Gold Digger: Aussie gold price hits ALL TIME HIGH as global conflicts rage

Pic via Getty Images

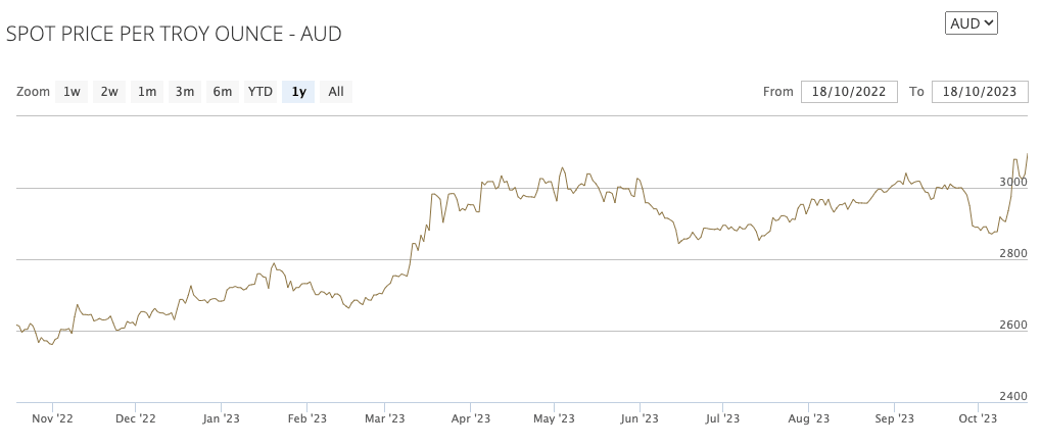

- Gold priced in Aussie dollars has hit its all-time high, soaring to $3,130/oz

- Amid escalating conflict in the Middle East, not to mention ongoing war in Ukraine, financial analysts see gold trending up

- JP Morgan says it’s allocating to the precious metal

For the second week running, gold has seen its time-honoured ‘flight to safety’ narrative come to the fore amid increasingly dire conflict in the Middle East.

Rounding out the week, at the time of writing, spot gold is changing hands for US$1,977, and just about $3,130 of our Aussie dollars – an all time high for bullion Down Under.

The new Aussie high beats the old record of $3073/oz set only about a week ago, on October 13.

Gold prices are now up about 3.3% over the past week, +7.3% year to date and roughly +20% over the past 12 months. US gold futures have also gained a bit more than 1% over the past week.

The latest surge in the yellow metal came amid/after the bombing of a Gaza hospital this week, which reportedly killed about 500 people and has seen both sides of the conflict apportioning blame for the attack.

Meanwhile, markets have also been digesting the latest noise from the Fed, specifically its chief Jerome Powell who spoke last night (AEDT) signalling no likely change to interest rates for November but leaving the door ajar for a potential hike in December.

Either way, plenty of gold-watching analysts are reasonably positive on the metal for now.

Models are dead.

Rates up.

Gold up.We have moved past the circus and into the horror house.

— Gold Telegraph ⚡ (@GoldTelegraph_) October 19, 2023

Gold to hit US$2,000 next, believe analysts

“Elevated risks in the Middle East are prompting safe-haven demand for gold, [and] the technical also has improved,” said Jim Wyckoff, senior analyst at Kitco Metals, in conversation with Reuters this week.

“I think gold will push above $2,000 in the near term,” he added, caveating:

“Gold will pull back if the Middle East situation simmers down, but right now the market place is expecting a further escalation.”

US$2k is a figure Sprott Asset Management’s Ryan McIntyre agrees with, though, as a short-term target.

“Gold could breach $2,000 in the near-term if there is an escalation of geopolitical conflict,” noted the financial analyst.

“Additionally, having the Fed pause rate increases or hint at a lower probability of increases in the future would be viewed positively,” he added.

On the more cautious side of the ledger, meanwhile, there’s City Index market analyst Fawad Razaqzada, who said in a note that with the dollar maintaining its bullish trend and bond yields on the rise again, it’s not going to take much to slam gold back down.

Walsh Trading’s Sean Lusk, however, told Kitco News that under current conditions, he expects gold prices to keep rising regardless of what bond yields do. He also sees the narrative around oil providing bullion with a boost.

Fears for oil and gas supplies as well as political uncertainty in the Middle East are growing by the day.

As Kitco notes:

Oil has also gone on a tear since the conflict began, with WTI crude rising from $81 per barrel on the day of the Hamas attacks to over $89 today, and Brent crude going from $83 to $92 at last trade.

Lusk calls all the contributing factors right now (world conflicts, US debt ceiling concerns again, as-yet-untamed inflation and more) a “perfect storm for precious metals or safer havens”.

