Forrestania IPO to hunt its mineral Bounty in a region of vast potential

Pic: John W Banagan / Stone via Getty Images

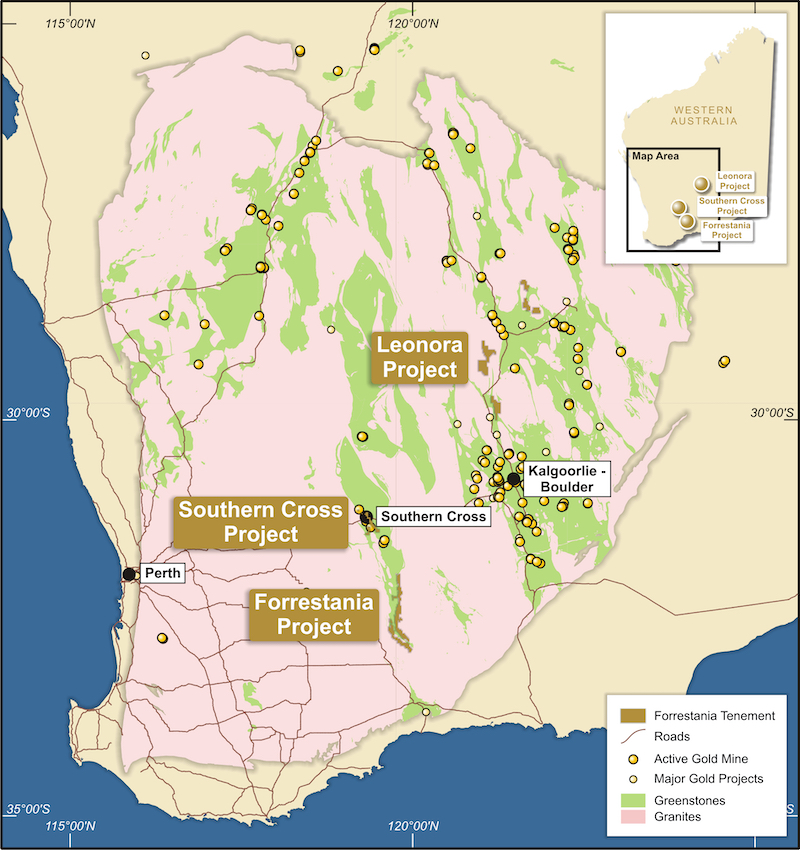

Historically a nickel, lithium and base metals hotspot, the golden potential of WA’s Forrestania region flew under the radar for many years and remains largely unfulfilled.

Despite the presence of the once prolific and now-shuttered Bounty gold mine, and a few successful regional operators, Forrestania has been mostly underexplored for gold – a huge opportunity for those with ground and knowledge of how to explore it.

Enter aspiring listee Forrestania Resources, an explorer led by a passionate and geologically minded team, which aims to put its golden stamp on its namesake region.

“The region was dominated by nickel explorers up until the 1980s, and more recently for lithium but until that point no one had systematically explored for gold,” Forrestania CEO and general manager Melanie Sutterby, an experienced career geologist, told Stockhead recently at the company’s West Perth offices.

“Aztec discovered Bounty in 1985, simply by looking at drill core inherited from the early nickel explorers that was never assayed for gold.

“They found a million-ounce gold deposit in a position where no one had ever looked before. It’s like the adage – you don’t know what you’re looking for until you find it.”

Now the Bounty mine site has been absorbed by Wesfarmers (ASX:WES) and SQM, who are set to jointly plough $1.9b into what will be known as the Mt Holland Lithium Project.

And while some like Classic Minerals (ASX:CLZ) have since discovered new deposits, the golden, and battery powered potential of the Forrestania greenstone belt remains largely unfulfilled.

Forrestania Resources presents a unique opportunity, with a consolidated regional landholding (more than 1000km2) over all the mineral rights within its IPO.

Bounty’s revenge?

The immediate priorities for Forrestania on the ground are the Lady Lila and Great Southern gold projects – the former of which was labelled by Sutterby as a Bounty lookalike.

Each will be explored using modern-day techniques not previously used over the project area before.

There is gold endowment already in the ground – Lady Lila has an established JORC resource of 24,000 ounces at 1.38 grams per tonne gold, with past drill intercepts including 14m at 3.7g/t from 74m with mineralisation hosted in a chert/banded iron formation along a shear zone.

