Glencore-backed Leeuwin is listing with highly prospective nickel, lithium projects

Leeuwin Metals is all set to break new ground, ready to list on the ASX with an oversubscribed IPO in its pocket. Pic via Getty Images.

Leeuwin Metals is set to become one of the most promising critical metals explorer to list on the ASX following an oversubscribed initial public offering which drew major miner Glencore to take a cornerstone position.

Nor is Glencore content to take a passive position, choosing rather to actively engage the company through a technical committee which allows it to bring its nickel expertise to the table.

So just what drew the Swiss multinational to take the 9.97% stake in Leeuwin, which is due to list on the ASX on 29 March 2023 under the ticker code LM1 after raising $8m?

The answer is a combination of a very attractive suite of assets – particularly its flagship William Lake nickel sulphide project, located in the world-famous Thompson nickel belt in Manitoba, Canada along with a well-credentialled and experienced leadership team.

World class nickel address

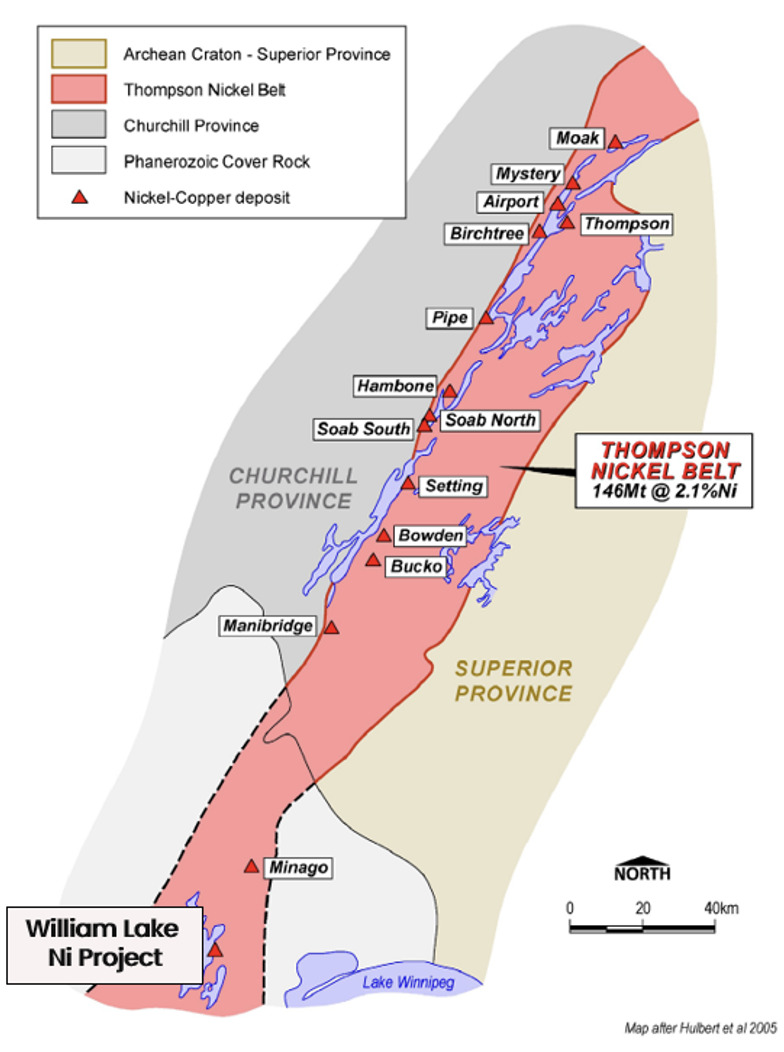

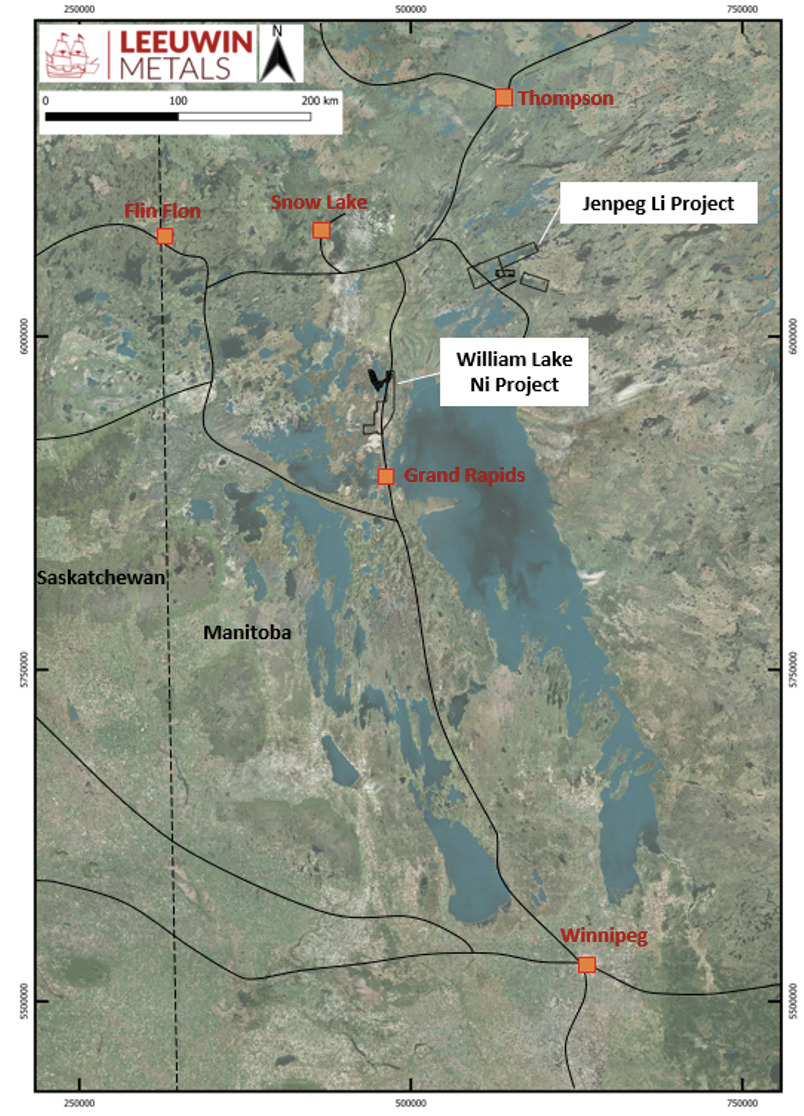

At the heart of Leeuwin’s offering is the highly intriguing William Lake project, which is located within the southern part of the world-class Thompson nickel belt in Manitoba, Canada.

This is a hot address for nickel exploration given that the belt hosts more than 18 nickel deposits and is the world’s fifth largest nickel mining camp with some 6 billion pounds of nickel produced since 1961. The Fraser Range in Western Australia is often compared to the Thompson Belt, this provides an opportunity for a Nova style deposit to be found.

