Gold Digger: De Grey expands Mallina once again, and juniors unearth near-impossible gold grades

Pic via Getty Images.

- De Grey gets bigger, and bigger, and even bigger ahead of its imminent DFS

- Catalyst Metals has some bonkers grades coming out of the Iris deposit at Four Eagles

- Cue: lots of gold. Musgrave’s Break of Day gold deposit returns “excellent” drill results

Our Gold Digger column wraps all the news driving ASX stocks with exposure to precious metals.

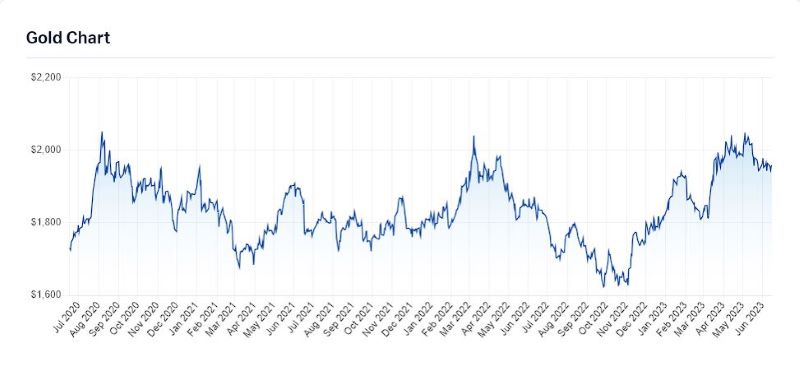

Gold prices fell this week as the market digested the US Federal Reserve’s widely anticipated pause on interest rate hikes.

It signalled that borrowing costs still need to rise by as much as half a percentage point by the end of the year, while hawkish central banks don’t believe recession would force rate cuts any time soon.

While spot gold is currently steady at US$1,955/oz, it is still its lowest price since mid-march. Silver also fell back from recent increases to US$23.89/oz.

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| CODE | COMPANY | 1 WEEK RETURN % | YTD RETURN % | 12 MONTH RETURN % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|

