FMG chops Twiggy’s dividend after iron ore volatility cuts profits by 40%

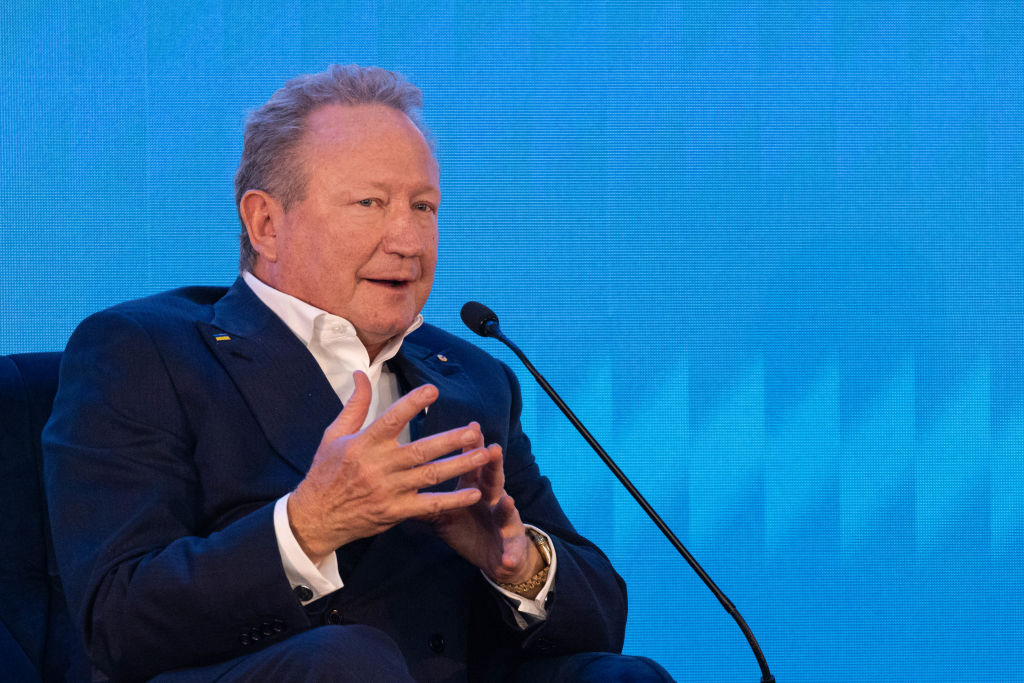

Pic: Luke Dray/Getty Images via Getty Images

- Fortescue Metals Group profit drops 40% to US$6.2 billion after lower iron ore prices hit earnings for six (billion)

- Twiggy Forrest will pocket another $1.35b in dividends after $6.4b full year payout

- MinRes returns to dividends as it ticks off on new Onslow iron ore hub

Financial reporters are fond of tracking just how fat Andrew Forrest’s wallet is getting off the back of Fortescue Metals Group’s (ASX:FMG) regular dividends.

They’re a little skinnier this year after the iron ore miner cum green energy megaphone saw profits in FY22 slide 40% to a tawdry US$6.2 billion.

Not last year’s record US$10.35b haul, but still a pretty penny, funding a $1.21 final dividend ($2.11 in FY22).

Underlying earnings fell almost US$6 billion (36%) from US$16.375b to US$10.561b with revenue sliding 22% from US$22.284b to US$17.39b.

Twiggy Forrest, owner of ~36.5% of the company he founded and is again executive chairman of, will pull in around $1.35b in cash after this year’s final dividend and around $2.3b for the full year.

Not the $4b cash splash Twiggy and his myriad listed and social investments enjoyed in 2021 but not anything other folk would shed a tear about.

The payout represents around 75% of profits, towards the upper end of FMG’s 50-80% payout policy. It means FMG has delivered ~$6.4b in total dividends to shareholders.

Analysts have been expecting that return to slide as FMG redirects profits to decarbonisation initiatives including its Fortescue Future Industries green hydrogen side business, which receives 10% of profits from the cash-generating iron ore assets.

FFI spent US$534m in FY22 and has US$1.1b in unspent capital, including US$342m of new capital delivered at the end of FY22.

FMG says it remains committed to a 2040 Scope 3 net zero target, a decade ahead of most major mining and energy businesses.

Outgoing FMG CEO Elizabeth Gaines, who also commented in the results on the need to stamp out sexual harassment in the mining industry following a WA parliamentary inquiry last year, noted it remained FMG’s second highest profit result in its history, promising a strong start to FY23.

“We are accelerating our transition to a vertically integrated green energy and resources company and are leading the way in decarbonisation. In FY22 our global economic contribution was $27.6 billion demonstrating our important contribution to the economy and the communities in which we operate,” she said.

“We have experienced a strong start to FY23 and through operational excellence, a sustained focus on productivity and a disciplined approach to capital allocation, we will continue to deliver benefits to all our stakeholders.”

FMG shipped a record 189Mt in FY22 as average iron ore revenue fell from above US$135/t to a tick under US$100/t, with guidance of 187-192Mt including 1Mt from its new Iron Bridge magnetite mine.

The big concern looks to be costs from the inflationary labour and supply chain environment in WA. C1 costs at FMG’s Pilbara ops rose from US$13.93/t in FY21 to US$15.91/t in FY22, and are expected to rise further to US$18-18.75/t in FY23.

Fortescue Metals Group (ASX:FMG) share price today:

Signed, Sealed, Delivered, Iron Awe

Twiggy and Co. wasn’t the only iron ore giant ticking off on its financials today.

Fellow billionaire Chris Ellison lodged his accounts for Mineral Resources (ASX:MIN) this fine morn.

Fresh off its comically awful recruitment ad with former Foreign Minister Julie Bishop, Ellison brought more cringeworthy humour from Perth’s Golden Triangle, joking that nothing he said could be used as evidence.

The firm is currently embroiled in a legal dispute with a former procurement officer.

But another announcement took precedence as MinRes got its multitude of international partners to tick off on the development of the $3 billion Onslow iron ore hub, starting with the Red Hill Iron Ore JV it acquired last year.

It will transform ~20Mtpa MinRes’ standing in the iron ore industry into a genuine mid-tier player, shipping 35Mtpa once the new hub is up and operating, with the ASX-listed miner committing $1.3 billion in a capital loan to claim an extra 17% of the project, giving it a total stake of 57%.

MinRes’ PR team was in finer form on that announcement, slyly choosing Stevie Wonder’s Signed Sealed Delivered as the hold music for its results call.

After a ‘mare in its half-year results in February, which included a $36m loss and dumped dividend, the final results were a better outcome.

While falling iron ore prices and inflationary pressures on costs meant MinRes was no chance of matching its $1.1b profit FY21 profit, higher lithium prices and record iron ore and mining services volumes saw the company deliver $3.42b in revenue, $1.024b in EBITDA and $400m in NPAT for the full year.

Lower iron ore prices were a $1.41b hit to MinRes’ earnings, offset by a $417m increase in spodumene sales.

The ASX 50 firm, which has $2.4b in the bank, will pay a $1 per share dividend (~$190m), down from $1.75/sh in FY21.

Mineral Resources (ASX:MIN) share price today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.