Eye on Lithium: Will the Russia nickel crisis spark an EV demand-pivot to lithium ferro-phosphate?

Pic: Getty

- EV battery makers look for alternative cathodes since nickel prices unlikely to return to pre-Russian invasion levels

- Forrestania defines 20 new targets at namesake lithium project and that’s just the initial ones

- Bulletin finds more spodumene lithium outcrops at its Ravensthorpe project in WA

All your ASX lithium news for Monday, March 21.

Nickel prices are super sensitive to the Russia/Ukraine conflict due to Russia’s sizable share (around 17%) of global production.

Trading is still halted on LME nickel markets since the short squeeze early this month saw the metal soar to over US$100,000/t and are unlikely to return to pre-invasion levels.

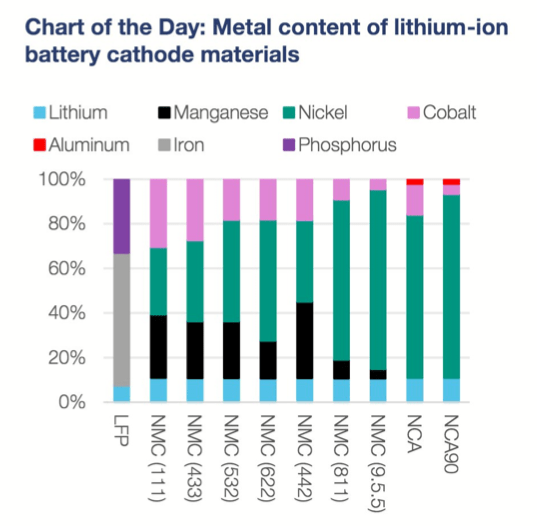

Commonwealth Bank analyst Vivek Dhar reckons these sky-high prices could be the turning point away from nickel-based cathodes in EVs to lithium ferro-phosphate instead.

“High nickel prices may also have a profound impact on electric vehicle battery chemistries in coming years,” they said.

“Most battery cathode chemistries favoured plans for higher nickel intensity to boost energy density as that allowed for more mileage.”

“High nickel prices will likely see the market pivot more towards nickel-free cathode chemistries like lithium ferro-phosphate (LFP) and push for next generation technologies like a lithium anode.”

Basically, an LFP battery uses lithium iron phosphate as the cathode and a graphitic carbon electrode with metallic backing as the anode.

Its energy density is lower than lithium ion battery types like (nickel/manganese/cobalt) but it has a lower cost and a long cycle life.

Plus, it’s also one of the most stable battery chemistries, and if nickel prices are going to be sky-high for a while, it could be a goer for battery manufacturers.

Here’s how ASX lithium stocks are tracking today:

Lithium stocks missing from our list? Shoot a friendly mail to [email protected]