| $401,943,154 | ||||||

| $14,261,801 | ||||||

| $43,552,030 | ||||||

| $98,269,451 | ||||||

| $24,181,929 | ||||||

| $147,357,003 | ||||||

| $45,116,778 | ||||||

| $12,204,256 | ||||||

| $7,472,172 | ||||||

| $18,839,020 | ||||||

| $8,221,076 | ||||||

| $14,237,642 | ||||||

| $6,286,459 | ||||||

| $3,625,053 | ||||||

| $107,640,000 | ||||||

| $9,965,025 | ||||||

| $37,317,776 | ||||||

| $55,676,585 | ||||||

| $24,374,670 | ||||||

| $5,381,200 | ||||||

| $18,818,347 | ||||||

| $22,960,199 | ||||||

| $8,442,074 | ||||||

| $5,589,412 | ||||||

| $605,409,592 | ||||||

| $6,606,276 | ||||||

| $12,977,233 | ||||||

| $19,142,499 | ||||||

| $5,888,682 | ||||||

| $34,839,265 | ||||||

| $32,452,204 | ||||||

| $20,553,951 | ||||||

| $3,765,852 | ||||||

| $49,875,611 | ||||||

| $20,648,571 | ||||||

| $9,227,326 | ||||||

| $17,111,296 | ||||||

| $11,862,116 | ||||||

| $8,582,995 | ||||||

| $29,539,536 | ||||||

| $43,643,634 | ||||||

| $7,179,495 | ||||||

| $351,431,495 | ||||||

| $382,621,517 | ||||||

| $40,340,560 | ||||||

| $39,825,854 | ||||||

| $130,620,354 | ||||||

| $9,178,348 | ||||||

| $41,388,959 | ||||||

| $1,262,379,372 | ||||||

| $2,764,196,164 | ||||||

| $4,537,489 | ||||||

| $327,344,649 | ||||||

| $113,634,333 | ||||||

| $152,106,296 | ||||||

| $21,435,108 | ||||||

| $11,162,127,564 | ||||||

| $6,075,792 | ||||||

| $14,872,872 | ||||||

| $32,893,890 | ||||||

| $108,126,145 | ||||||

| $29,970,298 | ||||||

| $6,412,696 | ||||||

| $22,485,166 | ||||||

| $19,982,391 | ||||||

| $6,912,138 | ||||||

| $39,825,000 | ||||||

| $18,819,324 | ||||||

| $55,362,355 | ||||||

| $32,753,280 | ||||||

| $424,109,691 | ||||||

| $46,761,669 | ||||||

| $217,503,930 | ||||||

| $51,367,505 | ||||||

| $9,989,361 | ||||||

| $1,377,870,169 | ||||||

| $4,441,946 | ||||||

| $2,348,450 | ||||||

| $37,058,020 | ||||||

| $10,847,896 | ||||||

| $61,882,118 | ||||||

| $43,478,591 | ||||||

| $22,105,600 | ||||||

| $6,391,950 | ||||||

| $1,990,487,817 | ||||||

| $35,406,136 | ||||||

| $140,322,097 | ||||||

| $199,902,158 | ||||||

| $127,806,370 | ||||||

| $99,961,670 | ||||||

| $21,045,511 | ||||||

| $14,722,619,699 | ||||||

| $634,819,425 | ||||||

| $14,103,278 | ||||||

| $9,145,132 | ||||||

| $90,293,206 | ||||||

| $236,569,315 | ||||||

| $6,931,360 | ||||||

| $8,256,420 | ||||||

| $2,530,288 | ||||||

| $16,141,874 | ||||||

| $7,825,849 | ||||||

| $8,665,594 | ||||||

| $6,026,475 | ||||||

| $19,681,747 | ||||||

| $2,963,131 | ||||||

| $55,423,663 | ||||||

| $17,508,200 | ||||||

| $62,920,961 | ||||||

| $17,965,037 | ||||||

| $11,159,067 | ||||||

| $34,433,450 | ||||||

| $28,594,961 | ||||||

| $9,087,404 | ||||||

| $28,555,654 | ||||||

| $20,804,443 | ||||||

| $104,644,881 | ||||||

| $7,879,730 | ||||||

| $33,129,243 | ||||||

| $19,504,998 | ||||||

| $39,394,239 | ||||||

| $53,065,240 | ||||||

| $26,610,664 | ||||||

| $130,184,182 | ||||||

| $8,972,368 | ||||||

| $37,521,477 | ||||||

| $37,847,908 | ||||||

| $4,335,706 | ||||||

| $4,349,755 | ||||||

| $74,238,031 | ||||||

| $13,173,783 | ||||||

| $33,528,029 | ||||||

| $5,642,075 | ||||||

| $4,267,580 | ||||||

| $7,845,759 | ||||||

| $2,942,972 | ||||||

| $11,810,775 | ||||||

| $7,522,068 | ||||||

| $2,462,014 | ||||||

| $25,143,441 | ||||||

| $7,013,882 | ||||||

| $101,646,874 | ||||||

| $925,095,611 | ||||||

| $844,451,641 | ||||||

| $23,151,633,651 | ||||||

