Eye on Lithium: US hit record lithium-ion battery imports in Q4 2021, with 80% from China

Pic: Getty

- QXR nabs $2.5m investment from Chinese firm Suzhou TA&A Ultra Clean Technology

- Woomera ready to kick off exploration at WA projects

- Core picks up six mineral leases next to its Finniss project in the NT

All your ASX lithium news for Monday, February 28.

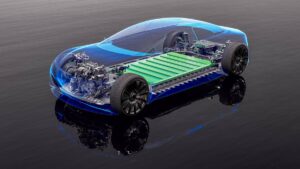

Despite Biden’s plans to establish a secure lithium supply chain in the US, the country is still importing lithium-ion batteries at record rates, and mainly from China.

S&P Global flagged that imports hit a quarterly record of 103,889 metric tons in the final three months of 2021, jumping 137% from a year earlier and 24% from the previous quarter.

That’s the sixth consecutive quarter of increasing imports as the Federal U.S. automakers and energy storage suppliers step up efforts to create more domestic alternatives for battery materials and factories for finished cells and packs.

China accounted for 80% of U.S. lithium-ion battery imports in the period, up from less than 50% in the fourth quarter of 2020 – and the country nearly quadrupled its shipments to the United States.

South Korea accounted for nearly 9% of U.S. lithium-ion battery imports in 2021’s fourth quarter, while Japan made up 3.1%.

Overall, U.S. battery imports more than doubled in 2021 to 320,360 metric tons, from 158,687 metric tons in 2020, and jumped 272% since 2019.

Here’s how ASX lithium stocks are tracking today:

| Code | Company | Price | % Month | % Week | % Today | Market Cap |

|---|---|---|---|---|---|---|

| QXR | Qx Resources Limited | 0.041 | 14% | 5% | 32% | $22,191,731.95 |

| MLS | Metals Australia | 0.055 | 38% | 22% | 28% | $11,262,908.09 |

| KGD | Kula Gold Limited | 0.048 | 20% | 0% | 14% | $9,037,376.54 |

| TMB | Tambourahmetals | 0.225 | -6% | -6% | 13% | $8,238,519.60 |

| WML | Woomera Mining Ltd | 0.018 | -5% | 0% | 13% | $10,909,329.06 |

| AX8 | Accelerate Resources | 0.043 | 16% | -12% | 10% | $9,884,897.06 |

| TKL | Traka Resources | 0.012 | -25% | 0% | 9% | $7,576,520.17 |

| NMT | Neometals Ltd | 1.335 | 3% | 2% | 6% | $688,212,376.98 |

| RMX | Red Mount Min Ltd | 0.0085 | -23% | -6% | 6% | $13,138,910.86 |

| AAJ | Aruma Resources Ltd | 0.086 | 6% | -18% | 6% | $12,713,881.74 |

| EUR | European Lithium Ltd | 0.088 | -20% | -20% | 6% | $95,606,405.12 |

| GL1 | Globallith | 1.365 | 0% | -9% | 6% | $175,595,540.46 |

| AVZ | AVZ Minerals Ltd | 0.785 | 19% | -2% | 5% | $2,571,786,994.60 |

| LPD | Lepidico Ltd | 0.0305 | -20% | -10% | 5% | $180,931,879.95 |

| AM7 | Arcadia Minerals | 0.215 | -7% | -10% | 5% | $7,173,462.50 |

| CAI | Calidus Resources | 0.765 | 11% | 8% | 5% | $292,193,460.22 |

| AML | Aeon Metals Ltd. | 0.05 | 19% | 4% | 4% | $41,558,826.62 |

| EMH | European Metals Hldg | 1.185 | -19% | -5% | 4% | $160,029,740.10 |

| MIN | Mineral Resources. | 46.57 | -18% | -2% | 4% | $8,466,154,959.13 |

| QPM | Queensland Pacific | 0.135 | -18% | -23% | 4% | $200,604,707.03 |

| CXO | Core Lithium | 0.7775 | 7% | -7% | 3% | $1,279,218,583.00 |

| SCN | Scorpion Minerals | 0.07 | 8% | -3% | 3% | $18,326,421.06 |

| LRS | Latin Resources Ltd | 0.037 | 12% | -3% | 3% | $51,937,817.62 |

| PNN | PepinNini Minerals | 0.405 | -9% | -12% | 3% | $24,181,234.03 |

| AZL | Arizona Lithium Ltd | 0.1175 | -10% | -16% | 2% | $229,743,142.33 |

| EFE | Eastern Resources | 0.052 | -12% | -7% | 2% | $50,194,678.07 |

| PLL | Piedmont Lithium Inc | 0.6875 | 14% | -3% | 1% | $360,049,052.00 |

| LTR | Liontown Resources | 1.44 | 6% | -8% | 1% | $3,134,882,033.14 |

| FFX | Firefinch Ltd | 0.6475 | -2% | -4% | 0% | $759,897,849.00 |

| IGO | IGO Limited | 10.93 | -8% | -11% | 0% | $8,269,364,517.96 |

| AGY | Argosy Minerals Ltd | 0.31 | -2% | -9% | 0% | $406,785,083.26 |

| ASN | Anson Resources Ltd | 0.11 | -4% | -12% | 0% | $112,353,920.80 |

| ESS | Essential Metals Ltd | 0.32 | -17% | -21% | 0% | $78,159,031.04 |

| GXY | Galaxy Resources | 0 | -100% | -100% | 0% | $2,715,139,305.12 |

| JRL | Jindalee Resources | 2.6 | 13% | -8% | 0% | $140,670,311.60 |

| LKE | Lake Resources | 0.905 | 8% | -3% | 0% | $1,106,363,854.79 |

| LPI | Lithium Pwr Int Ltd | 0.56 | -3% | -8% | 0% | $195,311,114.88 |

| AKE | Allkem Limited | 9.1 | -1% | -3% | 0% | $5,801,482,832.60 |

| SYA | Sayona Mining Ltd | 0.1125 | -13% | -13% | 0% | $798,403,637.14 |

| TON | Triton Min Ltd | 0.03 | -12% | -6% | 0% | $37,283,525.31 |

| DTM | Dart Mining NL | 0.1 | 12% | 2% | 0% | $12,449,093.00 |

| FG1 | Flynngold | 0.165 | 3% | 3% | 0% | $10,570,073.25 |

| GSM | Golden State Mining | 0.079 | -18% | -10% | 0% | $6,563,950.82 |

| MMC | Mitremining | 0.2 | 11% | 0% | 0% | $5,417,020.00 |

| SHH | Shree Minerals Ltd | 0.016 | 45% | -16% | 0% | $17,011,790.27 |

| TEM | Tempest Minerals | 0.023 | 5% | -8% | 0% | $9,151,720.65 |

| TSC | Twenty Seven Co. Ltd | 0.004 | 0% | 0% | 0% | $10,643,255.62 |

| WCN | White Cliff Min Ltd | 0.024 | 20% | -20% | 0% | $14,415,033.58 |

| CRR | Critical Resources | 0.075 | -23% | -19% | 0% | $110,803,987.65 |

| MTM | Mtmongerresources | 0.165 | 14% | -6% | 0% | $4,671,155.45 |

| ENT | Enterprise Metals | 0.015 | -6% | 0% | 0% | $8,595,302.18 |

| AVW | Avira Resources Ltd | 0.005 | 0% | -17% | 0% | $10,593,950.00 |

| BNR | Bulletin Res Ltd | 0.125 | 25% | -22% | 0% | $35,694,988.75 |

| ESS | Essential Metals Ltd | 0.32 | -17% | -21% | 0% | $78,159,031.04 |

| MRR | Minrex Resources Ltd | 0.056 | 2% | -14% | 0% | $46,295,768.96 |

| A8G | Australasian Metals | 0.45 | -12% | -16% | 0% | $18,076,722.30 |

| MQR | Marquee Resource Ltd | 0.1 | -20% | -17% | 0% | $21,446,510.20 |

| SRZ | Stellar Resources | 0.025 | 9% | -17% | 0% | $20,932,565.65 |

| GT1 | Greentechnology | 0.75 | -3% | -7% | -1% | $80,030,000.00 |

| RDT | Red Dirt Metals Ltd | 0.54 | -16% | 0% | -1% | $139,059,782.93 |

| VUL | Vulcan Energy | 8.54 | -1% | -6% | -1% | $1,136,097,126.70 |

| STM | Sunstone Metals Ltd | 0.075 | -5% | -10% | -1% | $170,203,594.40 |

| AS2 | Askarimetalslimited | 0.345 | -10% | -10% | -1% | $13,345,508.75 |

