GBM Resources grows gold hoard with +400,000oz Yandan project purchase

Pic: Tyler Stableford / Stone via Getty Images

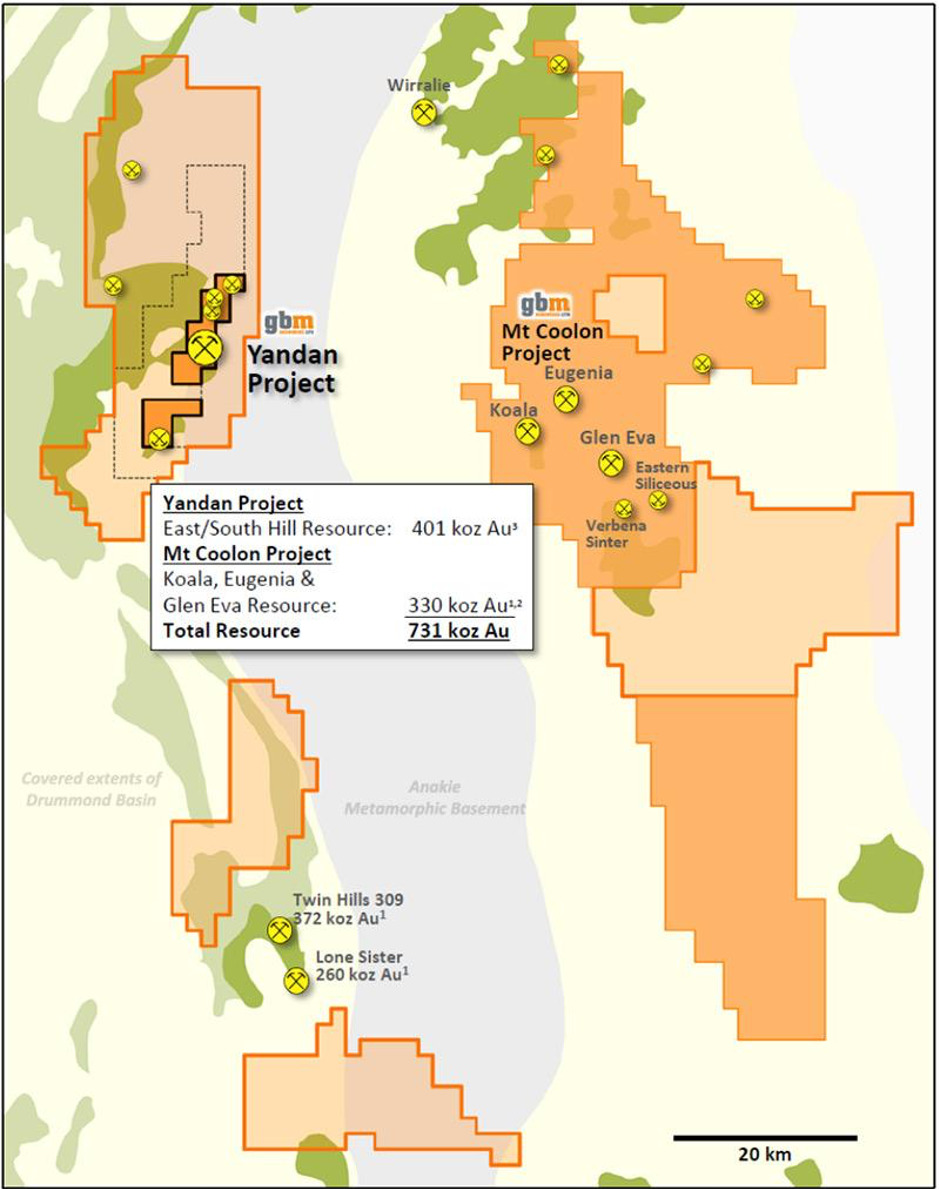

Special Report: The new acquisition of the +400,000oz Yandan gold project is part of GBM Resources’ (ASX:GBZ) strategy to build a multi-million ounce ‘processing hub’ at its flagship Mt Coolon Project in Queensland.

The +4,000sqkm, ~330,000oz Mt Coolan gold project in Queensland’s underexplored Drummond Basin is in epithermal elephant country.

These projects have a habit of getting very big.

GBM has a three-pronged strategy to build a multi-million-ounce resource base at Mt Coolon – acquisitions, recalculating existing resources using an updated gold price, and drilling fresh targets.

The Yandan project — strategically located ~40km west of Mount Coolon — has produced about 350,000oz and currently contains a JORC 2004 resource of 8.56 million tonnes at 1.5 g/t gold for 401,000oz.

GBM is currently updating the Yandan resource to meet JORC 2012 standards, a must-have for ASX-listed miners and explorers.

The all-share deal with gold-copper miner Aeris Resources (ASX:AIS) includes established mine infrastructure such as power, water dams and river access, tailings, and previous plant footprint.

“This acquisition represents an important milestone in the Company’s Drummond Basin ‘processing halo’ strategy and delivers a step change in the company’s resource base,” GBM managing director Peter Rohner says.

“GBM now control[s] JORC (2004, 2012) compliant Mineral Resources in excess of 700,000 ounces of gold at the Mt Coolon and Yandan projects (subject to completing the transaction), predominantly on registered mining leases with established mine infrastructure.”

The Yandan acquisition and capital raise

GBM will issue Aeris shares worth $3m (22.22 million shares at 13.5 cents) as consideration for the acquisition.

GBM has also closed a placement to raise about $5.4 million, subject to shareholder approval at an Extraordinary General Meeting (EGM) to be held on 22 October 2020, via the issue of 40 million shares at 13.5 cents.

The cash will be used to accelerate exploration programs at Mt Coolon.

The placement was strongly supported by a range of institutional and retail investors, GBM says.

Aeris will also subscribe for $1m in shares as part of the placement, to be escrowed for 12 months, which will see the miner own about 7.4 per cent of GBM.

“We welcome the support and investment by Aeris into GBM to advance this prospective asset, along with the strong support for our placement to advance our Mount Coolon Gold Project,” Rohner says.

This article was developed in collaboration with GBM Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.