The geological setting is similar to that of Bounty, the regional behemoth from which more than 1.3 million ounces was produced over a 12-year mine life.

“I see huge potential at Lady Lila, because of the geological context – this is a project that hasn’t been touched since the 1990s,” she said.

“There’s only a handful of drillholes into Lady Lila and it’s completely open in all directions.”

The Lady Lila deposit currently extends to about 1.8km of strike and goes down to around 50m depth above the weathering profile.

“We see a lot of opportunity out there to rapidly expand this resource – it’s exactly like Bounty. The geology is the same, the alteration is the same, the structure is the same,” Sutterby said.

“Our project also holds the potential to host economic strategic metal deposits, with historic exploration seeing a stop-start effort over the years as commodities like lithium and nickel fell in and out of trend.

“That to us is really exciting.”

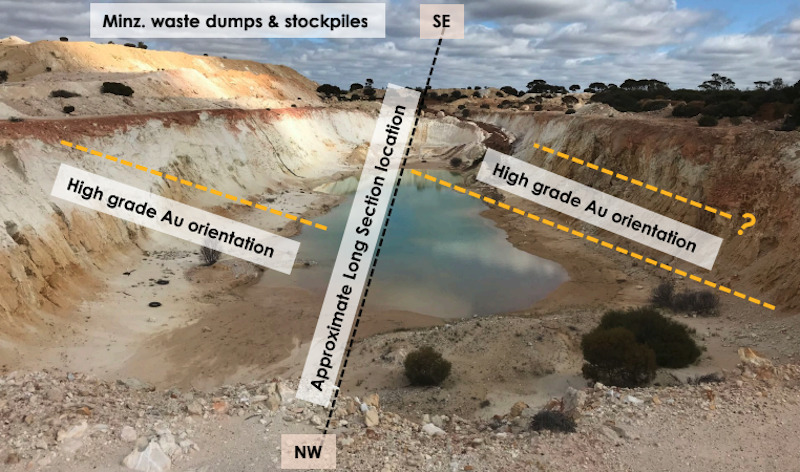

The other prospect of early interest at Forrestania is Great Southern, a historical area mined for 1000t of underground material at 7.13g/t in the 1920s and a further 2053t at 5.72g/t during the 1980s.

“Early miners followed the veins where they saw gold. From a discovery perspective that’s really exciting because the potential here could be something really special,” Sutterby said.

The mineralisation at Great Southern is hosted in granite, the sort of rock that’s creating a buzz throughout the Yilgarn region as explorers realise its potential.

Furthering the advantage for Forrestania is the quality of data it will acquire alongside the ground from Firefly Resources (ASX:FFR), which is parting with the project to focus on its Yalgoo assets.

“The geologist’s principal mandate in life is to collect data and make decisions based on it,” Sutterby said.

“Firefly has collected some excellent datasets over this ground over the years and engaged some really good consultants.

“Those are opinions that present us with an amazing opportunity to hedge off.”

And speaking of battery power, one of Forrestania’s top priorities is assessing the lithium and nickel prospectivity of their package, with a 2017 FFR drill program at the Gem prospect picking up ultramafic rocks, a significant pegmatite swarm and a whopping 33m grading 3.2 per cent Li2O from 69m.

Further gold targets at Forrestania include the Kit Kat gold project, along strike from CLZ’s near-production Kat Gap project. The company has about 10km of untested prospective strike as well as the Gemcutters gold project where drilling has previously intercepted 21m at 3.2g/t from 34m.

The company will also hold a six-tenement portfolio in the Leonora region that is prospective for massive intrusion related gold deposits, offering longer term potential for major discoveries.

Drilling the priority

Led by a youthful board with a strong geologist presence and backed by supportive industry experience, the expectation on listing Forrestania is that the drill rigs will hit the ground in quick time.

“Our work will consist of a targeted RC drilling program at the Gem lithium prospect and then onto the Lady Lila, and Great Southern gold prospects,” Sutterby said.

“We’re looking at having a schedule we can efficiently deal with, in terms of logistics, given we’re a small team and cognisant of making the maximum bang for our buck.”

The Forrestania IPO will look to raise $5 million, with listing planned for Q3 of this year.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.