Former Bell Potter analyst reckons NSM is way undervalued

Pic: John W Banagan / Stone via Getty Images

One veteran resources analyst has placed a valuation on Victorian gold explorer North Stawell Minerals that is more than 3x the current share price.

Groundwork managing director Peter Arden, who has previously worked as an analyst for notable brokers like Bell Potter Securities and Ord Minnett, has initiated coverage on North Stawell Minerals (ASX:NSM).

Arden has assigned NSM a very bullish valuation of $1.05, which is more than triple the current share price of 34c.

So, what’s his rationale for this high valuation? Well, according to Arden, it starts with highly prospective tenements.

“NSM represents a very attractive gold exploration opportunity because of its combination of favourable factors that include having a province-scale holding of some of the most highly prospective tenements for major gold deposits in a Tier-1 jurisdiction adjacent to a major and expanding gold operation,” he said in his research report.

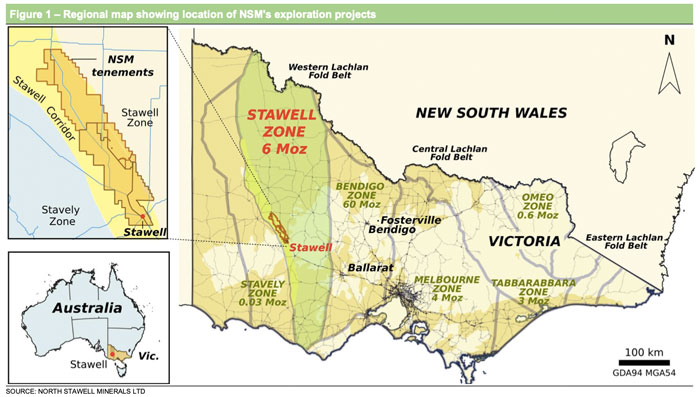

The company has a vast landholding in the Stawell Corridor that sits within Victoria’s famed ‘Golden Triangle’ that is responsible for over 66 million oz of combined historical gold production.

The Stawell Mineralised Corridor itself has yielded 6 million oz of historical production largely from the Stawell region and abutting privately owned Stawell gold mine.

What makes NSM’s landholding so prospective, Arden says, is the fact that it lies beneath shallow cover and has only been lightly explored despite hosting most of the estimated 38 million ounces of undercover gold endowment in the Stawell Zone.

The company recently completed an expanded initial drilling program at the Wildwood Dome that returned significant new intersections like 12m at 9.48 grams per tonne (g/t) gold from 34m.

The neighbouring Stawell gold mine was restarted three years ago and has produced roughly 2.5 million ounces. But the owners have identified the potential for a major expansion to production after uncovering extensive high-grade gold within the Magdala Basalt Dome.

‘Game changing’ geophysics

Meanwhile, NSM’s recent nearby exploration has also identified over 50 basalt dome and other targets in the Stawell Corridor.

And Arden says new detailed geophysics data could be a real “game changer” for the company.

“Gravity surveys have become increasingly more highly regarded in recent years as a very valuable technology for gold exploration,” he explained.

“NSM recently took the courageous but clearly now completely validated decision to carry out a detailed airborne gravity survey over all of its tenements.

“The quality of the resulting data is superb and for the first time ever really ‘lifts the veil’ on the likely nature and extent of a multitude of high-quality targets, confirming that the company’s tenements really do represent a genuine province-scale opportunity with very high prospectivity.”

NSM also ticks the cash box for Arden with around $12.5m in the bank at the end of June.

“NSM is well into its planned $14m exploration program on its highly prospective tenements over two years post IPO that includes 75,000m of drilling, representing one of the largest drilling programs by a junior explorer,” Arden noted.

“We initiate coverage with a $1.05/share valuation.”

This article was developed in collaboration with North Stawell Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.