| Code | Company | Price | % Month | % Week | % Today | Market Cap |

|---|---|---|---|---|---|---|

| GL1 | Globallith | 2.42 | 61% | 52% | 20% | $273,602,353.74 |

| AS2 | Askarimetalslimited | 0.52 | 35% | 33% | 18% | $16,777,211.00 |

| LRV | Larvottoresources | 0.225 | -17% | 22% | 15% | $8,035,462.50 |

| AAJ | Aruma Resources Ltd | 0.098 | -7% | 20% | 15% | $13,341,727.76 |

| QXR | Qx Resources Limited | 0.061 | 56% | 33% | 15% | $44,035,703.01 |

| FRS | Forrestaniaresources | 0.35 | -3% | 4% | 15% | $8,570,135.22 |

| EUR | European Lithium Ltd | 0.125 | 14% | 25% | 14% | $126,707,283.89 |

| LRS | Latin Resources Ltd | 0.064 | 68% | 52% | 12% | $84,302,414.10 |

| 1MC | Morella Corporation | 0.032 | 52% | 28% | 10% | $150,110,205.59 |

| BNR | Bulletin Res Ltd | 0.16 | 0% | 7% | 10% | $41,406,186.95 |

| EMH | European Metals Hldg | 1.21 | -3% | 6% | 10% | $154,854,661.50 |

| VKA | Viking Mines Ltd | 0.011 | -21% | -8% | 10% | $10,252,584.31 |

| KGD | Kula Gold Limited | 0.047 | -2% | 7% | 9% | $9,252,552.18 |

| AML | Aeon Metals Ltd. | 0.051 | 6% | 6% | 9% | $40,693,017.74 |

| LEL | Lithenergy | 0.985 | -1% | 10% | 8% | $40,950,000.00 |

| CXO | Core Lithium | 1.205 | 43% | 11% | 7% | $1,918,735,746.75 |

| WR1 | Winsome Resources | 0.455 | 18% | 28% | 7% | $57,145,497.45 |

| NWM | Norwest Minerals | 0.066 | 25% | -1% | 6% | $11,197,657.99 |

| LTR | Liontown Resources | 1.755 | 13% | 9% | 6% | $3,639,093,828.68 |

| RAS | Ragusa Minerals Ltd | 0.075 | 9% | 36% | 6% | $8,921,705.93 |

| MLS | Metals Australia | 0.078 | 73% | 10% | 5% | $26,782,679.03 |

| GT1 | Greentechnology | 0.81 | 0% | 8% | 5% | $81,620,000.00 |

| INR | Ioneer Ltd | 0.55 | -9% | 8% | 5% | $1,097,537,909.48 |

| AZI | Altamin Limited | 0.068 | 1% | 0% | 5% | $25,276,676.88 |

| SYA | Sayona Mining Ltd | 0.1725 | 33% | 8% | 5% | $1,171,403,674.65 |

| LPD | Lepidico Ltd | 0.0345 | 1% | 8% | 5% | $206,331,287.12 |

| GSM | Golden State Mining | 0.078 | -11% | 0% | 4% | $6,231,598.88 |

| SRI | Sipa Resources Ltd | 0.053 | -4% | -2% | 4% | $10,456,264.95 |

| AVZ | AVZ Minerals Ltd | 0.95 | 18% | 6% | 4% | $3,158,637,718.20 |

| WCN | White Cliff Min Ltd | 0.028 | -7% | 8% | 4% | $17,566,912.77 |

| RLC | Reedy Lagoon Corp. | 0.028 | -7% | 8% | 4% | $14,805,645.21 |

| GLN | Galan Lithium Ltd | 1.555 | 10% | 10% | 4% | $451,059,738.00 |

| TON | Triton Min Ltd | 0.029 | -9% | 0% | 4% | $34,797,956.96 |

| CHR | Charger Metals | 0.725 | 1% | 8% | 4% | $22,795,057.60 |

| QPM | Queensland Pacific | 0.15 | -14% | 3% | 3% | $223,751,404.00 |

| AZL | Arizona Lithium Ltd | 0.16 | 14% | 14% | 3% | $309,653,800.53 |

| EFE | Eastern Resources | 0.0505 | -10% | 7% | 3% | $48,421,236.79 |

| PLS | Pilbara Min Ltd | 2.88 | -3% | 0% | 3% | $8,335,135,740.40 |

| VUL | Vulcan Energy | 10.37 | 14% | 10% | 3% | $1,329,615,409.00 |

| NMT | Neometals Ltd | 1.73 | 32% | 18% | 3% | $924,014,227.26 |

| A8G | Australasian Metals | 0.495 | -7% | 5% | 2% | $19,482,689.59 |

| IGO | IGO Limited | 12.265 | 0% | -4% | 2% | $9,102,359,112.26 |

| MRR | Minrex Resources Ltd | 0.058 | -11% | 4% | 2% | $50,306,356.62 |

| G88 | Golden Mile Res Ltd | 0.064 | 14% | 3% | 2% | $10,900,154.66 |

