Firefly sets the scene early for thick and very high-grade gold at Yalgoo

Investors are getting excited over Firefly’s performance at Yalgoo. Pic: Getty Images

Special Report: Firefly has followed up maiden ‘bonanza’ grade gold hits at its Yalgoo project with much wider intercepts and even more shallow high-grade gold.

Just last week Firefly Resources (ASX:FFR) reported it had hit a ‘bonanza’ 1,439.55 grams per tonne (g/t) gold from just 51m in its very first drilling at the historic Yalgoo project in Western Australia.

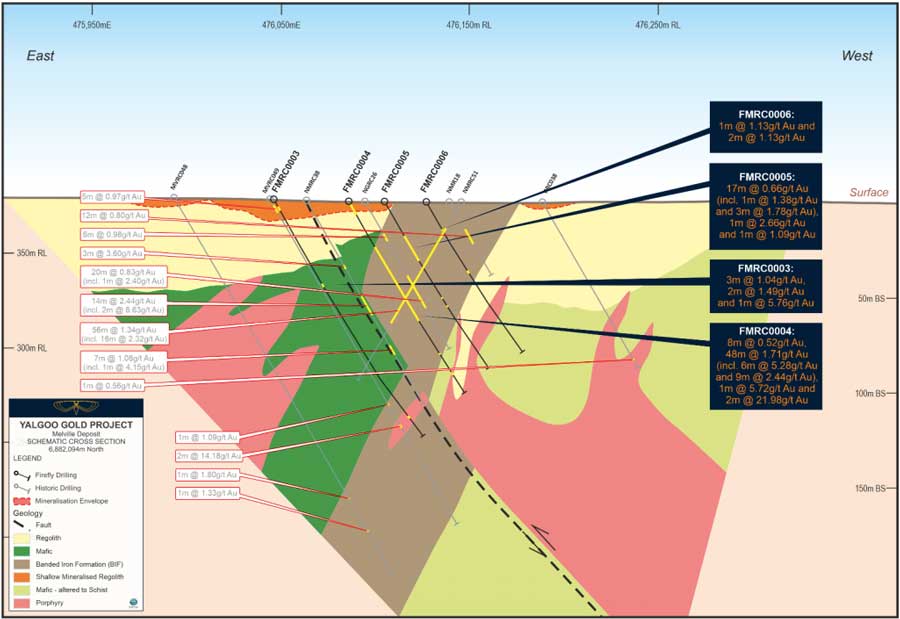

And this week the company has revealed its thickest hit yet of 48m at 1.71g/t from 33m, which included a 2m long intercept grading 21.98g/t from 107m.

There is no official definition for a bonanza grade, it’s just a way of describing speccy finds.

And generally, anything above 5g/t is considered high grade, but at today’s record gold price, grades as low as 1g/t can be economic, especially if they’re close to surface.

These extremely high grades have certainly got investors interested, with Firefly’s share price last week hitting a 52-week high of 23.5c – a massive 1,075 per cent gain since the market bottomed in March.

Firefly (ASX: FFR) share price chart:

Importantly, these results sit outside the historic Melville deposit resource, which Firefly is currently upgrading to JORC status – a ‘must-have’ for ASX-listed explorers and mine developers.

Firefly says these new drilling results increase its confidence in the Melville deposit and pave the way for a maiden JORC resource.

“This drilling gives us confidence that the historic geological interpretation and mineral resource estimate at Melville was done in a reasonably systematic and robust manner,” managing director Simon Lawson said.

“Growing the existing shallow un-mined mineralisation at the Melville gold deposit is a priority focus for Firefly and we are continuing to drill there with the aim of defining a JORC 2012 resource/reserve foundation for the Yalgoo gold project.

“At the same time, our very first drill program has already defined a new high-grade mineralised position outside the historical resource envelope – reflecting the exciting growth potential and upside at Melville, in particular the potential for very high-grade quartz vein systems throughout the area.”

The first 10 drill-holes demonstrate the potential for a mixture of large-scale, high tonnage banded iron formation (BIF) and porphyry-hosted gold mineralisation, as well as high-grade quartz-hosted gold mineralisation at the Melville gold deposit.

