Following in the footsteps of De Grey – who will find the next Pilbara gold monster?

These juniors are on the hunt for a hemi-style gold discovery. Pic: Getty Images

- After De Grey’s $6bn sale, juniors are lining up to find the Pilbara’s next Hemi

- Soon to be one of Australia’s largest gold mines, explorers are confident the region has more to give

- New Age, Peregrine, Artemis and more among the hot gold hunters in the district

The Pilbara is renowned for its world-class iron ore deposits and has more recently become a lithium hot spot. But the rising gold price has put its precious metals cargo on the map as well.

While there are existing gold mines in the region, like the Mark Creasy owned Warrawoona, Black Cat Syndicate’s (ASX:BC8) Paulsens and Capricorn Metals’ (ASX:CMM) Karlawinda, it was De Grey Mining’s (ASX:DEG) 2020 discovery of Hemi that really cemented its gold status as a gold hotspot, more than two years on from the flash in the pan ‘conglomerate gold rush’.

Hemi and the surrounding deposits within De Grey’s Mallina project have since grown to 13.6 million ounces of gold at 1.4 grams per tonne.

And now, record gold prices and Northern Star Resources (ASX:NST) $6 billion acquisition of De Grey has kicked off a swathe of M&A activities in the area this year – shining a spotlight on the Pilbara’s gold potential.

Gold juniors with a play in the region are all building cases as to why they could be on to the next Hemi.

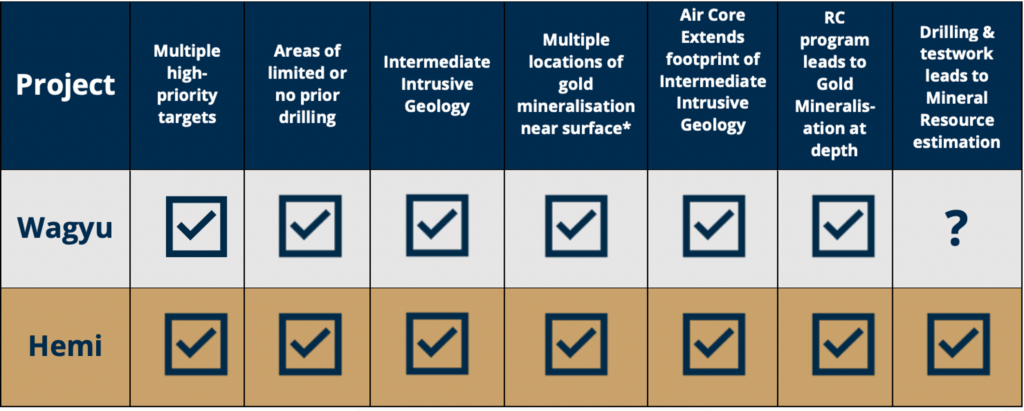

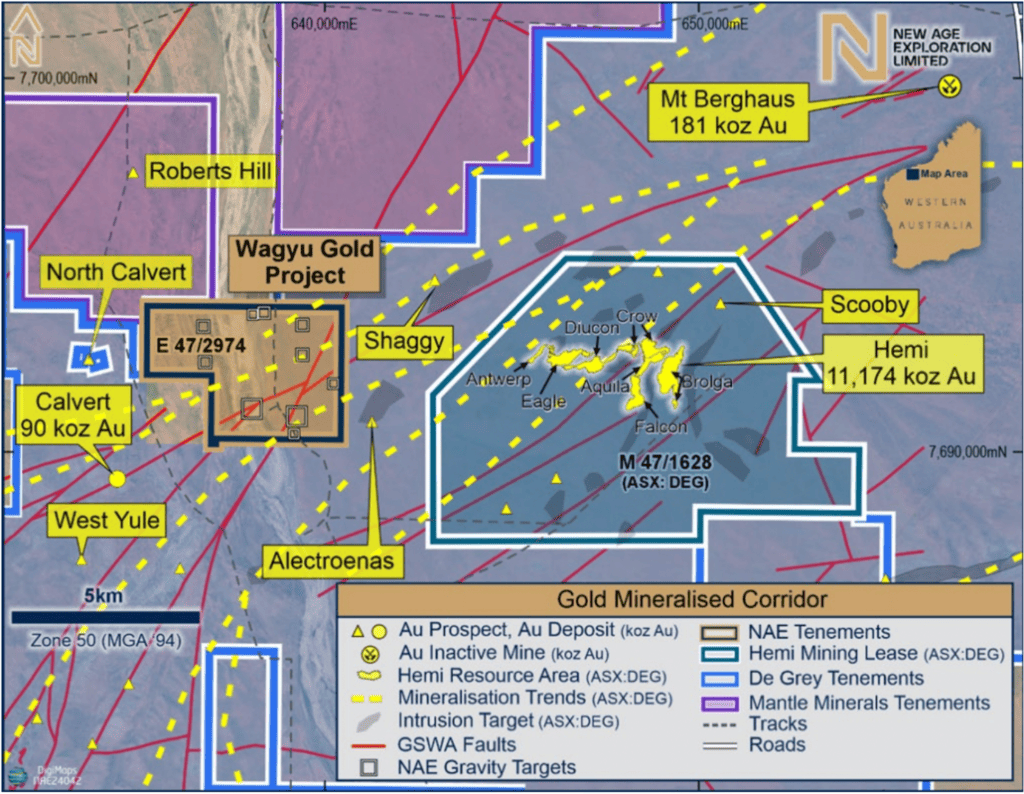

One is New Age Exploration (ASX:NAE), where executive director Joshua Wellisch says the company is so confident it has streamlined its assets to focus on the Wagyu project, which sits adjacent to – and along strike – from Hemi.

