Fiji’s mining sector might be heading for its time in the sun

Fiji is keen to build its mining sector. Pic: Getty Images

- Fiji has rich mineral wealth as demonstrated by the giant Vatukoula gold mine

- Pro-mining government has enjoyed political stability for more than a decade

- Country keen to build mining sector after COVID devastated tourism

Better known for its beaches, crystal clear waters and coral reefs, Fiji is unlikely to make the cut when one is asked to name mining destinations.

But discounting Fiji simply because it doesn’t occupy the same column inches as Western Australia, Canada or South America would be doing it a grave disservice.

While it doesn’t exactly have plenty of ground to parcel by virtue of being a small island nation, Fiji does have some very notable mines.

Chief of these is the world-class Vatukoula gold mine – formerly the Emperor gold mine – that has produced more than 7Moz of gold since operations began in 1935 and still holds significant quantities of the precious metal.

The poster child of Fiji’s mining industry is also reported to have seen some $200m in new funding to upgrade its systems.

A more recent development is the high-grade Tuvatu underground gold mine that’s operated by Canada’s Lion One Metals.

Initial pilot mining at Tuvatu started in late 2023 before mechanised underground production began in mid-May 2024.

There’s also the Namosi joint venture that is 73.24% owned by Newmont, which has a measured and indicated resource of 105.5Mt grading 0.22g/t gold equivalent, or 700,000oz contained gold equivalent, and an inferred resource of 1.35Bt at 0.1g/t, or 4.3Moz contained gold equivalent.

None of this prospectivity should come as a surprise to anyone with a passing familiarity with geology as Fiji is part of the Pacific Ring of Fire – the active tectonic boundary between the Pacific and Indo-Australian Plate that is known to host several world-class porphyry copper-gold and epithermal gold deposits.

And there are more opportunities emerging at the junior end of the market.

Pro-mining regime

Over the years, Fiji has seen a couple of military coups – the most recent in 2012 – that have negatively impacted investor confidence. But explorers in the region say the nation’s reputation is turning.

Speaking to Stockhead, Alice Queen (ASX:AQX) managing director Andrew Buxton said the coups certainly unsettled mining investment into Fiji during the 1980s and early 1990s.

However, he believes the company timed its entry into Fiji to absolute perfection when political stability returned.

Alice Queen looked at its Fiji projects as an opportunity back in 2014 and only made an expression of interest to the country’s mines department in 2020 during the COVID pandemic.

He also pointed out that Fiji was a former British colony and has a parliamentary democracy based on the Westminster system.

“Everything that we do there is almost like a replica of what we do here in Australia, which makes us feel very comfortable both legally and practically,” Buxton added.

“In terms of the legal system, it’s very reliable, very predictable and it doesn’t have any of those sort of corruption issues that a lot of other jurisdictions around the world tend to have. So we feel very comfortable working within that system in Fiji.”

Buxton also said the Fiji government was very receptive and supportive of new investment into mining.

“That actually got completely magnified a thousand times over during the COVID pandemic because the country, which previously relied on, I think, 80% of its revenue from tourism, found it had very little to fall back on once that got shut down,” he noted.

“It created a real push for more mining projects and investment in mining. It really firmed up their enthusiasm and aggression towards getting more mines up and running.”

Much of Fiji remains underexplored and several companies have joined Alice Queen in moving to leverage this renewed enthusiasm to make new discoveries.

Buxton added that Fiji’s small size meant that government officials were very accessible, particularly for an Australian company.

“We personally are able to sit down with the Minister for Resources Filimoni Vosarogo who is so accessible that I’ve got his mobile number and we text each other all the time,” Buxton said, adding that both Vosarogo and Prime Minister Sitiveni Rabuka were keen to get the company’s highly prospective Viani project up and running.

Fiji projects

Alice Queen was introduced to its Viani, Sabeto and Nabila projects by former Newcrest chief geoscientist John Holliday and the company’s former head of project generation and new business Patrick Creenaune.

Holliday was instrumental to the discovery of the giant Cadia Valley mine in New South Wales, which is still one of the most profitable mines in the world.

Both Holliday and Creenaune were advisors to Newcrest when the company acquired the Namosi project.

“They were two very experienced guys in Fiji. And John is my original partner in Alice Queen and our chief technical advisor,” Buxton said.

“He brought the projects to us on a very strong technical recommendation.

“We had everything lining up. We had good technical enthusiasm about taking these things on, we had a good government environment and an underexplored (jurisdiction) that everyone thought was a holiday destination.”

