 0% | $ 44,303,795.20 |

| HRZ | Horizon | 0.048 | 4% | 9% | 14% | 41% | 20% | $ 75,392,170.22 |

| CAI | Calidus Resources | 0 | -100% | -100% | -100% | -100% | -100% | $ 93,678,205.58 |

| CDT | Castle Minerals | 0.0025 | 25% | 25% | -29% | -64% | 25% | $ 3,793,628.21 |

| RSG | Resolute Mining | 0.3475 | -14% | -13% | -43% | -3% | -12% | $ 766,458,004.68 |

| MXR | Maximus Resources | 0.064 | 2% | 8% | 121% | 105% | 10% | $ 27,871,199.92 |

| EVN | Evolution Mining Ltd | 5.9 | 4% | 20% | 52% | 92% | 23% | $ 11,836,589,303.00 |

| CXU | Cauldron Energy Ltd | 0.011 | -15% | -29% | -41% | -73% | -8% | $ 17,536,855.31 |

| DLI | Delta Lithium | 0.19 | 3% | 12% | -16% | -30% | 12% | $ 125,394,813.60 |

| ALY | Alchemy Resource Ltd | 0.007 | 0% | 0% | 0% | -22% | 0% | $ 7,068,457.54 |

| NH3 | Nh3Cleanenergyltd | 0.02 | 0% | 0% | 43% | 67% | 11% | $ 10,992,095.70 |

| OBM | Ora Banda Mining Ltd | 0.885 | 12% | 40% | 116% | 277% | 36% | $ 1,683,302,420.17 |

| AVW | Avira Resources Ltd | 0.001 | 0% | 0% | 0% | -50% | 0% | $ 2,938,790.00 |

| LCY | Legacy Iron Ore | 0.01 | 11% | 11% | -31% | -31% | 0% | $ 87,858,383.26 |

| PDI | Predictive Disc Ltd | 0.3475 | 39% | 39% | 99% | 74% | 51% | $ 811,061,184.14 |

| MAT | Matsa Resources | 0.042 | 5% | 14% | 75% | 45% | 20% | $ 30,769,225.54 |

| ZAG | Zuleika Gold Ltd | 0.013 | 8% | 0% | -24% | -28% | 0% | $ 9,644,439.05 |

| GML | Gateway Mining | 0.023 | 5% | 0% | 10% | 5% | 10% | $ 9,402,866.79 |

| SBM | St Barbara Limited | 0.26 | 8% | 11% | 27% | 63% | 16% | $ 297,782,743.78 |

| SBR | Sabre Resources | 0.009 | 0% | 0% | -36% | -55% | -10% | $ 3,536,657.40 |

| STK | Strickland Metals | 0.07 | -9% | -19% | -28% | -26% | -18% | $ 161,141,276.17 |

| CEL | Challenger Gold Ltd | 0.049 | 2% | 2% | 11% | -37% | 4% | $ 81,011,504.69 |

| GG8 | Gorilla Gold Mines | 0.22 | 4% | -14% | 56% | 347% | -15% | $ 114,676,000.01 |

| NST | Northern Star | 17.75 | 5% | 13% | 25% | 34% | 15% | $ 20,782,258,400.24 |

| OZM | Ozaurum Resources | 0.125 | 268% | 346% | 123% | 92% | 317% | $ 26,623,557.77 |

| TG1 | Techgen Metals Ltd | 0.034 | 0% | 0% | 21% | 10% | -3% | $ 5,394,634.14 |

| XAM | Xanadu Mines Ltd | 0.0495 | 10% | 3% | -10% | -3% | 1% | $ 95,609,877.80 |

| AQI | Alicanto Min Ltd | 0.042 | 14% | 20% | 180% | 91% | 14% | $ 33,705,718.96 |

| KTA | Krakatoa Resources | 0.009 | -10% | 0% | -10% | -50% | -5% | $ 5,311,206.23 |