“We saw the run last week up to 1946, market backed off, down 25 bucks, then made new highs. So in that vein, this is bullish. It’s going to be close to $2,100, that’s where I can see this going,” added the analyst.

Malaysia to revisit using the gold dinar as a reserve currency says Prime Minister.

Prime Minister Datuk Seri Anwar Ibrahim said the matter will be discussed during the upcoming meeting on Islamic economics and finance held in December.

"If we can get between five and six per…

— BullionStar (@BullionStar) October 19, 2023

JP Morgan is buying

What’s the old Monopoly man company got to say, though? Aside from “Head straight to Go and collect $200”, some quite interesting things as it turns out.

In investment banking giant JP Morgan’s latest Global Markets Strategy report, chief market strategist Marko Kolanovic suggested the bank is cautious on equities “as long as interest rates remain deeply restrictive, valuations expensive, and the overhang of geopolitical risks persists”.

(They’re more bullish on equities broadly over the longer term, though – read here.)

That said, Kolanovic noted that the investment banking titan is currently putting more into bonds and commodities, and gold in particular.

“While it remains uncertain whether bonds have bottomed, we add back 1% to our government bond allocation given geopolitical risk, cheap valuations, and less pronounced positioning,” he said.

“We additionally increase our allocation within commodities to gold, both as a geopolitical hedge, and given an expected retracement in real bond yields.”

JP Morgan’s report projected spot gold prices to average around $1,920 per ounce in Q4 2023. Their quarter-by-quarter projections for 2024 are $1,950 in Q1, $2,030 in Q2, $2,100 in Q3, and $2,175 by Q4.

If things continue in the current vein, however, those figures from old JP might need a revision.

Biggest gold producer on the planet?

ChinaWhich central bank has been buying the most amount of gold in 2023?

ChinaWhich country is dumping US treasuries?

ChinaWhich investors are dumping US securities?

ChinaWhat else needs to be said?

Record premium last month as well.

— Gold Telegraph ⚡ (@GoldTelegraph_) October 19, 2023

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected] and/or [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.016 | 3% | 7% | -64% | $16,815,446 |

| NPM | Newpeak Metals | 0.001 | 0% | 0% | 0% | $9,995,579 |

| ASO | Aston Minerals Ltd | 0.035 | 0% | -13% | -54% | $46,622,314 |

| MTC | Metalstech Ltd | 0.16 | -18% | -11% | -61% | $32,062,780 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| GED | Golden Deeps | 0.051 | -6% | -12% | -64% | $5,891,640 |