William Lake covers over 500km2 of tenure and has all year-round access with excellent infrastructure provided by sealed roads via a provincial highway, connectivity to hydro for renewable energy, and a port to the north for exports to Europe.

While all these are strong points in the project’s favour, and it’s no wonder Leeuwin is set to shine as managing director Christopher Piggott told Stockhead the project boasts 152 existing holes which had uncovered high-grade nickel intercepts, this is what really drew the company to the project.

“Our main focus early on will be one of our high grade prospects, this trend at William Lake is host to Thompson style mineralisation, where this style of mineralization is seen at the Thompson Nickel Mine, operated by Vale” he noted.

“The William Lake project hosts a 3km long trend, 200m wide body. We have EM conductors and some of the drill hits from the previous explorers is 12.7m at 1.86% nickel plus 0.5g/t palladium and 7.8m at 1.7% nickel.

“Importantly, a lot of the previous drilling is very broad spaced of around 100m to 150m spacing. “This very broad spacing presents an opportunity to revisit the project and have a have another go to unlock value and unravel the geological story.”

Additional prospects at William Lake will also be explored one of these being a +1km long and +400m wide ultramafic body where previous drilling had returned hits such as 7.8m at 1.24% nickel from 216m, 15.7m at 1% nickel, 0.9g/t palladium and 0.42g/t platinum from 342.6m, and 9.87m at 1.48% nickel from 436.13m within the same hole

Lithium potential

For all of its obvious charms, William Lake isn’t the company’s only project – Leeuwin also holds the Jenpeg lithium project which shows enormous potential for lithium exploration.

“The project covers over 600 km2 of applications in a greenstone belt, and what we’re seeing there are swarms of pegmatites” Piggott said.

