Fortescue starts drilling next door to Kincora’s flagship Trundle porphyry project as a new major enters the district

Pic: Via Getty Images

In the last month Rimfire Pacific Mining announced it was drilling the western extension of Kincora’s brownfield Trundle porphyry project and satellite images have confirmed FMG is also now drilling the southern extension.

First assays from Kincora Copper’s (ASX:KCC) ongoing drilling program are expected this month.

At the same time, Alkane Resources (ASX:ALK) has illustrated the huge scale of what the porphyry systems in the district can hold, with a resource upgrade to almost 15Moz gold equivalent at its wider Boda-Kaiser deposits, as it picks up more early stage exploration ground, and a new major enters the Lachlan Fold Belt with a $135m earn-in deal with a junior explorer.

Drilling and corporate activity is hotting up in the world-class Lachlan Fold Belt surrounding junior explorer Kincora’s prospective portfolio of projects.

In recent weeks, multiple players have announced the progress of drilling or significant investment in planned drilling in the region.

3 rigs drilling the wider Trundle mineralised system

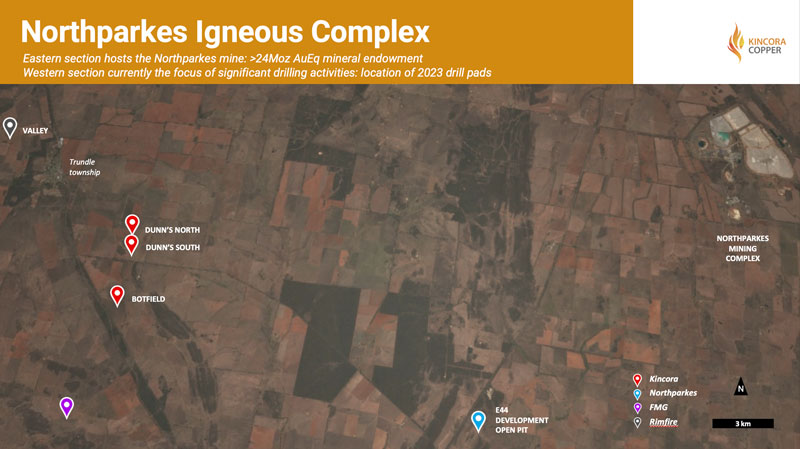

Kincora believes its flagship Trundle project holds a quarter of the Northparkes Igneous Complex, which to the east hosts Australia’s second largest porphyry mine, Northparkes –owned by China Molybdenum Co., Ltd (CMOC) (80%) and the Sumitomo Group (20%) – and a 24Moz gold equivalent endowment.

In the last few weeks, two other explorers have bought into this belief putting money into the ground in the wider Trundle mineralised system. The +$70 billion Fortescue Metals Group’s (ASX:FMG) and junior explorer Rimfire Pacific Mining (ASX:RIM) have both commenced drilling right next door to Trundle project testing the margins of Kincora’s project.

Satellite images show a drill rig on FMG’s license immediately adjacent to the south, testing the potential southern extension of the Dunn’s-Trundle Park system and targets that Kincora is currently drilling.

The same images illustrate two rigs on Rimfire’s neighbouring licenses, one drilling its Valley target adjacent to the northern section of the Trundle project, testing the western extension of Kincora’s Mordialloc system and target.

Having recently closed a $2.4m raising, Kincora has started a single rig, high impact and high conviction drilling program testing five adjacent systems and separate targets at the Trundle project, across an existing 3.2km mineralised strike that remains open.

Each target offers standalone large-scale, new porphyry discovery opportunities following up open ore grade intervals.

Also following the recent financing, Kincora has strengthened its share register and board.

The Bloomfield Group – a longstanding privately owned Australian mining and engineering group of companies – was the lead investor to the recent raising and increased its shareholding to 12.9%, becoming Kincora’s largest shareholder.

Meanwhile, Kincora has appointed Luke Murray, Chief Operating Officer of The Bloomfield Group, to its board who brings senior executive experience in open cut mining, processing, logistics and permitting in New South Wales to the Kincora team.

Concurrently, Lewis Marks has stepped down as a non-executive director, but remains as an advisor to the company.

New major enters the district

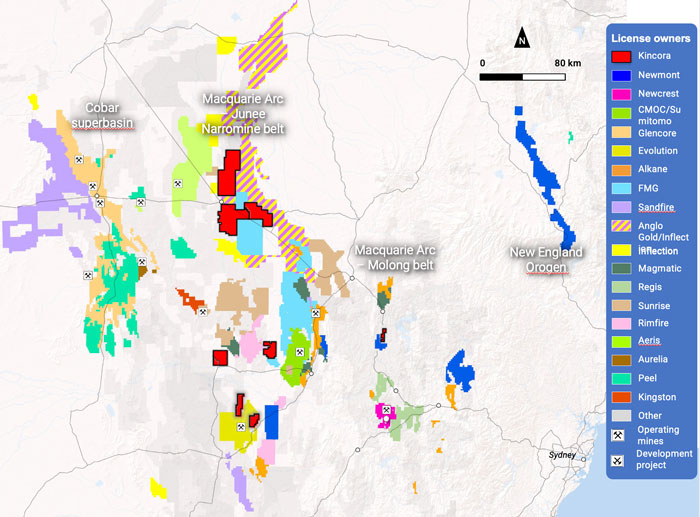

Newcrest Mining (ASX:NCM), Newmont, Fortescue, CMOC, Evolution Mining (ASX:EVN) and Alkane are the largest groups active in the Lachlan Fold Belt and currently focused on their existing land positions. However, Alkane in the last week has done a deal with Sandfire and a new gold major entering the district has the potential to kick off a new phase of corporate activity.