| MIN | Mineral Resources. | 46.93 | -2% | 1% | 1% | $8,745,653,271.41 |

| AGY | Argosy Minerals Ltd | 0.395 | 16% | 11% | 1% | $515,809,757.97 |

| ESS | Essential Metals Ltd | 0.44 | 9% | 17% | 1% | $106,252,550.16 |

| ESS | Essential Metals Ltd | 0.44 | 9% | 17% | 1% | $106,252,550.16 |

| PAM | Pan Asia Metals | 0.515 | -8% | 0% | 1% | $37,565,908.44 |

| LKE | Lake Resources | 1.565 | 67% | 21% | 1% | $1,963,036,417.40 |

| AKE | Allkem Limited | 9.98 | 6% | -6% | 1% | $6,330,629,068.98 |

| GXY | Galaxy Resources | 0 | -100% | -100% | 0% | $2,715,139,305.12 |

| PSC | Prospect Res Ltd | 0.89 | 4% | 5% | 0% | $383,851,372.53 |

| CAI | Calidus Resources | 0.925 | 30% | 9% | 0% | $372,124,732.40 |

| JRL | Jindalee Resources | 3.1 | 10% | 9% | 0% | $167,722,294.60 |

| ASN | Anson Resources Ltd | 0.115 | -8% | 0% | 0% | $117,460,917.20 |

| LIT | Lithium Australia NL | 0.105 | -9% | 0% | 0% | $108,467,136.33 |

| KAI | Kairos Minerals Ltd | 0.026 | 4% | 8% | 0% | $51,014,430.77 |

| ADV | Ardiden Ltd | 0.013 | 0% | 0% | 0% | $34,588,350.63 |

| VMC | Venus Metals Cor Ltd | 0.175 | -10% | -8% | 0% | $26,438,769.53 |

| IPT | Impact Minerals | 0.012 | -8% | -14% | 0% | $26,285,539.03 |

| SHH | Shree Minerals Ltd | 0.02 | 5% | 11% | 0% | $21,264,737.84 |

| LSR | Lodestar Minerals | 0.011 | 22% | -8% | 0% | $19,122,810.83 |

| RGL | Riversgold | 0.037 | 64% | 6% | 0% | $14,949,561.25 |

| RMX | Red Mount Min Ltd | 0.0085 | -6% | 6% | 0% | $13,960,092.79 |

| WML | Woomera Mining Ltd | 0.017 | -6% | -6% | 0% | $11,591,162.12 |

| BYH | Bryah Resources Ltd | 0.05 | -4% | 6% | 0% | $11,310,358.75 |

| DTM | Dart Mining NL | 0.08 | -18% | 0% | 0% | $9,959,274.40 |

| TMB | Tambourahmetals | 0.22 | -8% | 7% | 0% | $9,062,371.56 |

| BMM | Balkanminingandmin | 0.275 | -17% | 0% | 0% | $9,006,250.00 |

| TEM | Tempest Minerals | 0.022 | -12% | 0% | 0% | $8,753,819.76 |

| ENT | Enterprise Metals | 0.014 | -7% | 0% | 0% | $8,644,237.95 |

| AM7 | Arcadia Minerals | 0.225 | -6% | 0% | 0% | $7,873,312.50 |

| AOA | Ausmon Resorces | 0.008 | 14% | 0% | 0% | $6,858,314.74 |

| EMS | Eastern Metals | 0.19 | -16% | 3% | 0% | $6,764,000.00 |

| MTM | Mtmongerresources | 0.145 | -17% | -6% | 0% | $5,025,704.79 |

| LPI | Lithium Pwr Int Ltd | 0.685 | 12% | 13% | -1% | $240,651,195.12 |

| PLL | Piedmont Lithium Inc | 0.9425 | 33% | -1% | -1% | $503,009,705.00 |

| STM | Sunstone Metals Ltd | 0.082 | -1% | 6% | -1% | $185,880,241.26 |

| NVA | Nova Minerals Ltd | 0.69 | -26% | 8% | -1% | $126,141,599.50 |

| SCN | Scorpion Minerals | 0.067 | -7% | 3% | -1% | $18,326,421.06 |

| INF | Infinity Lithium | 0.1525 | -8% | 5% | -2% | $64,298,563.36 |

| AX8 | Accelerate Resources | 0.05 | 2% | 6% | -2% | $12,926,403.85 |

| FFX | Firefinch Ltd | 0.81 | 20% | 2% | -2% | $977,853,046.00 |

| IMI | Infinitymining | 0.17 | -6% | -6% | -3% | $10,062,500.00 |

| ZNC | Zenith Minerals Ltd | 0.32 | -12% | -6% | -3% | $113,488,371.15 |

| PGD | Peregrine Gold | 0.46 | -21% | -10% | -3% | $18,139,063.93 |

| RAG | Ragnar Metals Ltd | 0.03 | -19% | -5% | -3% | $11,553,231.56 |