| G88 | Golden Mile Res Ltd | 0.02 | 0% | -46% | -21% | $7,246,569 |

| DCX | Discovex Res Ltd | 0.002 | 0% | -20% | -50% | $6,605,136 |

| NMR | Native Mineral Res | 0.051 | 13% | -2% | -61% | $11,285,995 |

| AQX | Alice Queen Ltd | 0.014 | 0% | 8% | -72% | $1,771,208 |

| SLZ | Sultan Resources Ltd | 0.018 | -14% | -33% | -81% | $2,667,421 |

| MKG | Mako Gold | 0.019 | 36% | 0% | -54% | $10,944,155 |

| KSN | Kingston Resources | 0.086 | 5% | -3% | 13% | $42,824,718 |

| AMI | Aurelia Metals Ltd | 0.0975 | 6% | -3% | -7% | $156,727,618 |

| PNX | PNX Metals Limited | 0.003 | 0% | 0% | -20% | $21,522,499 |

| GIB | Gibb River Diamonds | 0.038 | 46% | 27% | -36% | $8,037,359 |

| KCN | Kingsgate Consolid. | 1.15 | 0% | -5% | -22% | $296,414,446 |

| TMX | Terrain Minerals | 0.004 | -20% | 0% | -33% | $5,030,575 |

| BNR | Bulletin Res Ltd | 0.105 | -16% | 31% | -16% | $28,771,928 |

| NXM | Nexus Minerals Ltd | 0.04 | -11% | -25% | -78% | $15,951,465 |

| SKY | SKY Metals Ltd | 0.042 | 2% | -7% | -13% | $19,378,720 |

| LM8 | Lunnonmetalslimited | 0.7 | 1% | -12% | -5% | $152,197,958 |

| CST | Castile Resources | 0.049 | 4% | -13% | -48% | $11,611,316 |

| YRL | Yandal Resources | 0.053 | 18% | 4% | -50% | $8,363,563 |

| FAU | First Au Ltd | 0.003 | 20% | -14% | -40% | $3,629,983 |

| ARL | Ardea Resources Ltd | 0.495 | -18% | -20% | -48% | $95,384,338 |

| GWR | GWR Group Ltd | 0.073 | -1% | -23% | 16% | $22,645,774 |

| IVR | Investigator Res Ltd | 0.038 | 0% | -7% | -24% | $53,175,291 |

| GTR | Gti Energy Ltd | 0.008 | -6% | -11% | -49% | $16,359,577 |

| IPT | Impact Minerals | 0.0095 | -21% | -21% | 46% | $28,647,039 |

| BNZ | Benzmining | 0.36 | 4% | -23% | -28% | $42,465,560 |

| MOH | Moho Resources | 0.007 | -13% | -13% | -71% | $2,380,311 |

| BBX | BBX Minerals Ltd | 0.025 | 4% | -38% | -58% | $16,386,548 |

| PUA | Peak Minerals Ltd | 0.0035 | 0% | 17% | -56% | $3,644,818 |

| MRZ | Mont Royal Resources | 0.17 | 0% | -24% | -11% | $13,990,139 |

| SMS | Starmineralslimited | 0.045 | 13% | 13% | -48% | $1,631,376 |

| MVL | Marvel Gold Limited | 0.01 | -9% | 0% | -58% | $9,501,698 |

| PRX | Prodigy Gold NL | 0.008 | 14% | 0% | -27% | $14,008,863 |

| AAU | Antilles Gold Ltd | 0.022 | -4% | -4% | -54% | $17,443,955 |

| CWX | Carawine Resources | 0.11 | -19% | 0% | 28% | $21,649,921 |

| RND | Rand Mining Ltd | 1.3 | -4% | -5% | -9% | $72,516,850 |

| CAZ | Cazaly Resources | 0.035 | 0% | -15% | 13% | $13,825,105 |

| BMR | Ballymore Resources | 0.12 | 26% | 9% | -41% | $17,543,672 |

| DRE | Dreadnought Resources Ltd | 0.043 | -4% | -20% | -57% | $151,517,676 |

| ZNC | Zenith Minerals Ltd | 0.094 | -6% | 1% | -70% | $32,771,422 |

| REZ | Resourc & En Grp Ltd | 0.015 | 0% | -6% | -21% | $7,497,087 |

| LEX | Lefroy Exploration | 0.17 | 0% | -15% | -42% | $33,371,298 |

| ERM | Emmerson Resources | 0.065 | 7% | 0% | -21% | $33,227,297 |

| AM7 | Arcadia Minerals | 0.095 | -10% | -14% | -68% | $10,359,760 |

| ADT | Adriatic Metals | 3.43 | -7% | -8% | 57% | $839,059,666 |

| GMR | Golden Rim Resources | 0.02 | -9% | -20% | -46% | $11,831,767 |

| CYL | Catalyst Metals | 0.68 | 17% | 46% | -46% | $139,755,590 |

| CHN | Chalice Mining Ltd | 1.87 | -19% | -30% | -55% | $729,306,195 |

| KAL | Kalgoorliegoldmining | 0.028 | 0% | 0% | -73% | $4,453,022 |

| MLS | Metals Australia | 0.034 | 6% | 3% | -21% | $20,593,194 |

| ADN | Andromeda Metals Ltd | 0.021 | 0% | -13% | -50% | $62,200,169 |

| MEI | Meteoric Resources | 0.2175 | -1% | -15% | 1713% | $407,537,996 |