| FRS | Forrestaniaresources | 0.31 | -10% | -14% | -2% | $8,851,123.26 |

| CHR | Charger Metals | 0.605 | -23% | -16% | -2% | $20,027,086.32 |

| PLS | Pilbara Min Ltd | 2.695 | -17% | -9% | -2% | $8,156,422,456.58 |

| BMM | Balkanminingandmin | 0.285 | -19% | -14% | -2% | $9,497,500.00 |

| GLN | Galan Lithium Ltd | 1.345 | -13% | -5% | -2% | $406,697,308.13 |

| INR | Ioneer Ltd | 0.53 | -18% | -12% | -2% | $1,107,296,135.46 |

| PAM | Pan Asia Metals | 0.48 | -9% | -14% | -2% | $36,092,735.56 |

| BYH | Bryah Resources Ltd | 0.046 | -13% | -12% | -2% | $10,631,737.23 |

| LIT | Lithium Australia NL | 0.1075 | -7% | -7% | -2% | $113,582,765.56 |

| KZR | Kalamazoo Resources | 0.29 | -9% | -16% | -3% | $43,195,326.27 |

| WR1 | Winsome Resources | 0.33 | -11% | -14% | -3% | $45,716,397.96 |

| INF | Infinity Lithium | 0.13 | -16% | -21% | -4% | $56,001,974.54 |

| ARN | Aldoro Resources | 0.365 | 18% | -8% | -4% | $34,062,663.82 |

| RLC | Reedy Lagoon Corp. | 0.024 | -27% | -20% | -4% | $13,696,430.75 |

| KAI | Kairos Minerals Ltd | 0.022 | -12% | -12% | -4% | $45,128,150.29 |

| EMS | Eastern Metals | 0.195 | -7% | -13% | -5% | $7,298,000.00 |

| PGD | Peregrine Gold | 0.48 | -6% | -17% | -5% | $19,249,654.64 |

| 1MC | Morella Corporation | 0.019 | -30% | -10% | -5% | $103,524,279.72 |

| PSC | Prospect Res Ltd | 0.855 | 6% | 0% | -5% | $386,301,012.30 |

| LRV | Larvottoresources | 0.185 | 23% | -31% | -5% | $7,874,587.50 |

| AZI | Altamin Limited | 0.064 | 3% | -4% | -5% | $26,248,856.76 |

| LEL | Lithenergy | 0.82 | -11% | -17% | -6% | $39,150,000.00 |

| ADV | Ardiden Ltd | 0.012 | -20% | -8% | -8% | $34,588,350.63 |

| RAG | Ragnar Metals Ltd | 0.029 | -24% | -22% | -9% | $11,925,916.45 |

| IMI | Infinitymining | 0.155 | -14% | -14% | -11% | $10,062,500.00 |

| NVA | Nova Minerals Ltd | 0.6 | -38% | -35% | -34% | $163,984,079.35 |

Who’s got news out today?

Chinese firm Suzhou TA&A Ultra Clean Technology will invest $2.85m in the company.

An MOU (non-binding deal which comes before a binding one) to work together on exploration, development, and potential offtake agreements for all QXR’s lithium projects in WA was also signed.

“This is an excellent development for our company, a strong vote of confidence in our lithium exploration projects, and it brings an experienced and large lithium sector investor onto our register,” chairman Maurice Feilich said.

“As well, their desire to collaborate with us on project exploration, development and secure future offtake for any lithium we discover on our projects delivers huge value at multiple levels to QXR.

“We now have the added financial flexibility to fast-track and scale up exploration activities in Western Australia as well as continuing to invest in ongoing trenching and drilling of our Drummond Basin gold assets where we are achieving excellent results.”

Woomera has completed a review across its entire lithium exploration portfolio in WA and is gearing up to exploreclose to Pilbara Minerals’ (ASX:PLS) Pilgangoora/Wodgina and Allkem’s (ASX:AKE) Mt Cattlin.

At the Pilbara project, lithium exploration drilling over the tenements was completed by Woomera in 2018 during a period of depressed lithium prices, and consequently no follow-up exploration has ever been completed.

At Ravensthorpe, Woomera believes there is good potential for the Mt Cattlin LCT pegmatite field to be more extensive than has been identified around the mine, and that they may extend into its project.

The company also plans to drill for sedimentary lithium carbonate within its Lake Dundas Project, south of Norseman and the Bald Hill lithium deposit.

Core has finalised the acquisition of six mineral leases next to the Finniss project in the NT which are host to more than 30 historic pegmatite mines.

The company said this adds “significant value” to the project, “enabling the acceleration of resource and mine-life expansion objectives.”

“Our investment in these MLs is in line with our resource and mine life expansion objectives at Finniss, and cements our dominant landholding in this lithium-rich and low-risk mining jurisdiction of the Northern Territory,” MD Stephen Biggins said.

“With construction progressing at the Finniss Project, Core’s prime directive of delivering first production of high-quality lithium concentrate in 2022, in the midst of a very high lithium price and high operating margin environment, is on track.”

The company has secured a $2.5m option funding agreement to advance its lithium project in Brazil.