| KZR | Kalamazoo Resources | 0.29 | -16% | -3% | -3% | $43,558,312.20 |

| SRZ | Stellar Resources | 0.028 | -7% | 4% | -3% | $24,281,776.15 |

| RDT | Red Dirt Metals Ltd | 0.55 | 2% | 6% | -4% | $170,482,421.76 |

| FG1 | Flynngold | 0.135 | -16% | -16% | -4% | $8,968,547.00 |

| CRR | Critical Resources | 0.074 | -20% | 3% | -4% | $114,374,760.65 |

| ARN | Aldoro Resources | 0.325 | -18% | -4% | -4% | $30,511,120.26 |

| PNN | PepinNini Minerals | 0.415 | -10% | -1% | -5% | $26,629,966.59 |

| MQR | Marquee Resource Ltd | 0.0995 | -17% | 1% | -5% | $22,722,273.21 |

| AVW | Avira Resources Ltd | 0.0055 | -8% | 10% | -8% | $12,712,740.00 |

| TKL | Traka Resources | 0.01 | -17% | 0% | -9% | $7,576,520.17 |

| MMC | Mitremining | 0.16 | -20% | -11% | -11% | $4,875,318.00 |

| TSC | Twenty Seven Co. Ltd | 0.0035 | -13% | -13% | -13% | $10,643,255.62 |

A total of 51 stocks were in the green today, with 25 flatlining and 24 in the red.

Who’s got news out today?

FORRESTANIA RESOURCES (ASX:FRS)

The $15.5m market cap company has defined new targets at its namesake project, with a massive pipeline of 20 initial prospects to explore – along with 6 more at the Southern Cross/Leonora project areas.

The explorer says this pipeline highlights the prospectivity of the Forrestania Project for potentially significant lithium, gold and nickel discoveries.

“Our Forrestania Project runs north-south for ~100km and covers significant areas of prospective Granite / Greenstone contact and the “Goldilocks” zone for lithium exploration,” CEO Angus Thomson said.

“We are particularly excited about the Goldilocks zone as this is essentially the “sweet spot” when exploring for lithium bearing pegmatites.”

“It really is a very exciting time at Forrestania Resources as we continue to build momentum, ramp up our exploration and look forward to drilling a number of high impact targets this year”

Forrestania Resources (ASX:FRS) share price today

The company has found more spodumene lithium outcrops at its Ravensthorpe project in WA, just 700m southwest from the spodumene at Big pegmatite.

BRN says the repeated occurrences of spodumene along the Eastern Pegmatite Trend provide further strong evidence for lithium in the area.

“Together with the Western Pegmatite Trend and our newly acquired tenements we feel we are building a substantial lithium play in an incredibly prospective area with an operating lithium processing plant on our doorstep,” CEO Mark Csar said.

Bulletin Resources (ASX:BNR) share price today

The company has kicked off drilling at its Cancet project in Quebec which will build on two previous campaigns at the project in 2017.

MD Chris Evans said drilling is a milestone because it means Winsome is one step closer to its plan of declaring a maiden resource.

“This is the culmination of 12 months of work since the Winsome Resources spin-out and listing process began in March 2021 and represents the new company’s first ‘ín-ground’ exploration work,” he said

“The drill program will focus on infill drilling to increase our knowledge of the ore body, as well as extension drilling with a view to extending the known mineralisation to the east, north and west.”

