Firefinch aiming for gold and lithium major leagues after $47 million capital raising

Firefinch is aiming for the gold and lithium major leagues. Pic: Getty Images

Gold miner Firefinch has banked $47 million in an oversubscribed capital raising that will bring a number of institutional investors on board and help ramp up its Morila gold mine in Mali.

Firefinch (ASX: FFX) has plans to up production from 50,000oz this year to 200,000ozpa by 2024 at Morila, once one of the world’s most prolific gold mines in the early 2000s under the stewardship of majors Randgold Resources and Anglogold Ashanti.

The raising follows Firefinch’s announcement of a headline-making deal that will bring one of the word’s largest lithium companies, Ganfeng, on board to jointly develop the massive Goulamina lithium project, also in Mali.

The raising will largely go towards development, exploration and working capital at Morila but will also provide Firefinch with working capital for Goulamina until the demerger of its stake into a separate company.

Firefinch managing director Michael Anderson caught up with Stockhead after the raising was announced, saying the $350 million miner is focused on building both projects into major players.

“Certainly, I believe we’re building two billion dollar businesses; one on the gold side and one on the lithium side and I think that’s entirely realistic when you look at the levels of production we’re targeting,” he said.

“Companies that are producing 150,000-200,000ozpa are capped at $700-800 million and companies that are producing hundreds of thousands of tonnes of spodumene concentrate like Pilbara (Minerals) for instance are capped at billions of dollars.

“$350m market cap is just the start, it’s a healthy start given where we were 6-8 months ago.

“I have no hesitation aiming for those sorts of levels of capitalisation, that’s why I’m here and those are the businesses we’re building.”

Institutional Investors on board after raising

Firefinch will issue 117 million new shares at 40 cents each.

Anderson said brokers Macquarie Capital, Euroz Hartleys, Canaccord Genuity, Petra Capital and Jett Capital received bids for almost double that of the $47m allocated.

The placement has shown the conviction institutions have in Firefinch’s growth plans through both Morila and the Goulamina demerger.

“I think the raising was very specifically targeted at increasing our institutional and sophisticated shareholder base,” he said.

“This company has got now 900 million shares out there and we are quite lightly represented by institutional holders.

“But we have attracted quite a significant number of new both domestic and international investors and I think that bodes extremely well for where are trying to take this company.”

Having launched a share purchase plan in October last year to fund the Morila acquisition, Firefinch had been unable to run a SPP for existing holders because of ASIC rules.

“But hopefully they will continue to support us as we try to build the value here and as I say at the board and management level we are very confident there is plenty of upside ahead of us,” Anderson said.

“There are a few rather large institutions that have come on board that we hope will follow up on the raising and potentially build their position.”

Firefinch is also progressing negotiations with institutions to secure debt funding to further underpin its expansion plans.

Morila pit primed for revival

Morila has produced more than 7.5 million ounces at an average grade of 3.81g/t since first entering production in the year 2000.

It currently contains a resource of 2.43Moz at an average grade of 1.5g/t.

