Galena Mining eyes solid and steady lead market as Abra mine heads to production in 2023

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

It was only months after listing on the ASX that Galena Mining (ASX:G1A) hit the proverbial motherlode at its Abra lead deposit near Meekatharra, striking 31.4m at 14.5% lead and 2.7% zinc in its first assays in November 2017.

It became clear the company would be able to post a high grade resource very soon, as the underlying commodity recovered from a long bear market that had, along with environmental concerns, claimed the life of WA’s only other lead mine Paroo Station.

Galena confirmed the deposit’s world class resource in early 2018, with the lead sulphide mine delivering impressive high grades of 36.6Mt at 7.3% lead and 18g/t silver.

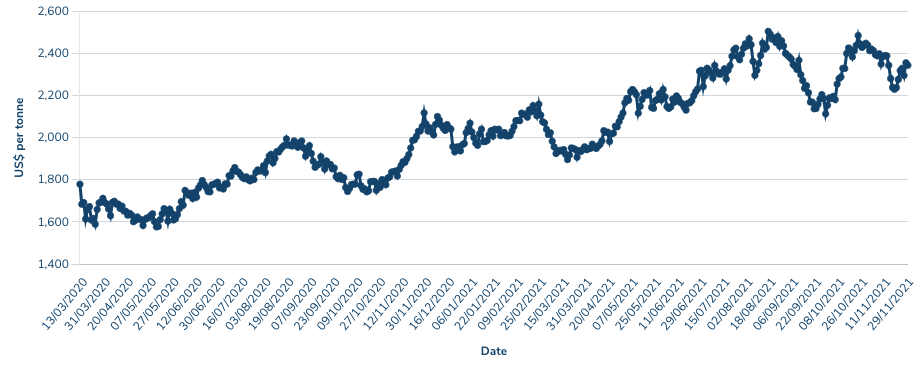

Although lead – strongly associated with its primary end use in lead-acid batteries for cars – has not enjoyed the fanfare other base metals have received from the new energy revolution, it has still seen a decent run since the start of the pandemic.

Lead is changing hands on a cash basis for US$2324.50/t, having dropped to around US$1600/t in mid-2020, and is up some 17% year to date.

It is good timing for Galena, which pushed the button on the Abra mine back in June, commencing the underground development in a 60-40 joint venture with Japanese smelter owner Toho Zinc.

Funded with a US$110 million debt package arranged by Taurus Mining Finance and US$90 million in equity from offtaker and JV partner Toho, Galena has commenced underground development and expects to begin commercial production in 2023.

Now containing a total indicated and inferred resource of 34.5mt at 7.2% lead and 16g/t silver, Galena says the mine will run for an initial 16 years, producing 95,000tpa of lead and 805,000oz of silver annually.

At 75%, Galena says Abra will produce the highest quality lead concentrate in the world, valued for its lack of impurities.

Despite being a quarter of the way through the construction of a major new WA mine, Galena is still worth under $100 million. Stockhead caught up with Galena managing director Tony James at the RIU Resurgence Conference in Perth to talk about Abra and the path ahead.

Tell me a little bit about the lead market. It hasn’t really received the attention of some of the other base metals of the battery metals thematic that we’ve seen this year. Why is it exciting to be building a lead mine at the moment?

“I think there’s a couple of things about this lead deposit that make it quite unique.

“One is it’s one of the cleanest lead concentrates in the world. If you compare it to other concentrates that will be made, it’s got 1/10th of the deleterious elements that other concentrates normally have.

“So the market has been very interested in our product because they really like to use it as a blending product into their smelters.

“It helps them with some of their environmental issues and also enables them to on-sell some of the lead as well through further marketing and sales.

“This mine will actually be in the top 10 lead mines in the world in terms of size and production. So that’s made it really interesting.

“I think what’s interesting about lead (as a product) is it’s quite an established market. So 400 million lead acid batteries get made a year in the world and even EVs, the commercial EVs that have been built, actually still have a lead-acid battery.