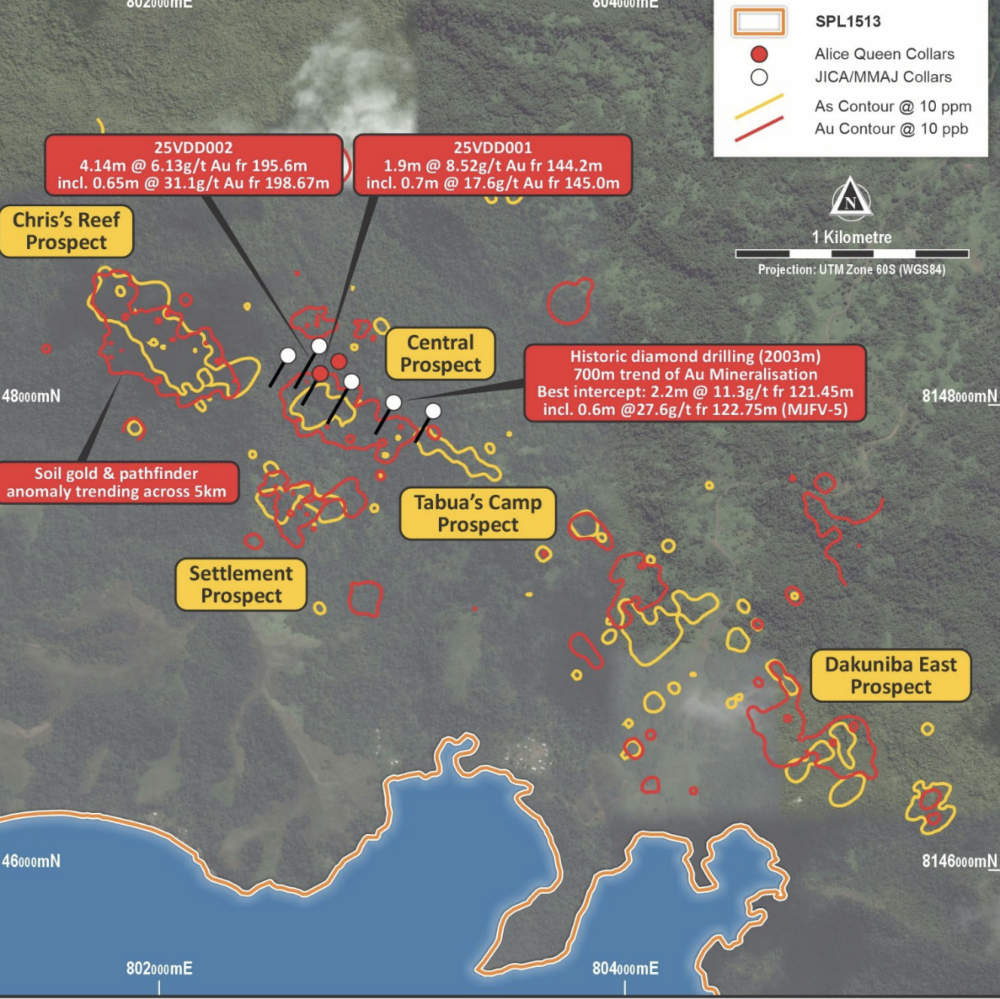

Of its three Fijian projects, Viani on Vanua Levu – Fiji’s second largest island – is the standout due to its potential size.

The company has defined a low sulphidation, epithermal vein zone striking about 5km at the project, where recent trenching and sampling work has identified areas of high-grade gold.

Buxton said while exploration was still in its early days, it saw the project as being potentially another Vatukoula.

He added that besides the scale, epithermal deposits generally were somewhat more predictable than other types of deposits.

“They are much sought after by smaller companies in the market. And that’s generally because the grades are higher while being near-surface,” Buxton said.

He added that while Viani was in quite a remote part of Fiji, it had plenty of support from the local community, the local village leaders and the government to do what it wanted within reason.

The company’s experience in working with the Kaurareg people – the traditional owners at its Horn Island project in the Torres Strait, Australia – also contributed to the success of its outreach.

“When we walked into Fiji, the population there and their customs and their spirituality, all of the things that they do are not dissimilar to he Kaurug people of the Torres Strait,” Buxton said.

“I’m not going to say they’re the same, that’d be rude, but the principles are pretty similar. And once you understand how they roll, it’s relatively straightforward to explain to them how this can benefit the whole community if we work together.”

Drilling plans

Looking ahead, Alice Queen plans to carry out more geophysics at Viani to firm up the next round of drilling with Creenaune and Holliday strongly recommending that this be narrowed down by ground magnetics.

“So our next step will be to undertake some detailed ground magnetics over, if not all of that 5km strike, then certainly the major part of it. (It will) turn up the targets for the next diamond core drilling program, which we hope will be inside a year or so,” Buxton said.

The company’s other projects sit on Fiji’s largest island Viti Levu. Sabeto – a 15km east-west trending zone that hosts several known areas of epithermal gold and porphyry copper-gold style mineralisation – shares a boundary with the Tuvatu gold mine.

“We’ve found some very interesting stuff in our surface sampling. We found what we believe to be a mineralised breccia and there’s been some historical drilling,” Buxton said.

“We feel we can do some very good work there shortly.

“Sabeto is also literally a 20-minute drive from the Nandi airport. It’s very easy access, good roadways and right next to the second biggest city in Fiji.

“Our third project is Nabila, which is about 45 minutes south of Nadi. It has an existing in-situ resource, unconstrained, around about 100,000 ounces.

“But it is near the coast, so we’ve just avoided that for the time being until we work out what the politics are around drilling and further exploration near to the sea.”

Not the only player

Alice Queen isn’t the only ASX-listed junior operating in Fiji.

Dome Gold Mines (ASX:DME) operates the Sigatoka iron sands project on the south coast of Viti Levu, which is prospective for magnetite and heavy minerals, the Nadroga copper-gold and Ono Island gold-silver projects.

It is progressing a feasibility study for Sigatoka and is seeking to raise up to $5m via a share purchase plan.

Proceeds will be used to fund completion of the prerequisites to obtain the issue of the mining licence for Sigatoka and commence mining operations.

Any excess will be used to ramp up mining operations and progress the company’s other projects.

The company also noted in its June 2025 quarterly report that it was investigating options to fund the next phase of exploration – airborne geophysical surveys followed by ground truthing of anomalies – at Nadroga.

At Stockhead, we tell it like it is. While Alice Queen is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.