Gina Rinehart gets into magnetite next door to Juno’s more advanced Mount Ida project

Pic: Getty Images

Gina Rinehart recently made moves that demonstrated just how much potential she sees in the lesser appreciated magnetite as the direct shipping ore in WA’s Pilbara fast runs out.

In early April, Australia’s richest person and chair of private miner Hancock Prospecting gave the green light for the company to inject $9m to earn an initial 30% stake in the Mt Bevan magnetite project in WA owned by Legacy Iron Ore (ASX:LCY) and Hawthorn Resources (ASX:HAW).

This is a significant move for Ms Rinehart because it is widely known that her MO is not to invest in anything she doesn’t think will be a big money-maker. How else do you think she got to be worth nearly $US30bn?

There are two main types of iron ores – hematite and magnetite. Hematite is higher grade in the ground, while magnetite deposits are large and quite low grade – but produce very high-grade products.

With the rapidly depleting direct shipping hematite ore — the stuff that you can just dig up and ship — in WA’s Pilbara, end users like steelmakers in China are increasingly demanding more processed ores like magnetite.

With magnetite concentrate being a higher grade and consistent product, commanding a premium price over DSO iron ore, it also has the advantage of a lower environmental footprint in the smelting process and is considered as the “green steel”, which is becoming the preferred raw material in the steelmaking process.

About a third of the world’s steel is made from processed magnetite-rich ores.

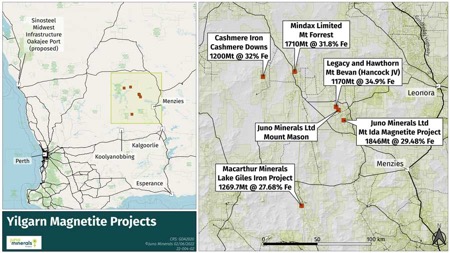

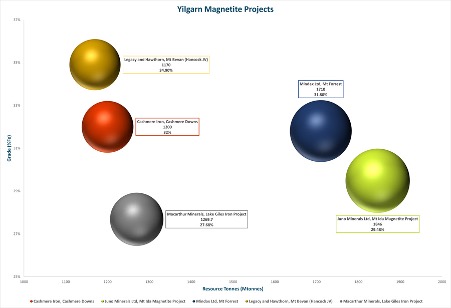

Yilgarn emerging as competing iron ore district

While the Pilbara has been the top iron ore jurisdiction for many years, dwindling supplies are forcing the industry to look for the next major iron ore province and the Yilgarn region in Western Australia is coming into the spotlight.

The Yilgarn Craton is a large mineral-rich region around 400km east of Perth in WA and has spawned numerous major mines over the past few centuries. While it is more typically known for its many gold and nickel discoveries, there are several iron ore projects in the region.

The Koolyanobbing mine in the Yilgarn region started producing DSO in 1993 under the ownership of Portman Mining, which was eventually acquired by Cleveland-based Cliffs Natural Resources in 2008.

The 6Mtpa mine was later acquired by Mineral Resources (ASX:MIN) in mid-2018, which is now looking at the magnetite potential of the operation.

MinRes said in its recent March quarter report that progress was made on studies into a viable development of a magnetite project in the Yilgarn.

“Results from the preliminary drilling program at Koolyanobbing received during the quarter were promising,” the company said.

The Yilgarn accounts for the bulk of WA’s land mass and is not just one single prospective area. It covers several different “terranes”, which in turn have their own “belts”.

Interestingly, the Mt Bevan project is a stone’s throw from Juno Minerals’ (ASX:JNO) Mount Ida project, which is further advanced than Mt Bevan.

Mount Ida sits on a granted mining lease and has previously had over $50m invested in it by previous owners Jupiter Mines, with a definitive feasibility study around 70% complete before work ceased in 2013.

Meanwhile, at Mt Bevan, Hancock Prospecting is about to begin a pre-feasibility study, which the company is required to fully fund if it wants to earn an additional 21% stake to become the majority owner of the project. Legacy and Hawthorn are more interested in retaining the non-iron ore rights over the project.

Juno’s Mount Ida project is the largest magnetite resource, at around 1.85 billion tonnes, and one of the most technically advanced magnetite projects in the Yilgarn. The magnetite resource can be processed to produce a high-grade premium concentrate of 67%.

Juno is undertaking preliminary reviews of past work completed and future work required to move the Mount Ida project towards development.

This article was developed in collaboration with Juno Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.