AngloGold Ashanti (ASX:AGG) has inked a large-scale exploration agreement with copper-gold explorer Inflection Resources to unlock the potential of the small cap, Canada-based juniors’ portfolio of early stage projects in the northern extension of the Macquarie Arc.

Kincora was an early entrant into this region securing a 100% interest in the Nyngan, Nevertire and Mulla projects, covering >1,730 sq.km of the core portions of the Arc.

Post Alkane’s discovery at Boda, a significant pegging rush from both Inflection and FMG took place on the extensions to Kincora’s ground.

During the first phase of a cumulative total earn-in agreement for up to $135m, AngloGold has agreed to spend $10m on exploration across Inflection’s portfolio of projects that are interpreted to sit on the Arc.

Sam Spring, CEO of Kincora, noted that Inflection’s flagship Duck Creek target is just 2.5km from Kincora’s Nyngan licence boundary and was pegged as a nearology play to the ground the company had already secured with an attractive structurally controlled magnetic feature.

“Duck Creek, like our drill targets at both the Nyngan and Nevertire projects, sit on the shoulders of local magnetic high anomalies truncated by cross arc structures – a common setting for deposits such as at Cadia, Cowal and Boda in the Macquarie Arc, and a common setting in other globally significant porphyry belts,” he explained.

“It is great to see another major group buy into the exploration strategy and belief in the potential of this underexplored part of the district that Inflection, FMG and Kincora already have.

“From a Kincora perspective this earn-in deal and Inflection’s $C14m market capitalisation provides a very favourable and direct peer group valuation for our Nyngan-Nevertire-Mulla project portfolio.

“Rimfire and FMG looking to test the margins of our flagship Trundle project is a nice surprise, providing further technical merit to our targets and catalysts for discovery of common new porphyry systems.”

The lure of porphyry country

Further demonstrating the appeal of the Lachlan Fold is Newmont’s recent $24 billion play for Newcrest. Newcrest’s flagship project, which still generates over 100% of its free cash flow, is the Cadia mine located in the south-eastern portion of the Macquarie Arc.

While the takeover bid has stalled with Newcrest snubbing the second offer put forward by the world’s largest gold miner, it is a strong indication of the rapidly growing interest from the global majors in increasing their exposure to copper and gold-rich porphyry systems in highly prospective and favourable jurisdictions.

The same expert that led the discoveries at Cadia for Newcrest, John Holliday, is leading Kincora in advancing its flagship Trundle project – the only brownfield project held by a listed junior in Australia’s foremost porphyry belt.

“In the Golden Triangle in Canada, which is probably the most comparable porphyry district to the Macquarie Arc from a geological and jurisdictional perspective, but where all-in drilling cost are probably two to three times as expensive, there is a very healthy junior explorer peer group with market caps of $20m to over $100m, many of which have attracted very significant industry partners,” Spring highlighted.

“Given the consolidated nature of the landholdings in the Macquarie Arc, you don’t see that dynamic, at least not yet anyway.

“The AngloGold deal with Inflection is another example of the recent pivot in the sector towards growth and increasing their exploration pipeline portfolio”.

Three positive developments for Alkane

In the last month, Alkane has released a maiden resource for its Kaiser deposit, taking total resources to 14.8 million ounces of gold equivalent across a 2.5km strike at the Boda and Kaiser porphyry deposits.

In the last week, Alkane has also acquired early stage exploration ground from Sandfire Resources, both adjacent to Boda but also on the conceptual southern extension of the Macquarie Arc.

Extension and infill drilling continues across the wider Kaiser-Boda-Boda Two-Boda Three targets and 3.5km mineralised corridor with further resource upgrades expected before year end.

The resource upgrade follow’s Alkane’s news last month that the Tomingley gold mine extension and expansion had received state government approval, with $50m in debt funding secured for project development.

The permit for the Tomingley mine, including relocation of a section of an existing major highway, provides further visibility of the ability to gain permits and achieve infrastructure solutions from the NSW government, in addition to the existing New Frontiers Exploration Program and $130m Critical Minerals and High-Tech Metals Activation Fund.

The latter two funds provide material financial assistance for non-ferrous projects’, further highlighting the state as an attractive jurisdiction and sending a further strong pro-investment message.

This article was developed in collaboration with Kincora Copper, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.