| SRN | Surefire Rescs NL | 0.014 | 8% | -7% | 0% | $23,119,089 |

| SIH | Sihayo Gold Limited | 0.002 | 0% | 0% | 33% | $24,408,512 |

| WA8 | Warriedarresourltd | 0.06 | -3% | -21% | -54% | $29,220,958 |

| HMX | Hammer Metals Ltd | 0.041 | -7% | -23% | -21% | $36,342,701 |

| WCN | White Cliff Min Ltd | 0.0115 | 5% | 5% | -39% | $14,455,713 |

| AVM | Advance Metals Ltd | 0.003 | -40% | -50% | -79% | $1,765,676 |

| WRM | White Rock Min Ltd | 0.063 | 0% | 0% | -22% | $17,508,200 |

| ASR | Asra Minerals Ltd | 0.008 | 0% | 0% | -70% | $11,523,097 |

| MCT | Metalicity Limited | 0.002 | -20% | 33% | -50% | $9,340,215 |

| AME | Alto Metals Limited | 0.045 | 0% | -4% | -42% | $32,139,004 |

| CTO | Citigold Corp Ltd | 0.004 | -11% | -11% | -33% | $11,494,636 |

| TIE | Tietto Minerals | 0.4125 | 11% | 15% | -40% | $467,991,537 |

| SMI | Santana Minerals Ltd | 0.535 | -2% | -9% | -22% | $92,762,879 |

| M2R | Miramar | 0.035 | -22% | -30% | -63% | $5,954,782 |

| MHC | Manhattan Corp Ltd | 0.005 | 25% | -38% | -29% | $17,621,879 |

| GRL | Godolphin Resources | 0.038 | -5% | -10% | -55% | $6,092,713 |

| TRY | Troy Resources Ltd | 0 | -100% | -100% | -100% | $62,920,961 |

| SVG | Savannah Goldfields | 0.063 | 0% | -5% | -68% | $12,627,734 |

| EMC | Everest Metals Corp | 0.11 | -8% | -12% | 10% | $14,661,142 |

| GUL | Gullewa Limited | 0.055 | 0% | 0% | -18% | $10,767,521 |

| CY5 | Cygnus Metals Ltd | 0.13 | -10% | -33% | -72% | $43,506,396 |

| G50 | Gold50Limited | 0.125 | 4% | -19% | 4% | $15,618,675 |

| ADV | Ardiden Ltd | 0.004 | -27% | -33% | -43% | $14,785,844 |

| AAR | Astral Resources NL | 0.085 | 4% | 16% | 31% | $65,562,589 |

| MGV | Musgrave Minerals | 0 | -100% | -100% | -100% | $230,571,100 |

| VMC | Venus Metals Cor Ltd | 0.11 | -8% | -15% | 35% | $20,870,155 |

| NAE | New Age Exploration | 0.006 | 20% | -25% | -33% | $9,866,444 |

| VKA | Viking Mines Ltd | 0.009 | -25% | -10% | 13% | $10,252,584 |

| LCL | LCL Resources Ltd | 0.03 | 15% | 3% | 32% | $22,240,525 |

| MTH | Mithril Resources | 0.0015 | -25% | -25% | -70% | $5,053,207 |

| ADG | Adelong Gold Limited | 0.007 | 0% | -13% | -13% | $4,174,256 |

| RMX | Red Mount Min Ltd | 0.004 | 0% | 0% | -27% | $10,694,304 |

| PRS | Prospech Limited | 0.025 | 9% | -7% | -3% | $5,054,479 |

| XTC | Xantippe Res Ltd | 0.001 | 0% | 0% | -79% | $17,528,005 |

| TTM | Titan Minerals | 0.04 | 8% | 0% | -49% | $54,898,317 |

| NML | Navarre Minerals Ltd | 0.019 | 0% | 0% | -58% | $28,555,654 |

| MZZ | Matador Mining Ltd | 0.045 | -6% | -20% | -54% | $15,143,714 |

| KZR | Kalamazoo Resources | 0.095 | 0% | -10% | -50% | $16,449,624 |

| BCN | Beacon Minerals | 0.027 | 8% | 8% | 8% | $101,432,741 |

| MAU | Magnetic Resources | 1.045 | 31% | 31% | 14% | $239,214,951 |

| BC8 | Black Cat Syndicate | 0.1875 | -6% | -23% | -42% | $55,637,477 |

| EM2 | Eagle Mountain | 0.075 | 4% | -9% | -61% | $23,177,482 |

| EMR | Emerald Res NL | 2.84 | 14% | 8% | 150% | $1,752,449,689 |

| BYH | Bryah Resources Ltd | 0.014 | 0% | -13% | -38% | $5,020,474 |

| HCH | Hot Chili Ltd | 1.04 | -5% | -24% | 11% | $125,417,466 |

| WAF | West African Res Ltd | 0.75 | 4% | -12% | -25% | $779,845,939 |

| MEU | Marmota Limited | 0.032 | 0% | -6% | -35% | $33,881,618 |

| NVA | Nova Minerals Ltd | 0.265 | 0% | 8% | -61% | $59,049,189 |

| DCN | Dacian Gold Ltd | 0.285 | 128% | 159% | 104% | $358,956,277 |

| SVL | Silver Mines Limited | 0.17 | 0% | -8% | 0% | $245,758,125 |

| PGD | Peregrine Gold | 0.26 | -4% | -13% | -56% | $13,763,515 |