| ARN | Aldoro Resources | 0.325 | 16% | -3% | 328% | 246% | -14% | $ 63,737,666.20 |

| WGX | Westgold Resources. | 2.45 | -4% | -14% | -16% | 24% | -13% | $ 2,367,205,321.90 |

| MBK | Metal Bank Ltd | 0.016 | 7% | -6% | -10% | -26% | 7% | $ 7,959,343.97 |

| A8G | Australasian Metals | 0.07 | -9% | -7% | -18% | -33% | -11% | $ 3,936,501.30 |

| TAR | Taruga Minerals | 0.01 | -17% | 0% | 43% | 25% | 0% | $ 7,060,267.85 |

| DTR | Dateline Resources | 0.003 | -14% | 0% | -50% | -70% | -14% | $ 7,548,781.41 |

| GOR | Gold Road Res Ltd | 2.605 | 5% | 23% | 56% | 78% | 27% | $ 2,818,454,834.00 |

| S2R | S2 Resources | 0.063 | -16% | -9% | -43% | -57% | -6% | $ 28,982,911.55 |

| NES | Nelson Resources. | 0.003 | 0% | 0% | 20% | 0% | 0% | $ 6,515,782.98 |

| TLM | Talisman Mining | 0.195 | 5% | -7% | -15% | 0% | -5% | $ 35,780,866.31 |

| BEZ | Besragoldinc | 0.07 | -5% | -20% | -20% | -56% | -22% | $ 29,915,204.47 |

| PRU | Perseus Mining Ltd | 2.84 | 1% | 9% | 17% | 67% | 11% | $ 4,006,778,824.68 |

| SPQ | Superior Resources | 0.006 | 20% | -14% | -25% | -39% | 0% | $ 15,189,046.59 |

| PUR | Pursuit Minerals | 0.085 | 6% | -11% | -43% | -58% | -11% | $ 7,018,220.08 |

| RMS | Ramelius Resources | 2.605 | 9% | 19% | 40% | 78% | 26% | $ 3,037,872,077.20 |

| PKO | Peako Limited | 0.003 | -25% | 0% | -25% | 30% | 0% | $ 4,463,225.88 |

| ICG | Inca Minerals Ltd | 0.007 | 0% | 17% | 75% | -8% | 40% | $ 7,187,057.73 |

| A1G | African Gold Ltd. | 0.072 | 11% | 22% | 157% | 111% | 31% | $ 25,573,700.34 |

| NMG | New Murchison Gold | 0.011 | 10% | 0% | 120% | 100% | 22% | $ 93,014,002.15 |

| GNM | Great Northern | 0.013 | -13% | 4% | 18% | -32% | -7% | $ 2,010,178.00 |

| KRM | Kingsrose Mining Ltd | 0.0345 | 1% | -4% | -18% | 11% | -1% | $ 25,619,901.65 |

| BTR | Brightstar Resources | 0.02 | -5% | 3% | 25% | 82% | 0% | $ 228,123,311.40 |

| RRL | Regis Resources | 3.25 | 9% | 26% | 105% | 70% | 27% | $ 2,485,521,744.86 |

| M24 | Mamba Exploration | 0.0165 | 10% | 38% | 65% | -68% | 38% | $ 3,876,795.05 |

| TRM | Truscott Mining Corp | 0.09 | 0% | 15% | 50% | 81% | 15% | $ 16,273,127.60 |

| TNC | True North Copper | 0.375 | 1% | -88% | -91% | -95% | -88% | $ 40,897,680.20 |

| MOM | Moab Minerals Ltd | 0.002 | 33% | -33% | -50% | -71% | 0% | $ 3,133,998.73 |

| KNB | Koonenberrygold | 0.027 | 17% | 59% | 108% | -3% | 125% | $ 24,480,049.27 |

| AWJ | Auric Mining | 0.315 | 0% | -5% | 62% | 174% | -7% | $ 47,665,078.72 |

| ENR | Encounter Resources | 0.245 | 2% | -22% | -54% | -8% | -25% | $ 119,710,156.56 |

