For zinc-focused Variscan, this near-term development opportunity could be a game changer

Getty Images

Special Report: It’s been a transformational year for Variscan Mines, one which culminated in an agreement to buy two advanced zinc projects in Spain — Novales-Usias and Guajaraz.

This acquisition is a gamechanger for Variscan (ASX:VAR) and its shareholders, says managing director and chief exec Stewart Dickson.

“We’ve used the word ‘transformational’ — it’s an overused word, but it’s genuinely applicable here,” he toldStockhead.

“Why? Because we think both projects are serious value drivers and have already enabled the company to raise new funds, attracting high-quality new investors. Not surprisingly, the strategy also has strong support among our shareholders.”

These aren’t greenfields – or unexplored – projects. Both Novales-Usias and Guajaraz include former producing mines that neighbour even larger mines regionally.

It’s that old adage about ‘being in the right address’, says Dickson.

“But what makes us different from those explorers that have a large world-class mine down the road — the nearology argument — is we actually own one of them ourselves.”

Novales-Udias: fast track to production

Variscan’s initial focus will be the 68sqkm Novales-Udias project, some 30km south west from the regional capital of Santander.

The nearby historic Reocín deposit is one of the largest known zinc-lead deposits in Europe.

The project itself is centred around the mothballed Novales underground mine, which represents a near-term redevelopment opportunity for Variscan.

“Novales was in production up until 1997, running at an average head grade of between 6 and 9 per cent,” Dickson says.

“But we know that it hit high grades of between 15 and 35 per cent.”

Anything above 12 per cent is generally considered high grade.

Old workings historically intersected karst-filled “ore bags”, which recorded multiple 20m to 30m wide intersections grading between 18 and 35 per cent zinc.

The largest of these ore bags was reported to be about 70m in height, 150m in length and 200m wide.

And the mine is in great shape.

“We have full access to the underground mine — rock stability is fine, and there’s no need for any significant dewatering,” Dickson says.

Importantly, it is on an already granted mining lease within trucking distance of the world’s second largest zinc smelter, owned by global miner Glencore.

If a toll treating agreement can be reached, Variscan will be able to slash any project redevelopment costs considerably.

Upcoming exploration work by Variscan will target the underground mine workings for extensions to the known mineralisation.

“We are really looking forward to the results from recent rock chip sampling” Dickson says.

“It’s like a shiny, glittery ballroom [down there]; it’s ridiculous. We know those grades are not everyday grades. “

Novales is priority #1 because early cashflow would be a gamechanger for Variscan. But there is another, potentially bigger opportunity here; proving up a regionally significant resource over its adjacent exploration tenements.

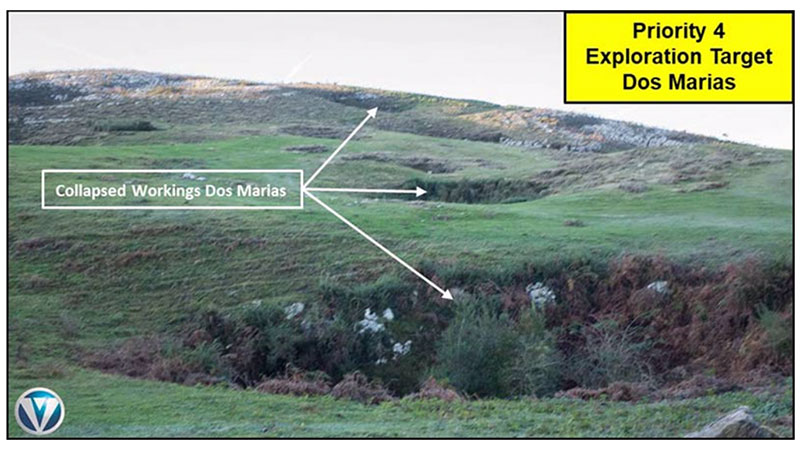

Historic regional soil geochemistry has identified multiple, very large zinc anomalies near historical zinc occurrences and small-scale underground mining, like this one:

The longer-term upside here is significant. “We think we have Reocín 2.0 on our hands if we can join up the very prospective areas. I can’t wait to get drilling on this ground. With the the recent funding rounds completed successfully, there is nothing in the way of us hitting the ground running,” Dickson says.

Guajaraz project: also drill ready

The Guajaraz project, about 60km southwest from the national capital of Madrid, also represents an excellent brownfields opportunity with drill-ready targets.

It is centred around the former producing La Union underground mine, where production began in 1945 and ceased in in the mid 1980s. Very little exploration has occurred since then.

Yet historical records indicate that the mineralisation was only partially exploited and remains open both along strike and at depth.

Recent mapping and sampling by the project vendors returned maximum results of 17.35 per cent zinc, 11.95 per cent lead, 0.4 per cent copper and 332g/t silver in separate samples.

This story was developed in collaboration with Variscan Mines, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.