“It’s the only project that has produced results thus far that look anything like Hemi,” he said.

“With the location directly along strike, we have a very good chance of finding a substantial deposit there.”

The company has confirmed Hemi style rocks thanks to recent aircore and reverse circulation drilling, with assays up to 28.6g/t.

Wellisch says this reinforces the project’s parallels to the discovery process at Hemi, where shallow oxide mineralisation guided targeting of deeper, high-grade zones.

“We were also able to fast track the project in about 9 months, benefitting from DEG’s 20 years of exploration work at Hemi,” he said.

“We knew what processes and what steps to take to firm up the initial targets and followed that through with aircore drilling to establish the initial gold mineralisation.

“We’re sitting on intermediate intrusive in all of the targets and now what we’re seeing is a highly gold mineralised supergene blanket across multiple targets which provides the pathway for us to vector in on where the gold mineralisation at depth is.

“Like Hemi was, we’re seeing exactly what they did in the early days.”

Earlier this month the company announced the sale of the Lochinvar project in the UK to focus resources on Wagyu.

The next round of drilling will aim to expand gold-enriched supergene zones and to further test deeper primary mineralisation.

“As we move into the next stages of drilling we’ll be able to push deeper and take a more refined approach in terms of our targeting,” Wellisch said.

“We want to expand on the supergene gold mineralisation, which is shallow – that in itself may represent an economic deposit – and then we’ll look to vector in on the gold mineralisation at depth and find … Hemi 2.0.”

Wellisch notes that Hemi is made up of six individual deposits, so even if NAE had 2 or 3 similar deposits you could be talking multiple million-ounce deposits.

“The opportunity is really significant at this market cap,” he said.

A number of other companies have active gold drill programs going on in the Pilbara.

Artemis Resources (ASX:ARV)

This year ARV kicked off a fresh exploration strategy with the appointment of new managing director Julian Hanna. He was the brains behind the early growth of Western Areas from an explorer into a leading Australian nickel producer, which was eventually acquired by IGO (ASX:IGO) for $1.3 billion in 2022. That stunning success was followed up by the development and sale of MOD Resources to Sandfire Resources (ASX:SFR), now the owner and miner of MOD’s Motheo discovery in Botswana’s Kalahari copper belt.

Hanna previously told Stockhead he was attracted to Artemis’ Pilbara portfolio, and he’s wasted no time getting exploration up and running at Karratha.

He reckons Artemis could have a slice of the Hemi action at the western end of the belt, where the Carlow deposit sits with its resource of 8.74 million tonnes at 2.5 grams per tonne gold equivalent for 704,000 ounces of AuEq, or 374,000oz of gold, 64,000t of copper and 8000t of cobalt.

Five diamond holes for 1790m were completed last quarter, and returned hits of up to 15.3g/t gold.

A further 3800m of diamond drilling is in the works now, with 1500m of RC drilling underway at the Titan target along with a gravity survey over the Cassowary Intrusion east of Kalgoorlie, where ARV is chasing Iron-Oxide-Copper-Gold mineralisation.

Moving to technical studies is the next goal to progress Carlow towards possible feasibility and early development stages.

Peregrine Gold (ASX:PGD)

At the Mallina project near Hemi, PGD has appointed highly experienced geologist Matt Rolfe as exploration manager. His previous roles include as the senior geologist managing Northern Star Resources’ Pilbara exploration program.

The company has its eye on a whopping 40 priority targets for intrusion hosted ‘Hemi style’ and other orogenic gold deposits, as well as 6 targets analogous to Chalice Mining’s ‘Julimar type’ Ni-Cu-PGE deposits.

PGD believes there are further Hemi style discoveries to be made in the Mallina Basin and with numerous targets already identified, Matt’s expertise and knowledge of the region gives them the best chance to unlock the potential of the project.

The company is now in the final stages of planning for a substantial 10,000m Aircore drilling program to test the majority of these priority gold and Ni-Cu-PGE targets as well as other Cu-Zn-Pb-Ag-Au targets identified in historical drilling.

Riversgold (ASX:RGL)

Back in Feb, the junior identified 12km of strike at its Tambourah project, with rock chips returning up to 101g/t gold.

The project was originally acquired for its lithium potential in the northwest corner of the tenement, but its gold potential is just becoming properly understood.

The area has always been highly prospective for gold, with gold being discovered there in 1891, which resulted in a gold rush.

The company is planning further rock chip sampling to refine drill targets.

Novo Resources (ASX:NVO)

Novo was the company that originally inspired the long-forgotten conglomerate gold rush, surging to ridiculous highs in the Canadian market for its theory that watermelon seed shaped nuggets found in the Pilbara were evidence of a historical link between the region and the Witwatersrand Basin in South Africa, the world’s most productive gold field.

Not so, the story didn’t hang together. But Novo had collected a massive tenement package it brought directly to the Australian market in a 2023 dual listing.

Novo had De Grey (now Northern Star) engaged on a JV at its Egina project next to Hemi, but also holds a host of tenements in the region either 100% or in JV with groups like Peregrine, Creasy and lithium giant SQM.

Most recently, the company’s attention has been turned to its Tibooburra and John Bull project in New South Wales, but it has been working up gold and antimony targets at Balla Balla and Sherlock Crossing.

At Stockhead, we tell it like it is. While Peregrine Gold, Artemis Resources, New Age Exploration and Riversgold are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.