Forrestania purchase to put Medallion Metals on fast-track to Ravensthorpe gold, copper production

Medallion Metals’ acquisition of FNO will enable a fast-track FID for its Ravensthorpe gold project. Pic: Getty Images

- Medallion snags Forrestania Nickel Operation from IGO for 1.5% net smelter royalty on future gold production

- Deal preserves $29m war chest to progress work streams to facilitate Ravensthorpe development decision

- Resource upgrade and metallurgical work will feed into key feasibility study

Special Report: Medallion Metals has executed an agreement to acquire IGO’s Forrestania Nickel Operation, which will enable a fast-tracked pathway to gold and copper production from its Ravensthorpe project in WA.

The agreement includes the existing Cosmic Boy processing plant and equipment, infrastructure, inventories and information including mineral rights other than nickel and lithium.

This is a key plank in Medallion Metals’ (ASX:MM8) plan to make a Ravensthorpe final investment decision in late 2025 that will transform it into WA’s newest gold and copper producer.

What makes the deal attractive is that there’s no upfront or deferred cash consideration with the company granting IGO (ASX:IGO) a net smelter royalty of up to 1.5% on all future gold production from the tenements as consideration for the acquisition.

It allows the company to preserve its circa $29m in cash reserves to progress multiple work streams such as testwork, feasibility studies and permitting activities to support the FID.

IGO also retains the right to explore for, develop and mine nickel and lithium minerals over the tenements.

“The company now turns its focus to the development of a new gold and copper producer in Western Australia,” managing director Paul Bennett said.

“Bringing the established high-grade gold-copper resources at Ravensthorpe together with the Forrestania plant and infrastructure can unlock significant value in the short term, with a substantial option on future growth from the new discovery potential of the tenure at both Ravensthorpe and Forrestania.

“Study work is at an advanced stage, permitting is being progressed as a priority and discussions continue to advance positively with offtake and finance parties.”

The acquisition is subject to several conditions including MM8 preparing and announcing a feasibility study, entering into a binding unconditional debt facility agreement and/or funding commitments, and reaching FID on the project.

