Eye on Lithium: US$116bn spend needed for EV revolution, while Liontown gets a $300m nod for Kathleen Valley

Analysts want Governments and automakers to recognise that the path to EV adoption is going to costs ALOT. Pic via Getty Images.

- Automaker’s EV targets could blow out spending on lithium projects to US$116bn

- Analysts agree there will be a deficit – but by how much is up in the air

- Liontown could be backed for $300m from Australia, US and South Korea

All your lithium news, Monday August 7.

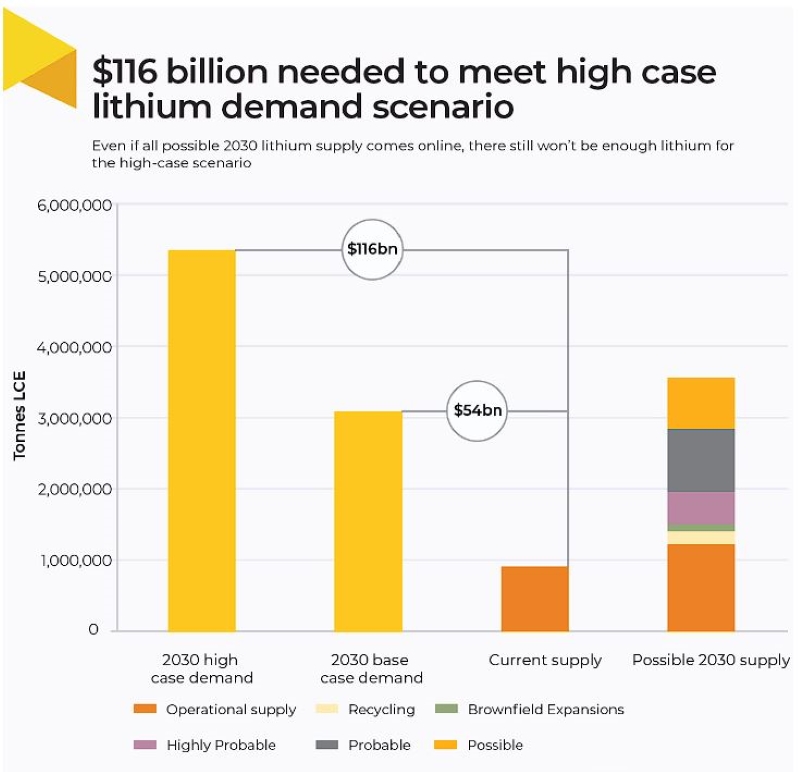

Ambitious decarbonisation targets set by governments and automakers will require US$116 billion of investment in lithium projects to meet global demand, says Benchmark Intelligence (BMI).

This is more than double the US$54bn base-case scenario BMI outlined last quarter and encompasses data from EV analyst Rho Motion and the International Energy Agency’s formulation on enacted national policies around net-zero emissions.

BMI’s latest forecast says we’ll require 5.3Mt of lithium carbonate equivalent (LCE) by 2030, compared to the 915,000t in production today.

“It’s almost impossible, and definitely a race against time,” Cameron Perks, an analyst at Benchmark, said. “The big money that needs to be spent takes time to get approval for and to deploy.”

BMI tracks around 400 projects, but Perks is concerned that those with the deepest pockets are not going to rush to invest heavily in even more projects.

“The players with skin in the game are the least likely to rush their spending,” he says.

“They don’t want to flood the market with lithium too quickly. They want to release it slowly to maximise their return.”

Ambitious automakers

There’s a lot of optimism with carmakers’ General Motors and Mercedes-Benz which both aim to produce 100% EV vehicles by 2035 and 2030 respectively.

Then there’s Stellantis – which pumps out the Peugeot, Dodge, Jeep, Alfa Romeo, Chrysler, RAM brands and more, that’s targeting 100% of its Chinese vehicles to be electric by 2030, 50% in the US and 100% in Europe.