| ICL | Iceni Gold | 0.065 | -11% | -29% | -24% | $16,310,286 |

| FG1 | Flynngold | 0.068 | 0% | 13% | -32% | $8,319,338 |

| WWI | West Wits Mining Ltd | 0.015 | 7% | 0% | -17% | $32,498,210 |

| RML | Resolution Minerals | 0.0055 | 10% | 10% | -59% | $6,915,105 |

| AAJ | Aruma Resources Ltd | 0.033 | 3% | -6% | -53% | $6,497,420 |

| AL8 | Alderan Resource Ltd | 0.011 | -15% | 38% | 22% | $7,400,336 |

| GMN | Gold Mountain Ltd | 0.005 | -17% | -29% | -17% | $11,345,393 |

| MEG | Megado Minerals Ltd | 0.031 | -3% | -18% | -61% | $8,397,033 |

| HMG | Hamelingoldlimited | 0.088 | -2% | 4% | -45% | $13,230,000 |

| TBA | Tombola Gold Ltd | 0.026 | 0% | 0% | -21% | $33,129,243 |

| BM8 | Battery Age Minerals | 0.21 | -16% | -32% | -58% | $19,164,431 |

| TBR | Tribune Res Ltd | 3.05 | 0% | -8% | -7% | $160,027,635 |

| FML | Focus Minerals Ltd | 0.16 | 0% | -6% | 14% | $41,551,004 |

| GSR | Greenstone Resources | 0.008 | -11% | -24% | -70% | $11,606,039 |

| VRC | Volt Resources Ltd | 0.008 | -6% | 7% | -73% | $31,515,391 |

| ARV | Artemis Resources | 0.02 | -23% | -44% | -50% | $29,923,449 |

| HRN | Horizon Gold Ltd | 0.3 | -4% | -11% | -6% | $37,554,492 |

| CLA | Celsius Resource Ltd | 0.011 | 0% | 0% | -15% | $24,706,568 |

| QML | Qmines Limited | 0.088 | -4% | -10% | -41% | $18,641,214 |

| RDN | Raiden Resources Ltd | 0.023 | -12% | -34% | 169% | $56,060,764 |

| TCG | Turaco Gold Limited | 0.05 | 0% | -14% | 11% | $25,135,833 |

| KCC | Kincora Copper | 0.03 | 3% | -19% | -53% | $4,967,039 |

| GBZ | GBM Rsources Ltd | 0.016 | 7% | -6% | -61% | $9,925,149 |

| DTM | Dart Mining NL | 0.02 | -9% | -26% | -78% | $3,806,269 |

| MKR | Manuka Resources. | 0.045 | 5% | -2% | -65% | $23,625,843 |

| AUC | Ausgold Limited | 0.031 | 2% | -11% | -28% | $68,884,236 |

| ANX | Anax Metals Ltd | 0.036 | 9% | -33% | -40% | $15,476,541 |

| EMU | EMU NL | 0.002 | 0% | -33% | -52% | $2,900,043 |

| SFM | Santa Fe Minerals | 0.043 | 0% | -2% | -49% | $3,131,208 |

| SSR | SSR Mining Inc. | 22.37 | 9% | -3% | 3% | $487,714,477 |

| PNR | Pantoro Limited | 0.044 | 13% | -4% | -74% | $213,365,251 |

| CMM | Capricorn Metals | 4.805 | 9% | 8% | 48% | $1,793,320,495 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | -7% | $130,184,182 |

| SI6 | SI6 Metals Limited | 0.0055 | -8% | -39% | 10% | $9,969,297 |

| HAW | Hawthorn Resources | 0.091 | -1% | -24% | 1% | $30,486,421 |

| BGD | Bartongoldholdings | 0.24 | 4% | 14% | 55% | $45,945,742 |

| SVY | Stavely Minerals Ltd | 0.07 | 1% | -5% | -53% | $25,667,471 |

| AGC | AGC Ltd | 0.061 | 3% | 5% | -8% | $6,250,000 |

| RVR | Red River Resources | 0 | -100% | -100% | -100% | $37,847,908 |

| RGL | Riversgold | 0.012 | -8% | 0% | -75% | $11,415,137 |

| TSO | Tesoro Gold Ltd | 0.02 | 33% | 0% | -49% | $17,911,414 |

| OKR | Okapi Resources | 0.115 | -4% | -30% | -53% | $24,159,892 |

| CPM | Coopermetalslimited | 0.125 | 4% | -14% | -62% | $6,386,118 |

| MM8 | Medallion Metals. | 0.07 | 11% | 4% | -62% | $22,142,034 |

| AUT | Auteco Minerals | 0.03 | 3% | -23% | -32% | $135,401,707 |

| CBY | Canterbury Resources | 0.027 | 0% | 0% | -39% | $3,902,135 |

| LYN | Lycaonresources | 0.215 | -9% | -30% | -14% | $8,614,781 |

| SFR | Sandfire Resources | 5.91 | -4% | -8% | 58% | $2,709,964,956 |

| NCM | Newcrest Mining | 24.795 | 3% | 0% | 52% | $22,480,960,602 |

| TMZ | Thomson Res Ltd | 0.005 | 0% | 0% | -74% | $4,881,018 |

| TAM | Tanami Gold NL | 0.039 | 5% | -3% | -5% | $45,828,785 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | $74,238,031 |