| $618,297,811 | ||||||

| $180,318,424 | ||||||

| $6,055,553,853 | ||||||

| $12,888,846 | ||||||

| $80,767,534 | ||||||

| $50,308,436 | ||||||

| $71,094,951 | ||||||

| $105,189,509 | ||||||

| $5,500,000 | ||||||

| $2,663,777,327 | ||||||

| $1,817,140,044 | ||||||

| $71,858,501 | ||||||

| $14,114,923 | ||||||

| $98,910,273 | ||||||

| $74,310,996 | ||||||

| $173,144,654 | ||||||

| $21,814,822 | ||||||

| $115,938,291 | ||||||

| $21,205,373 | ||||||

| $43,813,574 | ||||||

| $18,911,788 | ||||||

| $94,814,068 | ||||||

| $20,829,012 | ||||||

| $18,339,239 | ||||||

| $420,518,947 | ||||||

| $17,028,284 | ||||||

| $46,679,704 | ||||||

| $621,778,122 | ||||||

| $56,940,289 | ||||||

| $2,359,777,316 | ||||||

| $644,126,913 | ||||||

| $13,002,857 | ||||||

| $245,758,125 | ||||||

| $25,135,833 | ||||||

| $23,135,752 | ||||||

| $1,438,324,387 | ||||||

| $99,807,119 | ||||||

| $26,916,207 | ||||||

| $67,689,155 | ||||||

| $7,994,285 | ||||||

| $41,751,179 | ||||||

| $33,546,355 | ||||||

| $63,590,340 | ||||||

| $3,423,954 | ||||||

| $15,187,174 | ||||||

| $53,013,349 | ||||||

| $28,180,356 | ||||||

| $511,137,920 | ||||||

| $22,878,271 | ||||||

| $4,445,000 | ||||||

| $6,149,240 | ||||||

| $872,892,693 | ||||||

| $19,969,158 | ||||||

| $24,491,994 | ||||||

| $110,214,778 | ||||||

| $8,606,670 | ||||||

| $36,522,667 | ||||||

| $24,770,452 | ||||||

| $41,707,543 | ||||||

| $7,296,869 | ||||||

| $21,264,135 | ||||||

| $363,203,416 | ||||||

| $14,608,156 | ||||||

| $6,713,381 | ||||||

| $13,432,823 | ||||||

| $10,919,675 | ||||||

| $18,182,272 | ||||||

| $1,205,672 | ||||||

| $4,316,863 | ||||||

| $4,144,701 | ||||||

| $1,311,008,254 | ||||||

| $169,714,139 | ||||||

| $79,159,803 | ||||||

| $1,530,149,772 | ||||||

| $3,114,933 | ||||||

| $14,832,265 | ||||||

| $141,182,642 | ||||||

| $7,760,642 | ||||||

| $52,774,285 | ||||||

| $9,497,705 | ||||||

| $18,263,409 | ||||||

| $17,314,167 | ||||||

| $8,183,562 | ||||||

| $9,497,321 | ||||||

| $41,381,646 | ||||||

| $9,670,289 | ||||||

| $3,617,178 | ||||||

| $31,608,377 | ||||||

| $4,268,834 | ||||||

| $61,390,384 | ||||||

| $3,550,128 | ||||||

| $5,603,747 | ||||||

| $11,087,297 | ||||||

| $64,759,416 | ||||||

| $5,840,051 | ||||||

| $3,707,334 | ||||||

| $11,736,949 | ||||||

| $6,631,028 | ||||||

| $17,877,506 | ||||||

| $6,254,563 | ||||||

| $4,119,911 | ||||||

| $14,268,922 | ||||||

| $38,433,922 | ||||||

| $4,501,779 | ||||||

| $7,890,154 | ||||||

| $11,995,339 | ||||||

| $6,780,418 | ||||||

| $102,836,703 | ||||||

| $10,506,647 | ||||||

| $13,275,000 | ||||||

| $369,482,515 | ||||||

| $33,704,851 | ||||||

| $34,045,933 | ||||||

| $3,124,130 | ||||||

| $20,564,086 | ||||||

| $16,246,922 | ||||||

| $36,999,993 | ||||||

| $11,494,636 | ||||||

| $14,618,409 | ||||||

| $4,272,627 | ||||||

| $28,464,645 | ||||||

| $7,203,166 | ||||||

| $9,221,487 | ||||||

| $5,807,973 | ||||||

| $5,053,207 | ||||||

| $6,602,504 | ||||||

| $132,797,805 | ||||||

| $4,649,450 | ||||||

| $3,685,155 | ||||||

| $8,170,078 | ||||||

| $158,126,031 |

Top ASX Stories This Week

DE GREY MINING (ASX:DEG)

These guys just won’t stop proving up more shiny.

The biggest gold deposit Australia has uncovered in years has just gotten bigger, with De Grey announcing a resource increase of its Hemi discovery up to 9.5Moz, which is now a total project upgrade of Mallina of 1.1Moz since its 2022 estimate.

