Gold: Aussie battler Blackham has a shocker, but things are (hopefully) getting better

Pic: Tyler Stableford / Stone via Getty Images

Perpetual battler Blackham Resources (ASX:BLK) has been trying to right the ship for years.

In 2016, Blackham celebrated first gold pour at the 6.7moz Matilda-Wiluna Gold operation in the Northern Goldfields of WA.

The aim was to ramp up to its Stage 1 production target of 100,000 ounces a year.

But since then, the oxide/free milling operations have been plagued by low gold grades, low throughput, high all in sustaining costs (AISC) and a pesky debt pile that just wouldn’t go away.

Blackham has worked exceptionally hard just to stay afloat.

In FY19, Blackham produced 65,406oz at an AISC of $1760/oz, which gives it some wriggle room at current +$2000/oz gold prices.

But the June quarter was a shocker – 12,045oz at an AISC of $2376/oz.

The market responded badly in morning trade, with the stock falling 16.7 per cent to 1c per share; a far cry from the late 2016 peak of 75c per share.

The company says it is also fielding a variety of funding and corporate transactions from unnamed parties, including a potential takeover.

While production guidance for FY20 isn’t available yet, fortunes are primed for a reversal during the September quarter, Blackham says.

And that debt pile is slowly evaporating.

The “face value” of debt decreased from $21.2m in the March quarter to $13.4m currently.

Blackham is keen to repay remaining debt facilities and transition to a low capex, low risk 100,000oz-120,000oz a year sulphide mining and tailings retreatment operation at Wiluna.

These underground sulphide resources are extensive, but more difficult to treat. Blackham wants to push the button on Stage 1 development in the December quarter.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

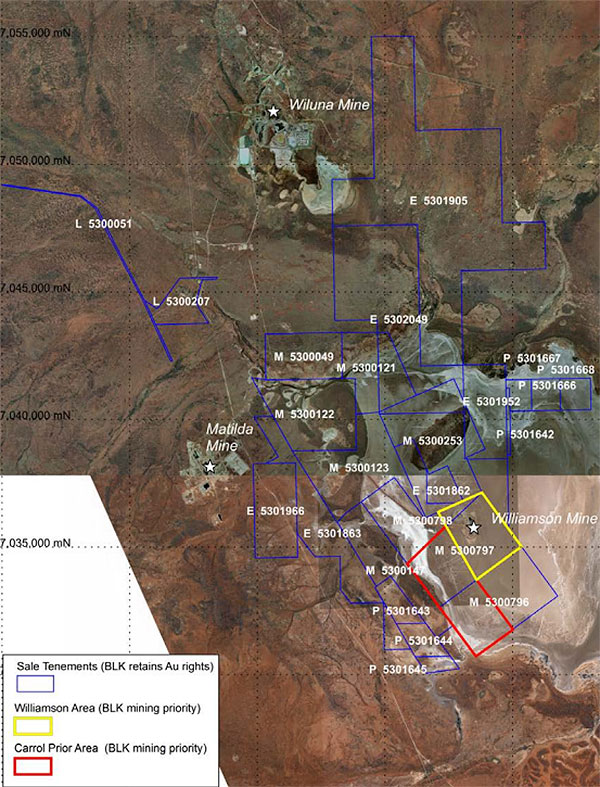

To further de-risk this transition Blackham has sold its adjacent, non-core Lake Way tenements to Salt Lake Potash (ASX:SO4) for a handy $10m.

Salt Lake will also contribute up to $10 million to the pre-strip of the 321,000oz Williamson open pit mine.

Why? Because the waste material can be used to construct its on-lake evaporation ponds.

That’s symbiosis right there.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.