| NWM | Norwest Minerals | 0.031 | -6% | -6% | 11% | $9,489,794 |

| ALK | Alkane Resources Ltd | 0.655 | 4% | 4% | 2% | $379,677,746 |

| BMO | Bastion Minerals | 0.017 | -6% | -26% | -75% | $3,346,484 |

| IDA | Indiana Resources | 0.057 | -2% | -14% | 8% | $29,627,183 |

| GSM | Golden State Mining | 0.034 | -11% | -13% | -11% | $6,879,178 |

| NSM | Northstaw | 0.035 | 9% | -5% | -75% | $4,204,445 |

| GSN | Great Southern | 0.026 | 4% | 18% | -38% | $19,620,515 |

| RED | Red 5 Limited | 0.315 | 2% | 19% | 110% | $1,125,211,506 |

| DEG | De Grey Mining | 1.29 | 8% | 0% | 29% | $2,338,823,985 |

| THR | Thor Energy PLC | 0.026 | -7% | -42% | -68% | $4,761,086 |

| CDR | Codrus Minerals Ltd | 0.06 | -6% | -35% | -14% | $5,235,000 |

| MDI | Middle Island Res | 0.02 | -5% | 5% | -68% | $3,094,481 |

| BAT | Battery Minerals Ltd | 0.035 | 35% | -10% | -77% | $4,186,157 |

| POL | Polymetals Resources | 0.285 | -2% | -14% | 50% | $42,370,444 |

| RDS | Redstone Resources | 0.007 | -13% | 0% | -13% | $6,099,649 |

| NAG | Nagambie Resources | 0.02 | 11% | -17% | -75% | $11,052,800 |

| BGL | Bellevue Gold Ltd | 1.4975 | 5% | -2% | 117% | $1,699,800,725 |

| GBR | Greatbould Resources | 0.064 | 2% | 2% | -29% | $33,001,263 |

| KAI | Kairos Minerals Ltd | 0.019 | 0% | -14% | -25% | $52,418,244 |

| KAU | Kaiser Reef | 0.195 | 15% | 5% | 11% | $28,836,059 |

| HRZ | Horizon | 0.031 | -9% | -24% | -45% | $19,627,543 |

| CAI | Calidus Resources | 0.13 | -10% | -26% | -65% | $79,024,382 |

| CDT | Castle Minerals | 0.009 | -10% | -18% | -67% | $10,682,683 |

| RSG | Resolute Mining | 0.365 | 1% | 3% | 104% | $777,103,255 |

| MXR | Maximus Resources | 0.038 | 36% | 36% | -14% | $11,221,202 |

| EVN | Evolution Mining Ltd | 3.675 | 4% | -1% | 83% | $6,613,861,925 |

| CXU | Cauldron Energy Ltd | 0.0085 | -6% | -22% | -23% | $7,788,549 |

| DLI | Delta Lithium | 0.6525 | -6% | -20% | 13% | $357,622,297 |

| ALY | Alchemy Resource Ltd | 0.011 | 10% | 0% | -59% | $12,958,839 |

| HXG | Hexagon Energy | 0.008 | -11% | -11% | -47% | $4,103,327 |

| OBM | Ora Banda Mining Ltd | 0.115 | 19% | -4% | 44% | $187,324,749 |

| SLR | Silver Lake Resource | 1.005 | 3% | 9% | -14% | $930,070,611 |

| AVW | Avira Resources Ltd | 0.001 | -33% | -33% | -71% | $3,200,685 |

| LCY | Legacy Iron Ore | 0.018 | -10% | 20% | -5% | $115,322,872 |

| PDI | Predictive Disc Ltd | 0.2325 | 13% | 3% | 29% | $475,696,140 |

| MAT | Matsa Resources | 0.027 | 0% | -7% | -23% | $12,843,199 |

| ZAG | Zuleika Gold Ltd | 0.016 | -11% | 33% | -6% | $8,368,810 |

| GML | Gateway Mining | 0.025 | -7% | -22% | -69% | $6,658,339 |

| SBM | St Barbara Limited | 0.205 | 8% | 3% | -6% | $163,594,076 |

| SBR | Sabre Resources | 0.032 | -3% | -30% | -47% | $9,619,044 |

| STK | Strickland Metals | 0.1025 | 14% | 97% | 138% | $142,501,187 |

| SAU | Southern Gold | 0.014 | -7% | 8% | -56% | $6,321,709 |

| CEL | Challenger Gold Ltd | 0.0785 | -8% | -10% | -56% | $93,329,492 |

| LRL | Labyrinth Resources | 0.007 | 17% | 17% | -64% | $8,312,806 |

| NST | Northern Star | 12.12 | 7% | 6% | 51% | $13,767,668,970 |

| OZM | Ozaurum Resources | 0.086 | -14% | -4% | 12% | $13,652,500 |