| SNG | Siren Gold | 0.049 | -4% | -22% | -11% | -17% | -25% | $ 10,729,559.84 |

| STN | Saturn Metals | 0.25 | 6% | 28% | 52% | 67% | 22% | $ 78,765,645.42 |

| USL | Unico Silver Limited | 0.215 | 16% | 10% | 48% | 122% | 10% | $ 91,968,188.55 |

| PNM | Pacific Nickel Mines | 0.024 | 0% | 0% | 0% | -43% | 0% | $ 10,103,834.52 |

| AYM | Australia United Min | 0.0035 | 17% | -13% | 17% | 17% | -13% | $ 6,449,021.20 |

| HAV | Havilah Resources | 0.205 | -5% | -2% | 14% | 32% | -9% | $ 69,547,540.68 |

| SPR | Spartan Resources | 1.42 | 7% | -11% | 26% | 221% | 1% | $ 1,881,437,916.33 |

| PNT | Panthermetalsltd | 0.007 | -22% | -22% | -72% | -75% | -36% | $ 2,233,536.87 |

| MEK | Meeka Metals Limited | 0.115 | 10% | 34% | 174% | 211% | 49% | $ 261,811,218.48 |

| GMD | Genesis Minerals | 3.24 | 4% | 26% | 60% | 104% | 31% | $ 3,735,945,350.76 |

| PGO | Pacgold | 0.06 | -14% | -19% | -56% | -68% | -20% | $ 7,361,442.93 |

| FEG | Far East Gold | 0.175 | -3% | 3% | 25% | 25% | -3% | $ 61,759,836.90 |

| MI6 | Minerals260Limited | 0.13 | 0% | 0% | -16% | -19% | 0% | $ 30,420,000.00 |

| IGO | IGO Limited | 4.97 | -2% | 0% | 0% | -27% | 4% | $ 3,771,193,708.74 |

| GAL | Galileo Mining Ltd | 0.14 | 0% | -7% | -18% | -33% | 12% | $ 26,679,365.15 |

| RXL | Rox Resources | 0.225 | 7% | 2% | 67% | 29% | 13% | $ 139,813,170.04 |

| PTN | Patronus Resources | 0.059 | 4% | 18% | 4% | -6% | 20% | $ 94,969,072.63 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | 0% | -98% | 0% | $ 1,544,025.56 |

| TGM | Theta Gold Mines Ltd | 0.16 | -9% | -9% | 23% | 67% | -11% | $ 135,908,580.16 |

| FAL | Falconmetalsltd | 0.135 | 0% | 8% | -45% | 8% | 17% | $ 23,895,000.00 |

| SXG | Southern Cross Gold | 3.45 | 0% | -1% | 62% | 218% | 0% | $ 764,630,196.45 |

| SPD | Southernpalladium | 0.43 | -18% | -27% | 13% | 19% | -28% | $ 38,881,125.00 |

| ORN | Orion Minerals Ltd | 0.015 | 0% | -6% | 0% | 15% | 0% | $ 109,412,482.37 |

| TMB | Tambourahmetals | 0.026 | -4% | 13% | -28% | -69% | 24% | $ 2,875,341.20 |

| TMS | Tennant Minerals Ltd | 0.012 | 33% | 20% | -37% | -60% | 33% | $ 10,514,794.57 |

| AZY | Antipa Minerals Ltd | 0.038 | 15% | 31% | 280% | 217% | 46% | $ 215,905,278.46 |

| PXX | Polarx Limited | 0.007 | -30% | 17% | -30% | -34% | 8% | $ 19,004,007.82 |

| TRE | Toubani Res Ltd | 0.155 | 19% | 0% | -11% | 24% | -9% | $ 36,633,593.44 |

| AUN | Aurumin | 0.069 | 10% | 1% | 97% | 130% | 5% | $ 34,400,649.94 |

| GPR | Geopacific Resources | 0.021 | -5% | 0% | -6% | 40% | 5% | $ 66,831,771.85 |

