Firefinch powers ahead with Goulamina DFS update and demerger plans for Leo Lithium

Pic: John W Banagan / Stone via Getty Images

Firefinch has received all regulatory approvals for its Goulamina JV lithium project in Mali with Jiangxi Ganfeng Lithium and is ready to kick off a major drilling program to support its expansion plans.

A definitive feasibility study (DFS) update is on track for later this year which will consider a 75% increase in production capacity from 2.3 million to 4 million tonnes per annum in a phase 2 expansion.

This would mean spodumene concentrate production would increase from 450,000 tonnes per annum in line with throughput upgrade – placing Goulamina among the largest producers globally.

Firefinch (ASX:FFX) is planning a major drilling program to support its expansion plans – as well as expanding resources and reserves – and expects a final investment decision (FID) for the project to be made in late 2021.

Proposed demerger of Leo Lithium

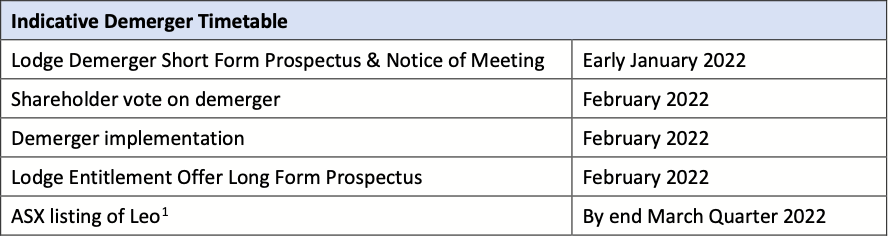

The company is planning to demerge Leo Lithium Pty Ltd into Leo Lithium Ltd – a standalone company which will hold a 50% interest in the JV with Ganfeng.

It’s all part of Firefinch’s strategy to advance Goulamina by completing all commercial, technical and regulatory work so that Leo can seek a listing on the ASX in the March 2022 quarter with an updated DFS complete, FID made and all funding received from Ganfeng.

“Considerable progress has been made advancing Goulamina over the past few months,” Firefinch managing director Dr Michael Anderson said.

“The key takeaway is that following the proposed demerger in 2022, Goulamina will be substantially funded, with engineering and procurement well progressed and 50km of drilling already underway.

“Importantly, Goulamina will be on a quick path to production, expected in 2023, and in an enviable position to take advantage of prevailing very strong lithium market conditions.”

The company is also undertaking an entitlement offer to existing shareholders to fund working capital, costs of the demerger and permit flexibility to accelerate expenditure at Goulamina.

Major drilling program planned

Ganfeng and Firefinch will undertake a major, two-year, US$6 million RC and diamond program comprising almost 50km of drilling at the project.

The drilling will target:

- Converting inferred mineral resources to indicated mineral resources;

- Defining extensions to Sangar at depth and to Danaya along strike and down dip;

- Testing the gap between the Danaya and Sangar Zones;

- Sterilisation of planned infrastructure areas; and

- Reviewing other exploration opportunities within the tenement.

The inferred mineral resources at the project total 43.7 million tonnes at 1.35% lithium and the company expects significant conversion to indicated resources and ore reserves – which would rank Goulamina even higher among the largest global lithium projects and is expected to support a multi-decade mine at a higher rate of production.

Final investment decision by year-end

Ganfeng will contribute US$130 million in cash to the JV and the first tranche of equity – US$39 million – is expected to be deposited into an escrow account shortly.

Once the JV subsidiaries have been restructured and the exploitation licence transferred, the cash will be released from escrow.

And when the DFS update is finalised, the companies will consider a FID for the project.

The FID is one of the pre-conditions for Ganfeng to make its second tranche of cash investment of US$91 million, and assistance with up to US$64 million of debt funding.

Firefinch share price today:

This article was developed in collaboration with Firefinch Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.