Gold: Did Magnetic Resources’ HN9 project just go Super Saiyan?

Mining

Mining

WA-based explorer Magnetic Resources (ASX:MAU) quietly slipped into Stockhead’s top 10 biggest resources movers for 2019 with a 12 month, +278 per cent gain.

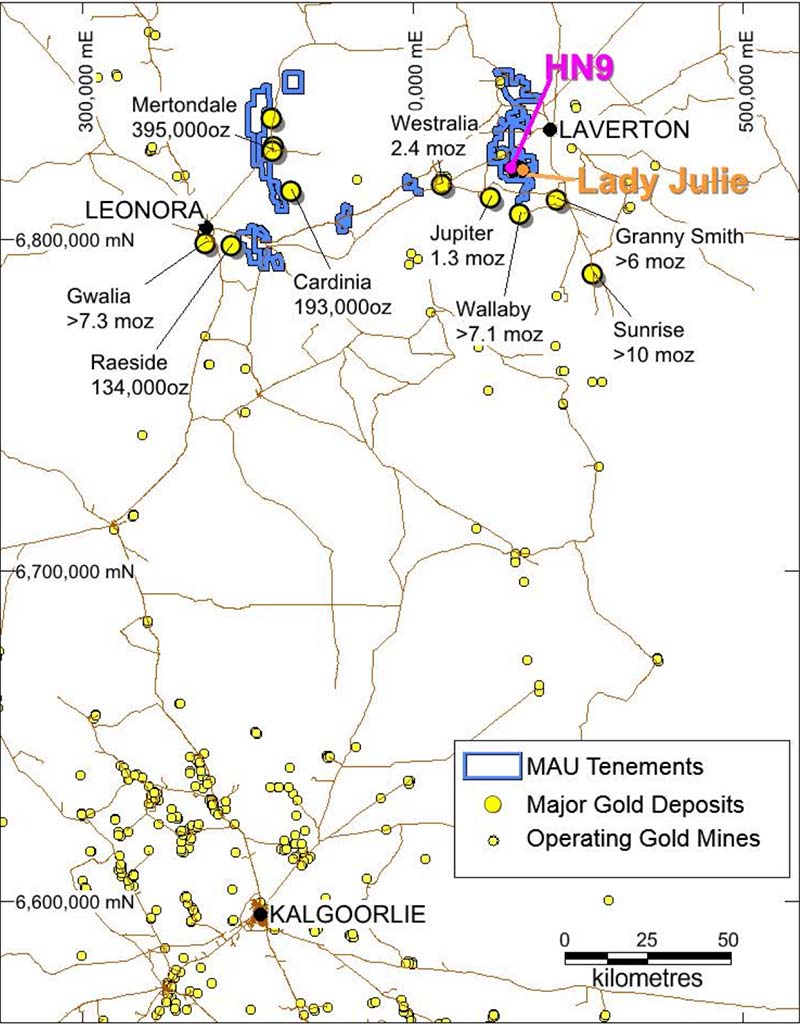

This former iron ore play may be onto something massive at Hawks Nest 9 (HN9) – a shallow, sub 50m-from-surface mineralised zone which is 3km long, 200m-wide and counting.

Today, the company announced the “breakthrough” discovery of a thick mineralised intrusive porphyry feeder zone up to 57m thick.

This porphyry is currently 400m long and counting.

This newly identified porphyry ‘crosscuts’ the near-surface flat dipping gold mineralisation “and may represent a ‘feeder zone’ of the entire 3km-long HN9 shallow dipping sequence”, Magnetic says.

Some of the thicker gold-mineralised zones encountered within this porphyry include 28m at 0.645 grams per tonne (g/t), just 4m from surface.

Magnetic says there are now three discernible mineralised zones within the sheared porphyry and sheared mafic/porphyry contacts.

Previously, the explorer had recognised only one.

These newly discovered zones are a potential indicator for deeper mineralisation, Magnetic says.

Case in point — all the nearby large deposits in the region including Wallaby (7Moz), Sunrise Dam (10Moz) and Jupiter (1.3Moz) have persistent internal shallow dipping mineralised lodes.

“With the Australian gold price at record levels of $2,249, the HN9 project — being only 15km from the Granny Smith operations owned by Gold Fields Australia and only 10km from the Jupiter operations owned by Dacian Gold at Laverton — is shaping up and has potential for a large-scale shallow deposit,” managing director George Sakalidis says.

“This significant 3km mineralised zone is coherent and is not closed off to the north and at depth and is so far defined by 465 RC [reverse circulation] holes totalling 20,484m.

“Also, the discovery of a thick mineralised intrusive porphyry feeder zone up to 57m thick and the multiple bands of silicified porphyry from deeper drilling, similar to the Wallaby and Jupiter Deposits, is a breakthrough and will be further investigated with an infill deeper drill program planned after assay results for the eight deeper holes are received shortly.”

The ~$100m market cap stock nudged 1.8 per cent higher to 55c per share in early trade.

Dreadnought Resources (ASX:DRE) – formerly Tychean Resources – has finalised the acquisition of the Metzke’s Find project; part of plans to consolidate the gold-rich Illaara Greenstone Belt in WA. Much of the underexplored belt was purchased last year from major miner Newmont, which had defined “several camp-scale (large) targets … undrilled due to a change in corporate focus”.

Metzke’s Find contains historic workings over ~700m of strike with shallow historic drilling results including 3m at 11.7g/t gold. A maiden 1,200m drill program will kick off in early March.

Black Cat Syndicate’s (ASX:BC8) 206,000oz Bulong project in WA keeps getting bigger. Recent drilling by the aspiring miner at the Myhree prospect included a #2 best ever intersection of 7.70m at 21.38g/t gold, 123.13m from surface.

“Numerous visible gold intersections and thick zones of high grade is also pleasing and reinforces our thoughts that Myhree offers a near-term, high-grade mining opportunity,” managing director Gareth Solly says. “We were also encouraged by numerous intercepts (like 1m at 13.10g/t gold from 29m) from drilling of early stage targets east of the Myhree-Boundary Corridor that were not previously drill tested.”