Elon Musk’s Tesla produced 1.3 million EVs in 2022 and has a target of 20 million by the turn of the next decade.

This means that for those targets to be reached, 7 terawatt hours (TWh) of batteries will be needed, and without large increases in the amount of lithium produced and refined, automakers will find their goals impossible to achieve.

“As a carmaker, consumer, or EV policy maker, should I be alarmed? Yes,” Perks said.

In order to meet these ambitious targets, automakers are increasingly cutting out the middlemen and looking to secure lithium directly.

In January this year, GM is investing US$650m in Lithium Americas to help the developer progress their Thacker Pass lithium mine in Nevada.

In tandem, Tesla is investing over a billion dollars to build its own lithium hydroxide refinery in Texas which began construction in May.

Yet Musk cites lithium chemical production as being the bottleneck for the battery industry.

Lithium ore is very common throughout Earth. What matters is refining capacity.

— Elon Musk (@elonmusk) April 21, 2023

2030 targets are lofty – yet some analysts such as RFC Ambrian are optimistic about the margins.

In a new report on the outlook for the lithium market, the corporate advisory firm says consensus demand forecasts for lithium sit at 2.92Mt of lithium carbonate equivalent, a CAGR of 19% and around 4X the 720,000t of production registered in 2022.

They show a deficit as large as 761,000t by then, setting a platform for the strong margins generated by hard rock lithium miners to continue into the future.

However, RFC says the deficit could be much smaller, expecting supply to come online faster than many market observers anticipate.

“This is a large deficit relative to the market size and suggests that higher lithium prices will still be necessary to attract new supply or cause some demand destruction,” RFC says.

“Based on our own analysis of lithium supply … we also expect that the market will be in deficit in 2030, but that the deficit may not be as large as currently indicated by consensus because the pace of new supply is picking up.”

Here’s how ASX lithium stocks are tracking:

45 battery metal-integral lithium stocks were up today, while 50 stagnated. 68 dropped into the red.

