Why Pensana Metal’s NdPr project is in the driver’s seat to supply growing electric vehicle market

Pic: Tyler Stableford / Stone via Getty Images

Special Report: Permanent magnets are set to play a crucial role in the burgeoning electric vehicle (EV) and new energy sectors – but there are questions whether the industry is equipped to meet increasing demand for the critical materials to make them.

Neodymium and praseodymium (NdPr) are expected to play a key role in the rapidly expanding green energy and EV sectors.

That’s because NdPr is used to make high-strength permanent magnets for the drivetrains of next generation EVs.

Analysts at Roskill say these neodymium-iron-boron (NdFeB) permanent magnets have already experienced double-digit growth in recent years.

And on current projections, demand for NdPr is going to outstrip supply within the next five years — possibly as early as 2020, according to Adamas Intelligence, particularly as new applications are developed.

The next major NdPr producer

China’s current stranglehold on NdPr production is loosening and it’s predicted the country will become a major net importer as a continued pollution crackdown sees the closure of more environmentally unsustainable operations.

Car manufacturers and magnet producers will be looking for alternatives and that’s where developer Pensana Metals (ASX:PM8) plans to step in.

It’s aiming to become one of a few select non-Chinese NdPr producers, just as EV demand really begins to take off.

The key is Pensana’s high grade, and potentially massive, Longonjo Project in infrastructure-rich Angola.

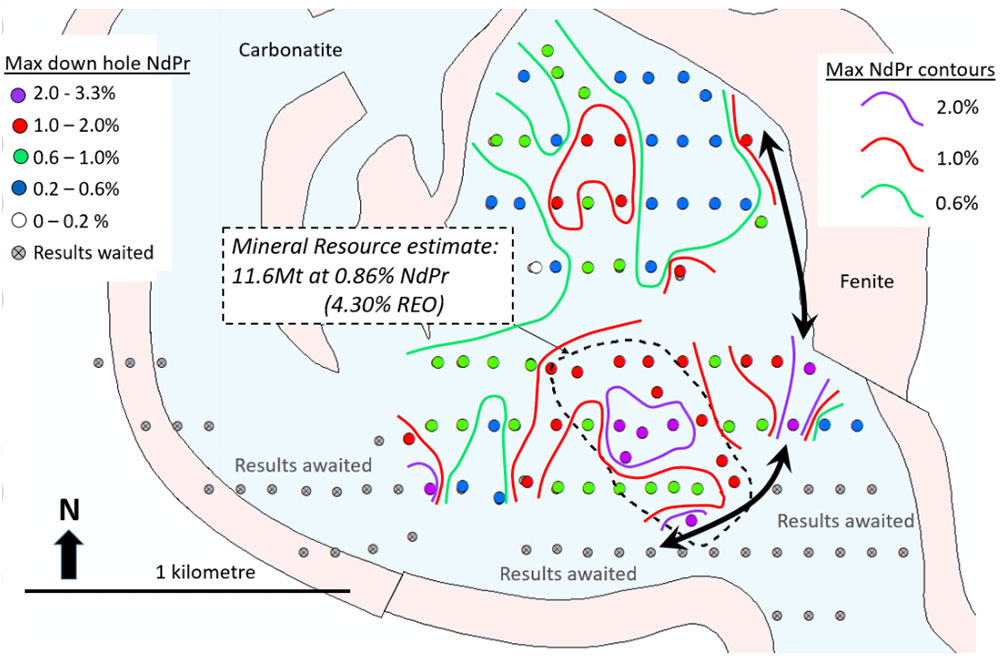

Pensana is close to updating the existing Longonjo resource of 11.6 million tonnes at 4.3 per cent rare earth oxides (REO), which already includes a good composition of NdPr at around 20 per cent.

The company reckons it can significantly grow the size of the project and make Longonjo one of the world’s largest NdPr deposits.

Results on track

Recent drilling results have furthered buoyed the company’s optimism.

The mineralised area has been extended by several hundred metres to the north, east and west – and Pensana still hasn’t found the edge of the deposit.

The latest batch of results include high grade intercepts including 10 metres at 8.03% REO with 1.98% NdPr from surface and 14 metres at 7.33% REO with 1.86% NdPr from 20 metres.

Pensana executive director Dave Hammond said: “We are eagerly anticipating the results from the remaining 41 holes in the untested southern area, which has considerable potential to add further extensions to the mineralisation”.

“These broad intersections of high-grade mineralisation from surface are expectational and they follow on from similar intersections reported in earlier holes,” he says.

“With just over half of the drill results received to date, it is clear that much of the weathered blanket covering the 3.8 square kilometre carbonatite is mineralised and that we are already looking at the potential for a very substantial expansion of the maiden mineral resource estimate.”

“Once all the results have been received, we look forward to reporting an upgraded Mineral Resource estimate in early 2019.”

A different approach to development

Pensana is also thinking about the economics of its project and looking at a low-cost development strategy.

Longonjo is located just 4km from one of Angola’s major rail lines, which links it to the $2 billion deep sea port in Lobito.

The modern infrastructure road, rail port and hydro power already in place on the project’s doorstep means Pensana can consider fast-tracking a low-cost, low-risk operation to cash in on rising demand.

“We want to leverage these unique advantages with the aim to rapidly develop a relatively low capital intensive, low technical risk, conventional open pit mine and on-site beneficiation plant to produce a high-grade mineral product for export,” the company said in a statement to investors.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Pensana Metals is a Stockhead advertiser.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.