Godolphin says Budget surplus slice for projects will spur REE investment

Mining

Mining

A Federal Budget surplus of $9.3 billion has given further wind to Australia’s rare earths scene, providing additional funding initiatives to explorers such as Godolphin Resources looking to accelerate critical minerals projects.

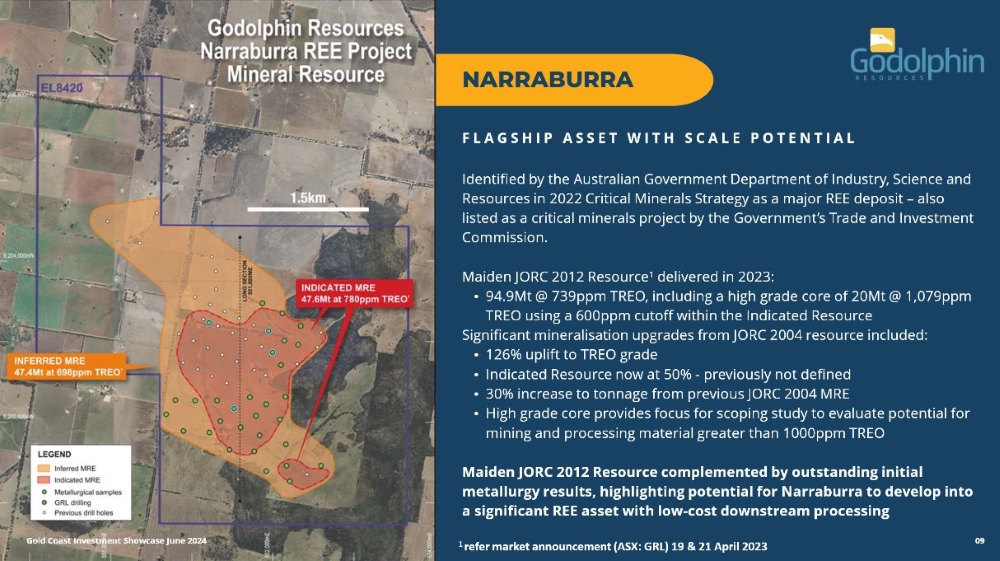

The explorer is in charge of one of Australia’s most promising major REE deposits, Narraburra, in NSW’s prolific Lachlan Ford mineralised belt, known for high-grade gold, copper, tin and now rare earths.

Stockhead spoke to Godolphin Resources (ASX:GRL) MD Jeneta Owens to give us her thoughts on the new initiatives and how critical minerals explorers are set to benefit from the surplus.

“It’s great that the government sees the long-term agenda, that all these minerals are required for transition into clean energy models,” Owens says.

“Assisting not just individual companies but promoting the refining capabilities as well.

“The trickle-down effect this has is really impactful. Investors see the government backing as a stamp of approval for what we’re doing, which it really is. That builds trust from the backers and helps projects develop.

“It’s been a long time coming and there’s a lot of positives around the sector for what lies ahead.”

After posting a $9.3 billion windfall, the Federal Government’s updated provision is:

A 10 per cent production tax credit totalling $7 billion over the decade for all 31 critical minerals to drive critical minerals processing in Australia

“This will enable us to realise the full value of our natural resources and maximise benefits for our nation,” says federal resources minister Madeleine King.

Inclusions:

The upgrade aims to hasten the development of tangible deposits into production. For REE deposits, it’s a more than welcome boost. Here’s why…

Those in the know have seen just how long it’s taken world-class deposits like Arafura Rare Earths’ (ASX:ARU) Nolans Bore or Lynas’ (ASX:LYC) Mt Weld to get going over the years.

That’s ‘cos governments and industries since the late ’80s got their fill from cheap Chinese labour that undercut the need for domestic supply chains.

And that’s bitten us in the tooshie now that China, the world’s second-largest economy, is deciding economic movements on its own terms.

The wakeup call is real and the West has finally come to terms with the necessity to diversify supply chains from China’s hegemony (which the West created, mind you); and both government and private backing for rare earths supplies outside the Middle Kingdom is at the top of many governments’ critical minerals list.

“The government clearly sees the extra demand for these types of products and the ongoing need for them into the future – particularly the support they’ve given Arafura,” Owens says.

“Investors themselves can see that these commodities are going to be needed in the future.”

Godolphin’s existing 94.9Mt at 739ppm TREO resource – which includes a high grade core of 20Mt at 1079ppm TREO (using a 600ppm cut-off) – may just get bigger, too.

The junior expanded the footprint of its landholding by another 112km2 recently, as well as putting ore samples through Phase 2 metallurgical testing via ANSTO, which achieved up to 95% recovery rates of the high-value magnetic rare earths neodymium and praseodymium (NdPr).

GRL has new target areas to dig up west of the current resource, which is the basis for ongoing drilling and resource expansion.

“We’re quite rich in the heavies (heavy rare earths) and they, and our lights extract really well,” Owens says.

“Industry standard at the moment is about 60% REE extraction across the board and from our samples so far we’ve averaged about 66%. With the higher grade core of the resource we’re pushing those numbers up to 95%.

“We’re looking forward to doing more metallurgy to increase and exploring out from our resource.”

At Stockhead we tell it like it is. While Godolphin Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.