Firefinch’s Mike Anderson on that huge Goulamina deal and what it means for shareholders

Firefinch managing director Mike Anderson explains what kind of upside investors can expect going forward. Picture: Supplied

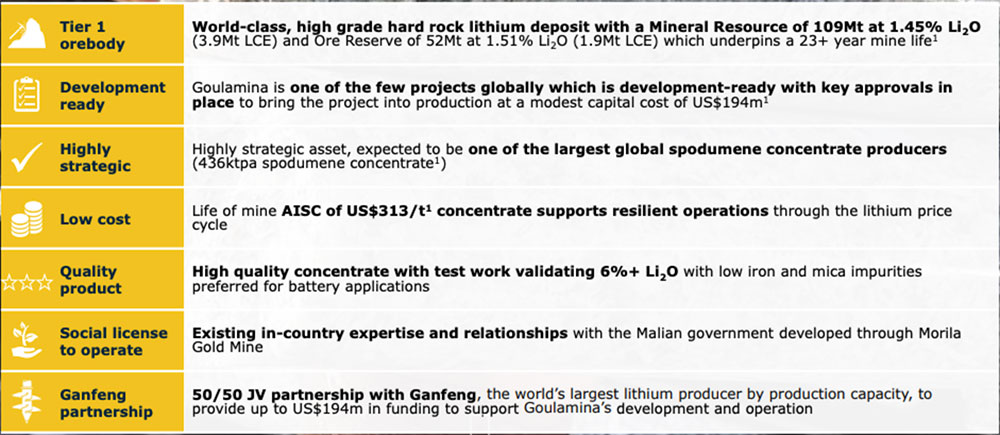

Gold producer Firefinch will team up with global lithium giant Ganfeng to develop “the world’s next lithium mine of scale”. Here’s how shareholders are set to benefit.

The binding deal will see Firefinch (ASX:FFX) establish a 50:50 joint venture (JV) with Ganfeng – which supplies tier 1 battery players such as BMW, LG Chem and Tesla — to develop Firefinch’s world-class Goulamina lithium project in Mali.

Ganfeng will invest $US130m in three tranches for its 50% share of the project, the final $US91m to be made upon a Final Investment Decision (FID).

These funds, together with up to US$64 million in debt funding to be arranged by Ganfeng, are expected to fund the project into production.

On FID, Firefinch intends to demerge its interest in Goulamina into a separate lithium focussed ASX company.

We asked Firefinch managing director Mike Anderson what kind of upside investors can expect going forward.

What sets the Goulamina lithium project apart from its peers?

“There is no shortage of lithium projects around the world, but there aren’t many that are shovel ready,” Anderson says.

“Being permitted, having a mining licence, and a completed feasibility that demonstrates the commercial metrics of the operation – that all takes time.

“That advanced level of progress is what attracts a partner like Ganfeng to Goulamina, knowing that the hard work has already been done.”

When the feasibility study came out in October last year – it seems like a completely different time. It barely made a ripple on the market.

“That’s the cyclicity of metals markets,” Anderson says.

“It just makes it all the more remarkable when you reflect where the company has come from, and where it is today with two exciting projects.

“When you have a quality project often your patience does get tested but it is days like this [when the Ganfeng is announced] when you get your rewards.

“We are far from done yet, of course, but it is nice to know that the future of the lithium and gold businesses are robust.

“Notwithstanding the market factors which we can’t control, we now have two quality projects with tremendous value creation and upside potential.”

How long have you been in talks with Ganfeng over this deal?

“The process [by Macquarie] only really kicked off at the beginning of March, but I suspect Ganfeng were aware of this project previously,” Anderson says.

“Even so, to achieve what we have in the space of three and a half months is a tremendously swift outcome for a transaction like this.

“We did have a competitive process and seriously tested the market, and the board is confident we have delivered the best possible outcome.

“We have a great partner, and both companies are committed to the success of this project.”

Does the speed and size of the deal speak to the sheer volume of quality lithium needed to feed the battery sector going forward?

“Absolutely. I am absolutely convinced that that is what is driving this surge of interest in lithium,” Anderson says.

“We all see the demand projections. The industry will need a number of new mining projects like Goulamina coming into development pretty soon.”

More generally, do you see a real move behind the scenes by the bigger players to lock up advanced lithium resources before they disappear?

“Yes, judging by the interest we had,” Anderson says.

“We had a handful of the world’s bigger players having a good look at the project.

“There is a pecking order of projects that are being snapped up now. They will dry up until the next wave of projects come along.”

Next steps at Goulamina?

“The next steps involve us putting the flesh and bones on a Front End Engineering Study and a project implementation plan,” Anderson says.

“We also need to make sure we tick all the right boxes with development approvals.

“We will probably be making a final commitment investment decision in the first half of 2022.

“There is a lot of work that goes on between now and then – but that’s normal for a credible project development.”

A what does this mean for Firefinch shareholders, now that they have the benefit of an emerging gold production centre, plus a world class lithium mine development?

“When the JV is consummated, we will have about 40% each [of the Goulamina project],” Anderson says.

“Firefinch will spin that 40% into a separate lithium vehicle, and our intention at the moment is an in-specie distribution of 80% of that [to Firefinch shareholders].

“So Firefinch will effectively own 20% of the company that owns 40% of Goulamina.

“We will maintain that stake for two key reasons. One, it is very important from a Mali government perspective that we demonstrate continuity of stewardship and ongoing involvement.

“Two, we have also put a lot of time and effort into this project, and we are confident that once Goulamina is [in production] we will see a future uptick in value to that investment.”

Do you see substantial upside to your market cap from here?

“We are about $400m market cap today. I believe there is the potential for a collective billion-dollar market cap – that’s our goal,” Anderson says.

“It will take us some time to achieve that, but I genuinely believe that to be a realistic goal for a company producing ~200,000oz gold and the levels of lithium concentrate that we are aiming for at Goulamina.

“One billion dollars is not far-fetched at all.

“It may take us a couple of years to reach that, but we are giving ourselves a fantastic platform to launch from.”

Firefinch share price today:

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.