| Code | Company | Price | % Today | Market Cap |

|---|---|---|---|---|

| LIT | Lithium Australia | 0.06 | 78.79 | $40,299,325 |

| MQR | Marquee Resource Ltd | 0.04 | 16.67 | $11,905,470 |

| RMX | Red Mount Min Ltd | 0.00 | 12.50 | $9,247,404 |

| IEC | Intra Energy Corp | 0.00 | 12.50 | $6,483,126 |

| MHC | Manhattan Corp Ltd | 0.01 | 12.50 | $23,490,230 |

| KAI | Kairos Minerals Ltd | 0.03 | 10.42 | $62,901,893 |

| GSM | Golden State Mining | 0.05 | 9.30 | $8,216,796 |

| MMC | Mitremining | 0.30 | 7.27 | $10,514,653 |

| 1MC | Morella Corporation | 0.01 | 7.14 | $42,690,063 |

| TKM | Trek Metals Ltd | 0.10 | 6.67 | $44,380,807 |

| NIS | Nickelsearch | 0.06 | 6.67 | $5,737,823 |

| AML | Aeon Metals Ltd. | 0.02 | 6.25 | $17,542,410 |

| LM1 | Leeuwin Metals Ltd | 0.36 | 5.88 | $15,226,900 |

| WC8 | Wildcat Resources | 0.20 | 5.41 | $123,130,746 |

| AM7 | Arcadia Minerals | 0.11 | 5.00 | $9,405,010 |

| EFE | Eastern Resources | 0.01 | 5.00 | $12,419,465 |

| MTM | MTM Critical Metals | 0.07 | 4.62 | $6,308,037 |

| G88 | Golden Mile Res Ltd | 0.05 | 4.55 | $14,493,138 |

| M2R | Miramar | 0.05 | 4.00 | $5,546,340 |

| LLO | Lion One Metals Ltd | 1.06 | 3.92 | $14,085,531 |

| WR1 | Winsome Resources | 2.14 | 3.88 | $334,707,805 |

| STM | Sunstone Metals Ltd | 0.03 | 3.85 | $80,131,607 |

| BNR | Bulletin Res Ltd | 0.06 | 3.77 | $15,560,328 |

| ANX | Anax Metals Ltd | 0.06 | 3.64 | $22,516,715 |

| LRV | Larvottoresources | 0.15 | 3.57 | $9,415,661 |

| KTA | Krakatoa Resources | 0.03 | 3.57 | $11,938,544 |

| A8G | Australasian Metals | 0.15 | 3.45 | $7,557,472 |

| FTL | Firetail Resources | 0.09 | 3.33 | $8,662,500 |

| ASN | Anson Resources Ltd | 0.17 | 3.13 | $203,283,770 |

| EMC | Everest Metals Corp | 0.17 | 3.13 | $20,709,297 |

| EMC | Everest Metals Corp | 0.17 | 3.13 | $20,709,297 |

| PLS | Pilbara Min Ltd | 5.14 | 3.01 | $14,960,955,530 |

| AKE | Allkem Limited | 14.74 | 2.65 | $9,156,770,115 |

| AZS | Azure Minerals | 2.73 | 2.63 | $1,038,027,952 |

| TMB | Tambourahmetals | 0.32 | 2.38 | $13,314,800 |

| TMB | Tambourahmetals | 0.32 | 2.38 | $13,314,800 |

| INF | Infinity Lithium | 0.12 | 2.22 | $52,041,610 |

| INR | Ioneer Ltd | 0.29 | 1.79 | $590,635,581 |

| GL1 | Globallith | 1.73 | 1.76 | $441,648,438 |

| SYA | Sayona Mining Ltd | 0.15 | 1.72 | $1,487,680,316 |

| QXR | Qx Resources Limited | 0.03 | 1.52 | $29,596,457 |

| AZI | Altamin Limited | 0.08 | 1.28 | $30,553,907 |

| LPI | Lithium Pwr Int Ltd | 0.29 | 0.88 | $179,332,705 |

| DLI | Delta Lithium | 0.92 | 0.55 | $478,155,840 |

| WES | Wesfarmers Limited | 49.97 | 0.43 | $56,416,123,343 |

| ADV | Ardiden Ltd | 0.01 | 0.00 | $16,130,012 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0.00 | $2,752,409,203 |