“This innovative funding facility provided by our funding partner, Lind, provides the company necessary working capital to continue to drill the newly discovered spodumene pegmatites in our Brazilian portfolio without the need for an equity placement, reducing dilution for existing shareholders,” MD Chris Gale said.

“We expected we can add a lot of value, very quickly in Brazil with these funds.”

The company expects over $5m cash will be received from the exercise of its LRSOC options, and says this funding, backed by the option money, now fast tracks the drilling program.

The company has picked up the Taylor Lookout lithium-tantalum project in WA.

EFE says the presence of tantalum in the creeks draining these areas indicates that potential exists for fractionated pegmatites potentially hosting lithium minerals.

Pegmatites have not been a focus of prior exploration on the tenement, which covers about 35.6 km2 and is approximately 450km from the deep water Wyndham Port.

The Galaxy Resources-Orocobre tie-up enjoyed a solid H1 FY22, reporting group revenue of US$192.3 million, including US$114.9 million from Mt Cattlin and US$65.6 million from Olaroz.

The revenue from Mt Cattlin was generated from sales of 96,871 dry metrics tonnes (dmt) of spodumene concentrate, grading 5.7% Li2O, at an average price of US$1,186/tonne CIF.

Revenue from Olaroz was generated from sales of 5,915 tonnes of lithium carbonate, a 143% revenue increase from the previous corresponding period (PCP), largely due to average FOB3 pricing increasing by 218% to US$11,095/t.

Plus, Olaroz Stage 2 reached 68% completion and commissioning is anticipated in H2 CY22, and construction of the Naraha lithium hydroxide plant in Japan is largely complete, with mechanical completion expected by the March quarter and first production to follow in the H1 CY22.

Construction at Sal de Vida commenced in January 2022 and commissioning and first production is now expected by H2 CY23.

Alkem says upwards pricing momentum for lithium products continues with March quarter FY22, indicative pricing for 43.5kt of spodumene concentrate shipments of US$2,500/t CIF for 6.0% Li2O and that lithium carbonate prices for H2 FY22 are expected to be ~US$25,000/t FOB, up ~125% on the H1 FY22 and up 25% from previous guidance

“With two revenue generating operations and a healthy balance sheet, we are in a strong financial position to continue to advance Sal de Vida and the development of James Bay,” MD and CEO, Martin Perez de Solay.

Stellar has pegged prospective lithium and tin ground in NE Tasmania.

“This application adds to the strategic package of EL’s and EL applications Stellar has assembled in NE Tasmania which, in addition to being highly prospective for high-grade Victorian slate belt style gold mineralisation, hosts excellent potential for lithium, tin and base metal mineralisation associated with the granite intrusives therefore enhancing Stellar’s commodity mix in Tasmania on top of its flagship Heemskirk tin project,” executive director Gary Fietz said.

A Geochemistry soil program has wrapped up at the Marble Bar project, with the company identifying multiple anomalies which is says are likely related to LCT pegmatite mineralisation.

“Coupled with the excellent soil sampling results we recently received from our nearby DOM’s Hill Lithium Project, we consider that the likelihood for LCT pegmatite mineralisation in the immediate area is very high, which is supported by Global Lithium’s (ASX:GL1) nearby Archer 10.5Mt at 1.0% Li20 deposit to the north,” chairman and CEO Luke Reinehr said.

The priority target areas will be the subject of a major field reconnaissance/mapping and rock chip sampling campaign to commence in March 2022 – prior to a planned extensive drill program.

The company’s recent rock chip sampling at the Wyemandoo pegmatite project has returned ‘exceptional’ rubidium grades – with individual samples up to 1.24% – plus some lithium and tantalum credits.

“The Wyemandoo project alone, covers a substantial ground holding extending over three tenements and contains a roughly defined pegmatite corridor of approx. 6,600 ha, whilst the Niobe ground holdings, in comparison, represent an extent of 195.84 ha,” Aldoro said.

“In addition, the Wyemandoo average rare element grades (particularly Rb) are demonstrably much higher than those recovered from Niobe.

“Because of this and coupled with the extensive occurrence of pegmatites over the project area (>1000 pegmatites identified by satellite and drone imagery to date); the Wyemandoo pegmatite project is positioning itself to be one of global significance.”

Drilling at Niobe is ongoing, and is expected to kick off at Wymeandoo in mid-March.

Ragnar says its mutually agreed to terminate the HOA to acquire WestOz Lithium. Investors didn’t like the news, sending the stock down 12.5% for the day.

Instead the focus is on progressing the Granmuren Deeps nickel-copper discovery at the Tullsta nickel project in Sweden.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.