Hemi is the biggest deposit at the 11.7Moz Mallina, and the latest resource update is a precursor to a much-anticipated definitive feasibility study (DFS) which everyone will be salivating over pretty soon.

Mallina has grown a staggering 432% since the Hemi deposit was discovered in 2020, giving De Grey a celebrity makeover from a junior gold explorer to one of the ASX 200’s most exciting stocks to watch in just three years.

The gold developer’s pre-feasibility study last year estimated that Mallina would produce 540,000oz of gold per annum for the first 10 years.

The DFS is very likely to increase that figure and will further cement it as one of Australia’s top five gold mines.

Ongoing drilling is STILL targeting strike and depth extensions to the Hemi deposits, with new shallow potential resources adjacent to the find.

De Grey managing director Glenn Jardine said the higher indicated ounces would support an improved ore reserve and the proportion of the long-term production profile sourced from those high-confidence reserves.

“Resource definition drilling completed for the 2023 MRE update at Mallina has succeeded in increasing Measured and Indicated resources from 6.8Moz to 8.1Moz with Hemi Indicated resources increasing from 5.8Moz to 6.9Moz,” Jardine said.

“The increase in Indicated resources has been aimed at improving the overall Ore Reserve and percentage of Ore Reserves within the DFS production profile. Increased Ore Reserves will further de-risk the project and maximise its debt-carrying capacity.

“The DFS is advancing to plan and due for completion in the September quarter 2023.”

CATALYST METALS (ASX:CYL)

A hotly anticipated maiden mineral resource of 665,000t at a whopping 7.7 grams per tonne (g/t) for 163,000oz of gold at CYL’s Four Eagles JV with Hancock Prospecting near Bendigo, Victoria has investors buzzing this week.

Some 70,000 of those ounces grade at 26.2g/t at the project’s Iris Zone, an underground deposit 100m below Boyd’s Dam and in close proximity to the proposed underground exploration tunnel.

CYL MD James said the completion of the maiden mineral resource is a significant milestone for Catalyst Metals [and] the discovery of the Iris Zone demonstrates the true potential of the Bendigo Goldfields.

“Iris has been known for a long time and there are many similar nearby prospects already with high-grade intercepts,” Champion de Crespigny said.

“These need to be tested. Further, the location of Iris – in close proximity to both Boyd’s Dam and the proposed exploration tunnel – is significant as it has the potential to underwrite its cost.”

CYL has been on a growth mission so far this year, taking over Vango Mining and planning a merger with the owner of WA’s Plutonic gold mine, Canadian miner Superior Gold (TSX-V:SGI).

MUSGRAVE MINERALS (ASX:MGV)

An extension drilling program at its flagship Cue gold project has uncovered multiple high-grade hits well above its resource grade of 10.2g/t at its Break of Day deposit.

Standout intersections include a mouth-watering 1m @ 845.1g/t from 24m within a broader 60.3g/t from just 14m, and 2m @248g/t from 36m and from within 9m @ 61.4g/t from 36m.

“These are fantastic results and continue to demonstrate the exceptional quality of the Cue gold project,” MGV MD Rob Waugh said.

“This and ongoing work is focused on further enhancing the project economics by growing resources, de-risking the project and adding to the initial five-year mine life.”

MGV’s Stage 1 PFS showed the Cue project would be a very high margin, low-cost operation running for an initial five years and delivering a pre-tax net present value of $235m and pre-tax internal rate of return of 95%, with a quick nine-month payback.

The Stage 1 PFS has an MRE for Break of Day pegged with 668,000t @ 7g/t for 149,300oz in open pit mining, with a subsequent underground mine inventory of 484,000t at 4.8g/t for 75,200oz to total 262,000oz.

“Following the strong financial metrics of the stage one pre-feasibility study in April 2023, the company has continued drilling to progress resource conversion and growth,” Waugh noted.

“This drilling is continuing to deliver excellent results at the Cue gold project in both extensional and infill drilling.”

The Break of Day deposit adds to its Lena and other regional deposits which have a current combined total resource of 927,000oz.

No doubt there’ll be more interesting news out of this gold explorer sooner rather than later.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.