| EMH | European Metals Hldg | 0.84 | 0.00 | $105,013,049 |

| EUR | European Lithium Ltd | 0.08 | 0.00 | $115,721,852 |

| MLS | Metals Australia | 0.03 | 0.00 | $21,217,230 |

| RLC | Reedy Lagoon Corp. | 0.01 | 0.00 | $4,533,757 |

| TKL | Traka Resources | 0.01 | 0.00 | $6,970,634 |

| AAJ | Aruma Resources Ltd | 0.04 | 0.00 | $7,651,872 |

| AX8 | Accelerate Resources | 0.02 | 0.00 | $7,971,637 |

| AS2 | Askarimetalslimited | 0.28 | 0.00 | $18,801,874 |

| EMS | Eastern Metals | 0.06 | 0.00 | $3,659,691 |

| TEM | Tempest Minerals | 0.01 | 0.00 | $6,588,681 |

| WCN | White Cliff Min Ltd | 0.01 | 0.00 | $12,278,519 |

| WML | Woomera Mining Ltd | 0.01 | 0.00 | $9,561,946 |

| AZL | Arizona Lithium Ltd | 0.02 | 0.00 | $60,096,750 |

| ENT | Enterprise Metals | 0.00 | 0.00 | $2,997,884 |

| PGD | Peregrine Gold | 0.28 | 0.00 | $15,428,218 |

| AVW | Avira Resources Ltd | 0.00 | 0.00 | $4,267,580 |

| MRR | Minrex Resources Ltd | 0.02 | 0.00 | $17,357,880 |

| SRZ | Stellar Resources | 0.01 | 0.00 | $13,077,535 |

| AOA | Ausmon Resorces | 0.00 | 0.00 | $4,361,802 |

| VKA | Viking Mines Ltd | 0.01 | 0.00 | $10,252,584 |

| IPT | Impact Minerals | 0.02 | 0.00 | $42,670,558 |

| SRI | Sipa Resources Ltd | 0.02 | 0.00 | $4,791,321 |

| VMC | Venus Metals Cor Ltd | 0.12 | 0.00 | $22,767,442 |

| RGL | Riversgold | 0.01 | 0.00 | $13,317,660 |

| ZNC | Zenith Minerals Ltd | 0.09 | 0.00 | $31,714,279 |

| EPM | Eclipse Metals | 0.02 | 0.00 | $34,477,016 |

| MXR | Maximus Resources | 0.04 | 0.00 | $12,489,975 |

| DRE | Dreadnought Resources Ltd | 0.05 | 0.00 | $170,456,189 |

| WMC | Wiluna Mining Corp | 0.21 | 0.00 | $74,238,031 |

| ZEO | Zeotech Limited | 0.05 | 0.00 | $76,766,538 |

| ALY | Alchemy Resource Ltd | 0.01 | 0.00 | $16,493,068 |

| LIS | Lisenergylimited | 0.29 | 0.00 | $48,115,114 |

| GW1 | Greenwing Resources | 0.20 | 0.00 | $33,690,317 |

| TYX | Tyranna Res Ltd | 0.02 | 0.00 | $72,301,357 |

| IR1 | Irismetals | 1.55 | 0.00 | $123,581,500 |

| TUL | Tulla Resources | 0.00 | 0.00 | $118,262,971 |

| LLL | Leolithiumlimited | 1.14 | 0.00 | $1,125,447,873 |

| CMD | Cassius Mining Ltd | 0.04 | 0.00 | $17,882,215 |

| ENT | Enterprise Metals | 0.00 | 0.00 | $2,997,884 |

| DTM | Dart Mining NL | 0.04 | 0.00 | $6,546,915 |

| XTC | Xantippe Res Ltd | 0.00 | 0.00 | $11,480,100 |

| KOB | Kobaresourceslimited | 0.13 | 0.00 | $13,704,167 |

| DYM | Dynamicmetalslimited | 0.24 | 0.00 | $8,225,000 |

| TOR | Torque Met | 0.15 | 0.00 | $13,968,871 |

| SBR | Sabre Resources | 0.04 | 0.00 | $11,367,961 |

| ICL | Iceni Gold | 0.11 | 0.00 | $22,942,857 |

| TMX | Terrain Minerals | 0.01 | 0.00 | $5,415,997 |

| MHK | Metalhawk. | 0.13 | 0.00 | $10,240,231 |

| NKL | Nickelxltd | 0.07 | 0.00 | $6,136,905 |

| L1M | Lightning Minerals | 0.19 | 0.00 | $7,451,458 |

| LTR | Liontown Resources | 2.73 | -0.37 | $6,034,180,306 |

| PLL | Piedmont Lithium Inc | 0.79 | -0.63 | $302,453,475 |

| GLN | Galan Lithium Ltd | 0.77 | -0.65 | $268,670,415 |

| IGO | IGO Limited | 13.70 | -0.72 | $10,450,295,819 |

| AGY | Argosy Minerals Ltd | 0.31 | -0.81 | $435,366,324 |

| NMT | Neometals Ltd | 0.52 | -0.95 | $290,189,117 |

| RIO | Rio Tinto Limited | 113.74 | -0.95 | $42,626,757,854 |

| VUL | Vulcan Energy | 4.07 | -0.97 | $687,748,087 |