| TG1 | Techgen Metals Ltd | 0.029 | 16% | -17% | -78% | $2,237,880 |

| XAM | Xanadu Mines Ltd | 0.07 | -1% | -23% | 150% | $117,923,342 |

| CHZ | Chesser Resources | 0 | -100% | -100% | -100% | $65,818,414 |

| AQI | Alicanto Min Ltd | 0.043 | -17% | 5% | 10% | $26,351,983 |

| KTA | Krakatoa Resources | 0.017 | -15% | -23% | -72% | $7,828,163 |

| ARN | Aldoro Resources | 0.088 | -5% | -23% | -64% | $12,116,137 |

| WGX | Westgold Resources. | 2.005 | 8% | 7% | 155% | $925,932,437 |

| MBK | Metal Bank Ltd | 0.038 | 0% | 9% | -4% | $13,653,541 |

| A8G | Australasian Metals | 0.2 | -2% | 33% | -27% | $10,163,496 |

| TAR | Taruga Minerals | 0.009 | -10% | 0% | -72% | $6,354,241 |

| DTR | Dateline Resources | 0.01 | -9% | -29% | -85% | $8,854,428 |

| GOR | Gold Road Res Ltd | 1.8575 | 6% | 8% | 46% | $2,018,894,483 |

| S2R | S2 Resources | 0.205 | 3% | 17% | 52% | $79,967,847 |

| NES | Nelson Resources. | 0.004 | 0% | -20% | -49% | $2,454,377 |

| TLM | Talisman Mining | 0.145 | 4% | 4% | 0% | $26,364,849 |

| BEZ | Besragoldinc | 0.11 | -24% | -21% | 115% | $50,172,109 |

| PRU | Perseus Mining Ltd | 1.675 | 4% | -6% | 5% | $2,272,357,833 |

| SPQ | Superior Resources | 0.02 | 0% | -26% | -57% | $36,691,075 |

| PUR | Pursuit Minerals | 0.008 | -11% | -11% | -33% | $26,495,743 |

| RMS | Ramelius Resources | 1.7275 | 1% | 18% | 179% | $1,938,003,878 |

| PKO | Peako Limited | 0.007 | 17% | 17% | -61% | $3,689,593 |

| ICG | Inca Minerals Ltd | 0.018 | 0% | 0% | -51% | $8,863,195 |

| A1G | African Gold Ltd. | 0.044 | 0% | 5% | -36% | $6,772,448 |

| OAU | Ora Gold Limited | 0.007 | -13% | -13% | 40% | $35,913,927 |

| GNM | Great Northern | 0.021 | -16% | -13% | -65% | $3,092,582 |

| KRM | Kingsrose Mining Ltd | 0.048 | -4% | -13% | -9% | $36,121,273 |

| BTR | Brightstar Resources | 0.011 | 0% | -8% | -45% | $21,074,167 |

| RRL | Regis Resources | 1.6375 | 4% | 1% | 5% | $1,246,309,033 |

| M24 | Mamba Exploration | 0.035 | -22% | -39% | -71% | $2,134,417 |

| TRM | Truscott Mining Corp | 0.063 | 3% | 31% | 80% | $10,922,125 |

| TNC | True North Copper | 0.15 | -12% | -19% | 183% | $38,976,218 |

| MOM | Moab Minerals Ltd | 0.007 | 0% | -42% | -36% | $4,271,781 |

| KNB | Koonenberrygold | 0.041 | 0% | 0% | -46% | $4,909,713 |

| AWJ | Auric Mining | 0.05 | 14% | 11% | -38% | $6,542,980 |

| AZS | Azure Minerals | 2.46 | 2% | -5% | 734% | $1,074,292,163 |

| ENR | Encounter Resources | 0.26 | -16% | -16% | 108% | $94,926,187 |

| SNG | Siren Gold | 0.062 | -5% | -15% | -67% | $9,855,012 |

| STN | Saturn Metals | 0.13 | -19% | -19% | -50% | $21,000,019 |

| USL | Unico Silver Limited | 0.094 | 25% | -4% | -25% | $25,460,437 |

| PNM | Pacific Nickel Mines | 0.084 | 0% | -1% | 15% | $34,715,008 |

| AYM | Australia United Min | 0.003 | 0% | 0% | -25% | $5,527,732 |

| ANL | Amani Gold Ltd | 0.001 | 0% | 0% | -33% | $25,143,441 |

| HAV | Havilah Resources | 0.23 | -6% | -4% | -26% | $75,993,410 |

| SPR | Spartan Resources | 0.43 | 16% | 12% | 109% | $381,879,251 |

| PNT | Panthermetalsltd | 0.071 | 0% | 4% | -58% | $4,341,650 |

| MEK | Meeka Metals Limited | 0.04 | 11% | -20% | -37% | $45,066,439 |

| GMD | Genesis Minerals | 1.51 | 10% | -4% | 31% | $1,567,116,502 |

