Eye on Lithium: Spot price up, but latest Federal government lithium forecast is a mixed bag

Pic via Getty Images

Where’s lithium at today? We’ll start with the Chinese-flavoured “spot price”.

Lithium Price Bot says… that actually the lithium carbonate pricing is up a fraction over the past 24 hours. In fact, it’s up over the past 48 hours, increasing its YTD rally to 12%.

Spod, however, is intraday flat.

2024-04-03#Lithium Carbonate 99.5% Min China Spot

Price: $15,324.90

1 day: $41.40 (0.27%) 📈

YTD: 12.01%#Spodumene Concentrate (6%, CIF China)Price: $1,135.00

1 day: $0.0 (0.0%) ➡️

YTD: -13.69%Sponsored by @portofino_porhttps://t.co/9GzDfr2z10

— Lithium Price Bot (@LithiumPriceBot) April 3, 2024

Chinese #lithiumstocks continue their rally on growth of lithium spot prices and futures. ASX peers are sluggish on negative spillover from Wall Street (strong macro data diminishes chances for Fed rate cuts). pic.twitter.com/lOC5gOpWVb

— Andrey Prykhodko (@Andr_rej) April 2, 2024

Meanwhile, how about some official, gov-compiled predictions and outlooks? The Aussie government, via the Federal Department of Industry has delivered a bit of a mixed bag for the battery metal in chief. Let’s take a quick squizz…

Holding out for a lithium price recovery

The Federal Department of Industry’s March quarter resources and energy quarterly report was released last week and it goes into some detail about the effect the tanking lithium commodity prices last year had on lithium miners.

It’s nothing regular readers of Stockhead don’t know, but weak lithium prices, details the report, has seen most lithium miners reduce production and stockpile with the aim of holding out for a decent price recovery.

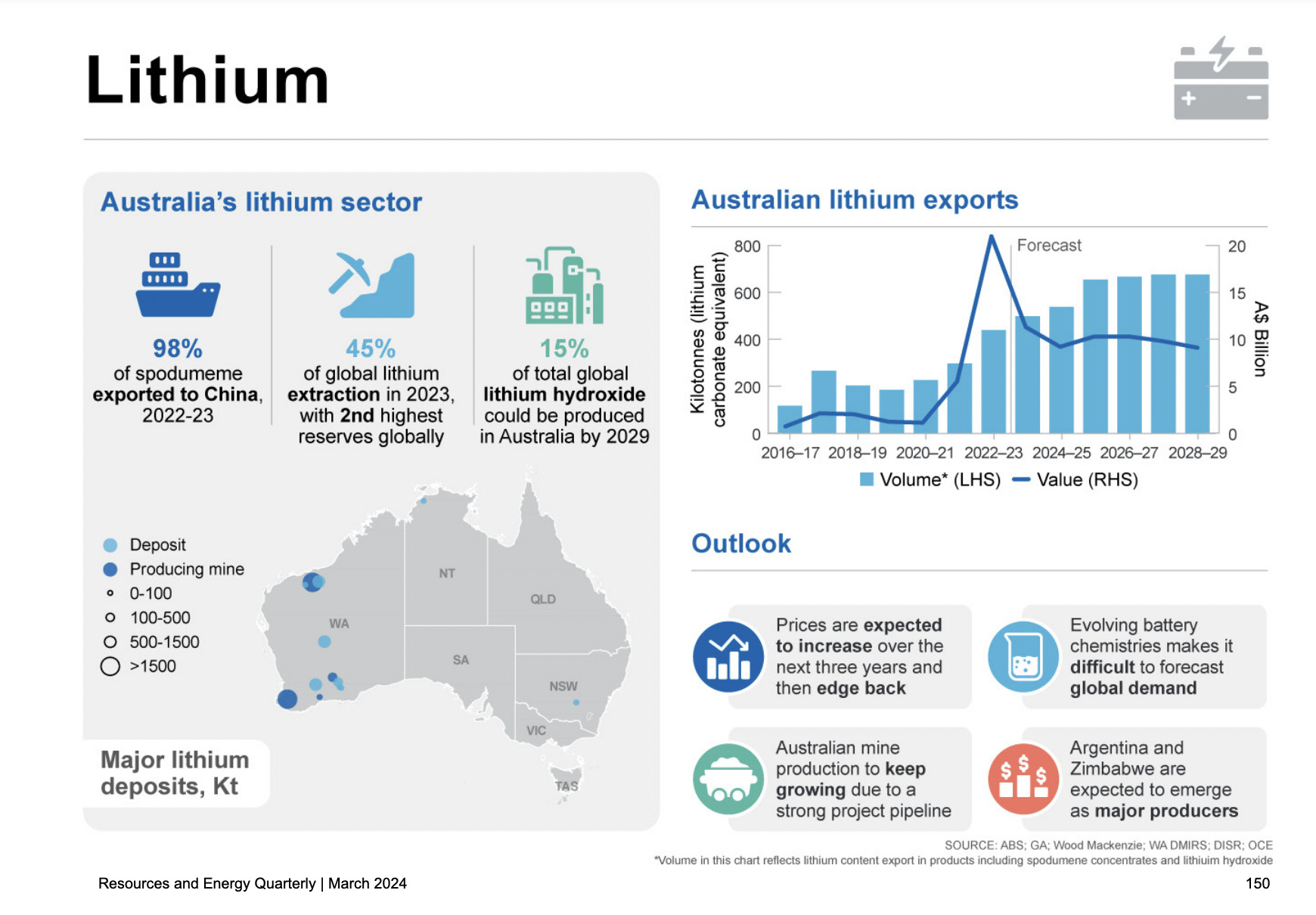

According to the government report, lithium export earnings are “predicted to fall from A$21 billion in 2022-23 to A$9 billion in 2028-29 (in real terms)”, with the caveat that “prices are difficult to forecast given the rapid pace of supply and demand growth”.

It also cites the uncertainty of forecasting due to the fact lithium is so tied to the EV demand and uptake narrative.

Does it have any more positive opinions than that, though?

The department does think that “a projected 70% increase in Australian lithium production over the period should partially offset the impact of lower prices”, and that a “modest recovery in the lithium prices over 2024 and 2025” is also likely.

Also, the Aussie government thinks the lithium spodumene price should rise to about US$1,360 a tonne by 2026.

Look, it ain’t much, but we’ll take it.

It, however, predicts a fall to about US$1,090 a tonne by 2029. Because: “from 2026, alternate battery chemistries could place some price pressure on lithium-ion EV batteries.”

ASX lithium form guide

We’re borrowing one from Market Index today… intraday gainers at close of play.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.