“I think it’s really important for investors to understand that this project isn’t a one-hit wonder,” Lawson told Stockhead.

“Getting bonanza grade results of up over 1,400 grams per tonne is pretty extraordinary for our maiden drill program – and it’s a fantastic outcome.

“But it’s the thick zones of mineralisation grading 1.5-2.0 grams per tonne that will really underpin the economics of an open pit mining operation. The fact that we have both styles of mineralisation is really exciting.

“The next phase of drilling gets underway this week and the plan is essentially threefold: to drill further around the high-grade zone we hit in our initial drilling; to continue systematically fleshing out the Melville resource; and to start to test along the prospective trend to the north of Melville for new discoveries.”

Lawson says beyond Melville to the north, there is high-grade shallow gold mineralisation in sporadic historical drilling along a strike extent of ~8km — along what is known as the “Melville trend”.

“In addition, adjacent to the Melville system and around 500m east, we see a parallel system of similar scale – the ‘Eastern trend’, which includes our Don Bradman gold prospect,” he explained.

“Our recent geophysical targeting work has illustrated the presence of the same rocks and structural elements on both trends, and the Don Bradman prospect has only had 12 RC (reverse circulation) drillholes drilled in its history with every one of them hitting gold at shallow depths.”

Shallow gold untouched

Firefly has acquired an entire historic goldfield in Western Australia, but what sets this particular patch of ground apart from other historic goldfields is that there is no open pit over the main historic gold deposit.

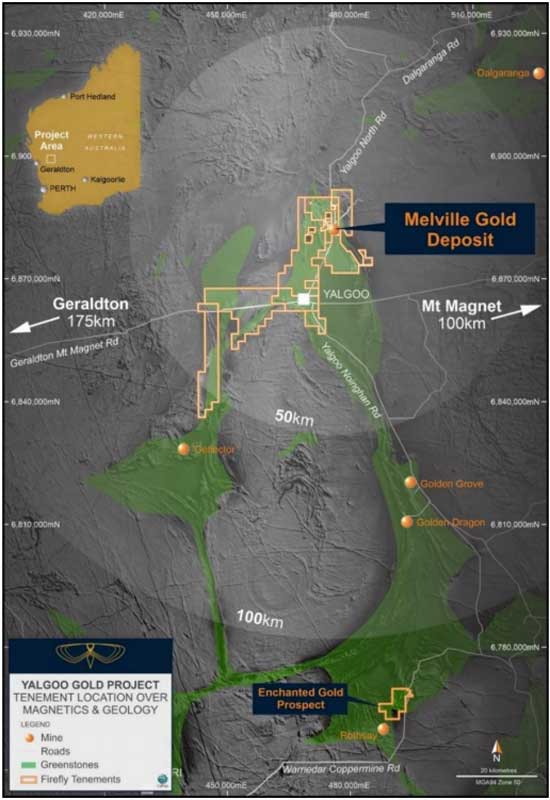

The Yalgoo project is located 175km east of Geraldton and encompasses a 600 sq km tenement package covering an entire historical goldfield that has an extensive history of high-grade gold production but has had no exploration for the past 15 years.

“The vast majority of historic goldfields typically have at least one if not several open pits where previous owners have already extracted the ‘cheapest’ shallow ore and, in most cases, at much lower gold prices,” Lawson noted.

“Subsequent operators conducting follow-on work are often faced with working around old pits and waste dumps as well as expensive low-angle resource drilling to achieve success.

“This is not the case for Firefly as we will be able to rapidly grow shallow gold resources in a favourable gold market unimpeded by historical workings and infrastructure.”

The Melville deposit is also strategically located within 150km trucking distance from five gold processing plants.

This is just the start of Firefly’s systematic growth strategy at Yalgoo.

The company is preparing to begin the second stage of its 10,000m drilling program this week.

Firefly’s goal is to establish the potential resource growth to the north of Melville, along the 8km long “Melville gold trend”, and Melville parallel lodes, including follow-up of the new mineralisation position discovered in the first four drill-holes.

This article was developed in collaboration with Firefly Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.