Going worldwide: Maximus shares rocket in early trade on lithium partnerships with South Korean Government and LG Energy

Mining

Mining

Maximus is the latest explorer to attract cashed up partners, inking two potentially company changing deals with Korean government agency KOMIR and battery maker LG Energy over the Lefroy lithium project.

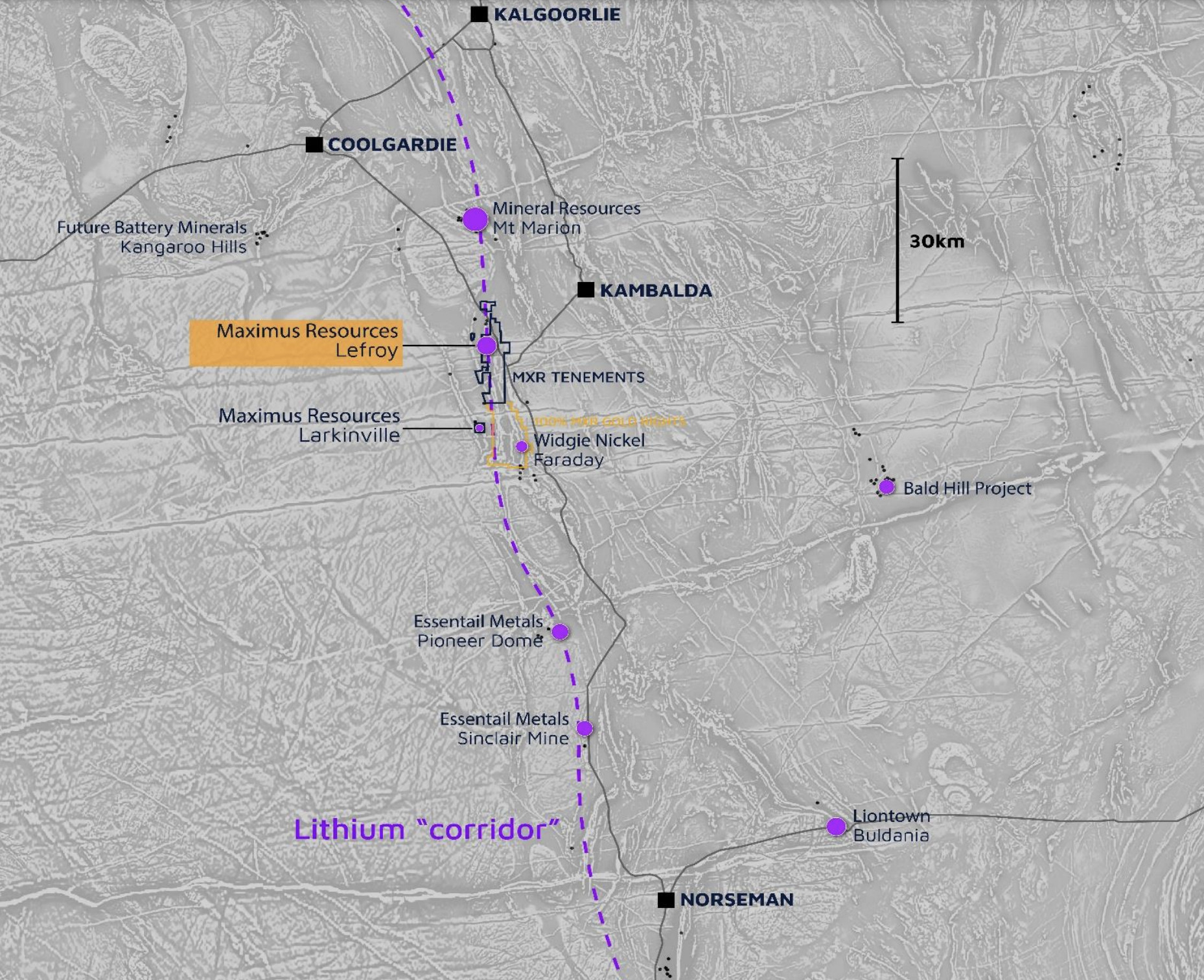

Maximus’s (ASX:MXR) early-stage Lefroy lithium project in WA’s Eastern Goldfields region includes a large area of shallow dipping stacked pegmatites, similar to the geological setting exhibited at Mineral Resources’ (ASX:MIN) world-class Mt Marion Mine, just 20km away.

Future Battery Minerals’ (ASX:FBM) Kangaroo Hills lithium project also sits nearby. FBM confirmed $7.6 million in funding earlier this year to drill its projects in WA and Nevada, USA, with a helping investment from Gina Rinehart’s Hancock Prospecting.

MXR’s Lefroy is one of a handful of projects within the famous ‘lithium corridor’ that stretches between Mt Marion to the north and Essential Metals’ (ASX:ESS) Pioneer Dome project to the south.

The area has attracted much investor attention in recent times given the aggressive corporate activity demonstrated by the likes of mining magnate Gina Rinehart for Liontown (ASX:LTR) and Mineral Resources’ (ASX:MIN) rich lister boss Chris Ellison.

In 2022, rock chip sampling from outcropping pegmatites returned assays up to 2.7% Li2O, 4,170ppm caesium and 17,250ppm rubidium, indicating the potential for domains of lithium enrichment within the multiple stacked pegmatite intrusions at the Lefroy project.

MXR’s farm in JV with the Korea Mine Rehabilitation and Mineral Recourse Corporation (KOMIR) now plans to follow up and expand on this geological understanding with 3,000m of drilling and undertaking 3,500 soil samples over the next four months.

Maximus will be responsible for managing the exploration and development activities during the farm-in period, with USD$3m (~A$4.8m) in financial support from KOMIR on lithium exploration activities to earn a 30% interest.

KOMIR is a Korean Government agency responsible for the country’s national resource security, including developing overseas mining and processing capacity to supply the Korean market.

In a separate non-binding MOU, global battery manufacturer LG Energy has acquired an option to snap up KOMIR’s interest in the joint venture.

The deal remains subject to approval from the Australian Foreign Investment Review board, but once it has received FIRB approval, MXR will expand the drill program to test several key lithium-bearing pegmatites, with the aid of the soil geochemistry sampling program.

Maximus will retain a significant upside, holding 70% interest in the Lithium JV at the end of the farm-in period.

South Korean investment in Australia’s battery minerals is part of a larger trend of cashed up international investors earmarking the high-quality critical minerals to be value added and shipped into Asian markets.

Australian Strategic Materials (ASX:ASM), for example, is working with Hyundai to develop its Dubbo rare earths project in New South Wales and recently kicked off operations at its South Korean metals plant in the Ochang Foreign Investment Zone.

“This is a significant partnership for the company and a strong endorsement of our lithium prospects with the backing from the Korean Government agency KOMIR,” MXR managing director Tim Wither says.

“Maximus is in a very strong position with a growing gold resource of 320,600oz on granted mining tenements, several exciting nickel prospects and now secured funding and support to advance our lithium prospects, while retaining a significant discovery exposure in one of the dominant hard-rock lithium-producing regions in the world.”

Maximus recently wrapped up drilling at the Hilditch gold deposit, a near term cash maker, and Kandui, a budding nickel sulphide discovery.

The 7,511oz Hilditch is just one of several highly prospective regional gold deposits in the company’s Spargoville tenements in WA.

Hilditch presents a near-term production opportunity for the company, especially given the ease of access to its shallow gold resource and its location close to several toll-treating gold operations.

This article was developed in collaboration with Maximus Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.