“The pegmatites were drilled in 1982-1983 by TANCO (Tantalum Mining Corporation of Canada). Until several weeks ago, Manitoba had the only operating lithium mine in Canada.

“That mine is further south from where we are, and Jenpeg is one of their old projects from the early 1980’s that they drill tested for tin and tantalum with a 23 hole program totalling 2,500m, they intercepted LCT type pegmatites with visible spodumene but they were never assayed for lithium.

“We managed to find core for two of the holes in the Winnipeg core library and we’ve verified that there is spodumene present.”

The company is currently re-assaying the core for lithium, which could unlock plenty of value given that the project hosts two parallel zones with strike lengths of 350m to 400m, along with spodumene dykes up to 10m wide observed in outcrop and drilling.

Jenpeg also includes the aptly named Spodumene Island, which while relatively untested, has two channel samples of 7m at 1.7% lithium and 7m at 1.45% lithium that are about 3.6km apart.

“Essentially, Jenpeg is a large-scale opportunity with a lot of exploration upside and for us it’s just about defining the potential scale of the project and then going and working it up by drilling, testing and working on the ground and building up a bigger picture there,” Piggott added.

He added that the company’s focus on William Lake was due to its more advanced nature with framework drilling already in place that gives it a potential pathway to resources down the line.

This contrasts with early stage projects which take time to work up.

Complementary projects

Leeuwin also has a number of complementary, earlier stage projects in Ontario, Canada, and Western Australia.

These includes projects in projects in the Gascoyne and Marble Bar regions targeting lithium and rare earths.

“We also have the interesting Ignace prospecting project in Ontario that’s not too far from Thunder Bay,” Piggott noted. “There’s mapped pegmatites there, but they just haven’t been tested for lithium.”

Board and Management team

Leeuwin’s other secret ingredient is its leadership team with Predictive Discovery non-executive chairman Simon Jackson fulfilling the same role in the company.

Jackson previously worked for TSX-listed Red Back Mining, which financed, developed and operated two gold mines in West Africa before it was acquired by Kinross Gold in 2010 for C$9.3bn.

Piggott notes that as a Canadian-focused critical minerals explorer, Jackson’s experience in North American and its equity markets is particularly helpful.

“And then we’ve got Scott Williamson as one of the non-executive directors,” he added.

“What we like about him is that he is young, energetic and really gets the zero carbon green metal space and was arguably one of the first movers when it comes to that kind of stuff.

“It’s Really good to have someone like that on the board as well just to bounce ideas off and he’s got a nice mix of the technical and the commercial skills.

“Simon and Scott are a good mix to back us up as well as the broader team.”

Piggott himself is a geologist had worked with Bellevue Gold as its senior geologist where he was involved in the discoveries of Tribune, Viago and Deacon.

He was also a part of the team that defined the Nova-Bollinger high grade nickel deposit, which is now owned and mined by IGO.

Other members of the team include founder and company secretary Nicholas Katris who is a Chartered Accountant with extensive corporate experience in ASX-listed resources, having recently worked as CFO at Canadian gold explorer AuTeco Minerals (ASX: AUT) and was Executive Director at Midas Minerals (ASX: MM1).

“To help us in Canada, we have Marcus Harden, our Ottawa-based chief geologist, he an impressive track record of mineral discovery and is ex-AuTECO and Bellevue. His experience and expertise will be instrumental to the future success of Leeuwin projects.” Piggott noted.

“We have got Daniel Oosterman as well, he’s also a geologist, but he used to work for a company that has a project north of us, importantly he’s got direct experience in Manitoba, the Thompson Belt and just how to operate in Manitoba from an environmental, social and government perspective.

“We have a sound team with skill sets that complement each other, the team has the ability to find projects, finance them and operate them.”

Aggressive exploration push coming

Following its listing on the ASX on the 29th of March, Leeuwin plans to embark on an aggressive exploration push.

Besides the re-assaying of core from William Lake for PGEs and ongoing surface geophysics, the company also intends to carry out a drill program targeting high-grade nickel sulphides.

“That’s just the news flow from William Lake, it is designed to be quite punchy with a focus on material news flow,” Piggot explained.

“At Jenpeg, we have re-assays of historical core and come the summer months, we want to get out there and do some field mapping and sampling.”

Exploration success could deliver immediate upside to the company’s shares given that it has an enterprise value of just $7.5m, which is half of its $15m market cap on listing with 63.5 million shares on issue.

This article was developed in collaboration with Leeuwin Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.