| CRR | Critical Resources | 0.04 | -1.11 | $77,576,257 |

| A11 | Atlantic Lithium | 0.44 | -1.14 | $268,066,330 |

| MIN | Mineral Resources. | 69.15 | -1.16 | $13,605,865,854 |

| NVA | Nova Minerals Ltd | 0.33 | -1.49 | $70,648,137 |

| SCN | Scorpion Minerals | 0.07 | -1.52 | $22,816,609 |

| LEL | Lithenergy | 0.62 | -1.59 | $64,896,300 |

| JRL | Jindalee Resources | 1.80 | -1.64 | $105,003,508 |

| LPM | Lithium Plus | 0.28 | -1.75 | $18,806,637 |

| LLI | Loyal Lithium Ltd | 0.53 | -1.85 | $36,444,601 |

| CHR | Charger Metals | 0.27 | -1.85 | $16,770,879 |

| SLM | Solismineralsltd | 0.47 | -2.08 | $32,140,996 |

| LRD | Lordresourceslimited | 0.09 | -2.20 | $3,379,023 |

| LRD | Lordresourceslimited | 0.09 | -2.20 | $3,379,023 |

| MAN | Mandrake Res Ltd | 0.04 | -2.22 | $26,944,196 |

| SGQ | St George Min Ltd | 0.04 | -2.38 | $35,301,443 |

| BMM | Balkanminingandmin | 0.18 | -2.70 | $11,298,323 |

| CAI | Calidus Resources | 0.17 | -2.86 | $106,378,976 |

| PL3 | Patagonia Lithium | 0.17 | -2.86 | $8,575,613 |

| ARN | Aldoro Resources | 0.16 | -3.03 | $22,212,918 |

| ESS | Essential Metals Ltd | 0.47 | -3.09 | $130,397,084 |

| CXO | Core Lithium | 0.62 | -3.13 | $1,189,450,748 |

| GT1 | Greentechnology | 0.60 | -3.23 | $132,046,064 |

| EVR | Ev Resources Ltd | 0.01 | -3.33 | $14,039,761 |

| CY5 | Cygnus Metals Ltd | 0.29 | -3.33 | $66,981,161 |

| KZR | Kalamazoo Resources | 0.14 | -3.45 | $22,694,629 |

| TON | Triton Min Ltd | 0.03 | -3.57 | $43,717,957 |

| IMI | Infinitymining | 0.13 | -3.70 | $10,422,187 |

| DAF | Discovery Alaska Ltd | 0.03 | -3.85 | $6,090,102 |

| PSC | Prospect Res Ltd | 0.12 | -4.00 | $57,782,433 |

| PNN | Power Minerals Ltd | 0.36 | -4.05 | $27,059,685 |

| LRS | Latin Resources Ltd | 0.40 | -4.17 | $1,101,745,105 |

| RAG | Ragnar Metals Ltd | 0.02 | -4.55 | $9,467,360 |

| MM1 | Midasmineralsltd | 0.41 | -4.65 | $31,583,247 |

| PAT | Patriot Lithium | 0.21 | -4.65 | $13,198,313 |

| QPM | Queensland Pacific | 0.10 | -4.76 | $183,366,532 |

| FRS | Forrestaniaresources | 0.10 | -4.76 | $9,777,853 |

| MNS | Magnis Energy Tech | 0.10 | -4.76 | $123,847,306 |

| YAR | Yari Minerals Ltd | 0.02 | -5.00 | $9,647,156 |

| EG1 | Evergreenlithium | 0.29 | -5.00 | $16,869,000 |

| LNR | Lanthanein Resources | 0.02 | -5.26 | $21,309,936 |

| VSR | Voltaic Strategic | 0.04 | -5.26 | $17,149,408 |

| OCN | Oceanalithiumlimited | 0.25 | -5.66 | $14,065,273 |

| KGD | Kula Gold Limited | 0.02 | -6.25 | $5,971,391 |

| FIN | FIN Resources Ltd | 0.02 | -6.25 | $9,936,566 |

| NWM | Norwest Minerals | 0.04 | -6.38 | $13,515,767 |

| REC | Rechargemetals | 0.22 | -6.52 | $24,284,429 |

| RAS | Ragusa Minerals Ltd | 0.06 | -6.67 | $8,555,927 |

| FBM | Future Battery | 0.10 | -6.82 | $47,062,965 |

| BUR | Burleyminerals | 0.14 | -6.90 | $14,688,030 |

| PAM | Pan Asia Metals | 0.26 | -7.14 | $43,613,202 |

| FG1 | Flynngold | 0.07 | -7.14 | $9,546,781 |

| PMT | Patriotbatterymetals | 1.40 | -7.59 | $527,765,688 |

| LPD | Lepidico Ltd | 0.01 | -7.69 | $99,297,974 |

| AUN | Aurumin | 0.02 | -7.69 | $7,671,030 |

| DAL | Dalaroometalsltd | 0.05 | -8.47 | $2,556,175 |

| THR | Thor Energy PLC | 0.00 | -10.00 | $7,296,457 |

| BYH | Bryah Resources Ltd | 0.02 | -10.53 | $6,640,600 |

