Fresh gold hits in Yandal Greenstone Belt lure juniors to underexplored field

Yandal Resources’ recent Arrika gold find has revitalised interest in the region. Pic: Getty Images

- Yandal Resources’ Arrikas find is a fresh discovery putting the Yandal gold belt back on the map

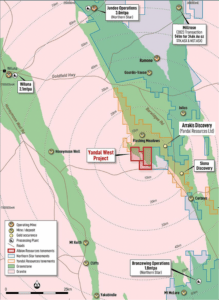

- Neighbour Albion Resources on the hunt for gold just down the road at Yandal West

- Region remains relatively underexplored compared to other famous goldfields

The Yandal Greenstone Belt, a remote region northeast of Leinster and Wiluna in WA’s Northern Goldfields, was famously opened up when billionaire prospector Mark Creasy sold his Jundee and Bronzewing discoveries to ‘Diamond Joe’ Gutnick’s Great Central Mines in the 1990s.

It’s also a key cog in the machine that is Australia’s largest gold producer, Northern Star Resources (ASX:NST), which produces more than 500,000ozpa from a string of mines cornerstoned by the legendary Jundee operations.

Despite being underexplored compared to other gold belts like Kalgoorlie and Coolgardie, Northern Star’s magnetic influence has lured juniors to the region.

Consider Hammer Metals (ASX:HMX), drilling at its Bronzewing South project – an infamous patch of dirt that was once central to a notorious Warden’s Court dispute between Mark Creasy and fellow prospector Leith Beal.

Or there’s Gateway Mining (ASX:GML), which entered the region after purchasing Strickland Metals’ (ASX:STK) 400,000oz resource in the district. This week, GML kicked off a 44,000m aircore program at the project.

But it’s Yandal Resources (ASX:YRL) and its recent swathe of discoveries that have really caught investors’ eyes, with a 268,000oz resource at Flushing Meadows and 182,200oz at Mt McClure, just 10km along strike from NST’s +1Moz Orelia mine.

It was the Siona discovery last year – in an intercept of 107m at 1g/t – that put Yandal back on the map.

This was followed by another emerging find at Caladan near Flushing Meadows in July, and then the Arrakis discovery last month, which returned 54m at 1.2g/t Au, 24m at 2.1g/t from 138m and 8m at 4.7g/t from 154m.

And it’s not just YRL seeing the love. Neighbour Albion Resources (ASX:ALB) welcomed the finds, with its Barwidgee prospect at the Yandal West located just 10km up the road from Arrakis.

Maiden drilling last month returned results of up to 12.6g/t at Barwidgee, plus further gold mineralisation was confirmed at depth to the east at the Collavilla and Collavilla East prospects.

“We’ve had some strong drill hits from our maiden campaign and we can’t wait to get back out there,” Albion CEO Peter Goh said.

“It’s great to see the region heating up with Yandal having some fantastic results close to us.

“Yandal has had two really successful hits in the last twelve months, so that brings some excitement in the region.

“Obviously it’s not all about nearology, but it shows we’re in the right region when that discovery is just 10km from where we were drilling.”

Options abound for any future development

Since acquiring the project in November from Great Western Exploration (ASX:GTE), Albion has seen its shares rerate, up 50%.

That could get even more substantial if drilling turns up something like its neighbour has found.

“Our Yandal West project is in a world class location on the greenstone belt, it’s close to three processing plants which just shows the pedigree of the area because you need a multi-million-ounce resource for those plants to get up,” Goh said.

“The great thing for us is probably it gives us options in the future if we have some success with the drill bit on how we could progress the project, whether that be through joint venture, toll treating or sale or something like that.

“It puts all the options on the table.”

Goh noted that the maiden drilling returned a lot of shallow, high-grade hits, mostly within 50m, which could lead to low cost mining down the track.

“Compared to Yandal and Gateway, we’re a fraction of the market cap so we offer high leverage into this exploration success, especially in this region,” he said.

The next step for Albion is to get boots back on the ground, with the company fine tuning drill targets, interpreting a gravity survey and planning an upcoming IP survey at the project.

“We hope to be back drilling mid-November,” Goh said.

“We’re systematically selecting our targets to get the best bang for buck for investors/shareholders.”

At Stockhead we tell it like it is. While Albion Resources is a Stockhead advertiser, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.