| PGO | Pacgold | 0.225 | 7% | 7% | -50% | $18,843,909 |

| FEG | Far East Gold | 0.165 | -13% | -6% | -76% | $29,800,025 |

| MI6 | Minerals260Limited | 0.39 | -13% | -24% | 30% | $94,770,000 |

| IGO | IGO Limited | 11.18 | -3% | -14% | -31% | $8,632,853,068 |

| GAL | Galileo Mining Ltd | 0.315 | -9% | 0% | -74% | $62,251,852 |

| RXL | Rox Resources | 0.225 | 0% | 5% | 2% | $79,207,053 |

| KIN | KIN Min NL | 0.05 | 32% | 28% | -32% | $55,373,076 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -94% | $12,357,082 |

| TGM | Theta Gold Mines Ltd | 0.14 | 4% | 12% | 75% | $98,710,501 |

| FAL | Falconmetalsltd | 0.15 | -3% | 15% | -25% | $25,665,000 |

| SXG | Southern Cross Gold | 0.78 | 5% | -8% | 129% | $70,243,386 |

| SPD | Southernpalladium | 0.42 | 6% | -13% | -60% | $18,092,897 |

| ORN | Orion Minerals Ltd | 0.017 | -6% | -6% | -6% | $102,360,624 |

| TMB | Tambourahmetals | 0.115 | -12% | -43% | -18% | $9,123,439 |

| TMS | Tennant Minerals Ltd | 0.027 | -7% | -16% | -7% | $21,264,135 |

| AZY | Antipa Minerals Ltd | 0.0135 | 4% | 13% | -50% | $56,467,588 |

| PXX | Polarx Limited | 0.009 | -5% | 0% | 0% | $14,036,551 |

| TRE | Toubaniresourcesinc | 0.11 | 0% | -15% | 0% | $12,928,173 |

| AUN | Aurumin | 0.029 | 4% | 16% | -68% | $8,953,292 |

| FXG | Felix Gold Limited | 0.065 | -6% | -18% | -54% | $7,715,916 |

| GPR | Geopacific Resources | 0.017 | 0% | 0% | -73% | $12,317,867 |

Best-performing goldies over the past week

Dacian Gold (ASX:DCN) +128% – read more here about Genesis Minerals’ takeover bid

Gibb River Diamonds (ASX:GIB) +46%

Maximus Resources (ASX:MXR) +36% – MXR has made a lithium move, more here

Mako Gold (ASX:MKG) +36%

Battery Minerals (ASX:BAT) +35% – read about BAT’s new gold acquisition here

Kin Mining (ASX:KIN) +32% – plus, KIN has some relationship to BAT’s news, too

Who else is turning heads?

Felix Gold (ASX:FXG) has uncovered high-grade, near-surface antimony at the NW Array prospect within its Treasure Creek project in Alaska, opening alternative commercialisation opportunities.

Per our special report:

The company’s 400sqkm Treasure Creek project lies in the Fairbanks gold mining district in the Tintina gold province of Alaska, a province boasting 100 years of gold production.

FXG’s ground, sandwiched between Kinross’ 11.8Moz Fort Knox mine (19km away) and Freegold Ventures’ 19.7Moz Golden Summit Project (18km away), returned a substantial discovery at the NW Array in 2022 as well as several other potential gold systems.

Latest drilling results from eight holes at the NW Array prospect have further confirmed the antimony opportunity at Treasure Creek with near surface results, including:

- 1.5m at 26% antimony from 22.86m, and 16.76m at 1.91% antimony from 51.82m;

- 6.1m at 13% antimony from 30.48m; and

- 6.1m at 7.96m antimony from 3.05m, including 1.52m at 28% antimony from 6.10m.

Antimony is emerging as a critical strategic metal in the US due to its significance in the production of military equipment.

Narratives, timing and sentiment – as important as they ever were.

FXG share price

At Stockhead we tell it like it is. While Felix Gold is a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.