| BM8 | Battery Age Minerals | 0.40 | -12.09 | $33,769,264 |

| CTN | Catalina Resources | 0.00 | -12.50 | $4,953,948 |

| LKE | Lake Resources | 0.19 | -12.79 | $305,825,612 |

| LSR | Lodestar Minerals | 0.01 | -20.00 | $18,433,973 |

WHO’S GOT NEWS OUT?

Here’s more news out from the lithium plays today.

LIONTOWN RESOURCES (ASX:LTR)

Japanese conglomerate Sumitomo Corp wants to build a supply chain network through future production from Liontown’s Kathleen Valley lithium development.

This includes studying ways to get the raw production processed into LCE and further refined into lithium hydroxide so it can supply the Japanese market and elsewhere, Sumitomo says,

While details aren’t yet inked, the two companies say they plan to take about 24 months to conduct a thorough study for the scale of the production rates and downstream processing options.

Talks about this move have arrived on the same day that the company could receive $300m in Australian, US and South Korean funding towards the $895m project.

Three letters of support/interest, are indicating a total non-binding and conditional finance interest for up to $300 million to support the delivery of the Kathleen Valley Project.

Any financial support is subject to the eligibility criteria, and credit and risk requirements outlined in the individual letters announced to market.

While not tattooed yet, it looks like Liontown is charging straight into production at its gigantic 156Mt Kathleen Vally lithium-tantalum project, and regardless of an intergovernmental cash input from the West, it already has offtake deals with LG Energy Solutions, Tesla and Ford Motors.

“We are putting our downstream strategy into action by partnering with Sumitomo Corporation to explore the feasibility of developing downstream lithium products between Australia and Japan – two longstanding and successful partner nations in natural resources,” LTR MD Tony Ottaviano said at the ongoing Diggers & Dealers conference in Kalgoorlie.

“Liontown really is powering ahead on all fronts, and our flagship Kathleen Valley Project is now less than 12 months from first production.”

FUTURE BATTERY MINERALS (ASX:FBM)

After a successful round of exploration at its Kangaroo Hills lithium project (KHLP) last month where diamond drilling showed hits of up to 1.36% Li2O, Future Battery Minerals now fully owns the project.

FBM bought the remaining stake from Lodestar Minerals (ASX:LSR) in a $4m deal consisting of cash and shares and is actively drilling the Big Red prospect that recently proved up 29m @ 1.36% Li2O from 38m at hole KHRC011.

FBM Exec chair Mike Edwards says the acquisition is a significant step in FBM becoming the next lithium producer in WA.

“The acquisition of the remaining 20% interest confirms the belief and potential we see at Kangaroo Hills and allows us to confidently move forward with our strategic plans for the project,” Edwards says.

KLHP is situated in a well-endowed Goldfields lithium province nearby Mineral Resources’ (ASX:MIN) operating Mt Marion lithium mine and after drilling 47 holes over 6,000m it has identified six highly-prospective targets within the tenement area.

At Stockhead, we tell it like it is. While Future Battery Minerals is a Stockhead advertiser, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.