“So lead-acid batteries are here to stay. Even though 50% of lead going into batteries is recycled lead, 65% is how much lead (supply) goes into those batteries on an annual basis.

“So it’s a very stable market. Wood Mackenzie forecasts it’ll be a 24% increase in demand over the next 10 years. So the market looks pretty steady and pretty stable.”

We haven’t seen a lead project in WA for a while, probably not since Paroo Station shut down. Has it been difficult at all to get people in Australia over the preconceptions they might have about lead projects being dirty or being difficult?

“It is difficult and I think there is a mindset in the world that lead’s a dirty mineral and it doesn’t have a big future.

“And it’s a little bit of a misconception, I think, because it does have a major part in our society. But it certainly doesn’t have the lustre of gold or lithium or anything like that.

“So that is something we have to deal with. What I think is interesting is the people that have actually understood commercially this project and what this project can do economically understand the value of the project.

“One of the important things to remember is this is a lead sulphide deposit, not a lead carbonate deposit, and lead carbonate deposits are the ones that actually cause more issues environmentally and from a hazard point of view.

“Lead sulphide deposits actually are a much safer and more environmentally stable product to mine.”

So you’ve got about 7.2%. lead content in the resource. How does that compare to other projects?

“In terms of the head grades it can be high.

“Typically lead is mined with other elements, like it’ll be lead-zinc or lead will be one of the products that come out of the mine.

“But normally, what happens with a lot of mines is the lead component might be a lot lower percentage, it might be 2%, or 1%.

“The fact this is predominately a lead mine with a silver by-product, it’s at a higher grade. So it’s actually quite a good healthy grade.

“Now, what that means is that we can produce a concentrate that’s 75% lead. Most lead concentrates in the world sit between 55% and 65% lead. So that’s what makes this product so good, is we can get such a high concentrate back. And we’ll be producing effectively 130,000t of concentrate a year, which is 100,000t of lead.”

How much are you looking at in terms of a margin? And how is that going to be impacted by future lead prices?

“Depending on the supply and demand of lead, our forecast lead price that we’re using in our long term forecasts is sitting around between $0.90 and $1 a pound US.

“Our cost base is sitting at less than 50 cents a pound, so we’re sort of sitting in the 46 cents a pound type (margin) range. We think that the long term forecast is quite stable.

“And that holds us in good stead going forward. I think the other interesting thing about this project with our joint venture partner, Toho Zinc, they have a lead smelter that needs concentrate.

“So they need our lead. It’s a bit like a security for us to a degree.

“They are desperately keen to get their 40% of the concentrate that we produce in the long term.

“So I think the economics look very strong and very stable.”

Is there a lot of exploration potential outside of the main Abra deposit, and in terms of the lead market itself do we need to have a lot of new discoveries to cater for the demand?

“There are not too many new mines starting around the world in terms of new lead sources.

“So this project is certainly one that’s right up there in terms of being a dominant lead mine for quite a few years to come. In terms of exploration, we have a huge area.

“The joint venture has 100km2 sitting around the Abra deposit that has many targets that look very similar to Abra that we’ve done very little exploration on.

“They show the same rock types, they show the same stratigraphic horizons, they just need more drill holes or more exploration.

“Certainly from the joint venture’s point of view, there’s a lot of upside just around Abra.

“Immediately to the west of Abra there’s a package of 500km2 tenements that Galena is 100% owner of. There are multiple lead and other base metal targets there as well that need exploration.

“We even have copper targets, manganese targets there, gold targets there and also lead-silver targets. That’s called the Jillawara project, the level of exploration that’s gone into there is very minimal.

So certainly, our strategy at the moment is to focus on Abra, get the Abra mine up and running, learn from getting access to that ore body, take some of those learnings into the exploration program.

“We believe that the level of exploration work that’s been done in that area is very low. It’s very green. There’s a lot more work to do and a lot more knowledge to be had, but the potential is enormous.”

Galena Mining share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.