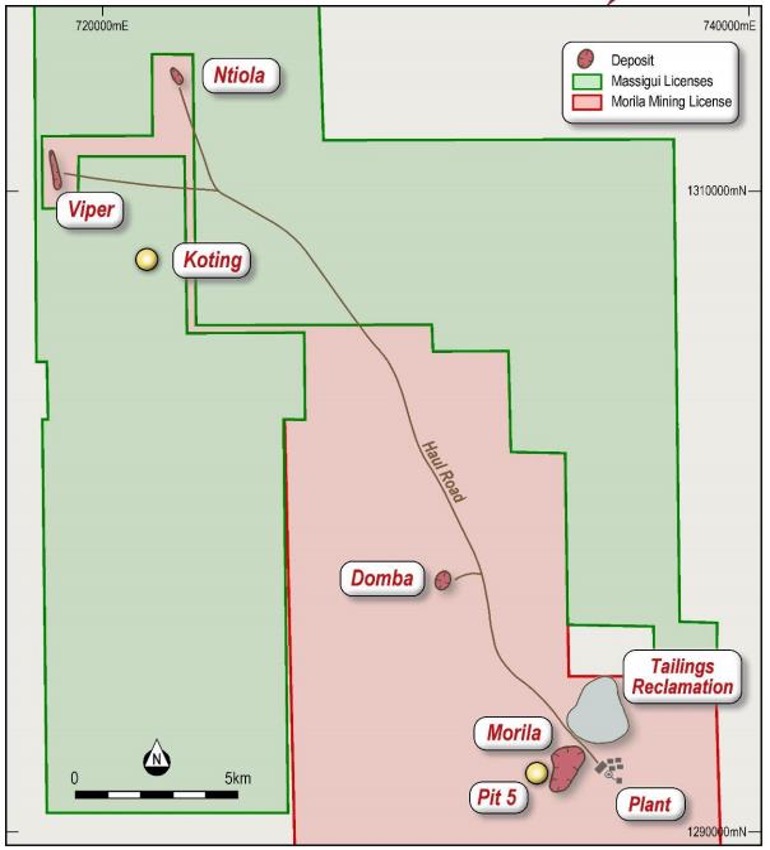

The main source of gold since Firefinch acquired the mine last year has been the retreatment of tailings, but the company has acted speedily to increase resources at satellite deposits outside the Morila Super Pit.

In May, open pit mining began at Morila Pit 5, on the western edge of the Morila Super Pit, with mining at the Viper satellite deposit only weeks away.

The bigger game that will help Firefinch grow its production base to 120,000oz next year, 170,000oz by 2023 and 200,000ozpa by 2024 is reviving the main pit.

It contains measured and indicated resources of 21.2Mt at 1.6g/t for 1.09Moz, with a further 770,000oz in the inferred category.

Dewatering will take place over the next three months so Firefinch can conduct drilling from the first bench to infill and extend the current resource, which will be brought online by the second half of 2022.

“We believe there is the opportunity for higher grades in the Morila pit, we’ve got 50m at 5g/t, that’s what we’re targeting straight away,” Anderson said.

“Our resource and reserve grade at the minute is 1.5g/t, but there is 2,3,4-to-5-gram material in the pit floor, we know that.

“There’s very little drilling outside of the historical pit shell, so we’re very confident we’ll find more ounces and higher-grade ounces, all of which will contribute to the inventory at Morila.

“That’s at the minute where 90% of the ounces sit and it’s 1km from the ROM pad, so that’s the obvious place to look first, but we are finding some significant success at the satellites too.”

Gold price environment ripe for Morila growth

On top of that gold prices are now far above what they were when mining at the main pit halted back in 2009.

“We do know they mined the highest-grade parts of the Morila orebody but it does plunge into the pit floor and that’s where we have 50m at nearly 5g/t,” Anderson said.

“It’s not closed out at depth by any stretch of the imagination, so a small higher-grade underground operation is a realistic proposition.

“And today’s gold prices, at US$1700-1800/oz gold, enable us to mine an awful lot deeper than in the past when the price was a lot lower.”

Given how quickly they have identified valuable satellite pits, the opportunities across Morila’s broader 650km2 regional tenure are also exciting Firefinch’s board and management team.

“Six months ago when we acquired this project there was just over 120,000oz in the resources at the satellites, there’s now 220,000oz and we’re not finished yet, so we genuinely believe there’s prospects across the entire portfolio,” Anderson said.

Goulamina development well timed for lithium price surge

Given its heft and influence in the global lithium market Ganfeng, Firefinch’s new partner in the Goulamina lithium mine, is sure to be listened to when it makes comments about the market for the prized battery metal.

The commodity has seen a sharp uptick in demand and pricing since bottoming out last year, with Ganfeng last week predicting a return to prices last seen in the 2017 boom.

At 436,000tpa over 23 years, Goulamina will be one of a handful of world class hard rock spodumene mines to be brought into production in the coming years.

Firefinch completed a DFS in October last year and is now progressing front end engineering design on the back of the Ganfeng deal.

The Chinese major will take a 50% stake in Goulamina by committing to US$130m in equity and arranging US$64m of debt funding for the project.

Anderson said positivity around future pricing in the lithium market suggested Goulamina would be starting up at the right time.

“I certainly believe so, and I know our partner Ganfeng has made statements to that regard and has been quoted in the press recently,” he said.

“There is a strong sense that lithium sentiment, lithium prices and lithium demand are all trending in the right direction and of course timing is very important.

“When we completed the feasibility study 12 months ago that didn’t speak to the climate we came out into, so I think if Ganfeng are to be believed and we are in an appreciating price and demand environment that does bode very well for Goulamina.”

This article was developed in collaboration with Firefinch, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.