“Planning is also underway for our spring and summer exploration programs, which will commence once ground conditions permit. This will be a combination of on the ground field exploration, taking rock and soil samples, trenching and drilling.”

“The programs will be based on targets identified by the magnetic survey already conducted and an upcoming geophysical gravity survey that will be completed in April 2022.”

Winsome Resources (ASX:WR1) share price today

Liontown says assays from its Buldania project in WA confirm the potential for incremental extension at the main Anna deposit, as well as defining multiple, new lithium mineralised pegmatites at the Northwest prospect.

Key intersections from Anna include:

- 3m at 1.1% Li2O from 36m;

- 21m at 0.5% Li2O from 8m including 1m at 2.0% Li2O from 13m; and

17m at 1.1% Li2O from 18m including 7m at 1.4% Li2O from 19m and 2m at 1.9% Li2O from 30m.

At Northwest assays returned:

- 5m at 1.3% Li2O from 32m;

- 10m at 1.1% Li2O from 48m;

“The expanding Northwest Prospect presents an exciting opportunity for further follow up exploration and, along with the potential for incremental extension of the Anna Deposit, ensures that Buldania continues to emerge as an attractive asset,” MD and CEO Tony Ottaviano said.

Liontown Resources (ASX:LTR) share price today

The initial RC drilling of the recently discovered foundation pegmatite at the company’s Manindi Project in WA has produced thick intersections of pegmatite with visible lithium bearing minerals.

The intersections are under recent rock chip sample results that averaged 1.29% Li2O, 0.51% Rb over the entire 500m pegmatite strike length and included results of up to 2.30% Li2O and 0.70% Rb.

MLS has completed around half of its 3,500m program and plans to follow up with diamond drilling to provide accurate intersection boundaries, structural orientations and petrography, as well as metallurgical samples for lithium and tantalum concentrate testing.

Metals Australia (ASX:MLS) share price today

The company has added further lithium project management and engineering experience to its team with the appointment of new chief technical officer Brett Rabe.

Rabe’s appointment comes as the company looks to fast-track the development at Big Sandy, a very shallow, flat lying mineralised sedimentary lithium resource with excellent available infrastructure in Arizona.

AZLs successful 2019 drill program at Big Sandy resulted in the estimation of a total indicated and inferred JORC resource of 32.5 million tonnes grading 1,850 ppm Li for 320,800 tonnes Li2CO.

This represents 4% of the Big Sandy Project area that contains an estimated exploration target of between 271.1Mt to 483.15Mt at 1,000 >2,000ppm Li.

AZL managing director Paul Lloyd said with Rabe’s significant experience in engineering and project management at Lithium Americas Corp’s Thacker Pass Project, the company is confident he’ll be able to contribute significantly towards the sustainable development of Big Sandy.

“Thacker Pass represents the most similar project to Big Sandy and, through Brett’s appointment, we’ll be able to apply his learnings to fast tracking the project,” he said.

Currently at the project, an application for a permit of exploration including 145 exploration holes and a bulk sample is awaiting Bureau of Land Management (BLM) approval.

The BLM is continuing its evaluation of the company’s drilling application, and once that process has been completed, AZL will receive a decision on its exploration drilling application.

Arizona Lithium (ASX:AZL) share price today

GOLDEN MILE RESOURCES (ASX:G88)

The explorer has picked up three exploration licenses near Marble Bar – in the lithium rich East Pilbara region of WA – which it says add to its portolio focused on critical green metals.

Called the Calatos project, the tenements within 100km radius of the major Wodgina and Pilgangoora Lithium Mines and approximately 20km from Global Lithium Resources’ss (ASX:GL1) recent Archer discovery.

The company has also completed a capital raising of $1,600,000 at $0.056 per share which will fund exploration at Calatos – in addition to continued exploration of the company’s existing projects – Yarrambee, Yuinmery and Quicksilver.

Golden Mile Resources (ASX:G88) share price today

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.