Global gold output hits record highs, but Australia is about to fall back into the pack

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

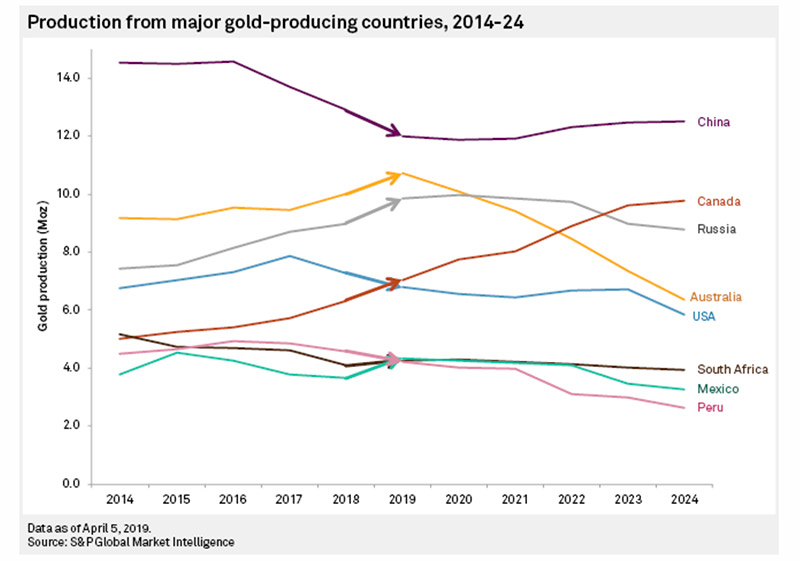

In 2019, global gold production will increase for the 11th straight year to reach a record high 109.6 million ounces, according to new data.

S&P Global Market Intelligence analyst Christopher Galbraith says these extra 2.3 million ounces for 2019 also represents the “strongest growth in the past three years”.

More than half of this 2.3-million-ounce increase will probably come from new mines. Mines like the 300,000 ounces per year Gruyere joint venture in Western Australia (50% Gold Fields 50% Gold Road Resources), which is expected to come online early in the June quarter.

But it’s all downhill from here – for Australia, anyway

Looking at the current project pipeline, global output will probably stay steady until 2022, Galbraith says.

“From there on, gold production is expected to fall by over 3 million ounces in 2023 and up to 5 million ounces in 2024.”

The 2024 drop will leave production 7.2 million ounces lower than 2019 levels. And if only half of this new production enters the market, gold production could be 13 million ounces lower than 2019 levels.

With some big mines reaching the end of their lives, Australia will be partly to blame. The current second-largest gold producing nation behind China is expected to fall to fourth place in 2024.

Check this out:

“We expect the country to slip to fourth place globally in 2024 due to depletion of several long-lived assets, including St. Ives, Paddington, Telfer, Edna May, Southern Cross and Agnew/Lawlers,” Galbraith says.

By 2024, Canada is the only major gold-producing country to increase output.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebookor Twitter

Could Aussie gold stocks step up to fill the gap?

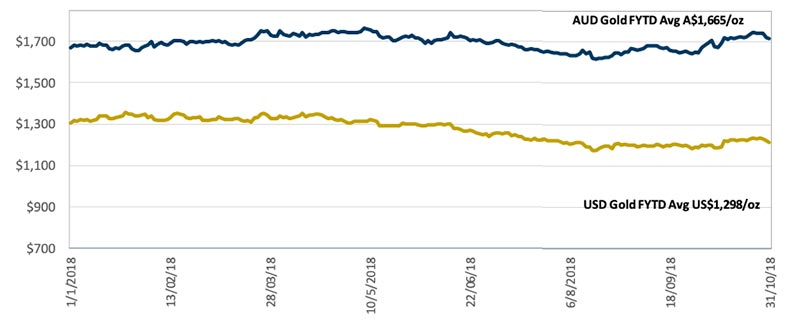

Australia is a great jurisdiction to be a gold producer, mostly because our gold price — compared to the $US benchmark — looks something like this:

At around $1780 per ounce, decent local producers are making good money right now.

Hedley Widdup, executive director at fund manager Lion Selection Group, says Australia is definitely an attractive place for gold miners to set up shop, but there’s still a lack of big tier 1 gold mines in the pipeline.

“It’s a great jurisdiction,” he told Stockhead.

“[But]I can’t think of much that could replace a tier one gold mine domestically.

“However, I wouldn’t be over eager to write off all the assets with a five-year or so life – gold mines have a habit of revealing secrets slowly.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.