Godolphin resource upgrade unlocks 421,000 gold ounces and 21M silver ounces

Godolphin’s upgrade to the Lewis Ponds gold, silver and base metals project includes indicated resources that point to development opportunities. Pic: Getty Images

- Godolphin’s new resource for Lewis Ponds underpins near-term development opportunities

- Resource upgrade delivers 470,000oz gold & 21Moz silver with tonnes up 58%

- Scoping mining study and metallurgical studies now underway along with planning for more drilling

Special Report: Godolphin’s upgrade to resources at its gold, silver and base metals Lewis Ponds project in the Lachlan Fold Belt of NSW has reiterated the potential for the company’s near-term development opportunities.

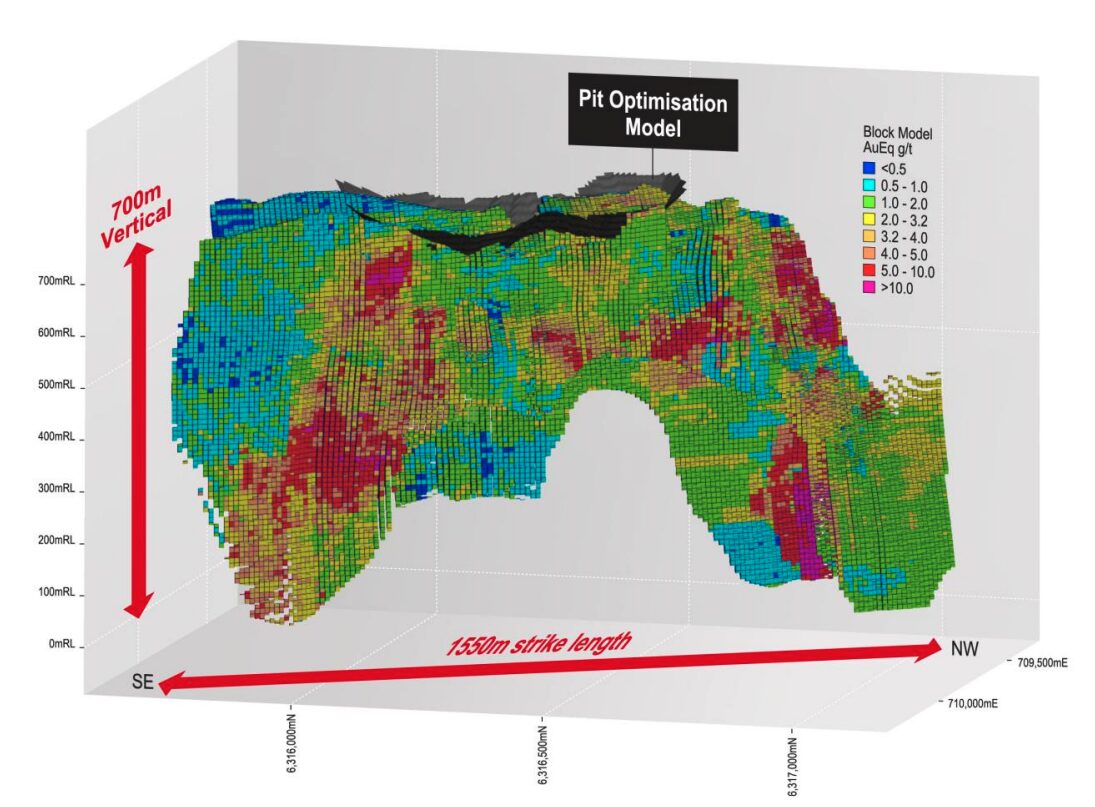

The updated resource confirms the project as a large, high-grade gold and silver deposit with a total inferred and indicated resources of 9.83Mt (5.01Mt Indicated, 4.82Mt Inferred) @ 1.49g/t Au, 66.15g/t Ag, 2.46% Zn, 1.38% Pb, 0.15% Cu.

This marked a 58% increase in overall tonnes, 18% rise in gold content to 470,000oz and a 31% uplift in silver to a whopping 21Moz.

Alongside the increased mineral resource confidence, the upgrade also delivered an open pit resource of 2.88Mt grading 0.52g/t gold, 41.22g/t silver, 1.52% zinc, 0.59% lead and 0.12% copper, or contained resources of 47,800oz gold, 3.8Moz silver, 44,000t zinc, 17,000t lead and 3,000t copper.

What makes this even more attractive as a development option is that 64% of this open pit resource – 14,000oz gold and 1.5Moz silver – sits in the higher confidence indicated category that has enough geological certainty to enable mine planning.

This allows Godolphin Resources (ASX:GRL) to use the resource to underpin the initial scoping study into the development of the project.

Lewis Ponds is an emerging gold discovery with significant silver and base metal co-products which covers ~148km2 about 15km east of Orange.

It hosts extensive historical gold and base metal workings stemming from the area’s active mining history.

Resource upgrade

The broader resource upgrade took resources from Lewis Ponds out from 6.2Mt at 2g/t gold, 80g/t silver, 2.7% zinc, 1.6% lead and 0.2% copper in the inferred category up to 9.83Mt at 1.49g/t gold, 66.15g/t silver, 2.46% zinc, 1.38% lead and 0.15% copper with more than half the tonnage (5.01Mt) in the indicated category.

Contained resources now total 470,000oz of gold, 20.9Moz of silver, 241,000t of zinc, 136,000t lead and 15,000t copper.

GRL had upgraded the resource based on the ~56.6km of diamond, 5848.2m of reverse circulation – and 2094.55m of combined RC and diamond drilling in 218 holes it had completed since the initial resource was released in February 2021.

There is also plenty of potential for growth as the resource, which is open in all directions, sits within a larger mineralised system which extends for 9km to the southeast.

Adding further interest, there are large gaps within the resource that could provide upside with further infill drilling.

‘A major increase from our previous MRE’

“These results have considerably exceeded our expectations and highlight the exceptional potential for the Lewis Ponds project,” GRL managing director Jeneta Owens said.

“Through infill drilling and improved geological understanding of the Spicer’s and Tom’s Lodes and the introduction of a portion of the Torphy’s Lode, we have significantly increased the global resource metal inventory, including 58% more tonnes, an 18% uplift to the contained gold to 470,000oz, and a massive 31% increase to the contained silver metal to 21Moz.

“Critically, this was achieved alongside increased mineral resource confidence, via the delivery of an open pit and underground resource sections which are classified as 64% and 45% Indicated, respectively.

“This is a major increase from our previous MRE, an exceptional milestone for Godolphin and provides a very strong foundation for the initial scoping mining study.”

Owens added there was growth potential with drilling of new lodes such as the Quarry Footwall Lode and more of the Torphy’s Lode, expected to be incorporated into future updates.

“Our geologists are developing additional drill programs, with a focus on targeting the copper-enriched exploration target and the polymetallic exploration target which was announced last month.”

In July 2025, GRL had outlined a Stage 1 copper-dominated exploration target of 3-5Mt grading between 1% and 1.5% copper, or 30,000-75,000t contained red metal, and a polymetallic dominant exploration target of 3-5Mt at 1.42-2.46g/t gold equivalent (gold, silver, zinc, lead and copper).

Next steps

GRL is now carrying out a scoping study underpinned by the upgraded resource estimate.

It’s also conducting metallurgical testwork aimed at improving both gold and silver recovery.

Results from these studies are expected to be delivered in the coming weeks.

Additionally, the company is planning to carry out additional drilling to underpin further resource growth.

This will test known mineralisation and exploration target areas.

This article was developed in collaboration with Godolphin Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.