Ravensthorpe project

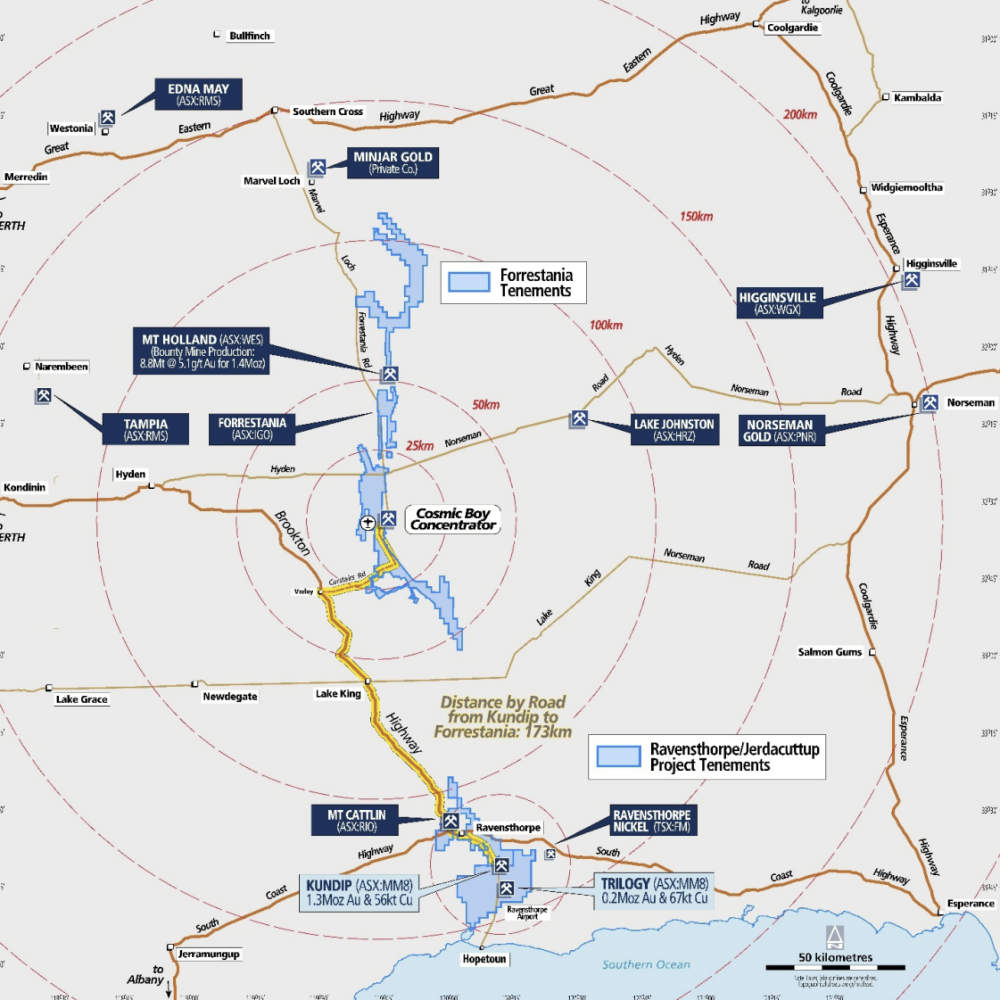

The ~300km2 Ravensthorpe project is centred on the historical Kundip mining centre midway between the regional centres of Ravensthorpe and Hopetoun.

It benefits from excellent infrastructure and is easily accessed by sealed roads with a sealed airstrip 10km to the south of the project.

Resources currently stand at 19.2Mt grading 2.1g/t gold and 0.3% copper for contained resources of 1.3Moz gold and 56,000t copper.

A scoping study completed in December 2024 estimated the project could produce 336,000oz of gold and 13,000t of copper from a production inventory of 2.7Mt grading 3.9g/t Au and 0.6% Cu, over a mine life of 5.5 years.

This will generate pre-tax free cash flow of $498m using a base case assumed gold price of $3615/oz and copper price of $5.54/lb, which increases to $637m at a gold price of $4000/oz and copper price of $6.15/lb.

Given that gold prices currently stand at about US$3352/oz ($5177.44/oz) while copper is priced about US$4.40/lb ($6.80/lb), these figures can be considered to be fairly conservative.

Forecast average all-in-sustaining cost is estimated at just $1845/oz of gold inclusive of net by-product credits while total pre-production capex is expected to be about $73m including mine establishment and process plant modifications.

Pre-tax NPV and IRR is estimated at $329m and 129% respectively in the base case with payback expected within just 12 months

Establishment of the proven, industry standard process route of gravity-flotation-CIL at Forrestania is expected to deliver high gold recovery of 98% and copper recovery of 80%.

MM8 notes there’s plenty of upside as the initial production inventory represents just 44% of existing sulphide resource (gold) with existing shallow drilling indicating the potential for further mineralisation at depth.

There is also potential for commercialisation of its oxide and transitional resources (10.3Mt at 1.6g/t gold for 520,000oz of contained gold).

Next steps

The company is currently working with IGO to finalise ancillary agreements and progress towards transaction finalisation and closure.

It expects to release an updated resource estimate in August that incorporates the results of the recently completed 17,000m drill program along with metallurgical recovery and metal deportment assumptions that will inform the feasibility study.

MM8 has also materially progressed process engineering associated with planned modifications to the Cosmic Boy flotation plant.

It will now begin placing orders for long lead time items inclusive of a secondary ball mill.

Additionally, the company has submitted all additional information requested by the Department of Climate Change, Energy, the Environment and Water following its determination that the project will be assessed under preliminary documentation following its referral under the Environment Protection and Biodiversity Conservation Act 1999.

Work has also started on submissions under the Environmental Protection Act 1986 while negotiations with potential offtake and finance parties are ongoing with MM8 expecting to mandate a preferred offtake and finance partner to work on an exclusive basis to establish binding concentrate offtake terms and finance terms.

This article was developed in collaboration with Medallion Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.