| FXG | Felix Gold Limited | 0.135 | 13% | 52% | 265% | 246% | 61% | $ 44,402,362.11 |

| ILT | Iltani Resources Lim | 0.22 | 5% | 13% | 13% | 33% | 7% | $ 9,539,043.89 |

| BRX | Belararoxlimited | 0.16 | -6% | 0% | -38% | -24% | -9% | $ 24,473,899.21 |

| TM1 | Terra Metals Limited | 0.03 | -10% | 20% | -35% | -25% | 7% | $ 13,044,321.98 |

| TOR | Torque Met | 0.066 | -10% | 27% | -37% | -68% | 25% | $ 16,727,483.04 |

| ARD | Argent Minerals | 0.024 | 33% | 41% | 85% | 200% | 41% | $ 34,695,371.52 |

| LM1 | Leeuwin Metals Ltd | 0.12 | -4% | 4% | 64% | 30% | -14% | $ 7,836,407.00 |

Top ASX Gold Stories this Week

Canadian gold and nickel hopeful Aston is heading into a leftfield merger with Torque Metals (ASX:TOR), the owner of the 250,000oz Paris gold project in WA’s Eastern Goldfields.

Few if any M&A deals really have serious synergy and the addition of Aston’s 1.5Moz Edleston in Ontario to Torque’s higher grade Paris project, which brings with it a reasonable lithium inventory as well, fits the vibe of a week Married at First Sight made its reappearance on Australian screens.

But the deal brings significant corporate heft to the table. Entities related to Aston’s Tolga Kumova and Evan Cranston, key figures in the early days of rags to riches ASX gold story Bellevue Gold (ASX:BGL), will tip $1m into Torque collectively and join its board.

$4m of cash will also be pumped into Torque, which stands well placed to develop its Paris project at a time of rising gold prices, given its proximity to mills like Higginsville, Lakewood, St Ives, Mt Monger and more.

“As Torque already owns the Paris Gold Project, located in the heart of the Western Australian Goldfields, the merger enhances the strategic potential of this asset and aligns with Torque’s broader growth objectives,” Torque MD Cristian Moreno, who will lead the combined company, said.

“With a resource of 250,000 ounces at an impressive grade of 3.1 g/t gold, the project spans a substantial ~1,200km² tenement package, positioning it as a cornerstone of our portfolio. Complementing this, Aston’s Edleston Gold Project in Ontario, Canada, is situated in the renowned Abitibi Greenstone Belt and contributes a significant resource of 1.5 million ounces at 1.0 g/t gold.

“This project’s ~310km² landholding offers additional high-grade exploration opportunities, further solidifying our growth potential.

“A key advantage of this merger is the injection of $4 million cash on a pre-costs basis from Aston into Torque Metals. This strategic funding approach ensures that the company is well-capitalised to advance exploration efforts in the current robust gold price environment.”

And lastly a quick one on Emmerson Resources, which announced a 490,000oz maiden resource at the White Devil deposit near Tennant Creek in the NT at a nice grade of 4.2g/t.

Its bounty in the region now sits at 866,000oz at 4.6g/t.

But White Devil is significant in the context of its JV with London-listed Pan African Resources, which assumed control of the project and Nobles processing plant construction by acquiring Tennant Creek Mineral Group last year.

The South African gold producer will send a 6% royalty ERM’s way on the material it mines.

BUT, White Devil is potentially large enough to hit the major deposit milestone that could see ERM elect to take a 40% stake.

Bridge Street Capital Partners – grain of salt here of course, since they raised money for ERM – told clients this week they were working on a new valuation for the junior, assuming White Devil becomes the main source of supply at Nobles from year 2 or 3 on, “likely to be significantly higher than both our base and upside case estimates”.

Those sat at 13c and 21c respectively on initiation. ERM is currently at 10c.

The views, information, or opinions expressed in the last segment of this article are solely those of the broker and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.